ES Short Term Trading 10-1-2010

New month!

Opening near the top of the O/N range. Lets see what the scary October brings us feeble minded traders.

Opening near the top of the O/N range. Lets see what the scary October brings us feeble minded traders.

Small time frame isolators are coming out of oversold area and up to the 50% line, right in that area they should turn back down again as the market starts moving down and below previous low

bogeyman?

Originally posted by CharterJoe

Originally posted by BruceM

damn reports......I'd like to see the 49.75 gap filled today....where is our volume?

10am on a Friday who comes up with these times??

can it go back,sure

1138 R and the underside of the triangle

36.5 last stand for this congestion band

1138 R and the underside of the triangle

36.5 last stand for this congestion band

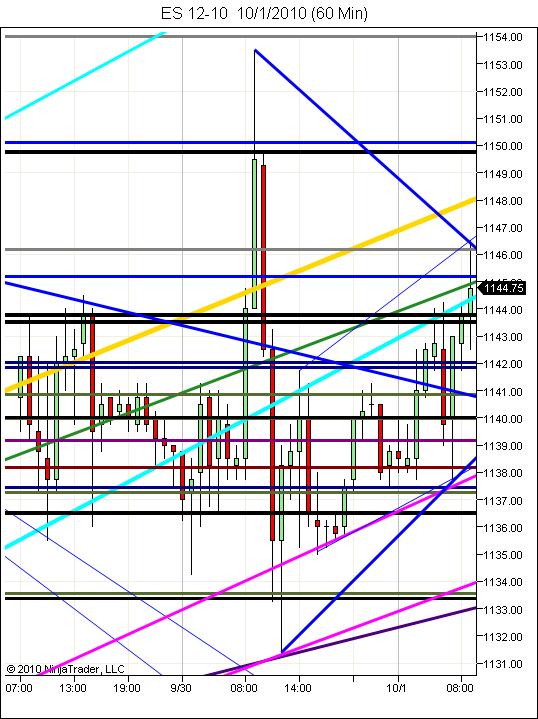

DavidS.The apex of your triangle comes out at about 1140.

1140 is also 38% ret. from yesterday's intraday h/l. In other words, it is better if the price does not move above that point. Right now trading at 1137.00.

Guys, thanks for taking the time to post the charts.

I will post some later tonight.

1140 is also 38% ret. from yesterday's intraday h/l. In other words, it is better if the price does not move above that point. Right now trading at 1137.00.

Guys, thanks for taking the time to post the charts.

I will post some later tonight.

Originally posted by DavidS

invalidates the triangle to me but I've seen em hit an apex and pivot,could be another formation for all I know

1140.25 area 50% 1127-1153.75

1140.25 area 50% 1127-1153.75

Interesting that 1140 is the 38% h/l from yesterday's move. 1140 is the apex of the 60m triangle. 1140 is also 50% of the O/N and today's low. hmmmm and Bruce was talking about the 1141 yesterday....make it or break it! ES now trading at 1140.25....

1144.00 next resistance and upper line of the 60 min. triangle. If that was to happen then it is most likely it will challenge the 1153 high. Will see.

1144.00 next resistance and upper line of the 60 min. triangle. If that was to happen then it is most likely it will challenge the 1153 high. Will see.

the triangle as it existed, new lower line with lod here from 1131

we're also in a channel with trendline 27-31 on bottom

maybe meander most of day but I think down and my breach level is 1147.31 for higher

23.8 retrace of 30th range

all this from a flash crash test dummy

let the rally begin

we're also in a channel with trendline 27-31 on bottom

maybe meander most of day but I think down and my breach level is 1147.31 for higher

23.8 retrace of 30th range

all this from a flash crash test dummy

let the rally begin

watching BIDU sub 100, AMZN,NFLX for break of todays low,that's where the pain will be to me for lower,former high flyers

1137.75 hr S level

1139.75 R here

I usually mention the BKX but it's stuck sub 46.5 a little and until higher doesn't matter to me here

1137.75 hr S level

1139.75 R here

I usually mention the BKX but it's stuck sub 46.5 a little and until higher doesn't matter to me here

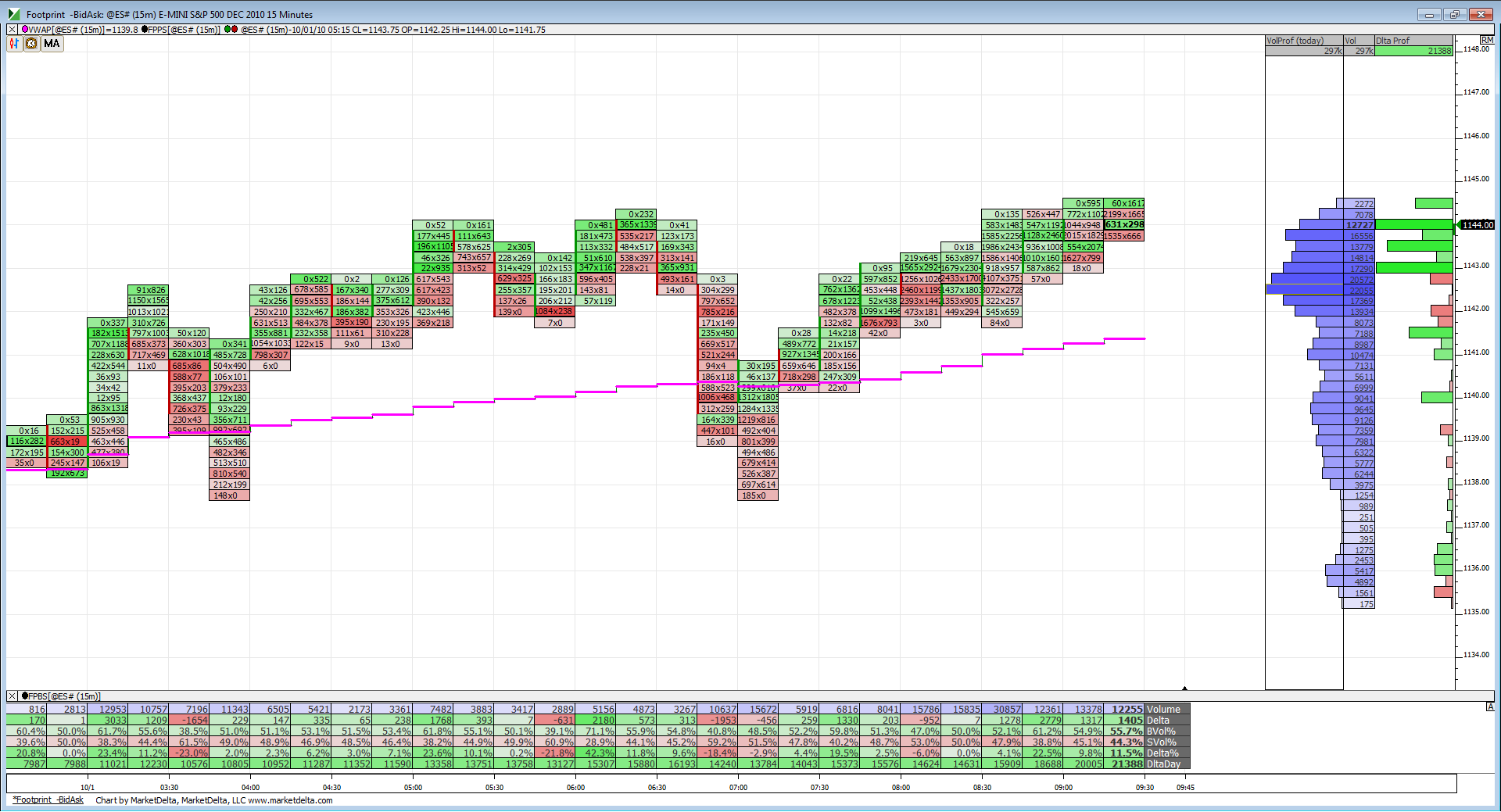

it would be a bit strange if they don't try to test that volume at 42.50 as long as new bigger volume doesn't come back in

Hopefully most saw the the trade of the day which was buying the hour breakdown with Tick and Volume diverging.......perfect retest of 50% of days range....

A top 5 entry given that 33.75 - 35.25 was the critical volume spike from yesterday

Hopefully most saw the the trade of the day which was buying the hour breakdown with Tick and Volume diverging.......perfect retest of 50% of days range....

A top 5 entry given that 33.75 - 35.25 was the critical volume spike from yesterday

low volume..gap at 41.75 is keeping me pressing longs...a better time of day for that.....unlike yesterdays failure at the 49.75!

Have a good weekend everyone!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.