ES short term trading 9-30-10

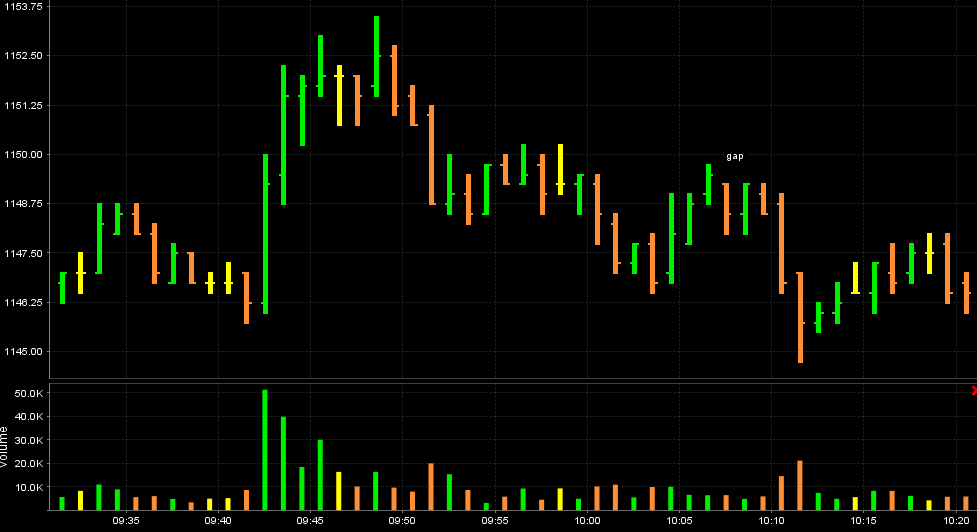

Key resistance up here at 47.75 - 50....short now...reports at 10 and a different open today in day session...monitoring for break out

Bruce,

do you see any sort of a ledge of volume in the 45 area?

the reason I ask is price tried 46 a couple of days ago and was rejected, but retrace has orderly

I never believe the first "break above" recent resistance, but today (if RTH goes) would be second move up.

I don't know whether this really matters or not... but I'll relat it anyway

Today is last trading day of the quarter.

I had a friend who was a margin clerk at a mutual fund. He told me that in an up quarter, the big boss man would come to him and have him calc max margin available for all traders and then instruct those traders to "empty the margin drawer" to boost or maintain value of positions on the books for the calc of end of quarter management fees (they are marked to the market value as of close today).

sometimes it seems that way and other times it just doesn't matter at all, but I was pretty surprised to hear it right from my friend's mouth.

do you see any sort of a ledge of volume in the 45 area?

the reason I ask is price tried 46 a couple of days ago and was rejected, but retrace has orderly

I never believe the first "break above" recent resistance, but today (if RTH goes) would be second move up.

I don't know whether this really matters or not... but I'll relat it anyway

Today is last trading day of the quarter.

I had a friend who was a margin clerk at a mutual fund. He told me that in an up quarter, the big boss man would come to him and have him calc max margin available for all traders and then instruct those traders to "empty the margin drawer" to boost or maintain value of positions on the books for the calc of end of quarter management fees (they are marked to the market value as of close today).

sometimes it seems that way and other times it just doesn't matter at all, but I was pretty surprised to hear it right from my friend's mouth.

retest of 46 there from above

prior R level

BKX pierced 46.5 today but currently in the 46.40's

5 day average of H versus Open is 7.25

open today was 45.25 plus 7.25 = 1152.50 (this is just the "average" distance travelled from Open to H over the prior 5 trade days)

Monday fibs should work all week, but with such a small range on Monday it doesn't really mean much in terms of points.

618 extension up of Monday = 1150.25, if that Px prints usually means additional push to full extension, meaning print 1153.50.

open today was 45.25 plus 7.25 = 1152.50 (this is just the "average" distance travelled from Open to H over the prior 5 trade days)

Monday fibs should work all week, but with such a small range on Monday it doesn't really mean much in terms of points.

618 extension up of Monday = 1150.25, if that Px prints usually means additional push to full extension, meaning print 1153.50.

popped up as I posted that

see if it holds 46.50

46 again

see if it holds 46.50

46 again

53.50 printed

good luck trading to all

good luck trading to all

perfect Paul...great stuff

Originally posted by PAUL9

5 day average of H versus Open is 7.25

open today was 45.25 plus 7.25 = 1152.50 (this is just the "average" distance travelled from Open to H over the prior 5 trade days)

Monday fibs should work all week, but with such a small range on Monday it doesn't really mean much in terms of points.

618 extension up of Monday = 1150.25, if that Px prints usually means additional push to full extension, meaning print 1153.50.

Rburns...here is a shot of that gap that caused me to cover shorts way to early...it goes on the radar though...didn't want ya to think I forgot about you....or that gap!!!!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.