ES short term trading 9-22-10

I think the O/N session sums up all the key areas which are

1127 - 1128.75 - Key volume from Mondays rally, breakout point and just under O/N low *******

1133.75 - 1136 - peak volume when Fed announced and magnet price from YD, gap fill and O/N midpoint

1140 - O/N high and near Mondays high

we know they like to break the Mon- Tuesday range!

we need to be aware of Pauls .62 concept and it's targets . From now on I'll call it the P-62. I like it !

My early bias is long at 31.75 to get above 34.50 but if we start spending time near 27 ( when day session opens) and buyers don't show up then the bias needs to shift.

At 9 am we are set to open inside YD range. So be careful if they drive it right out of that range lower with volume at the open. Then I will be long and wrong and will need to cover. Will watch volume closely and a report at 10 a.m.

1127 - 1128.75 - Key volume from Mondays rally, breakout point and just under O/N low *******

1133.75 - 1136 - peak volume when Fed announced and magnet price from YD, gap fill and O/N midpoint

1140 - O/N high and near Mondays high

we know they like to break the Mon- Tuesday range!

we need to be aware of Pauls .62 concept and it's targets . From now on I'll call it the P-62. I like it !

My early bias is long at 31.75 to get above 34.50 but if we start spending time near 27 ( when day session opens) and buyers don't show up then the bias needs to shift.

At 9 am we are set to open inside YD range. So be careful if they drive it right out of that range lower with volume at the open. Then I will be long and wrong and will need to cover. Will watch volume closely and a report at 10 a.m.

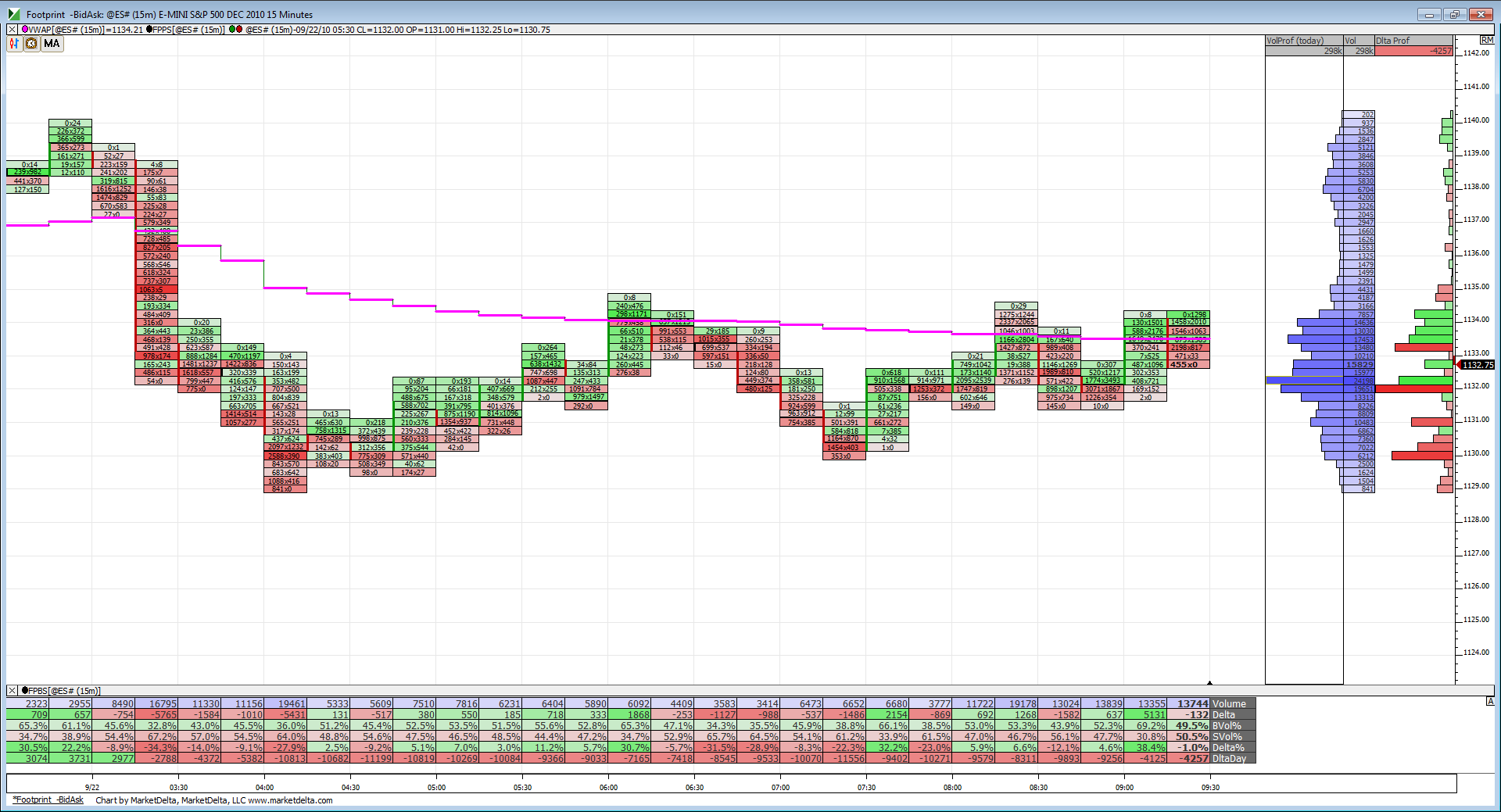

Coming into the open you can see most of the volume between 1134 and 1132 with VWAP right in the middle. Multiple tests of VWAP from underneath show pressure to the downside.

P-62. I like it.

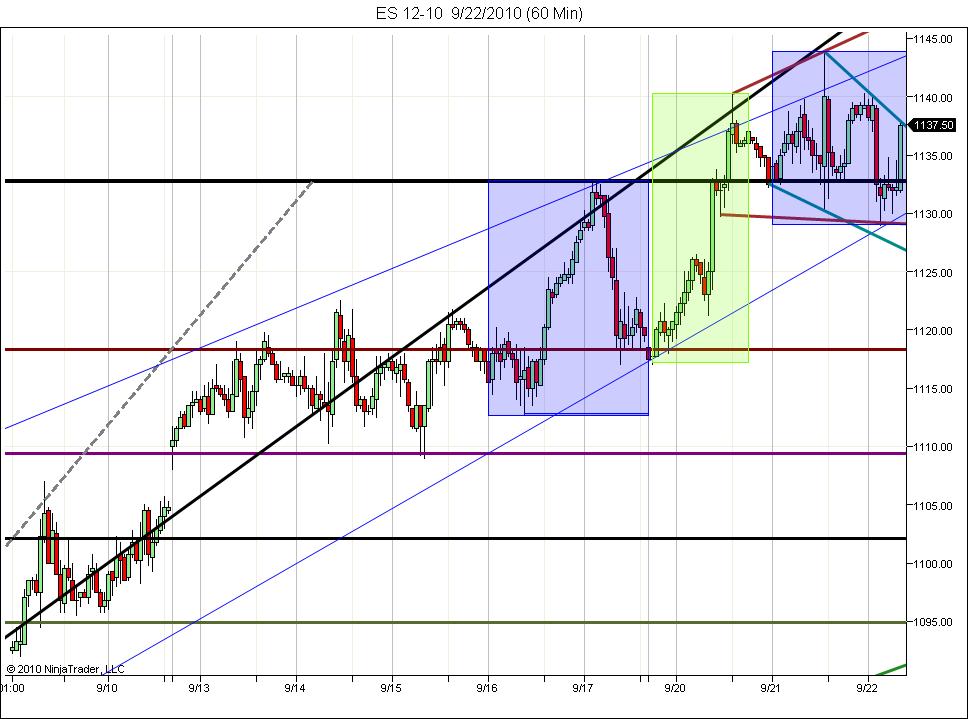

green area could be an extended impulse wave and has 2 possibilities.

1. will retrace back to 1122 area of the 2nd wave

2, is indicative of a 1st wave that keeps on going without the required retrace of most extensions

Note the 1137 area was 50% for the after fed lift. Currently 1136.5 is the 50% retrace for the move down to the former high 1129 area from 1144. So the 1137 area is of note today for whatever they do.

If they go down the 1130.5 is the 50% retrace of the wave up from 1117.

green area could be an extended impulse wave and has 2 possibilities.

1. will retrace back to 1122 area of the 2nd wave

2, is indicative of a 1st wave that keeps on going without the required retrace of most extensions

Note the 1137 area was 50% for the after fed lift. Currently 1136.5 is the 50% retrace for the move down to the former high 1129 area from 1144. So the 1137 area is of note today for whatever they do.

If they go down the 1130.5 is the 50% retrace of the wave up from 1117.

now on the 38 for the 36.25 test...small as report in 18 minutes

I only see news out at 10:30...crude inventories.

Originally posted by BruceM

now on the 38 for the 36.25 test...small as report in 18 minutes

normally I would have added up there above the plus 5.5 number but knowing a report is coming spooked me from add ons/.//anyway, I'm flat at 36.50......good trade but could have been better with the add on......waiting now..

all air pockets were filled..that is real point

all air pockets were filled..that is real point

july house price index at 10

i can hold back rallies off 33.75 then they should push out the O/N low and try to test that 27 - 28.75 area I've been watching since Monday's trade...so i like shorts!!

Thanks!

Originally posted by chrisp

july house price index at 10

most everything I watch looks stable except BKX with GS under 150 and DB down about 5 from yesterday(DB to offer 300B in stock,not sure when sale is, at 33 euros which I assume converts to less than the $60 price of Tuesday.)Not sure DB in BKX,doesn't matter.If selling them now will hold em down awhile. If selling later can ramp higher before sale. I'm just watching for the move in BKX

MSFT down after announcing 23% increase in dividend.selling em to buy em?

even INTC holding 19 so far

so does everything else follow banks and MSFT or do they flip a switch? We'll see.

bounce off 1130.5

MSFT down after announcing 23% increase in dividend.selling em to buy em?

even INTC holding 19 so far

so does everything else follow banks and MSFT or do they flip a switch? We'll see.

bounce off 1130.5

wow,

I have no handle on this market at all...but, I also had nothing coming into it. Yesterday I could understand today, I might as well start drinking early.

with price under the 50% of the week, next line of support could be Monday's Low of 21.75

currently at last week's RTH H of 1126.75, could produce a stall and a minor retrace up.

...but 32.50 (50% of the RTH week) is critical mass and I would have to guess that if it is tested from underneath, fail and go down and undercut whatever the low put in place right now (11:35am) is

so far, LOD is 26.50.

I have no handle on this market at all...but, I also had nothing coming into it. Yesterday I could understand today, I might as well start drinking early.

with price under the 50% of the week, next line of support could be Monday's Low of 21.75

currently at last week's RTH H of 1126.75, could produce a stall and a minor retrace up.

...but 32.50 (50% of the RTH week) is critical mass and I would have to guess that if it is tested from underneath, fail and go down and undercut whatever the low put in place right now (11:35am) is

so far, LOD is 26.50.

if you look at the time 12:10 EST ...you will see the other volume spike and why I started shorts at that 31 print....it's all about volume...the rest is just silly lines on our charts

They ALWAYS like to TRY and test volume....it doesn't mean they will actually be able to push it far enough for a complete test though...we capitalize on them TRYING to make the test.....and make more money when they get a complete test...just try and pick pieces off along the way.....the greedy get what they deserve....you know the old saying!!!

They ALWAYS like to TRY and test volume....it doesn't mean they will actually be able to push it far enough for a complete test though...we capitalize on them TRYING to make the test.....and make more money when they get a complete test...just try and pick pieces off along the way.....the greedy get what they deserve....you know the old saying!!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.