ES Short Term Trading 9-17-2010

gapguy says odds high for fill of up gap on OpEx Fridays

I don't know whether it happens early or late?

my own stuff: price has printed (RTH) at the 618 extension of Monday's range. odds highly favor RTH print at 1.00 full extension which is 1127.25 (it was a small range on Monday).

politicaly, everyone talking about re-arrangement of Congress due to dislike of Democratic control... Same condition was in place in Clinton's first term... the 2 year election was 1994, sentiment very similar, price trended higher into elections.

I don't know whether it happens early or late?

my own stuff: price has printed (RTH) at the 618 extension of Monday's range. odds highly favor RTH print at 1.00 full extension which is 1127.25 (it was a small range on Monday).

politicaly, everyone talking about re-arrangement of Congress due to dislike of Democratic control... Same condition was in place in Clinton's first term... the 2 year election was 1994, sentiment very similar, price trended higher into elections.

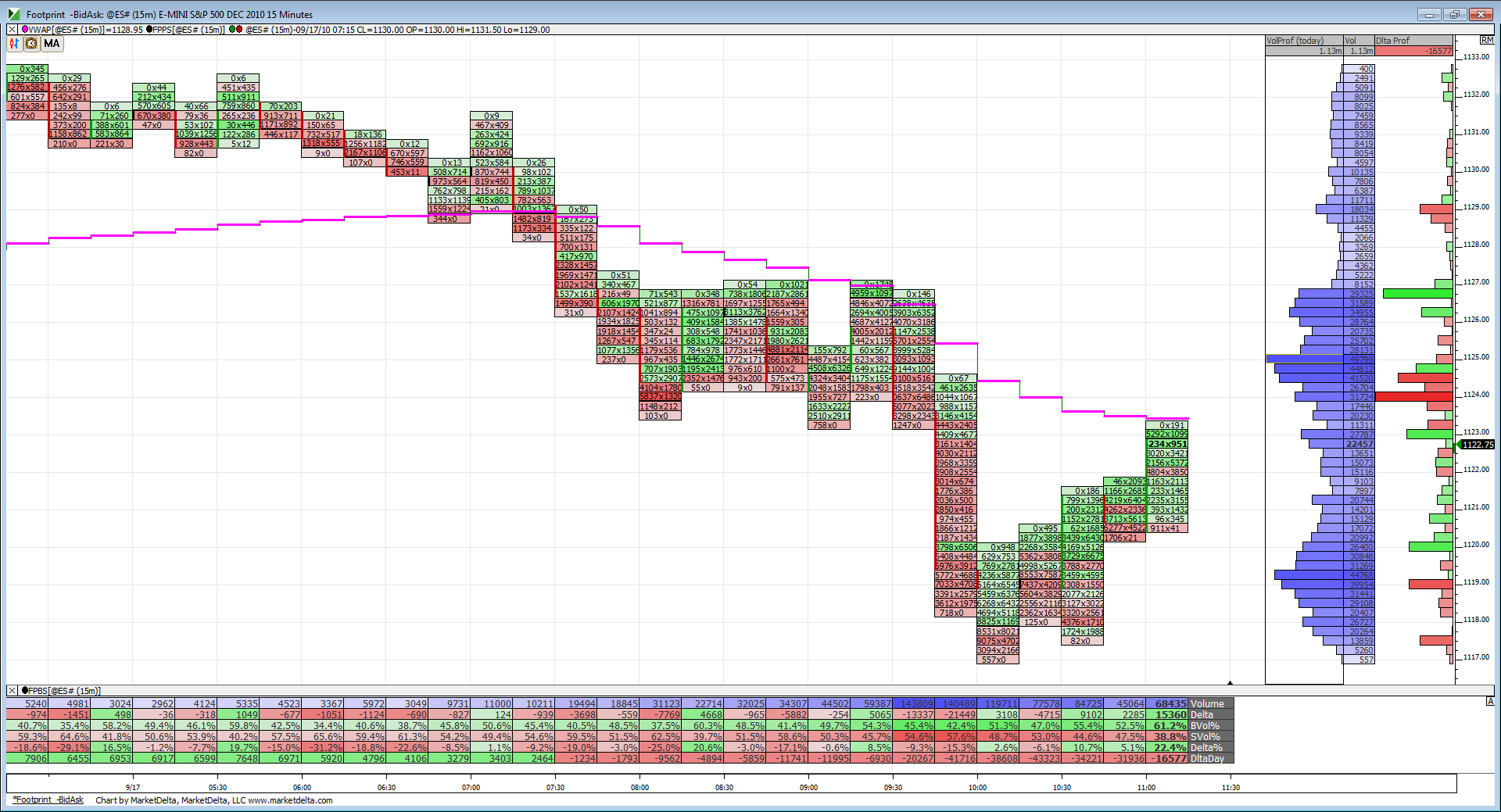

Here is a look at the selloff into 1117.00

1116.75 was the Volume POC from yesterday.

Prices are now back to VWAP and volume is remaining strong.

Big volume now at the top of the range and the bottom of the range as you can see in the histogram on the right side.

1116.75 was the Volume POC from yesterday.

Prices are now back to VWAP and volume is remaining strong.

Big volume now at the top of the range and the bottom of the range as you can see in the histogram on the right side.

I'll note the gap left below in case of a tumble(colored area). We're right at the 50% retrace level here(1122.5). Only 1130.25?? I might have to start using the cash index for EW with the value changes from rollover messing with my charts.

My open about 1127.

My open about 1127.

I agree Dave with using cash charts for the EW counts.

Originally posted by DavidS

I'll note the gap left below in case of a tumble(colored area). We're right at the 50% retrace level here(1122.5). Only 1130.25?? I might have to start using the cash index for EW with the value changes from rollover messing with my charts.

My open about 1127.

Even with the 5 pt difference made by the different contracts 1132 should have hit in my mind. Oh well, what happens there isn't all important.

That horizontal bar at the top of my chart above 1124 is the 1129 previous high equivalent.

That horizontal bar at the top of my chart above 1124 is the 1129 previous high equivalent.

1132 in the ES or cash?

Originally posted by DavidS

Even with the 5 pt difference made by the different contracts 1132 should have hit in my mind. Oh well, what happens there isn't all important.

That horizontal bar at the top of my chart above 1124 is the 1129 previous high equivalent.

You asking for the yearly open and close or the dailies?

Originally posted by Big Mike

Does anyone have a source for RTH Open and Close for ES for 2008 and 2009.

Thanks in advance!

Originally posted by Lorn

You asking for the yearly open and close or the dailies?

Originally posted by Big Mike

Does anyone have a source for RTH Open and Close for ES for 2008 and 2009.

Thanks in advance!

Dailies, sorry for omitting that.

Good observation David.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.