ES Short Term Trading 9-14-2010

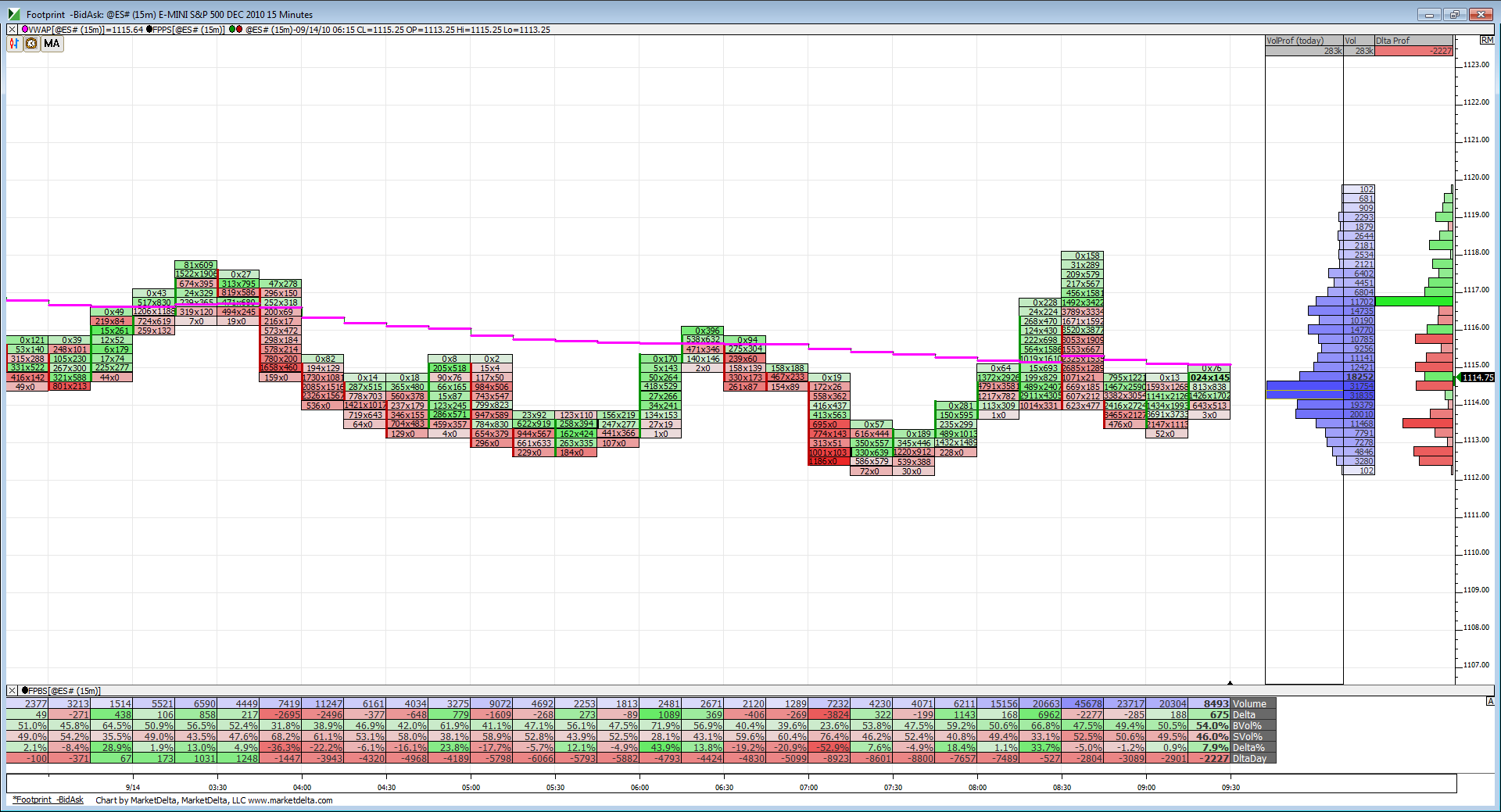

A look at the footprint into the open. Today marks the first time in about a week we see prices struggling to get above VWAP before the open. Should be interesting to see if that spills over into RTH.

Some food for our minds this morning courtesy of our main man Bruce:

A few things I will always keep in mind based on probabilities along:

1) The markets ability to trade back to the weekly daily pivot.

2) The markets ability to trade towards the previous days Low or High if we open outside that range.

3) The markets attempt to take out the previous days Low or High if we open in the range.

4) The markets ability to run the overnight Low and/or High.

5) The markets ability to break last weeks high or low if we open in that range on the first day of the week.

Something to keep in mind. Volume has been horribly low for September and the daily range has been getting smaller. Both factors weigh on small traders ability to execute solid trades. Until we see range expansion, play it close to the chest and take profits quicker then normal.

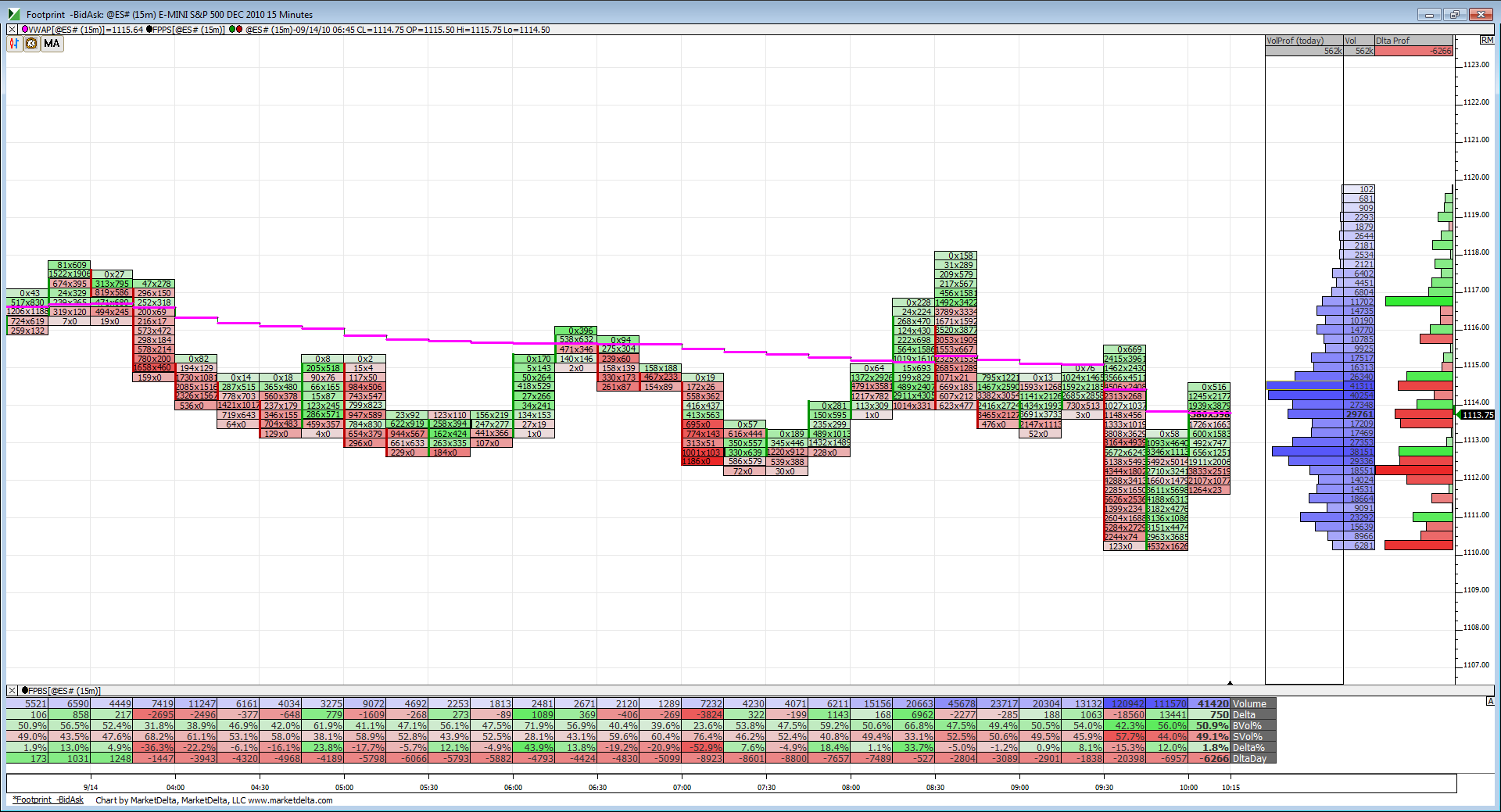

So far we have challenged yesterdays lows and now prices are trying to get back above VWAP. Notice where the volume is.

Something I forgot to mention earlier.

Yesterday and today mark day 12 and 13 of Kool's 12-13 day cycle.

Yesterday and today mark day 12 and 13 of Kool's 12-13 day cycle.

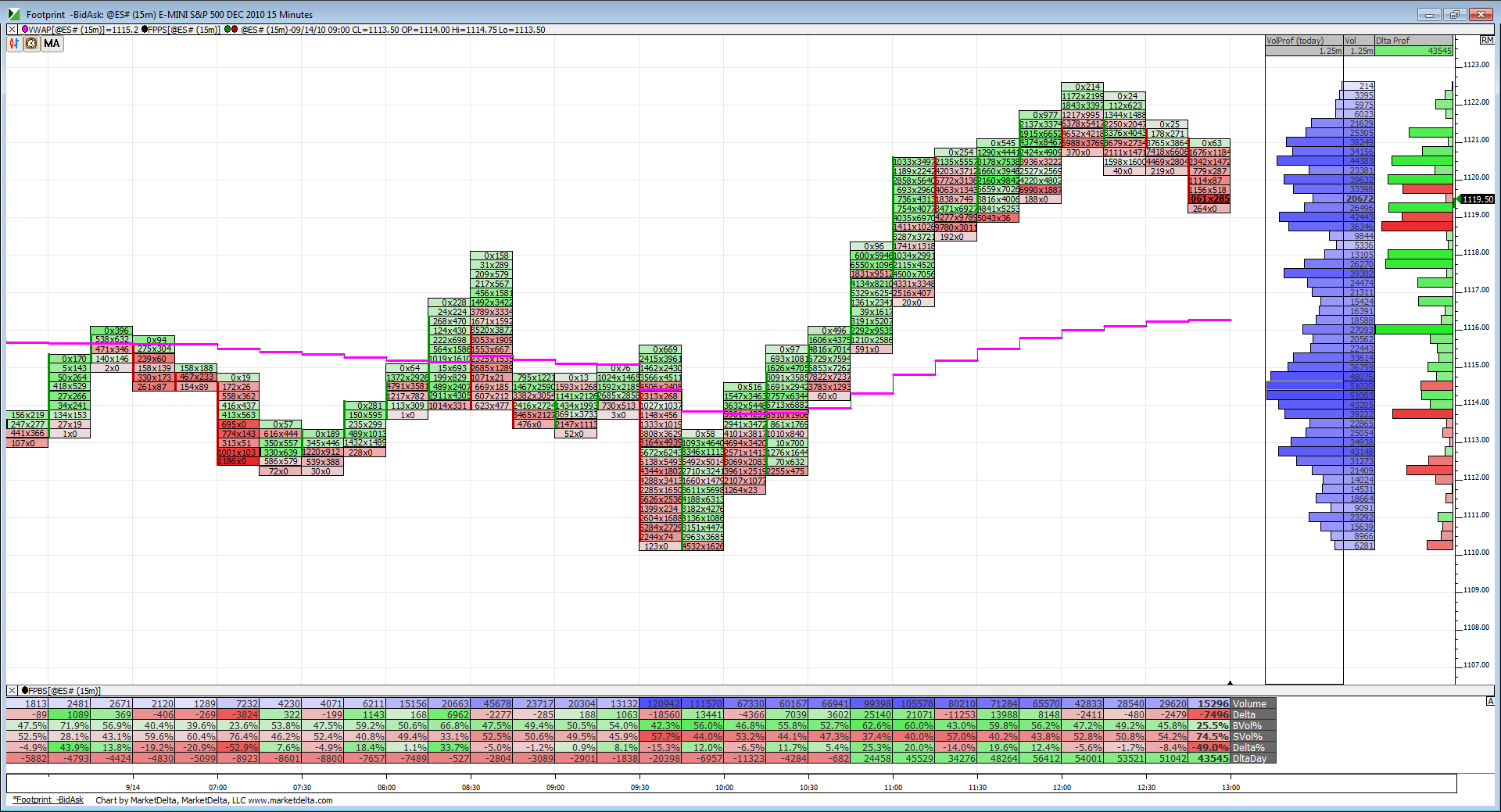

So that was some serious buying coming into the market from the lows of this morning. Take a look at delta listed on the bottom of the chart. We went from -20k at the open to currently +40k. I'm interested to see if this pullback tests VWAP or not.

Something surprising is the internals of the markets are quite neutral imo.

1578 Advancers

1367 declines

245 adv volume

211 decl volume

TRIN sitting at 1.02 (according to tradestation)

1578 Advancers

1367 declines

245 adv volume

211 decl volume

TRIN sitting at 1.02 (according to tradestation)

1119.00 yesterday high...obvious retest here.

any opinions on options expiration and Sept contract expiring this week affecting price???

I'm no expert on options. It certainly could affect the volatility but probably not much else. As for Sept contract expiration, most of the volume went into the December contract this past Friday.

Originally posted by chrisp

any opinions on options expiration and Sept contract expiring this week affecting price???

For those who like this look of the markets. 5-min PRC chart. Interesting to see if the 1118.00 price holds support or the lower projections will be seen.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.