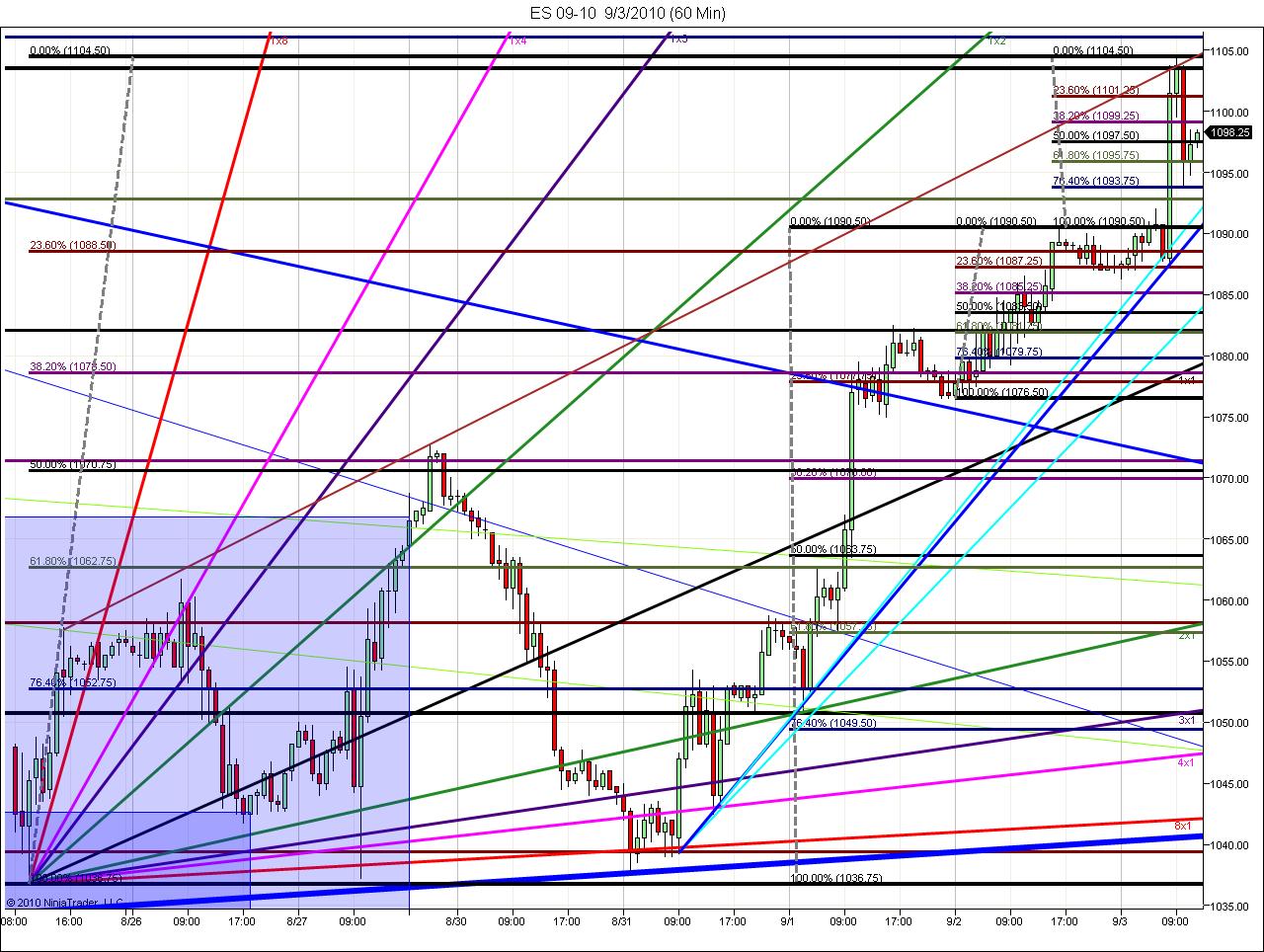

Es short term trading 9-3-10

Here are my Supp/Resistance numbers ahead of the big report..

89 - 91.50...this is the highest volume of any price when we combine the profile from May6th forward ********** big kahuna

1101.75

1106.75

1110.50

1115.25

1118.50 ***** ( Ok maybe not tomorrow)

Support

1083.50

1077.50 - 79 ***

1070 -1071.75

1065.75

1059 - 1060.25

51 -53.25

46.25

89 - 91.50...this is the highest volume of any price when we combine the profile from May6th forward ********** big kahuna

1101.75

1106.75

1110.50

1115.25

1118.50 ***** ( Ok maybe not tomorrow)

Support

1083.50

1077.50 - 79 ***

1070 -1071.75

1065.75

1059 - 1060.25

51 -53.25

46.25

on 1102.25 for 99.50...short

1100.75 is O/R high

added at 1104 for 1102.75 fill in

1101.50 needs work..too..reports in 15

ym is trying to lead higher..never like that..if it wasn't for that report I'd be aggressively short now

will manage above 1106....if they spike it up....

flat at 96.75......not sure from here.....1/2 gap traders below and air pocket above

air fillied in at 98.50....didn't get long but knowing that helped me take a good profit...just an FYI..

Here is that gap at 1102.75 and the reason i added to my short above

Here is that gap at 1102.75 and the reason i added to my short above

How are you two today? :)

I'm late to the gate today and may have to be in and out.

First thing I noticed when I ramped up my charts a few ago was the equality of today and yesterday so far. 14 points? 1076.5-1090.5 & 1090.5-1104.5 Equal in distance if exclude O/N.

Broke that 1098.5 and was being R til 12:30. Will still keep an eye over the shoulder

Just for noting. If this is a C wave up the minimum target is 1137. We'll see. There are still a possibilities of down by EW rules.

1115 the major R above.

Also, BKX up to 46.87 hod and backed off some here., but remains sub 50.

Treasuries definitely flipped negative last 3 days.

Of interest(to me), GOOG at 470 S/R. Semis still down. INTC under 18.5

I don't know if there's more for today. I would think the 1100 and hod would be key levels to watch up and the 1098.5 and 1093/4 levels down. Usually don't try to kill em into labor day because you've got the whole month left to do it.

I'm late to the gate today and may have to be in and out.

First thing I noticed when I ramped up my charts a few ago was the equality of today and yesterday so far. 14 points? 1076.5-1090.5 & 1090.5-1104.5 Equal in distance if exclude O/N.

Broke that 1098.5 and was being R til 12:30. Will still keep an eye over the shoulder

Just for noting. If this is a C wave up the minimum target is 1137. We'll see. There are still a possibilities of down by EW rules.

1115 the major R above.

Also, BKX up to 46.87 hod and backed off some here., but remains sub 50.

Treasuries definitely flipped negative last 3 days.

Of interest(to me), GOOG at 470 S/R. Semis still down. INTC under 18.5

I don't know if there's more for today. I would think the 1100 and hod would be key levels to watch up and the 1098.5 and 1093/4 levels down. Usually don't try to kill em into labor day because you've got the whole month left to do it.

Yea its Friday and a 3-day weekend....thinking of taking the rest of the day off.

Cheers!

Cheers!

a great ending......hope all enjoy the 3 day weekend....here is how it looked in my world......I'm not showing the one minute micro gaps on this chart....

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.