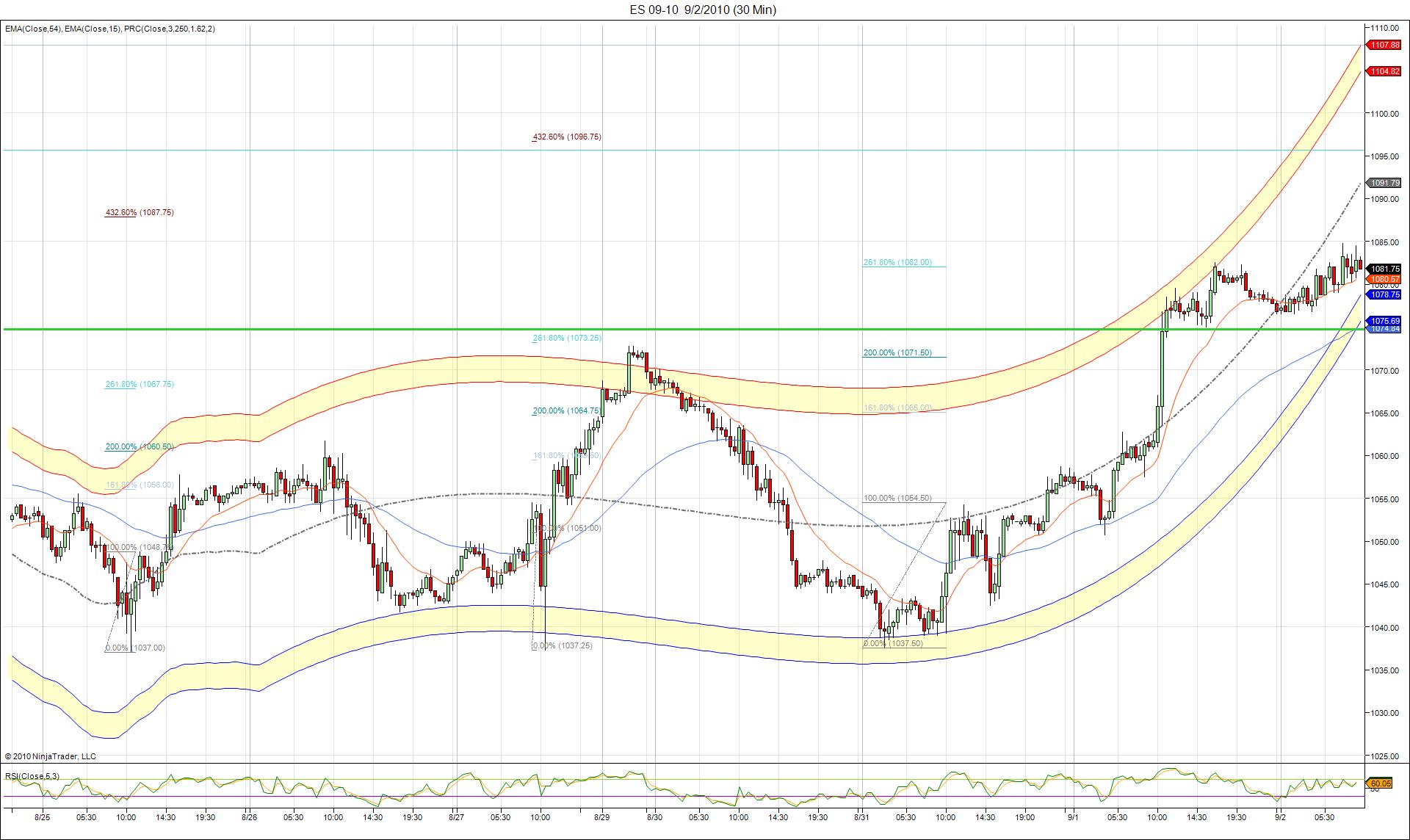

Es short term trading 9-2-10

Numbers today

1082.50

1077.50

1071.75 - 1073.75 **** key support

1065.75

1059 - 1061***

Further upside will be determined by O/N high if reports at 8:30 rally the market

1082.50

1077.50

1071.75 - 1073.75 **** key support

1065.75

1059 - 1061***

Further upside will be determined by O/N high if reports at 8:30 rally the market

Here are some numbers on the NQ that should produce some good trades.

pay close attention to the 1828-1831 area lots of s&r around that area.

1801

1811

1823

1831

1847

sq nine

1807

1828

1849

other important numbers on the upside...

1842.5

1850.25

1860.5

pay close attention to the 1828-1831 area lots of s&r around that area.

1801

1811

1823

1831

1847

sq nine

1807

1828

1849

other important numbers on the upside...

1842.5

1850.25

1860.5

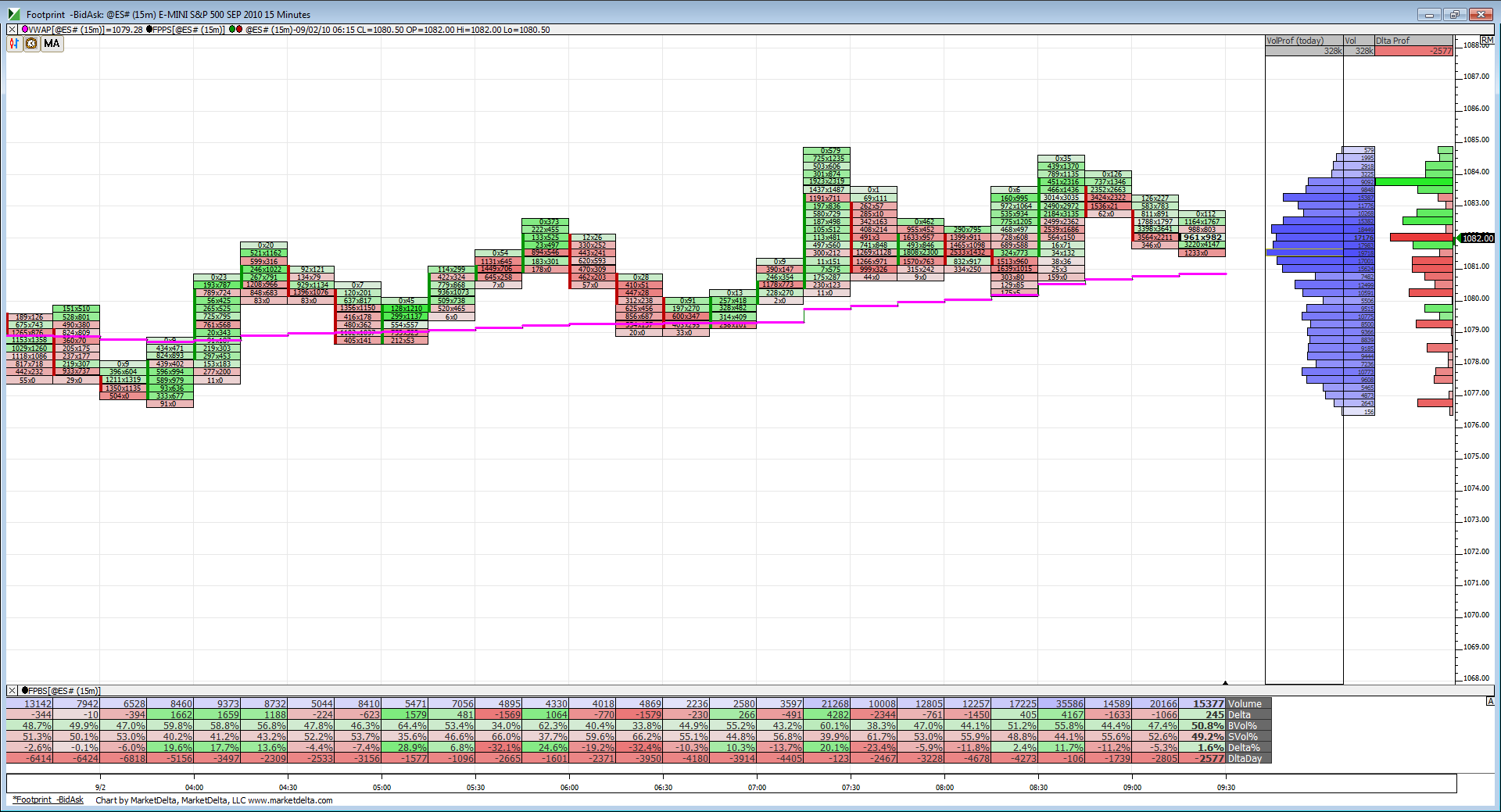

I'm on 84.25 short looking for the 82.50 retest...yesterday was the "P" profile and thinking that they will try to fade extremes early on today

I like a "sell the rallies " mentality for the day session . If the O/N is going to stay symmetric then they will need to retest 80.50...so that is secondary target...may need to wait for day session...but that is 50% of O/N range and a swing low that seems too obvious

Those PRC bands seem to produce some fairly low risk trades on the SECOND test of your bands Lorn...when they make the 1-2-3 pattern

two reports at 10 today..FYI.....I'm Only trading short above 82.50 today..or at least early on

I agree and even better when a decent fib number is projected into that area of the band or even better with a spike just above to touch a fib projection.

Originally posted by BruceM

Those PRC bands seem to produce some fairly low risk trades on the SECOND test of your bands Lorn...when they make the 1-2-3 pattern

Significant R 84.5-87.5

The fib levels to the left are for the decline from 1128-1037.

The fib levels to the left are for the decline from 1128-1037.

so 80 - 82.50 will be our top dog after reports hit at 10....I hope they run it up first as I am not a great buyer of declines in general and would like an opportunity to sell the rally again...will look at 2.5 - 5 points above O/N high for shorts if they run it up...which goes well with some of your numbers David...

Key question: what kind of volume will it take to break it away from the entire consolidation of yesterday and the O/N..? I think a lot....as we consolidated for most of YD except that first hour run

Key question: what kind of volume will it take to break it away from the entire consolidation of yesterday and the O/N..? I think a lot....as we consolidated for most of YD except that first hour run

91 would be a good target usually.

seeing a lot of volume here

seeing a lot of volume here

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.