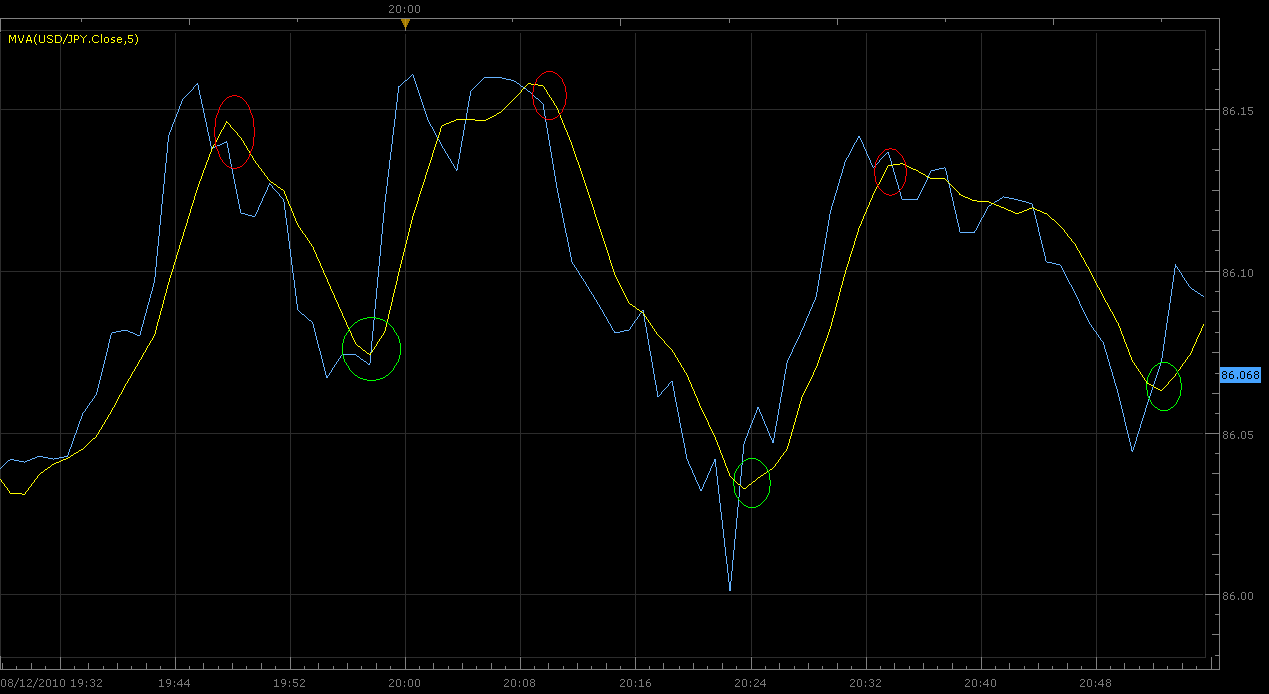

5 period SMA system

I'm not sure how well this works on the Eminis, but it works well on the Usd/Jpy and the Euro during usd time zone. I have traded this for almost a year on the euro and yen it works well...depends on how much time you put in on it but it averages out about 5-10 pips an hour.

1) 1min chart with 5 period s.m.a. or a hull 10 period there both almost the same thing.

2) I am looking at the sma, I want to catch the hook at the bottom when the sma hooks up after it has been going down I buy after the price trades and CLOSES above the sma.

*** Price must close above the ma hook to be vaild*** If you jump the gun you'll get shot in the butt

1) 1min chart with 5 period s.m.a. or a hull 10 period there both almost the same thing.

2) I am looking at the sma, I want to catch the hook at the bottom when the sma hooks up after it has been going down I buy after the price trades and CLOSES above the sma.

*** Price must close above the ma hook to be vaild*** If you jump the gun you'll get shot in the butt

with this entry strategy, what is the best exit strategy? scale out? trailing up since trend better in currency?

always enjoy your work Joe...do u find there are things that would mimic Internals...for these markets...like we have in the stock market..?

Mr Tee,

I think this system is like all good systems it needs to be adjusted to your way of trading. Most of the time I add Bollinger Bands, looking for price to be near on extreme or the other. Also larger time frames like the 5min and 15min will shed some light on when or where is the best place to exit a trade. Its a System not a set of rules....websters defines a system as a regularly interacting or interdependent group of items forming a unified whole. I think this is the best definition for profitable discretionary trading as its not rules rather its a tool used with other tools to preform maximum productivity with minimum wasted effort and expense.

I think this system is like all good systems it needs to be adjusted to your way of trading. Most of the time I add Bollinger Bands, looking for price to be near on extreme or the other. Also larger time frames like the 5min and 15min will shed some light on when or where is the best place to exit a trade. Its a System not a set of rules....websters defines a system as a regularly interacting or interdependent group of items forming a unified whole. I think this is the best definition for profitable discretionary trading as its not rules rather its a tool used with other tools to preform maximum productivity with minimum wasted effort and expense.

When trading, we often fall into the trap of thinking that fundamentals or technicals are moving the market. It is as if the support or resistance line was something real. We often forget that the thing that is really moving the market is expectations and the applications of vast amounts of money to support those expectations. Market movements are really only indirectly connected to fundamentals or technicals.

“Never confuse the finger pointing at the moon with the moon itself” – Chinese Proverb

At the core of the currency market, central banks set targets around acceptable price levels and use then apply macro-economic policy levers, jaw boning and perhaps even the odd intervention by the mythical plunge protection teams to keep the price within the acceptable price region.

Baring a few exceptions, most central banks play an international tit-for-tat game of seeing “who can devalue their currency the most”. A devalued currency helps prop up the domestic export economy and keeps unemployment under control. Whereas an over valued currency usually creates inflation and is accompanied by interest rate rises to combat the inflation. Given that low unemployment is usually politically more acceptable than the consequences of inflation and high interest rates, the international race to the bottom continues. At the moment the Fed is the king of the heap as it has successfully managed to push the US Dollar the lowest.

Its the expectations by cashed up market participants around future policy changes and the movement of money based on those expectations which in turn drive the market. These expectations are an extremely strong force in the Forex market and the Forex market can be subject to speculative exaggeration as forex traders are inclined to bet fairly quickly on certain trends not yet factored into other markets, such as the 3 month bond markets.

To trade the Forex Market successfully a good trader needs to really master sentiment analysis and concentrate on how expectations are driving the market. Since other traders are in the same situation, only a few factors genuinely end up affecting exchange rates. This process can easily gain momentum of its own, with no one daring to buck the trend. Re-appraisal only occurs when an exchange rate is quite clearly outside the acceptable band for the central bank.

As the USD is the currency that is used for the majority of international trade and is held in reserves by most central banks, expectations around the USD is the most important place to start your analysis from. While many moves in the market can be explained by trade differentials, interest rate differentials, commodity prices, geo-politics, etc, the majority of moves are based on expectations around US interest rate policy, future economic growth and US participation in global politics. To demonstrate this point, attempts to explain the large cyclical swings in the commodity currencies, such as the Aussie dollar on the basis of interest rate differentials or commodity prices is largely a waste of time. Evidence suggests the Aussie dollar movements are largely a by product of sentiment toward the USD. The USD cannot explain many of the short term moves, but it does explain 85% of long term moves.

As always the currency market evolves. Pre-World War II, the pound was the dominant currency for international trade. After the war finished Winston Churchill made a stupid mistake around setting the exchange rate policies, and the whole world moved over to the US Dollar as the preferred currency for international trade. The same thing is happening to the US dollar now. The dollar is chronically devalued at the moment and a number of central banks are moving a portion of their reserves into Euros and the demand for the Euro as the preferred currency for international trade is increasing. As a result the dollar is quite volatile. However, this does not mean that it is all down hill for the “mighty” dollar. The English pound is still a highly valued currency after all these years (certainly much higher than what the UK economy might imply it is worth). Rome wasn’t built in a day, and the fall of the Roman empire took centuries of mismanagement before the Barbarians came knocking at the gate. Just like the decline of Rome, it will take a very long time before the US dollar will be displaced by the Euro and even then it will hold its value for a long time to come.

“Never confuse the finger pointing at the moon with the moon itself” – Chinese Proverb

At the core of the currency market, central banks set targets around acceptable price levels and use then apply macro-economic policy levers, jaw boning and perhaps even the odd intervention by the mythical plunge protection teams to keep the price within the acceptable price region.

Baring a few exceptions, most central banks play an international tit-for-tat game of seeing “who can devalue their currency the most”. A devalued currency helps prop up the domestic export economy and keeps unemployment under control. Whereas an over valued currency usually creates inflation and is accompanied by interest rate rises to combat the inflation. Given that low unemployment is usually politically more acceptable than the consequences of inflation and high interest rates, the international race to the bottom continues. At the moment the Fed is the king of the heap as it has successfully managed to push the US Dollar the lowest.

Its the expectations by cashed up market participants around future policy changes and the movement of money based on those expectations which in turn drive the market. These expectations are an extremely strong force in the Forex market and the Forex market can be subject to speculative exaggeration as forex traders are inclined to bet fairly quickly on certain trends not yet factored into other markets, such as the 3 month bond markets.

To trade the Forex Market successfully a good trader needs to really master sentiment analysis and concentrate on how expectations are driving the market. Since other traders are in the same situation, only a few factors genuinely end up affecting exchange rates. This process can easily gain momentum of its own, with no one daring to buck the trend. Re-appraisal only occurs when an exchange rate is quite clearly outside the acceptable band for the central bank.

As the USD is the currency that is used for the majority of international trade and is held in reserves by most central banks, expectations around the USD is the most important place to start your analysis from. While many moves in the market can be explained by trade differentials, interest rate differentials, commodity prices, geo-politics, etc, the majority of moves are based on expectations around US interest rate policy, future economic growth and US participation in global politics. To demonstrate this point, attempts to explain the large cyclical swings in the commodity currencies, such as the Aussie dollar on the basis of interest rate differentials or commodity prices is largely a waste of time. Evidence suggests the Aussie dollar movements are largely a by product of sentiment toward the USD. The USD cannot explain many of the short term moves, but it does explain 85% of long term moves.

As always the currency market evolves. Pre-World War II, the pound was the dominant currency for international trade. After the war finished Winston Churchill made a stupid mistake around setting the exchange rate policies, and the whole world moved over to the US Dollar as the preferred currency for international trade. The same thing is happening to the US dollar now. The dollar is chronically devalued at the moment and a number of central banks are moving a portion of their reserves into Euros and the demand for the Euro as the preferred currency for international trade is increasing. As a result the dollar is quite volatile. However, this does not mean that it is all down hill for the “mighty” dollar. The English pound is still a highly valued currency after all these years (certainly much higher than what the UK economy might imply it is worth). Rome wasn’t built in a day, and the fall of the Roman empire took centuries of mismanagement before the Barbarians came knocking at the gate. Just like the decline of Rome, it will take a very long time before the US dollar will be displaced by the Euro and even then it will hold its value for a long time to come.

A good US economy equals a rise in the Eur, Aud, Cad, Nzd and a decline in the Usd dollar, and yen

A bad or uncertain future will drive the Eur, Aud, Cad, Nzd down and the Usd, Swiss franc and yen will rise.

risk currencies include Euro, Cad, Aud, Nzd

risk aversion, reserve currencies "safe havens" include US Dollar, Yen, And the Swiss Franc

The Pound is somewhere in between...I havn't quite figured them out.

A bad or uncertain future will drive the Eur, Aud, Cad, Nzd down and the Usd, Swiss franc and yen will rise.

risk currencies include Euro, Cad, Aud, Nzd

risk aversion, reserve currencies "safe havens" include US Dollar, Yen, And the Swiss Franc

The Pound is somewhere in between...I havn't quite figured them out.

Joe,

What do you mean "or a hull 10 period"

John

What do you mean "or a hull 10 period"

John

Joe, I assume the Yellow line is a 5sma, so the Blue line is price?

Thanks for your postings. Always good stuff!

piper

Thanks for your postings. Always good stuff!

piper

yes blue line is price.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.