ES short term trading 8-11-10

Volume numbers I'm using on Wedsneday from the RTH session

1111.25

1114.50

1118.75

We'll confirm in the mornming once O/N session completes.

1111.25

1114.50

1118.75

We'll confirm in the mornming once O/N session completes.

Today's OR:

Yesterday: LOD was L of 30/60min OR

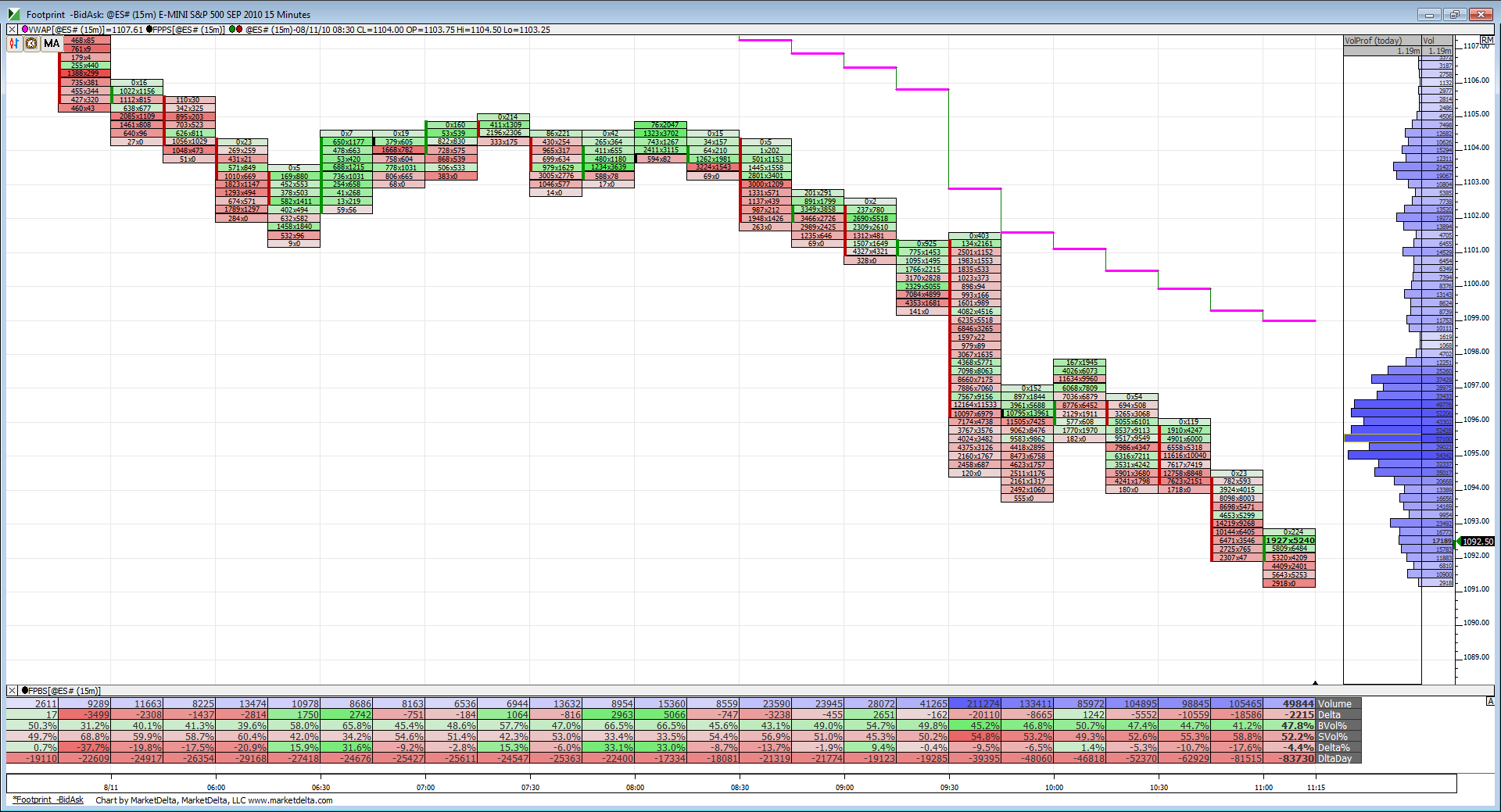

OR 5min 15min 30min 60min

High 1101.50 1101.50 1101.50 1101.50

Low 1095.50 1094.50 1093.75 1093.75

Range 6 7 7.75 7.75

Yesterday: LOD was L of 30/60min OR

ES still trying to lead down...hour low real important more than usual when we diverge like this

hoping they push it out the lows..

next key area is 88.50 - 89.50 but that would surprise me if they don't back and fill up some more...so not expecting a straight push by any means...only ES came out and $tick diverge...makes sense with only one leading

selling has caught up in the other markets...that was sneaky..next fade point will be at 89 print ..otherwise just watching until taht prints....if it prints

in general there are many who will look at that 96.50 volume to help pull up there longs and keep the day symetric...like they have been doing for the last 5 or 6 days

91.50 will make it equi - distant off the 96.50 and the current RTH high but I'd prefer the buys from a bit lower

91.50 will make it equi - distant off the 96.50 and the current RTH high but I'd prefer the buys from a bit lower

long 91.75 due to data gap now..

92.50 filled that gap....new lows will stop this out..and will try again fom lower....second target is hour low..

Looking at the volume between 1094-1097 and the price action there we have had a mini range that prices have now broken under. As Bruce suggests, will prices want to come back into this range or trend to the lower key numbers?

so if 96.50 is gonna keep this symetric then we can project....take current high and subtract the 96.50 ...then subtract that answer from the 96.50 to project the other side ....

LOL Bruce I kind of felt the way you did about that post, however I am lacking your diplomacy when dealing with such feelings. I also have suffered in the past with trend days and like you are becoming more able to deal with them. Like you with the ES down 25+ and average range recently at 23-25 Shorting or looking for more downside for the day seems like a very low probability. Standing aside for both of us was certainly a wise move.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.