ES short term trading 7-22-10

Numbers for tomorrows day session:

1091

1086 - 1087

1079 - 1080..HV

1073 - 1075 ...singles will fill and closing Vwap

1066

1061

1053- 1056

1048

keep in mind we have singles from 70.25 - 74.25

Will refine them once we see what overnight brings

1091

1086 - 1087

1079 - 1080..HV

1073 - 1075 ...singles will fill and closing Vwap

1066

1061

1053- 1056

1048

keep in mind we have singles from 70.25 - 74.25

Will refine them once we see what overnight brings

Originally posted by chrisp

TTT 3 day cycle, Sell day, push price up to sell what was bought at yesterday lows, hold price up while selling... FWIW

Thanks Chrisp,

How does one know which day one is in in the cycle?

That is, do they always follow

buy day

sell day

sell low day, then

buy day

or are there sometimes pause days in between?

Originally posted by blueNo pause.. Buy Day, Sell Day, Sell Short Day... Theory works pretty good and really good for justifying markets rising and falling. look at the TTT thread in the forum as well as Rich's site http://www.taylortradingtechnique.net/ , takes a little time, but can be time well spent

Originally posted by chrisp

TTT 3 day cycle, Sell day, push price up to sell what was bought at yesterday lows, hold price up while selling... FWIW

Thanks Chrisp,

How does one know which day one is in in the cycle?

That is, do they always follow

buy day

sell day

sell low day, then

buy day

or are there sometimes pause days in between?

I got a lot to say to many of you...and emails too...I just got back from swimming and will explain how that worked out for me...the good, the bad and the ugly. need to get some chow

look at your one minute for th ebig volume report surge but more later

look at your one minute for th ebig volume report surge but more later

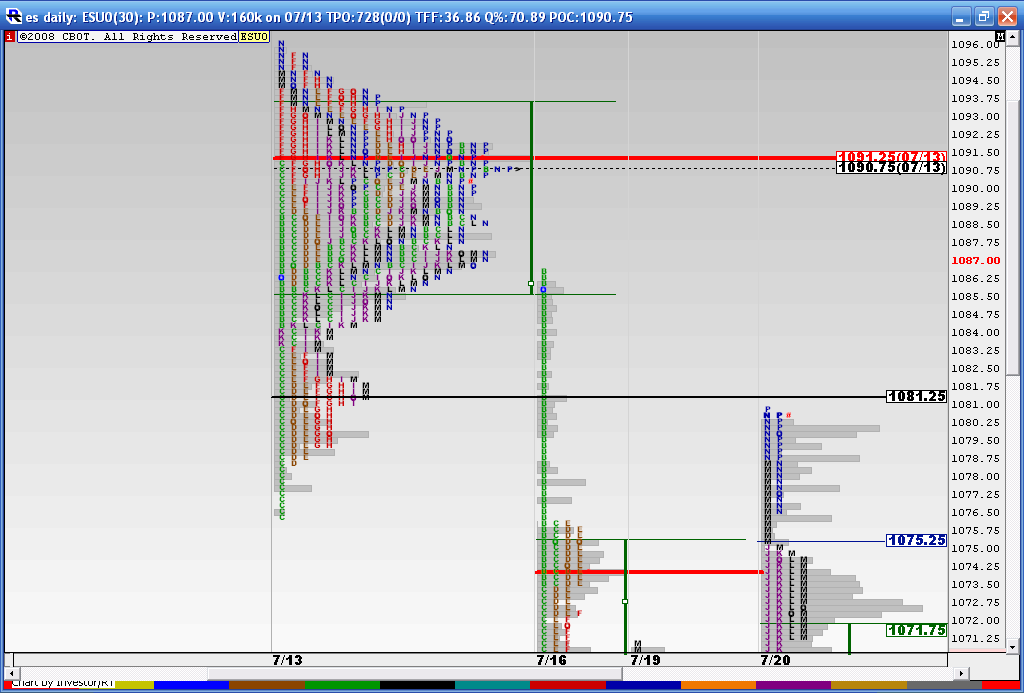

here is the consolidation taken from my MP thread from last Tue, wednesday and Thursday. It is labeled 7-13 but really is a combination of those 3 days.I'm finding that merging the long term profiles together is not really helping me so far in my quest to hold for longer term moves BUT merging together consolidations and days that overlap with their value areas is helping me a out a bit.

You can see the 1091 and the Value are high (Green horizontal line)at about 93.75. The Va low is 1086 area. We are churning in that area now so the market is poised to make a move from here in search of new Value..so usually one of two things will happen. We will breakout of the highs or lows on poor volume and then trade back into the range and attempt to revist the opposite end of the range or if we breakout on good/ high volume then we should travel up to 1101 on the longside or a down breakout will go for 1075 or lower...!

2 PM had been making moves recently but I'm not trading anymore today...next post will go into some details from my journal entries and general babbling...For some reason my wife thinks we need to celebrate my Daughters 1/2 birthday...she's 18 months old today....she a real gem and luckily for all her brothers love her!!

Anyway, here is that chart

You can see the 1091 and the Value are high (Green horizontal line)at about 93.75. The Va low is 1086 area. We are churning in that area now so the market is poised to make a move from here in search of new Value..so usually one of two things will happen. We will breakout of the highs or lows on poor volume and then trade back into the range and attempt to revist the opposite end of the range or if we breakout on good/ high volume then we should travel up to 1101 on the longside or a down breakout will go for 1075 or lower...!

2 PM had been making moves recently but I'm not trading anymore today...next post will go into some details from my journal entries and general babbling...For some reason my wife thinks we need to celebrate my Daughters 1/2 birthday...she's 18 months old today....she a real gem and luckily for all her brothers love her!!

Anyway, here is that chart

I agree Chrisp ..Rich does good work even though I don't use it, the people from his thread always seem pleasant and he seems like a real straight shooter. He won't make excuses if something doesn't work. He seems like a good educator for the Taylor cycle.

Originally posted by chrisp

Originally posted by blueNo pause.. Buy Day, Sell Day, Sell Short Day... Theory works pretty good and really good for justifying markets rising and falling. look at the TTT thread in the forum as well as Rich's site http://www.taylortradingtechnique.net/ , takes a little time, but can be time well spent

Originally posted by chrisp

TTT 3 day cycle, Sell day, push price up to sell what was bought at yesterday lows, hold price up while selling... FWIW

Thanks Chrisp,

How does one know which day one is in in the cycle?

That is, do they always follow

buy day

sell day

sell low day, then

buy day

or are there sometimes pause days in between?

Happy 1/2 BD to her. True capital!

I think I had two windows open to the site and 2 earlier posts lost. Just in case someone else encounters the problem, and this one posts. (Crossing fingers)

If an ABC wave up. My preferrred count here. In wave C that projects to 1115. As we sidewind these 3-4 waves here, just thought I'd put it out there.

I think I had two windows open to the site and 2 earlier posts lost. Just in case someone else encounters the problem, and this one posts. (Crossing fingers)

If an ABC wave up. My preferrred count here. In wave C that projects to 1115. As we sidewind these 3-4 waves here, just thought I'd put it out there.

Thanks ...I pissed off a few vendors some years back and they love to send stuff to my old email after I have a challenging or losing day.....so that was really meant for them. I always ask them to come on here and post real time with some reasons and they never do.

They are the type that will tell you they bought down at 1061 yesterday afternoon and held overnight. After the move takes place. For once I'd like to see some trend traders or anyone post an actual trade in advance with the reasons and see it go a long distance.

It disturbs me when folks on forums in general "boast" about their numbers being hit when you never even knew they were in on a trade/move or they don't post consistent and repeatable ideas.

They are the type that will tell you they bought down at 1061 yesterday afternoon and held overnight. After the move takes place. For once I'd like to see some trend traders or anyone post an actual trade in advance with the reasons and see it go a long distance.

It disturbs me when folks on forums in general "boast" about their numbers being hit when you never even knew they were in on a trade/move or they don't post consistent and repeatable ideas.

Originally posted by mnytr35

Bruce,

I'm certain nobody wants to see you fail. You add alot of value to this forum. I've been quietly trying to learn for weeks. At some point I hope to be able to add value here.

I think you folks with the long idea may be right....someone posted on another forum about high $ticks in the morning and little zero readings will often have another leg of buying in the PM session. That with holding the report volume spike and air pockets seems to be healthy for the long side...

You certainly wouldn't catch me fading new highs if I was trading anymore today.

You certainly wouldn't catch me fading new highs if I was trading anymore today.

I was out most of yestrerday and on after market open 45min today. TCB'ing. Looking for long entry out of this consolodation. R above definitely at 1095. Maybe it'll be after hours again. AMZN reports(blah). Not really a cornerstone. More of a siren. I sure wasn't up last night to catch that turn. After hour moves generating chasing. Most longs,think conviction, reentered today after getting whacked wed..

That 1115 is a minimum for a wave C. 96x 68% roughly 65 from 1050.

I just started with an entry here 1092.

That 1115 is a minimum for a wave C. 96x 68% roughly 65 from 1050.

I just started with an entry here 1092.

1091 stop, I have no conviction

OK, you got the explosive rally off of the 12-13 day low. If you go back and look at my charts you will notice the high never comes in untill day 5 at the earliest, more commonly day 6-8. Friday would be day 3 ,the way i count it. however you have this little demon to deal with....Closing tick +1238! And you know how i feel about that! I would not be surprised to see some back and fill tomorrow.certainly by the close mon! ... good trading all!!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.