ES short-term trading for 7-15-10

Bruce,

You were right again (what else is new)

I see 81 printed, but I don't remember why you expected it.

Today is looking pretty grim, especially with the seasonal weakness koolblue had in that average performances of trade days of the month.

It is before 11 o'clock and the ES has already undercut its 5 day average of the Low versus the Open which is at 1086.50 for today. A move like this often means trend sell day.

with 5 day average RTH range at 12, today's RTH H minus 12 = 79.75, have to watch PA there , with second air, return to 83.25 likely? Am I reading this right, Bruce?

You were right again (what else is new)

I see 81 printed, but I don't remember why you expected it.

Today is looking pretty grim, especially with the seasonal weakness koolblue had in that average performances of trade days of the month.

It is before 11 o'clock and the ES has already undercut its 5 day average of the Low versus the Open which is at 1086.50 for today. A move like this often means trend sell day.

with 5 day average RTH range at 12, today's RTH H minus 12 = 79.75, have to watch PA there , with second air, return to 83.25 likely? Am I reading this right, Bruce?

Originally posted by PAUL9

Is there anytbody out there besides phileo?

just post something.

what's the weather like where you live.

LOL!

I would have thought Bruce would have popped in to provide some further commentary on his trade thesis in yesterday's O/N globex session.

Weather in Dallas ... it's already about 150 degrees and 101% humidity with a heat index of 217 degrees ... should warm up later.

“If I owned Texas and Hell I would rent out Texas and live in Hell”

“If I owned Texas and Hell I would rent out Texas and live in Hell”

Originally posted by PAUL9

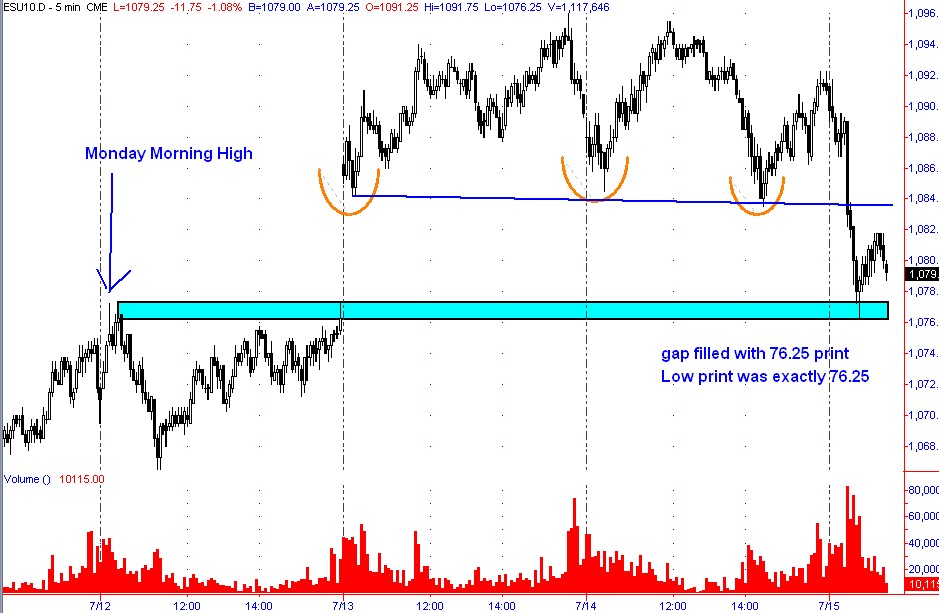

GAP now filled and with the end of the half hour near at hand, MP letters down in this area will create large area of single prints above.

Long 77.00 target 82.00 stop 74.50

I actually had a nice thick S/R line drawn at 1076, but didn't believe in it (or maybe too scared is the word!) in the face of that 10pt drop. Congrats on the courage to take the setups in the face of emotions.

where to now?

22pt drop, half of it done in RTH. I would be surprised to see sellers give up that kind of control.

Nevertheless, 50% RT of the drop from 1088.5 is about 1083, which is also the S1 pivot. Will be watching to see who takes control of that level.

22pt drop, half of it done in RTH. I would be surprised to see sellers give up that kind of control.

Nevertheless, 50% RT of the drop from 1088.5 is about 1083, which is also the S1 pivot. Will be watching to see who takes control of that level.

LOL, Monkeymeat.

trader43,

I have only just started looking at MP again.

My inspiration for the trade was actually bolstered by a failed trade I posted on Monday where I bought a breakout of the first 15minute RTH range, had a .618 extension target and failed to tighten or take some profits when price reached within 3 ticks of my target. That target was 77.75, high print swing after breakout of OR15 was 77.25.

Monday's Highs were the first line of visible support (if you look at an RTH only chart, and it seemed to me that thee had to be at least some people willing to buy a gap fill after a 20+ point decline from today's Highs.

My mention of the anticipated "creation" of single prints did give me added confidence, but MP is a peripheral for me right now, main call to action was gap fill (and already 20pts off the high), and

I can post a simple chart, help, do I "upload" or "attach"

trader43,

I have only just started looking at MP again.

My inspiration for the trade was actually bolstered by a failed trade I posted on Monday where I bought a breakout of the first 15minute RTH range, had a .618 extension target and failed to tighten or take some profits when price reached within 3 ticks of my target. That target was 77.75, high print swing after breakout of OR15 was 77.25.

Monday's Highs were the first line of visible support (if you look at an RTH only chart, and it seemed to me that thee had to be at least some people willing to buy a gap fill after a 20+ point decline from today's Highs.

My mention of the anticipated "creation" of single prints did give me added confidence, but MP is a peripheral for me right now, main call to action was gap fill (and already 20pts off the high), and

I can post a simple chart, help, do I "upload" or "attach"

Thanks Paul for your chart.

What are you think what futher happened?

Trader43

What are you think what futher happened?

Trader43

Mornin,

Not a lot of huury to cover so far. 1083.5 needs to hit.

Not a lot of huury to cover so far. 1083.5 needs to hit.

You can look here in the morning as it will be updated by then but we have had lots of high closing $Ticks this week...

http://www.wallstreetcourier.com/index1.htm

so doubt we have lots of divergence lately. This guy corey posts some simple but effective view points regarding internals too..

www.afraidtotrade.com

http://www.wallstreetcourier.com/index1.htm

so doubt we have lots of divergence lately. This guy corey posts some simple but effective view points regarding internals too..

www.afraidtotrade.com

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.