ES short term trading 6-08-10

By all rights , i would think today begins the rebound that everyone expected yesterday, but time will tell! Remember the weekend preview and the cycles . tomorrow they turn down ,basically for the rest of the week. tomorrow is also a kools cycle turn date and a bradley turn date so the action today should be interesting . heres a short term look as we wind down the globex session....

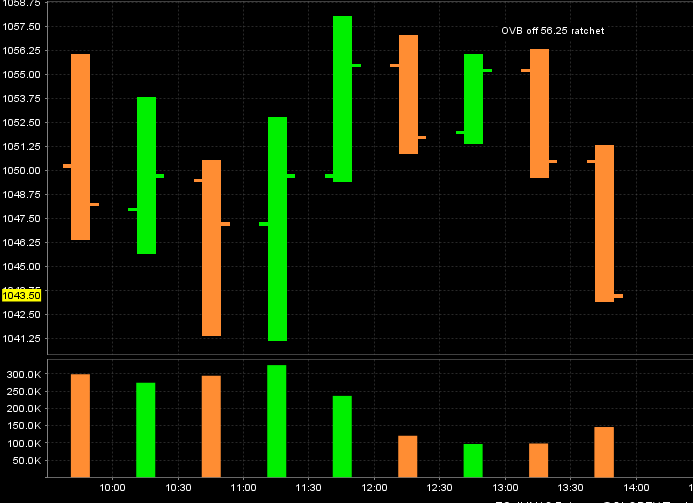

in my world we had a big single print buying tail from may 6th I think from 44 down to 38..that's why I thought that 43.75 ratchet was a cool target.....it will be cool if that could hold back this decline today....62.50 should be easy then

Originally posted by phileo

WTF? Did Bernanke release the PPT?

10pts in 10min

http://www.trading-naked.com/JerrysDragonPattern.htm

long 1051.25, just a couple ticks from the opening price.

target 1056

long 1051.25, just a couple ticks from the opening price.

target 1056

Originally posted by phileo

http://www.trading-naked.com/JerrysDragonPattern.htm

long 1051.25, just a couple ticks from the opening price.

target 1056

tail hook was the morning drop 1053-1047

back formed dbl bottom 1041.5

head was consolidation 1051-1053

exited 1055.5. not gonna be a dick for a tick.

Originally posted by phileo

http://www.trading-naked.com/JerrysDragonPattern.htm

long 1051.25, just a couple ticks from the opening price.

target 1056

I usually don't trust these patterns, but today, it lined up nicely with some support confluence:

dbl bottom 1041.5

support-turned reseistance-turned support: 1046-1047

opening price + place of multiple reacitons: 1050.5

Originally posted by McFuture

Originally posted by hari

Originally posted by feng456

thanks Bruce. im also sim trading your ratchet levels as well to see how they play out with regards to stops, targets, and frequencies.

feng456, when you get a chance can you please link me up to where I can find more info about ratchet levels? I am new to this forum, I looked in search for "ratchet levels" but it came up with no results.

Thanks for sharing your strategy in "My Trading Plan" thread.

Hari,

This was posted a few days back by Paul9... it might help with ratchets:

Posted - 06/01/2010 : 08:55:49

Originally posted by feng456

what do you mean when you say "Rat"?

He's referring to the ratchet levels... the split of the split between the 00, 25, 50, 75 levels

25 / 2 = 12.50 split

12.50 / 2 = 6.25 split of split

50 + 6.25 = 56.25

............56.25 + 6.25 = 62.50

...........................62.50 + 6.25 = 68.75

..........................................68.75 + 6.25 = 75.00

wash rinse repeat

Thanks McFuture!

phileo,

RE Jerry's dragon pattern...

Look at a daily chart of the ES. It sure looks like a potential dragon pattern to me with today's action potentially forming the right feet/foot.

tail hook and back have formed, would be confirmed with a close above the "back" which is close above 1105.67 CASH

I am referring to the cash price because Thursday of this week is roll forward to SEP contract so prices will be different from chart, but cash is cash.

RE Jerry's dragon pattern...

Look at a daily chart of the ES. It sure looks like a potential dragon pattern to me with today's action potentially forming the right feet/foot.

tail hook and back have formed, would be confirmed with a close above the "back" which is close above 1105.67 CASH

I am referring to the cash price because Thursday of this week is roll forward to SEP contract so prices will be different from chart, but cash is cash.

Originally posted by PAUL9

phileo,

RE Jerry's dragon pattern...

Look at a daily chart of the ES. It sure looks like a potential dragon pattern to me with today's action potentially forming the right feet/foot.

tail hook and back have formed, would be confirmed with a close above the "back" which is close above 1105.67 CASH

I am referring to the cash price because Thursday of this week is roll forward to SEP contract so prices will be different from chart, but cash is cash.

Yes, I see that on the daily ES chart.

Tail hook at around 1090 (May 7 lo)

Tail is 1170, Left leg 1037 (May 24 lo), Right leg potentially today's lo (1041.25).

A lot has to happen to complete this potential dragon pattern (the most important of which being that today's lo must not be violated).

But basically, a breakout of 1105 is very actionable, with a target of 1170 as per this pattern.

I may enter SPY with a smaller position size on the breakout of 1105.

a look at a current short.....remember we traded on both sides of 60 minute range so still neutral day.....once again the 30 minute OVB off a rat!!

I'd really like to see the 15 minute set up a higher low to new highs on the day from here...if we can't get new lows the 15 minute will make that higher low which hopefully will compress the Market higher..but the lows must hold now for that to happen!!

I'd really like to see the 15 minute set up a higher low to new highs on the day from here...if we can't get new lows the 15 minute will make that higher low which hopefully will compress the Market higher..but the lows must hold now for that to happen!!

I would call that "Range air" and hopefully Kool or Phileo will jump in here as they watch more for that....on consolidation days that will fill in and I would assume that range air fills in quite often...

And great observation about that being the highest volume bar on the day.....you get it...awesome....see how often that gets tested

Is it any surprise that the VA low from Tuesday is in the 47 area? No, It shouldn't be as the high vertical volume comes first and then the time builds up there because price is attracted to areas that had high vertical volume..

Hopefully REd will getto the Candle questions..

And great observation about that being the highest volume bar on the day.....you get it...awesome....see how often that gets tested

Is it any surprise that the VA low from Tuesday is in the 47 area? No, It shouldn't be as the high vertical volume comes first and then the time builds up there because price is attracted to areas that had high vertical volume..

Hopefully REd will getto the Candle questions..

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.