ES short term trading 6-04

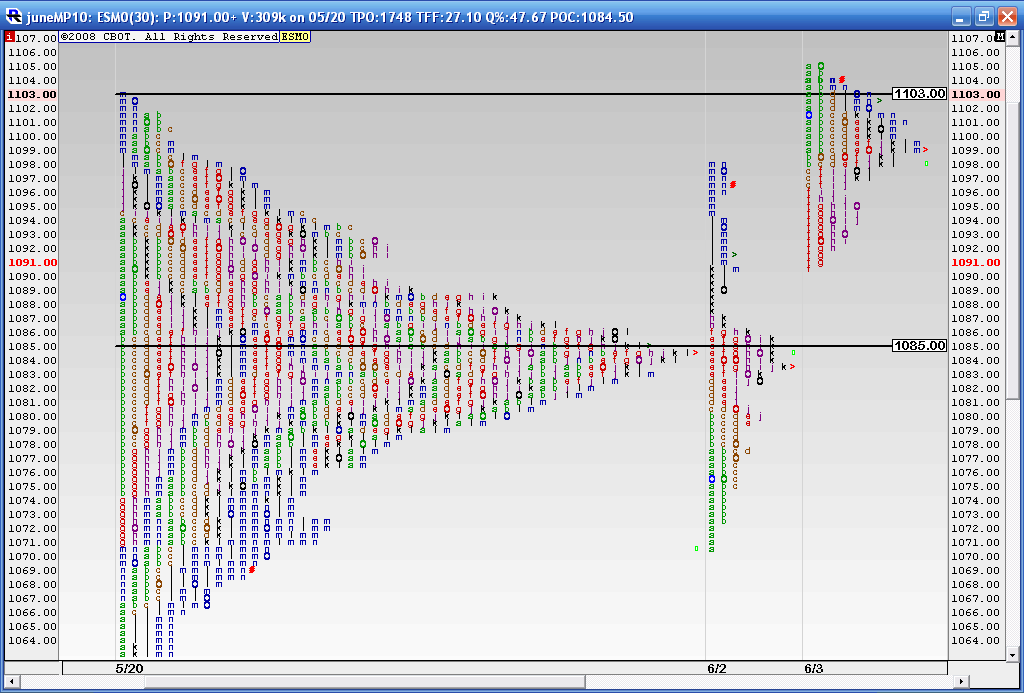

Here is a composite profile that includes all this consolidation from 5-20 including Tuesdays Trade. You may remember that Tuesday closed down at 1068 which is far below that huge volume node at 1085. This also shows what happened on Wednesday and today. Wednesday closed back above the 1085 and then today they established Value higher than Wednesday.

If I was writing an MP book then this would be "Textbook" with that high node at 1085 and then closing and building value higher today.

With any luck we will have a nice rally from here. The simplistic view is that if this rally fails then that 1085 becomes the attractor price and back down we go.

If I was writing an MP book then this would be "Textbook" with that high node at 1085 and then closing and building value higher today.

With any luck we will have a nice rally from here. The simplistic view is that if this rally fails then that 1085 becomes the attractor price and back down we go.

Originally posted by feng456

im out at 86.5 for a loss of 5.5 and a net gain of 0 for the week with commissions. yay.

exiting at 1082 when you had 2 chances to do so would have saved you 4.5 pts.

So I guess the issue here becomes:

is there a quantifiable condition where capital preservation becomes a higher priority than following your trading plan so relentessly rigidly.

nice hindsight. following ur advice on other days would lead to me losing out on profit and also possibly taking a loss. serioulsy there's a reason for discipline.

Originally posted by feng456

nice hindsight. following ur advice on other days would lead to me losing out on profit and also possibly taking a loss. serioulsy there's a reason for discipline.

I apologize if my previous post came across as an attack, please understand that I'm not trying to criticize what you did at all, I know i should be the last person on earth to criticize anyone.

you know i've been following your hybrid gap fade strategy with interest. I guess what i'm trying to say is, is there any modification that you can make to your trading plan which will minimize losses like today in particular?

I am interested in helping to improve your hybrid gap fade strategy, because I think there is enough potential there that I may even use it myself..... Based on my stats that I've collected for the past 4months, over 72% of all gaps fill. The challenge is to minimize the losses from the 28% of the ones that don't.

yeah i gap faded for a while and for a while it was really profitable but i found from march to may, my particular strategy first became barely profitable (like 4 points a month or something) to severely negative for May.

i am just really frustrated right now because despite the hours of hard work analysing and ****, despite following my plan with discipline, i just lost an entire week's work. again! it's been months since ive made any gains (jan was my last positive month) and i am beyond frustrated at this. im getting old here ffs. time isnt gonna stop because i cant make **** happen. seriously i duno wtf im doing wrong. thats why i made the thread about my trading plan.

right now the thing i do is based on 1 month of backtesting really. i have no idea if that's enough but the months before that were really different in volatility so they are kinda skewed. from what im getting i think im on right track? i really dont know...i just know it's been the same old losing money or no making any for the past half a year and im ****ing tired of it.

i am just really frustrated right now because despite the hours of hard work analysing and ****, despite following my plan with discipline, i just lost an entire week's work. again! it's been months since ive made any gains (jan was my last positive month) and i am beyond frustrated at this. im getting old here ffs. time isnt gonna stop because i cant make **** happen. seriously i duno wtf im doing wrong. thats why i made the thread about my trading plan.

right now the thing i do is based on 1 month of backtesting really. i have no idea if that's enough but the months before that were really different in volatility so they are kinda skewed. from what im getting i think im on right track? i really dont know...i just know it's been the same old losing money or no making any for the past half a year and im ****ing tired of it.

well, I think we are headed to 1070, unfortunately, I just don't know where to get in for the elevator ride down.

the long is 77.75 close..for the air below 80...hopefully u see it

hoping for a rally now with a failed hour breakdown into the key 75 - 77.50 zone

http://www.mypivots.com/Board/Topic/5754/1/es-short-term-trading-6-3-10

"1081 was the start of Mon. breakdown, and start of yesterday's breakout."

1081-1082 was:

- today's opening price

- Tues. VAL and last wed's. POC

- support for this morning's gap fade attempt

I think Bruce also mentioned 1081.25 a couple of times too....

I hate hindsight trading; I have to start reviewing prior threads more often.....

"1081 was the start of Mon. breakdown, and start of yesterday's breakout."

1081-1082 was:

- today's opening price

- Tues. VAL and last wed's. POC

- support for this morning's gap fade attempt

I think Bruce also mentioned 1081.25 a couple of times too....

I hate hindsight trading; I have to start reviewing prior threads more often.....

Today's avg range is 33pts. Avg. range for past 5 sessions is 28.8pts. today's RTH range is 14pts.

I think 1074 may be the LoD, what does everyone think?

I think 1074 may be the LoD, what does everyone think?

phileo, I keep track of average (5 day) RTH range and that average is 21.40 for today, so on average, price range RTH has not hit average.

Oh great..u'll enjoy that...Have you read Daltons Book?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.