ES short term trading 6-2-10

Lots matching up again

86 - 87.5 rat and POC

81.25 Rat and Va low

75 - 77 Rat, weekly PV and current O/N high, breakdown point from YD aftrenoon *******

67 - 68 rat and current O/N low - YD low****

the MP players wll be watching to see if price is brought back uo into value today or if new value will be established lower from that late day spike. Usually after a consolidation and run out in the afternoon that closes on it's lows we get follow thorugh...so many will be trying to get short up in the 76 - 77 area in the O/N and target lows below YD's low

We know we will probably print at least two ratchets so we can watch which one prints first to try and establish which one will print second. This is being done in attempt to hold runner contracts longer with a good signal. My bias is short untill we trade below YD's lows, then we need to be thinking about the possible GAP AND RAT down at the 61 - 62 area. Below there is 56 area and another RAT. That may be an agressive goal. Goodluck today

86 - 87.5 rat and POC

81.25 Rat and Va low

75 - 77 Rat, weekly PV and current O/N high, breakdown point from YD aftrenoon *******

67 - 68 rat and current O/N low - YD low****

the MP players wll be watching to see if price is brought back uo into value today or if new value will be established lower from that late day spike. Usually after a consolidation and run out in the afternoon that closes on it's lows we get follow thorugh...so many will be trying to get short up in the 76 - 77 area in the O/N and target lows below YD's low

We know we will probably print at least two ratchets so we can watch which one prints first to try and establish which one will print second. This is being done in attempt to hold runner contracts longer with a good signal. My bias is short untill we trade below YD's lows, then we need to be thinking about the possible GAP AND RAT down at the 61 - 62 area. Below there is 56 area and another RAT. That may be an agressive goal. Goodluck today

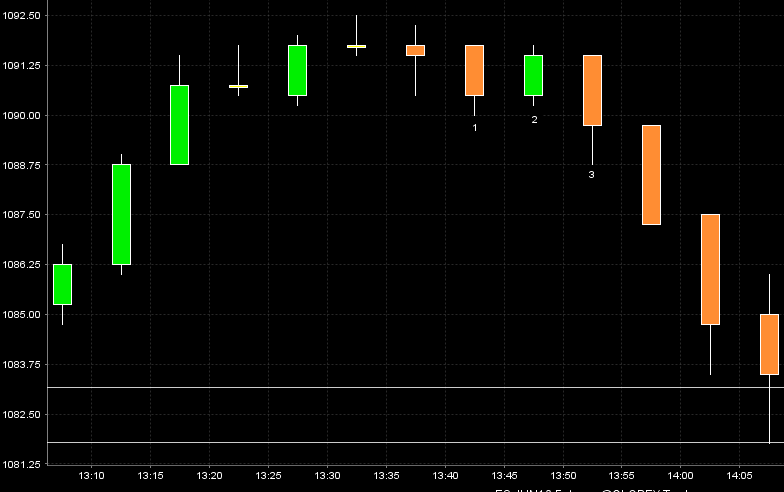

ak1, here is one of the swing highs I mentioned in the other thread..

1) you are expecting a swing high ( the devloping VA high was up there)

2) you get a down close - labelled "1"

3) you get the up close - labelled "2" - this is the last attempt of the bulls to rally

4) The rally fails and you go short on bar "3" as it breaks bar 2's low.....BAR 3 would fail only if it goes on to take out the high of bar 2....that would make bar 3 an outside bar to the upside or you may chose to exit if bar 3 doesn't close in the direction of your trade. Of course it does happen sometimes and you will get stopped out. It obviously didn't this time and the market sells off.

Here is the chart

1) you are expecting a swing high ( the devloping VA high was up there)

2) you get a down close - labelled "1"

3) you get the up close - labelled "2" - this is the last attempt of the bulls to rally

4) The rally fails and you go short on bar "3" as it breaks bar 2's low.....BAR 3 would fail only if it goes on to take out the high of bar 2....that would make bar 3 an outside bar to the upside or you may chose to exit if bar 3 doesn't close in the direction of your trade. Of course it does happen sometimes and you will get stopped out. It obviously didn't this time and the market sells off.

Here is the chart

hey crew,

O/N Market has been boxed in by 1077.5-1078.5 and 1067.5-1068.5 areas. I will be watching those two lvls for breakout - should be good for 2pts IMO.

gap fill is 1070, YD lo 1068.5, and O/N session reversed in this area 3x.

o/n bias was initially up, but European selloff resulted in a more range bound, neutral p/a.

What I'm looking for today is gap fill attempt (down to 1068), and then breakout attempt (1078).

something else I found useful:

O/N Market has been boxed in by 1077.5-1078.5 and 1067.5-1068.5 areas. I will be watching those two lvls for breakout - should be good for 2pts IMO.

gap fill is 1070, YD lo 1068.5, and O/N session reversed in this area 3x.

o/n bias was initially up, but European selloff resulted in a more range bound, neutral p/a.

What I'm looking for today is gap fill attempt (down to 1068), and then breakout attempt (1078).

something else I found useful:

Yesterday BruceM wondered how often a gap down day closes above the close of the previous day.

All these numbers are based on whatever TradeStation uses for it's continuous ES contract.

LookBack period was yesterday through to June 2000. 10years of data, about 2500 trade days

Definition of a Gap Down: Open is less than the RTH Close of the previous day (the 4:15pm ET Close)

There have been 1171 gaps down over the 10years (no minimum size for the gap, if the open was just 1 tick lower than the previous close, that's a gap).

1171/2500 mneans about 47% of the time the price at the open was less than the previous day's close.

OF ALL those gaps down, only 433 managed to close above the close of the previous day. 433/1171 = 37% of the time...

To state it another way:

this means that regardless of anything else, historically, over the past 10 years, when the market gaps down, the chance of a close LESS THAN the previous day's Close is 63% of the time.

---------

Now, here's something I filtered for.

When I looked at the chart yesterday, I noticed that yesterday's Open was actually lower than the lowest low of the prior 2 RTH sessions, so I filterd for that...

Over the same 10years, gaps down whose open was LOWER than the Lowest RTH Low of the prior 2 trade days occurred 231 times. (only about 9% of the time (This was the case yesterday)

Of those 231 occurrences, only 71 closed above the previous day's close, that's about 30.7% of the time.

To state it more obviously, a gap down whose open is lower than the lowest Low of the prior 2 RTH sessions has failed to close higher than the previous day's Close 69.3% of the time.

All these numbers are based on whatever TradeStation uses for it's continuous ES contract.

LookBack period was yesterday through to June 2000. 10years of data, about 2500 trade days

Definition of a Gap Down: Open is less than the RTH Close of the previous day (the 4:15pm ET Close)

There have been 1171 gaps down over the 10years (no minimum size for the gap, if the open was just 1 tick lower than the previous close, that's a gap).

1171/2500 mneans about 47% of the time the price at the open was less than the previous day's close.

OF ALL those gaps down, only 433 managed to close above the close of the previous day. 433/1171 = 37% of the time...

To state it another way:

this means that regardless of anything else, historically, over the past 10 years, when the market gaps down, the chance of a close LESS THAN the previous day's Close is 63% of the time.

---------

Now, here's something I filtered for.

When I looked at the chart yesterday, I noticed that yesterday's Open was actually lower than the lowest low of the prior 2 RTH sessions, so I filterd for that...

Over the same 10years, gaps down whose open was LOWER than the Lowest RTH Low of the prior 2 trade days occurred 231 times. (only about 9% of the time (This was the case yesterday)

Of those 231 occurrences, only 71 closed above the previous day's close, that's about 30.7% of the time.

To state it more obviously, a gap down whose open is lower than the lowest Low of the prior 2 RTH sessions has failed to close higher than the previous day's Close 69.3% of the time.

great work!! thank you

crap i have to do all my backtesting manually...good work though we need more of this.

anyone know why 72.50 is attracting volume and the spikes are there?

grr really hard to establish a bias so close to one of the ratchet levels....probably going long but if 75.00 = open then im going short. what a crapshoot

went long 75.75

i just realised my target is right on the O/N high...that's unfortunate.

Thanks Bruce. Going loong 71.25

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.