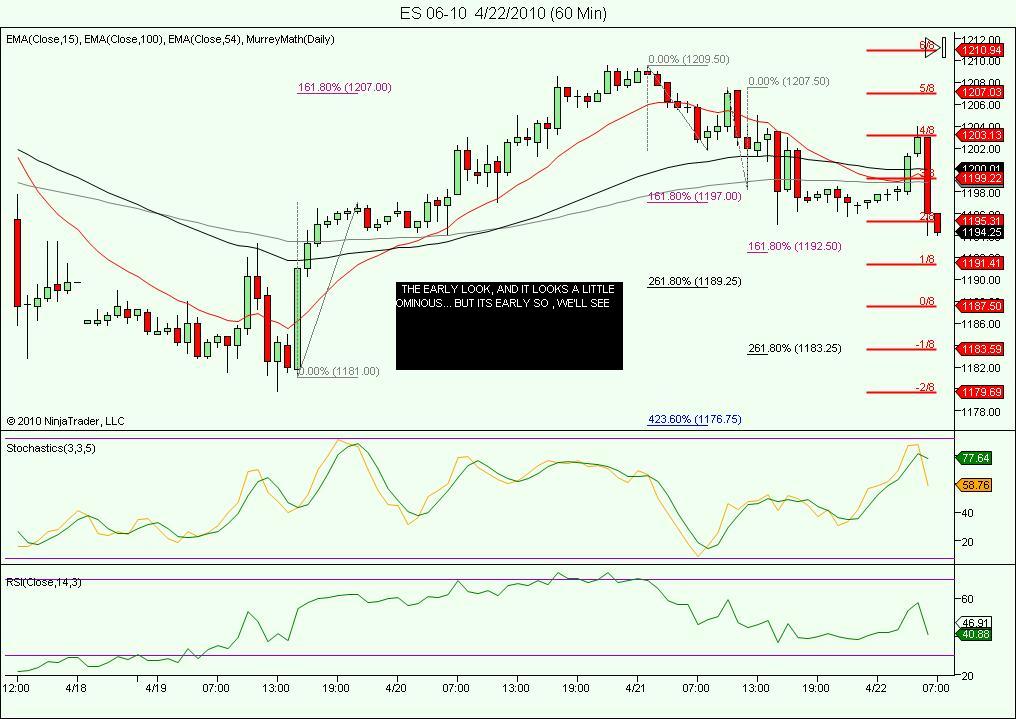

ES short term trading 4-22-10

And a quick look at the very short term set up.. you want to buy when price exceeds the lower regression band and it hits a projection...

am I the only one awake and stupid enough to buy 92.75 in the overnight..?

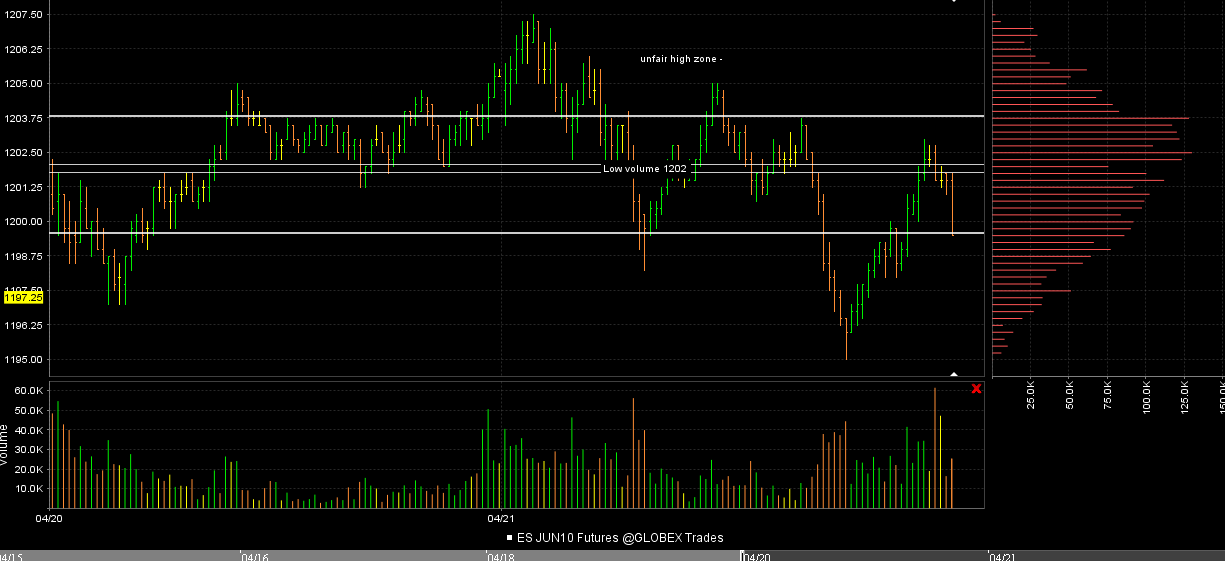

here is how the two day shaped up...notice the nice symetric volume histogram......trends tend to come from this but was hoping that would happen in the day session....no surprise that the high volume up at the 1202- 1203 initiated the selloff overnight

MM , I agree it seems that the overnight is stealing some of the better trades

the 1195 - 1197 has shown volume in the overnight so that is the current key area which includes the two day breakdown point and 50% of the overnight range.....report at 8:30

MM , I agree it seems that the overnight is stealing some of the better trades

the 1195 - 1197 has shown volume in the overnight so that is the current key area which includes the two day breakdown point and 50% of the overnight range.....report at 8:30

89 - 87 has some confluence of numbers as it is a low volume area from Mondays trade and then I have low volume at 85 and that is also the weekly open.....In the back of my mind I'm looking at Fridays range as one big zone as excursions above and below that range have been met with selling and buying...so until we reslove that we are just stuck...we need to see where RTH opens and based on the average ranges try to fiqure out if there is enough power to break out with confiction

got 95.25 and last contract at B/E....that was highest volume bar from overnight so someone sold that fairly hard...

Hey Bruce,

The overnight/Globex sessions have definitily been moving much more lately. This may become a regular thing as the market keeps evolving, but have notices especially in the past few weeks.

It was Phileo who'd originally posted yesterday with the observation, "Might be just my bias, but it feels to me like the overnight GLOBEX session seems to be taking away more and more of the RTH trade opps.....," and I agree with him. It seems that some of the overnight moves kind of suck some of the juice (and setups) from the RTH price action here and there.

May make for an adjustment in my sleeping vs. trading schedule when I trade the ES ... still mostly doing stocks which is a clock-in/clock-out job ... for now.

The overnight/Globex sessions have definitily been moving much more lately. This may become a regular thing as the market keeps evolving, but have notices especially in the past few weeks.

It was Phileo who'd originally posted yesterday with the observation, "Might be just my bias, but it feels to me like the overnight GLOBEX session seems to be taking away more and more of the RTH trade opps.....," and I agree with him. It seems that some of the overnight moves kind of suck some of the juice (and setups) from the RTH price action here and there.

May make for an adjustment in my sleeping vs. trading schedule when I trade the ES ... still mostly doing stocks which is a clock-in/clock-out job ... for now.

Thanks for giving credit where it is due MM...

Daily S1 = 94 and weekly PV at 94.50 so lots of interest down here...no if only the report will cooperate

Daily S1 = 94 and weekly PV at 94.50 so lots of interest down here...no if only the report will cooperate

I've got a minor Price Action Support level around 1188 that's coinciding with the Daily S1 fwiw. Have been keeping an eye on the YM and NQ as well, seeing which may be leading the way (or not). Should also note that YM got down near 11,000 ... might perhaps offer some semblance of support. And actually, for the ES, that's more like a 2-point minor support "zone" from 1190-1188.

holding 4 longs from avergae 93 now..( new campaign).targeting 95.50 first in RTH...50% will be next target up top IF we get the rally....will be watching 89 if they run it down first

Originally posted by redsixspeed

1213.00 on the radar....

==================================================================

SPX hit 1213.42 and we have stalled

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.