SPY Straddle Trade

Just put bot a 117 SPY (April) straddle apprx. 2:30cst Thursday ... cost $3.82 ... 10 contracts each side.

Rationale: HEALTHCARE/POLITICS coming to a head and who knows what's gonna happen during the weekend (in effect, a partial "event" trade).

Also, volatility low/anemic.

And have a solid, "straight-line" and significant run up off of low of SPY 105 to 117 in less than 2 months (11% move ... 12 SPY points ... apprx. 120 SP-500 points) ... expectation of a decent move out of this area in a short time frame.

Just tossing out a trade and my rationale. Will cover on any decent price shock in next 2-3 trading sessions ... if that doesn't happen, will ride it further into next week.

Addendum: Also of interest leading to trade was quadruple witching and some reports coming out early next week.

MM

Rationale: HEALTHCARE/POLITICS coming to a head and who knows what's gonna happen during the weekend (in effect, a partial "event" trade).

Also, volatility low/anemic.

And have a solid, "straight-line" and significant run up off of low of SPY 105 to 117 in less than 2 months (11% move ... 12 SPY points ... apprx. 120 SP-500 points) ... expectation of a decent move out of this area in a short time frame.

Just tossing out a trade and my rationale. Will cover on any decent price shock in next 2-3 trading sessions ... if that doesn't happen, will ride it further into next week.

Addendum: Also of interest leading to trade was quadruple witching and some reports coming out early next week.

MM

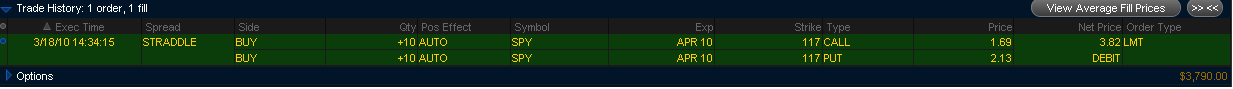

Not that it's necessary I guess, but thought I'd post a screenshot of fill/position.

Am using thinkorswim thingy through my TDAmeritrade acct. for trading on this one. Trying to get familiar with that product still.

Am using thinkorswim thingy through my TDAmeritrade acct. for trading on this one. Trying to get familiar with that product still.

congrats on the trade !!!

Yeah Phileo, you'd think I'd have booked a little or had an open profit. I put the thing on when SPY was trading right at 117.00 give or take a penny or two just before yday's close. And after a drop of almost 1.00 this morning to 116.00, the straddle didn't even gain a freakin' dime. I went ahead and just scratched out. I was biased short about 70% and prob. shoulda put the position on that way.

Reminds me of a trade back in 2002 when a buddy and I bot puts outright on the Q's. The next day, after a point drop in the underlying, we bailed because the puts hadn't even budged.

Been trading/studying options for over a couple of decades and sometimes the action and pricing just gets wonky. Used Optionvue for a few years a while back; great learning tool.

Wasn't looking to make a killin' ... just risking a little to make a little ... oh well. Let's see what happens with the rest of the session.

Reminds me of a trade back in 2002 when a buddy and I bot puts outright on the Q's. The next day, after a point drop in the underlying, we bailed because the puts hadn't even budged.

Been trading/studying options for over a couple of decades and sometimes the action and pricing just gets wonky. Used Optionvue for a few years a while back; great learning tool.

Wasn't looking to make a killin' ... just risking a little to make a little ... oh well. Let's see what happens with the rest of the session.

I'm also trying to get used to looking at things thru this thinkorswim platform ... kinda cool but is diff than what I'm used to seeing with the layout of options etc.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.