Modified Regular trading hours and studies

I have been thinking about doing studies based on a different set of trading hours for ES

rather than 8:30 to 15:15 (RTH) and 15:30 to 8:30 Globex.

I have noticed that on some days (especially straight up or straight down) that the move

will often start before RTH. For example, 7:15am. If a trading day was built with

different hours e.g. 7am to 15:15 modified regular trading hours (MRTH), then OHLC are

different.

This will give different indicator values

(e.g. CCI, SAR, BOL Bands, ATR, etc. etc.)

also gaps will be different - and gap closings

and candlesticks will look different.

Before lauching off on this I thought I would ask people thoughts on it.

1. Perhaps someone else has already tried this and could share their thoughts.

2. Perhaps a better start time than 7am?

3. Other thoughts?

As always I would ask negative, bitter and closed-minded people to just move along to another thread without comment. (Nothing positve or useful to say - then just don't say it.) Forum trolls need not apply.

rather than 8:30 to 15:15 (RTH) and 15:30 to 8:30 Globex.

I have noticed that on some days (especially straight up or straight down) that the move

will often start before RTH. For example, 7:15am. If a trading day was built with

different hours e.g. 7am to 15:15 modified regular trading hours (MRTH), then OHLC are

different.

This will give different indicator values

(e.g. CCI, SAR, BOL Bands, ATR, etc. etc.)

also gaps will be different - and gap closings

and candlesticks will look different.

Before lauching off on this I thought I would ask people thoughts on it.

1. Perhaps someone else has already tried this and could share their thoughts.

2. Perhaps a better start time than 7am?

3. Other thoughts?

As always I would ask negative, bitter and closed-minded people to just move along to another thread without comment. (Nothing positve or useful to say - then just don't say it.) Forum trolls need not apply.

After I did that gap fade study I started a more intensive study with much more data and millions of records of 1 minute data in the E-mini S&P 500.

Because the ES market is now a 24-hour market the "open" at 9:30am for gap purposes is picked because (1) it's the traditional open and (2) there is more volume from 9:30 onwards.

However, because you can trade the markets earlier than 9:30am, as you mentioned, the gap can be measure to any time point in the morning and as you suggested could be 7:30am or 8:30am or 8:45am. or even 6:34:57. If you go even further the close could be at 4pm, 3:30pm or even 8:30pm. For that matter, the lunch slowdown could be considered a "market stop" and you could trade the gap that is created between 11:30am and 2:30pm.

I digress somewhat but I did run some test that looked at the gap to times that were earlier than the traditional 9:30am gap. However, I'm pretty sure that those gaps did not show any more promise than the standard gap study because I would have (1) remembered those results (which I don't) and (2) would have written about them here.

Unfortunately I never finished that gap study and still haven't been able to find time to return to complete it...

Because the ES market is now a 24-hour market the "open" at 9:30am for gap purposes is picked because (1) it's the traditional open and (2) there is more volume from 9:30 onwards.

However, because you can trade the markets earlier than 9:30am, as you mentioned, the gap can be measure to any time point in the morning and as you suggested could be 7:30am or 8:30am or 8:45am. or even 6:34:57. If you go even further the close could be at 4pm, 3:30pm or even 8:30pm. For that matter, the lunch slowdown could be considered a "market stop" and you could trade the gap that is created between 11:30am and 2:30pm.

I digress somewhat but I did run some test that looked at the gap to times that were earlier than the traditional 9:30am gap. However, I'm pretty sure that those gaps did not show any more promise than the standard gap study because I would have (1) remembered those results (which I don't) and (2) would have written about them here.

Unfortunately I never finished that gap study and still haven't been able to find time to return to complete it...

Including the 8:30 am economic release time into your MRTH data will have a significant effect on the performance of any study or indicator.

In terms of indicators on short fixed time frame charts, less than 30 minute, I find my indicators work better at the "official" open if some of the pre-open session is included, up to the lookback period of the indicator at a minimum. This helps me fix the problem indicators run into with a large opening gap. Taking the indicator lookback period into account, my implied MRTH start time is probably around 7:30am.

Non time based charts, such as volume or tick charts, will tend to condense the overnight globex session into a few bars, which is a convenient way to see the true price support and resistance levels established overnight.

The official open, at 9:30, being a high volume event does produce what I consider a meaningful price level or zone that can be referenced during that trading session. The opening range is something I tend to keep track of each day. It is not uncommon to see the market complete a fib retrace back to the opening range after the ORB and initial range expansion. I also like to keep track of the RTH opening gap.

In terms of MP, insight can be found by breaking apart the profile into two parts: one overnight / globex profile, and the standard RTH profile. It might be interesting to use a single MRTH profile with the modified start time, not sure how to construct the IB in that case however ?

In terms of indicators on short fixed time frame charts, less than 30 minute, I find my indicators work better at the "official" open if some of the pre-open session is included, up to the lookback period of the indicator at a minimum. This helps me fix the problem indicators run into with a large opening gap. Taking the indicator lookback period into account, my implied MRTH start time is probably around 7:30am.

Non time based charts, such as volume or tick charts, will tend to condense the overnight globex session into a few bars, which is a convenient way to see the true price support and resistance levels established overnight.

The official open, at 9:30, being a high volume event does produce what I consider a meaningful price level or zone that can be referenced during that trading session. The opening range is something I tend to keep track of each day. It is not uncommon to see the market complete a fib retrace back to the opening range after the ORB and initial range expansion. I also like to keep track of the RTH opening gap.

In terms of MP, insight can be found by breaking apart the profile into two parts: one overnight / globex profile, and the standard RTH profile. It might be interesting to use a single MRTH profile with the modified start time, not sure how to construct the IB in that case however ?

Thank you for your replies.

I should have clarified that all the times I was referring to in my original post are CT (so that 9:30ET is 8:30CT).

Regarding the gap studies, I have had a similar thought about the arbitrariness of 8:30AM CT as the open with 24 hour news and with many important economic announcing being made pre 8:30CT.

In this randomly selected day (see attached) there is a lot of volume at the 7am time (6:30-7:00CT), and in this case the bulk of the price movement was from midnight to 7AM.

I currently look at the preopening move as part of my data gathering for the upcoming day. Though I don't have stats on it, some days the big swing in price action happens before the open, and so my thought was to include an hour (or two?) into the trading day (though probably still closing it at regular close - margin meeting trades and professional evening of their positions having been completed.

I should have clarified that all the times I was referring to in my original post are CT (so that 9:30ET is 8:30CT).

Regarding the gap studies, I have had a similar thought about the arbitrariness of 8:30AM CT as the open with 24 hour news and with many important economic announcing being made pre 8:30CT.

In this randomly selected day (see attached) there is a lot of volume at the 7am time (6:30-7:00CT), and in this case the bulk of the price movement was from midnight to 7AM.

I currently look at the preopening move as part of my data gathering for the upcoming day. Though I don't have stats on it, some days the big swing in price action happens before the open, and so my thought was to include an hour (or two?) into the trading day (though probably still closing it at regular close - margin meeting trades and professional evening of their positions having been completed.

Originally posted by pt_emini

....

In terms of MP, insight can be found by breaking apart the profile into two parts: one overnight / globex profile, and the standard RTH profile. It might be interesting to use a single MRTH profile with the modified start time, not sure how to construct the IB in that case however ?

What is IB please?

Originally posted by pt_emini

....

It might be interesting to use a single MRTH profile with the modified start time, not sure how to construct the IB in that case however ?

Tks for the link to IB PT.

Now that I have read it I do not understand how it would be hard to construct it. It seems you would enter the extra data lines (say 4 more lines if you use 30min data and start 2 hours earlier) in DT's MP calculator and it would produce your IB, would it not?

----

Initial Balance

The Initial Balance (IB) is a Market Profile concept.

The IB is the Range established from the first two Brackets of a Market Profile. These two brackets are usually the first hour of trading and as such the IB is usually the area from the Low to the High from the first hour.

The IB is monitored as a break-out area for Range Extension traders.

The IB High is also seen as an area of resistance and the IB Low as an area of support until it is broken.

--------------------

Bracket

A Bracket is a Market Profile concept.

A Bracket is viewed as a column of identical letters that has been formed while creating a Market Profile. Once the letters are collapse against the left margin they no longer appear in the same column.

Typically a bracket will be formed over a half hour period but the first bracket in some markets may not be half an hour if that market does not open on the hour or half hour.

A Bracket has a high and low and some traders also track the open and close of the bracket using different letters. A Bracket can be thought of as a bar on a bar chart without the open and close markers.

Originally posted by blue

Now that I have read it I do not understand how it would be hard to construct it. It seems you would enter the extra data lines (say 4 more lines if you use 30min data and start 2 hours earlier) in DT's MP calculator and it would produce your IB, would it not?

I think what pt_emini was saying is that he is not aware of the validity of the trading strategies around an IB that starts at a time other than 9:30 ET. i.e. the standard times in which to create the IB are from 09:30 to 10:30 ET and if you started all your indicators at say 08:30 ET then the IB would be from 08:30 to 09:30 ET and would be a very different IB that everyone else was using. Might work - might be a fantastic strategy - but I don't know anybody that does that or uses it.

Originally posted by day trading

Originally posted by blue

Now that I have read it I do not understand how it would be hard to construct it. It seems you would enter the extra data lines (say 4 more lines if you use 30min data and start 2 hours earlier) in DT's MP calculator and it would produce your IB, would it not?

I think what pt_emini was saying is that he is not aware of the validity of the trading strategies around an IB that starts at a time other than 9:30 ET. i.e. the standard times in which to create the IB are from 09:30 to 10:30 ET and if you started all your indicators at say 08:30 ET then the IB would be from 08:30 to 09:30 ET and would be a very different IB that everyone else was using. Might work - might be a fantastic strategy - but I don't know anybody that does that or uses it.

Thanks.

I guess I wasn't thinking about or worried about someone else's assessment of "validity".

I was thinking that if you want an edge on the crowd you must do things differently (or think about things differently or both) than the crowd.

I once had a dream and the message I received was:

"Because everyone is looking at it [the market] the same way, no one has an advantage."

Guess I'm an 'off the beaten path' type person.

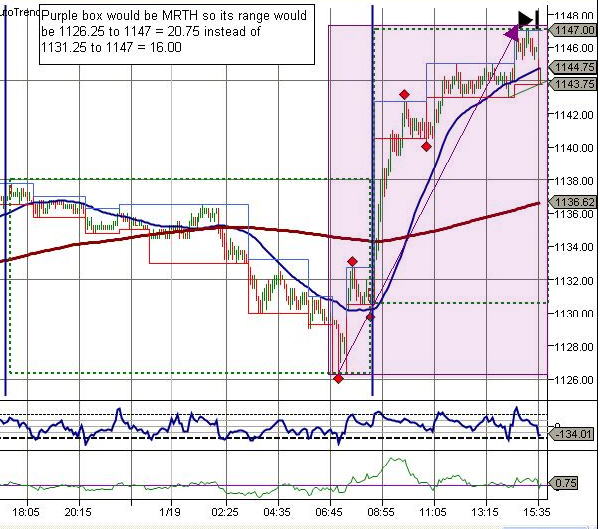

Today was an example of what I meant by the move starting before 8:30CT.

The move started at 1126.25 at 7:03CT so a 6:30CT start of the day, would include this low.

So the MRTH would give a 'truer' reflection of the day's range. By 'truer' I mean includes the whole of the day's move.

The CCI hit its low of -248 @ 7:05CT on this graph. The dotted line is -200. So if a trading rule in your strategy included BUY after a crossup above -200 you would have a signal with the MRTH and you would not if you used RTH.

Most of the indicators were "invented" when Globex didn't exist (or didn't exist with any real volume, pre 24HR trading and news.)

The move started at 1126.25 at 7:03CT so a 6:30CT start of the day, would include this low.

So the MRTH would give a 'truer' reflection of the day's range. By 'truer' I mean includes the whole of the day's move.

The CCI hit its low of -248 @ 7:05CT on this graph. The dotted line is -200. So if a trading rule in your strategy included BUY after a crossup above -200 you would have a signal with the MRTH and you would not if you used RTH.

Most of the indicators were "invented" when Globex didn't exist (or didn't exist with any real volume, pre 24HR trading and news.)

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.