Negative divergencies

Ive been playing this game off and on for over 20 years now and i thought id just about seen it all, but a question for you veteran players. I dont know if ive ever seen such a strong and long lasting advance as what weve seen this year in the face of such massive negative divergencies! We all know divergencies can last a while , but i can show you charts where this year they started in august somewhere around 980-1000! Thats 5 freakin months so far! Anybody ever remember such long divergencies? Makes me feel sorry for newer players (and some veterans too!) trying to trade off of just technical indicators! lol.. thoughts? comments?

thx for the input JCX! I also follow price action much more than indicators and have been one of the bigger bulls on this forum since March. But im getting the same eerie , this is historic, feeling i got when the money markets nearly melted down last year. I might be making way too much out of this, time will tell, but i got a feeling 2010 is going to be a lot of fun!

Originally posted by koolblueI mentioned in my last commentary (the December edition) on the website: "And speaking about 2010, I have a suspicion that it is going to be a year that goes down in the history books. I am staying in the camp that we are in about the third inning in this whole mess, the 'Wave 2' calm before the 'Wave 3' big storm that I think may start in 2010." I was referring to the 'Wave 3' of problems hitting the market. Perhaps they can 'extend and pretend' until 2011 or 2012 (Oh, that would be ominous, with the Mayan calendar thing and all...), but I think there are so many potential things that could pull out a lower level supporting card in this house of cards that I think it is a low probability event that the house stand for another full year. Just one man's opinion. I would only consider trading what I see right before me. But I have that extremely queasy feeling, so I'm going to be watching over my shoulder very closely for that tiger hiding in the brush at dusk that I can't see, but I sense is right out there, waiting...

...Or a warning sign of epic proportions? Either way, i think were going to get our answer early in 2010! All i really know is , i have my sixth sense telling me this may be historic much like the march low was (in several indicators) and some thing historic may be coming next!

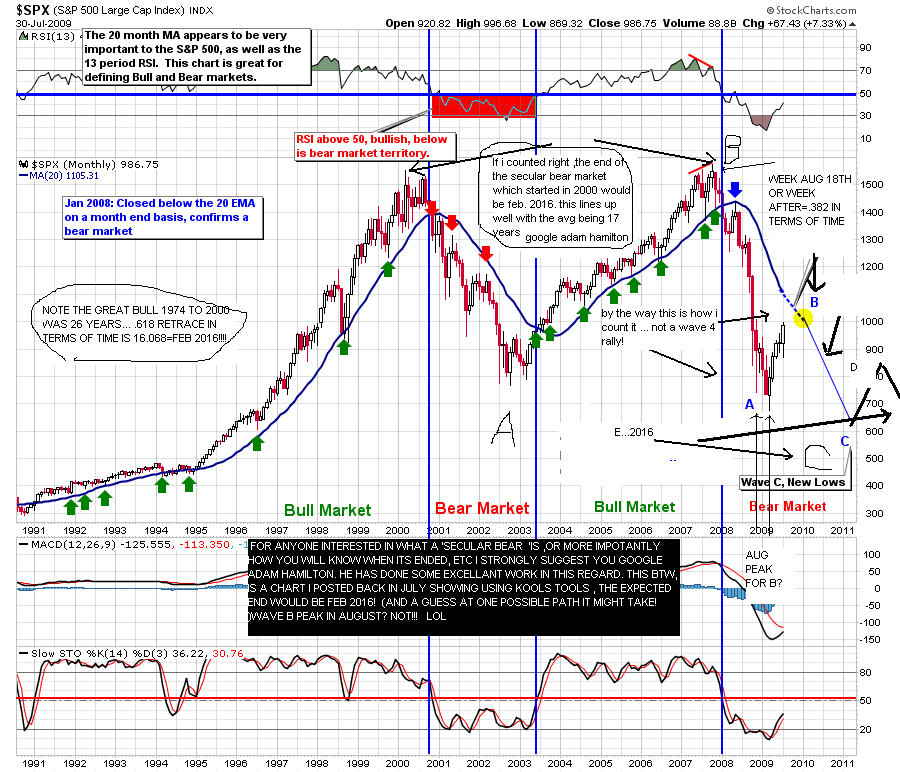

Well put Jim. Originally ,back in March , in studying what i percieve to be a secular bear market (not due to bottom till at least feb 2016), i put forth the premise that the market could advance to 2011, then decline to 2016. I no longer think it can stay afloat that long. I suppose im still looking for slightly higher prices early in 2010, but this bull thinks its time to ... BE AFRAID, BE VERY AFRAID!

kool, yeah, we are on the same page with the secular bear cycle. My average for those is that well-known 17.2 years, so I'm thinking 2017, but precisely when that happens, it's pretty immaterial. What is critical is what we are looking at shortly, and that is that this cyclical upturn looks close to having played itself out, and the secular influence will start to be the key driving force. I especially think this is so because everyone is bullish (save the few perma-bears).

When I hear the forecasts for 2010 its not will the market be up or down, it's how much will it be up. Very, very low end is still up over 10%, with lots 20%'s and some 30%'s, and more. My favorite call is up for five straight up years with no 10% correction. Other than the few perma-bears and doomsayers, I haven't heard a single bearish forecast, like down 5% or 10%. Everyone is on the same side of the boat.

The other curious factor, one which so far is doing exactly what I thought it would, is the market/USD correlation. I had heard that the correlation of the market and USD (inverse correlation in this case) was among the highest ever seen for the market with any intermarket factor. Then talk came of a dollar rally. I was thinking watch and see, the correlation will decouple, or go to a positive correlation, in other words, the market is still going to go up.

So, the dollar pops, and the correlation immediately gives way after all that time (I liked to watch it endlessly go tick for tick intraday), and the market, lo and behold, just keeps going up. Not much you can do with an engineered market with a predetermined ascent plan in place (this is my opinion). But, I think this can only last so long.

Rates are either going to explode in a treasury dump, or the USD carry trade is going to really unwind, or the USD is going to collapse in any number of currency crises that could happen, or something of the sort, then the market will have to show it's going up on actual great earnings and a strong economy, for real. Then we'll see. And we all know how that should play out. 2010 is going to be something to remember, I think.

When I hear the forecasts for 2010 its not will the market be up or down, it's how much will it be up. Very, very low end is still up over 10%, with lots 20%'s and some 30%'s, and more. My favorite call is up for five straight up years with no 10% correction. Other than the few perma-bears and doomsayers, I haven't heard a single bearish forecast, like down 5% or 10%. Everyone is on the same side of the boat.

The other curious factor, one which so far is doing exactly what I thought it would, is the market/USD correlation. I had heard that the correlation of the market and USD (inverse correlation in this case) was among the highest ever seen for the market with any intermarket factor. Then talk came of a dollar rally. I was thinking watch and see, the correlation will decouple, or go to a positive correlation, in other words, the market is still going to go up.

So, the dollar pops, and the correlation immediately gives way after all that time (I liked to watch it endlessly go tick for tick intraday), and the market, lo and behold, just keeps going up. Not much you can do with an engineered market with a predetermined ascent plan in place (this is my opinion). But, I think this can only last so long.

Rates are either going to explode in a treasury dump, or the USD carry trade is going to really unwind, or the USD is going to collapse in any number of currency crises that could happen, or something of the sort, then the market will have to show it's going up on actual great earnings and a strong economy, for real. Then we'll see. And we all know how that should play out. 2010 is going to be something to remember, I think.

Nice work, kool.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.