Blue's Notes

I'm going to try posting my trading journal.

The idea of posting is that:

1. it would be discipline for me

2. someone else might benefit from the journal.

At this time I do not want feedback posted in the journal.

I am not looking for feedback (negative or positive).

If people feel the need to comment they can PM me.

I may mix in little bits of philosophy and things that I am currently thinking or reading to see if, on later review, they influenced my trading.

So if it is of interest or helps someone else that's great.

I would like to repeat no feedback at this time please.

Thanks.

The idea of posting is that:

1. it would be discipline for me

2. someone else might benefit from the journal.

At this time I do not want feedback posted in the journal.

I am not looking for feedback (negative or positive).

If people feel the need to comment they can PM me.

I may mix in little bits of philosophy and things that I am currently thinking or reading to see if, on later review, they influenced my trading.

So if it is of interest or helps someone else that's great.

I would like to repeat no feedback at this time please.

Thanks.

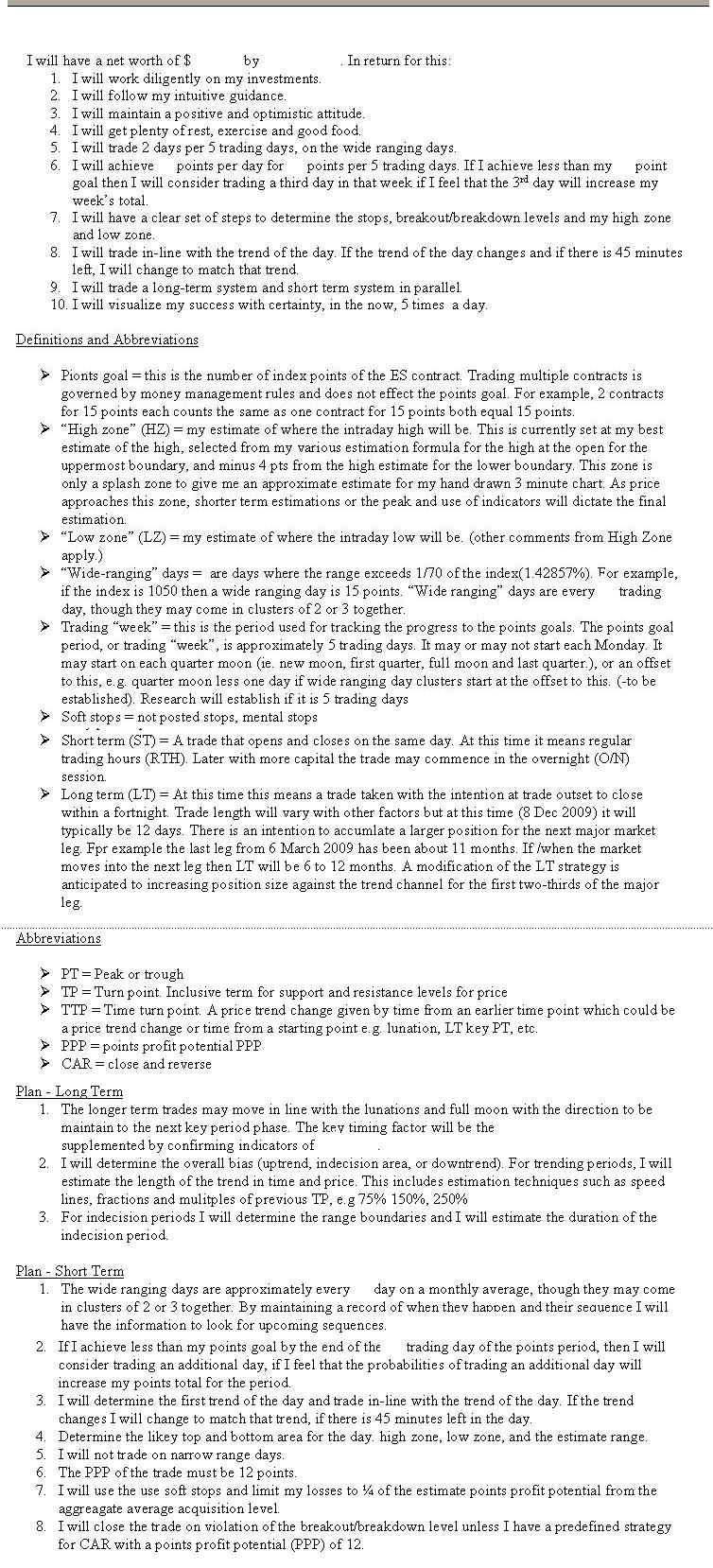

The first part the affirmation is from Think and Grow Rich.

I didn't put in a definition for indecision period. This is my term for a topping or bottoming phase where there is a lack of consensus in the marketplace as to direction. The longer term (several months to years) is what I refer to for strategy bias.

I didn't put in a definition for indecision period. This is my term for a topping or bottoming phase where there is a lack of consensus in the marketplace as to direction. The longer term (several months to years) is what I refer to for strategy bias.

Monday 7 Dec 2009

Trade1

Setup: Buy at support

Results: Failed trade. Loss 3.5 pts.

Details

Buy 1105.75 @ 13:27, Close 1102.25 @ 13:37 Loss 3.50 in 10 mins. Price went up to @8:54 from 1104.50 open, then down filling your trade 8:58, then you close at 9:04, then it bottomed at then it bottomed 1105 @ 9:07. CCI on one was < 290 at 9:04.

Thinking

Another run at high. This was WRONG and silly in hindsight. It had formed a perfect double top! C'mon Ian!

Factors

Did not remember that the high was probably in with double top at 1110.25 at 8:54 and 12:23 (double top) and that it was too late in the day to go up a third time and still make your estimated low.

Errors

1. You were not in your sell or buy zone - you had no business trading. Mark these zones on chart in the morning and stick too them.

2. Support at mid-zone untested theory.

3. Not a wide-ranging day - you shouldn't have traded.

Learning

1. By 10:30 either high or low is in. Add/subtract estimated range to get other end. e.g. (1110.25-20.25 = 1090. Adjusted to MPO-1 = 1092.50 giving 17.75 range.

2. Don't take a trade to walk away. After taking the trade you went to get breakfast. Make breakfast first, this would have allowed you to enter at 1105 when it hit SMA260 on 1 minute support.

3. Stick with gameplan. You believed it would trend down after taking stops this was right. However, it only just when to the O/N high and not beyond. Don't take trades on paper you wouldn't take in real life - wait for sweet ones.

Post Op

It has risen to 1109.50 @ 9:32. This is +3.50 from 1106 entry

Additional heat was only 1105 or 1 more point!

HAVE CONFIDENCE IN YOURSELF.

DON'T PANIC.

Trade1

Setup: Buy at support

Results: Failed trade. Loss 3.5 pts.

Details

Buy 1105.75 @ 13:27, Close 1102.25 @ 13:37 Loss 3.50 in 10 mins. Price went up to @8:54 from 1104.50 open, then down filling your trade 8:58, then you close at 9:04, then it bottomed at then it bottomed 1105 @ 9:07. CCI on one was < 290 at 9:04.

Thinking

Another run at high. This was WRONG and silly in hindsight. It had formed a perfect double top! C'mon Ian!

Factors

Did not remember that the high was probably in with double top at 1110.25 at 8:54 and 12:23 (double top) and that it was too late in the day to go up a third time and still make your estimated low.

Errors

1. You were not in your sell or buy zone - you had no business trading. Mark these zones on chart in the morning and stick too them.

2. Support at mid-zone untested theory.

3. Not a wide-ranging day - you shouldn't have traded.

Learning

1. By 10:30 either high or low is in. Add/subtract estimated range to get other end. e.g. (1110.25-20.25 = 1090. Adjusted to MPO-1 = 1092.50 giving 17.75 range.

2. Don't take a trade to walk away. After taking the trade you went to get breakfast. Make breakfast first, this would have allowed you to enter at 1105 when it hit SMA260 on 1 minute support.

3. Stick with gameplan. You believed it would trend down after taking stops this was right. However, it only just when to the O/N high and not beyond. Don't take trades on paper you wouldn't take in real life - wait for sweet ones.

Post Op

It has risen to 1109.50 @ 9:32. This is +3.50 from 1106 entry

Additional heat was only 1105 or 1 more point!

HAVE CONFIDENCE IN YOURSELF.

DON'T PANIC.

The post for the paper trade of Dec 7 was mostly to get the ball rolling on my posting discipline. Now that I have my rules printed I should have never traded for far too many embarrassing reasons to list them all.

Anyways, it is done.

I have started.

Today was not a wide-ranging day so I shouldn't have (and didn't)trade.

The overnight drop highlights to me the importance of completing my long term strategy. For the longer term I will trade ETFs on the index, e.g. SSO and SH. These are all the leverage/risk I can afford at this time. Also I am less likely to bounce myself out of the trade on a short-term counter move.

Anyways, it is done.

I have started.

Today was not a wide-ranging day so I shouldn't have (and didn't)trade.

The overnight drop highlights to me the importance of completing my long term strategy. For the longer term I will trade ETFs on the index, e.g. SSO and SH. These are all the leverage/risk I can afford at this time. Also I am less likely to bounce myself out of the trade on a short-term counter move.

Wednesday 9 Dec 2009

No trades

Setup: Do not trade on narrow range days

I slept in today until 8am (PST). It feels good to have typed out my trading plan. Crystallizing it on paper brings forward a reality check. I have a peak indicator in a spreadsheet. This is for the LT strategy. Next I need to make one for the trough, which I was hoping to do tonight but I am behind schedule as I have spent some time working on some estate planning.

No trades

Setup: Do not trade on narrow range days

I slept in today until 8am (PST). It feels good to have typed out my trading plan. Crystallizing it on paper brings forward a reality check. I have a peak indicator in a spreadsheet. This is for the LT strategy. Next I need to make one for the trough, which I was hoping to do tonight but I am behind schedule as I have spent some time working on some estate planning.

Thursday 10 Dec 2009

Observation

If you are to create a great masterpiece with your life you must guard the gates of your mind. To remain open inspiration you must stay positive and stay away from negative thoughts and negative people.

Trade1

Setup: Sell in HZ

Profit target: Low zone

Results: Still short 2

Conditions

Forgot alarm for 4:00am. Woke at 4:18am. Rollover day required extra time for watching Ninja video on roll-over and restarting program to get correct data. Combination of lost time resulting in not having all preopen calculations done by opening. Quick surge to 1106.25 at 8:39 and I was not ready to take trade even though it was in my HZ 1104.75 to 1108.75.

PreTrade

Had to go to washroom as it entered high zone. It topped at 1106.25 at 8:37, 40,&49. Pullback to 1103.25 @8:54then up to 1104.50 @ 9:00. As this was one tick below your HZ estimate's lower boundary of 1104.75 you waited and it dove to 1105.50 @9:05. You ended up chasing the trade as it fell. Foolish.

Details (Sim trades)

Sold 1 = 1101.25 (9:13)

Sold 1 = 1102.00 (9:24)

Sold 1 = 1103.75 (9:29)

Price went back into the HZ with H1105.50 @10:18 (only 0.75 less than 1106.50 of 8:37) -WAIT for it!

11:27 going to store. Left hard stop for 3 @ 1109.25.

Bot 1 = 1101.25 (12:24)

Bot 1 = 1100.00 (14:28)

Sold 1=1101.00 (14:00)

Left 2 short at close posted buy-stop above and buy below.

Post Op

Everything was a mess. Though I had done a roll-over of the Ninja contract as per the video all of the charts were on the Dec contract. When I realized this I decided it was time for breakfast. Had a whey shake and vitamins. Got quiet and gathered thoughts. Decided to "start afresh".

I recomputed my HZ and LZ with March 2010 contract.

New HZ=1104 to 1100.

New LZ=1087.50 to 1083.50.

Learning

1. If you're in a rush and not ready - don't trade. Be settled clear and confident.

2. If conditions are going against you (computer problems, haven't made new charts for rolled over contract, etc.) take this as a sign and don't trade.

3. FOMC meeting results coming out? Holiday? Know these things! If you haven't checked - don't trade!!

MAKE SURE ALL YOUR DUCKS ARE IN A ROW.

BE RELAXED AND CONFIDENT.

Have the trade flow mapped out with expected TP and TTP. If the trade falls off the mapped trade flow something may be wrong and you need to close the trade immediately until you figure it out.

Tomorrow

Hanukkah begins at sundown. Expecting a light volume day.

Observation

If you are to create a great masterpiece with your life you must guard the gates of your mind. To remain open inspiration you must stay positive and stay away from negative thoughts and negative people.

Trade1

Setup: Sell in HZ

Profit target: Low zone

Results: Still short 2

Conditions

Forgot alarm for 4:00am. Woke at 4:18am. Rollover day required extra time for watching Ninja video on roll-over and restarting program to get correct data. Combination of lost time resulting in not having all preopen calculations done by opening. Quick surge to 1106.25 at 8:39 and I was not ready to take trade even though it was in my HZ 1104.75 to 1108.75.

PreTrade

Had to go to washroom as it entered high zone. It topped at 1106.25 at 8:37, 40,&49. Pullback to 1103.25 @8:54then up to 1104.50 @ 9:00. As this was one tick below your HZ estimate's lower boundary of 1104.75 you waited and it dove to 1105.50 @9:05. You ended up chasing the trade as it fell. Foolish.

Details (Sim trades)

Sold 1 = 1101.25 (9:13)

Sold 1 = 1102.00 (9:24)

Sold 1 = 1103.75 (9:29)

Price went back into the HZ with H1105.50 @10:18 (only 0.75 less than 1106.50 of 8:37) -WAIT for it!

11:27 going to store. Left hard stop for 3 @ 1109.25.

Bot 1 = 1101.25 (12:24)

Bot 1 = 1100.00 (14:28)

Sold 1=1101.00 (14:00)

Left 2 short at close posted buy-stop above and buy below.

Post Op

Everything was a mess. Though I had done a roll-over of the Ninja contract as per the video all of the charts were on the Dec contract. When I realized this I decided it was time for breakfast. Had a whey shake and vitamins. Got quiet and gathered thoughts. Decided to "start afresh".

I recomputed my HZ and LZ with March 2010 contract.

New HZ=1104 to 1100.

New LZ=1087.50 to 1083.50.

Learning

1. If you're in a rush and not ready - don't trade. Be settled clear and confident.

2. If conditions are going against you (computer problems, haven't made new charts for rolled over contract, etc.) take this as a sign and don't trade.

3. FOMC meeting results coming out? Holiday? Know these things! If you haven't checked - don't trade!!

MAKE SURE ALL YOUR DUCKS ARE IN A ROW.

BE RELAXED AND CONFIDENT.

Have the trade flow mapped out with expected TP and TTP. If the trade falls off the mapped trade flow something may be wrong and you need to close the trade immediately until you figure it out.

Tomorrow

Hanukkah begins at sundown. Expecting a light volume day.

Friday 11 Dec 2009

Observation

Stay fit, keep positive and well rested. Health is the foundation of all wealth.

No Trades

Setup: Too narrow 7.75 range

Conditions

Slept til 6:00am. Narrow range day as expected.

Observation

Stay fit, keep positive and well rested. Health is the foundation of all wealth.

No Trades

Setup: Too narrow 7.75 range

Conditions

Slept til 6:00am. Narrow range day as expected.

Wednesday, April 21, 2010

Conditions

Today is my “day off” from trading. Last week I did not take off my Wednesday and was so tired I blundered buying when I should have been selling. More importantly I closed a winning trade too early and missed out on a potential gain. This one tired Friday transformed a potential $1837 week into a negative $225 week. By sleeping in on Friday and taking no action I would have made enough for my month.

So today, when my alarm when off at 4:30am, I went over turned it off and went back to sleep.

In trading, what makes a good trade is following your rules for a setup. In trading as a profession, following your overall strategy, including rest, exercise, good food and positive outlook determine a successful or unsuccessful week. Get the framework right, work hard and work intelligently be open to new ideas both from others and your intuition and your success is guaranteed.

Sleeping in today and not giving in to fear and doubt “I need to trade” I count as a success. So today is a successful day – by following my strategy. Another success was too improve the automation of my record keeping and note taking. This was done to reduce the hours of work in my trading day by enhancing the work after market close. Hopefully this will save me some time each day.

At present harvesting more time is my main goal. Until I can reduce trading work time per week so that I can restore my exercise time – everything else is against my life goals.

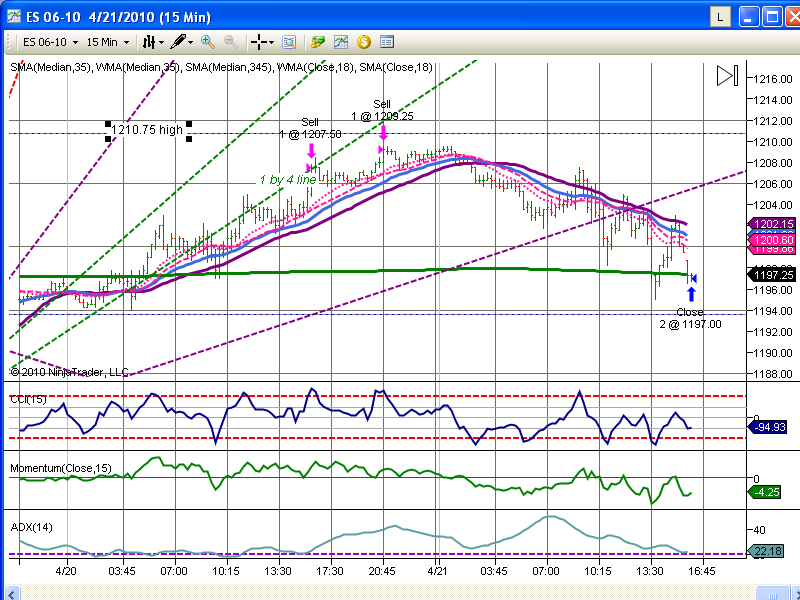

Trades (sim)

SLD 1 @ 1207.50

SLD 1 @ 1209.50

BOT 1 @ 1197.00

P/L 22.75pts * $50 = 1137.60

Observations

This trade is almost an exact reply of last Thursday evening/Friday morning – the difference being that I slept in and so let the trade work itself. Looking at the hourly chart the IB graph shows a potential double top has formed? Confirmation will be on a trendline break. However, I am trying to stay away from prediction other than the bias for the day.

Acknowledgements

I would like to acknowledge Hunter’s wonderful closing to his top-notch video presentation. He closes his presentation with his visualization for his trades.

He visualizes himself trading perfectly and winning and adds his enthusiasm “Go baby, Go! Yes, Yes, Yes!!!”

I only hope to be able to aspire to this excellent visualization. Thank-you Hunter.

{Triva: enthusiasm < L=enthusiasmus < Gk=enthousiasmos, enthous=inspired, en=in + theos=god}

Conditions

Today is my “day off” from trading. Last week I did not take off my Wednesday and was so tired I blundered buying when I should have been selling. More importantly I closed a winning trade too early and missed out on a potential gain. This one tired Friday transformed a potential $1837 week into a negative $225 week. By sleeping in on Friday and taking no action I would have made enough for my month.

So today, when my alarm when off at 4:30am, I went over turned it off and went back to sleep.

In trading, what makes a good trade is following your rules for a setup. In trading as a profession, following your overall strategy, including rest, exercise, good food and positive outlook determine a successful or unsuccessful week. Get the framework right, work hard and work intelligently be open to new ideas both from others and your intuition and your success is guaranteed.

Sleeping in today and not giving in to fear and doubt “I need to trade” I count as a success. So today is a successful day – by following my strategy. Another success was too improve the automation of my record keeping and note taking. This was done to reduce the hours of work in my trading day by enhancing the work after market close. Hopefully this will save me some time each day.

At present harvesting more time is my main goal. Until I can reduce trading work time per week so that I can restore my exercise time – everything else is against my life goals.

Trades (sim)

SLD 1 @ 1207.50

SLD 1 @ 1209.50

BOT 1 @ 1197.00

P/L 22.75pts * $50 = 1137.60

Observations

This trade is almost an exact reply of last Thursday evening/Friday morning – the difference being that I slept in and so let the trade work itself. Looking at the hourly chart the IB graph shows a potential double top has formed? Confirmation will be on a trendline break. However, I am trying to stay away from prediction other than the bias for the day.

Acknowledgements

I would like to acknowledge Hunter’s wonderful closing to his top-notch video presentation. He closes his presentation with his visualization for his trades.

He visualizes himself trading perfectly and winning and adds his enthusiasm “Go baby, Go! Yes, Yes, Yes!!!”

I only hope to be able to aspire to this excellent visualization. Thank-you Hunter.

{Triva: enthusiasm < L=enthusiasmus < Gk=enthousiasmos, enthous=inspired, en=in + theos=god}

Remember to check your range estimates!

The blue figures are leg1

The purple are the estimated range added/subtracted to each end.

So with 1088.00 @09:25CT in place the low end is 1062.50

Actual low 1059.25, so not correct but would have kept me out of trouble.

(there are different estimates of range and the one in blue -25.50 is the one I settled on (default of the average of several estimates shown in purple 25.50)

The blue figures are leg1

The purple are the estimated range added/subtracted to each end.

So with 1088.00 @09:25CT in place the low end is 1062.50

Actual low 1059.25, so not correct but would have kept me out of trouble.

(there are different estimates of range and the one in blue -25.50 is the one I settled on (default of the average of several estimates shown in purple 25.50)

.......................

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.