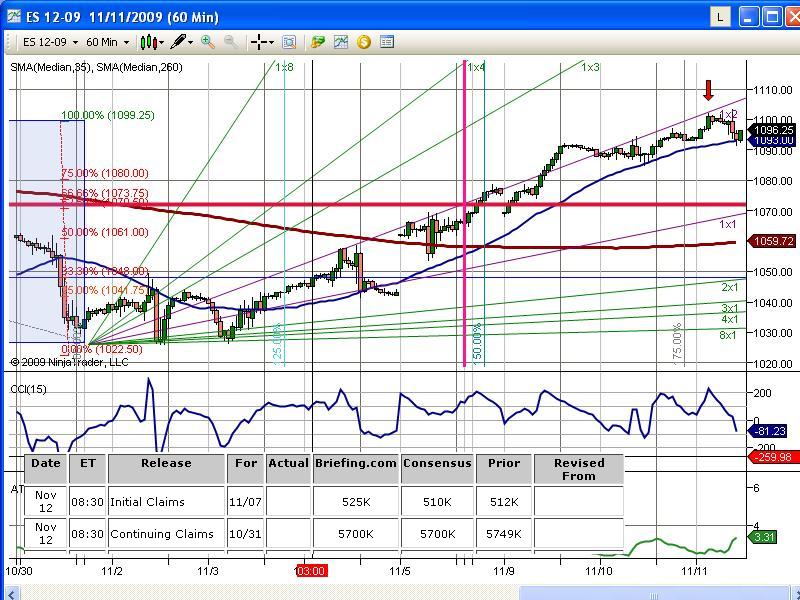

ES S/R Map for 11-11-2009

Nice call on that gap MM..didn't have that but the tried and true plus 4 - 5.5 helped a bit....first day in a few that they actually hit a minus 4..triples sit at the days highs and lows so I am powerless...just as well volume showing the "b" pattern so I wouldn't be surprised to see an attempt at the highs first...sitting on the side

quote:

Originally posted by MonkeyMeat

note to self: when ES retested 1102.50 area reaching 03.25, NQ was concurrently testing Wkly R2 Pvt of 1793 ... with slight $TICK divergence on ES before breaking down ... subsequently traded down to 92.00 area to fill in gap from yday's close

Thx Bruce ... I ended up selling some @1101.75 up there as it broke below 1102.00 which was the low of the prior two 5min bars when price stalled, after the test of potential resistance at the gap-close from Oct 08 on daily ... undid some of the damage from poor trades in the first half hour ... was out @95.25 based on what looked like a retest/bounce on the 1min chart at 93.75 (also near a price action support zone I had) inside of the first hour of trading ... at least that was the rationale ... a few posts back I made some observations that would have added to my size were I to have been aware of all the aligning factors.

As for "what now" ... I don't see anything in this range bound trading we're currently in as we create that "b" ... done for day I think.

As for "what now" ... I don't see anything in this range bound trading we're currently in as we create that "b" ... done for day I think.

Question Bruce ... when you reference triples as in the prior post "...triples sit at the days highs and lows so I am powerless..." I'm clueless as to what that's describing ... blame it on my own ignorosity ... but would be nice for someone to learn me on that.

quote:

Originally posted by blue

quote:

Originally posted by gio5959

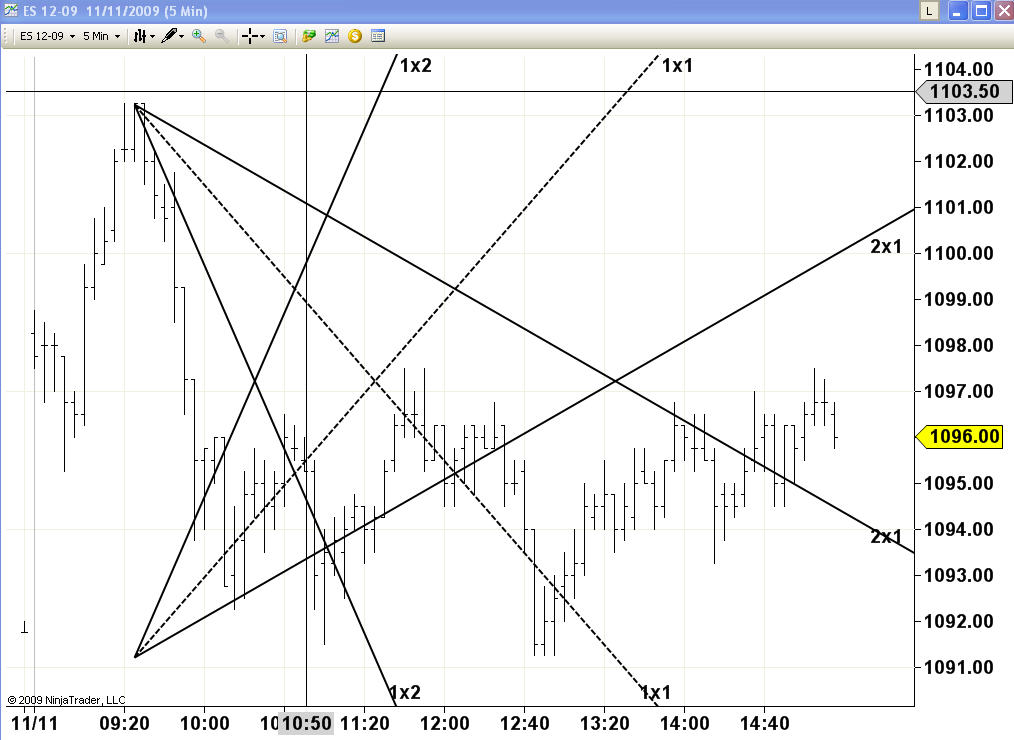

what are you using for points per bar on the gann

thx

Hi Gio,

An excellent question! I am very encouraged someone asked it!

I have struggled with that very important question for quite some time.

I do not yet have an answer for you. This shows how I have wasted my time fooling around with fine-tuning and forgetting to spend my time on big picture analysis first.

I have made the on Saturday past, decision to step back and make sure I have a picture of the forest before looking at the twigs.

In any case, I do not have the answer for you other than to say that I have concluded:

1. you must do your chart by hand,

2. you must use intuitive guidance and trial and error to determine the ratio.

So at this point you're on your own my friend - PM me if you get an answer!

Your question highlights the weakness of what I have posted. It is a mechanical out-of-the-box, fool-around new to ninja, chart.

In the same vein, to be taken with a grain of salt, I attach another...

as far as im concerned ninja gann fan is a pos and so is esignal's - the same guy (chris) must of wrote both of them

on ninja, try using .25 points per bar and see if you feel better about the 1x1

ensign gets it right most of the time

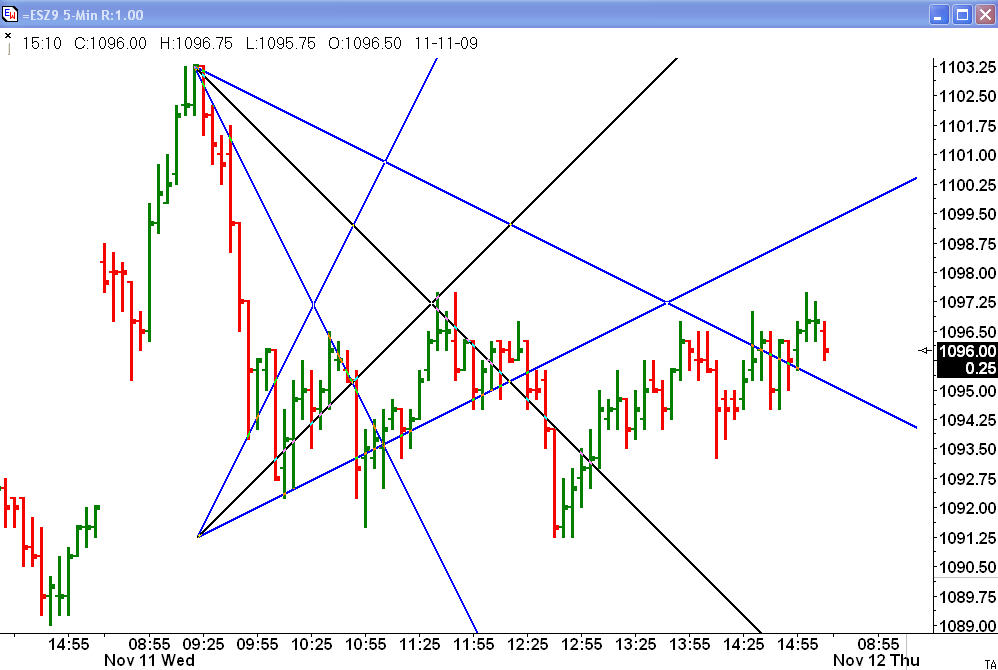

here's a couple of pics - both on a 5min chart for today - on the ninja im using .25 points per bar - on the ensign its set to their default

by using .25 points per bar on ninja i was able to get it to look like ensign's

if you want to make a living from gann then gannalyst professional 5.0 gets it right all the time - and, its free

quote:

Originally posted by jimkane

blue, read this:

http://www.mypivots.com/forum/topic.asp?TOPIC_ID=4142

Thanks Jim!

[

Thks Gio

quote:

Originally posted by gio5959

as far as im concerned ninja gann fan is a pos and so is esignal's - the same guy (chris) must of wrote both of them

on ninja, try using .25 points per bar and see if you feel better about the 1x1

ensign gets it right most of the time

here's a couple of pics - both on a 5min chart for today - on the ninja im using .25 points per bar - on the ensign its set to their default

by using .25 points per bar on ninja i was able to get it to look like ensign's

if you want to make a living from gann then gannalyst professional 5.0 gets it right all the time - and, its free

Thks Gio

here you go MM..they work better when they form within the days range and will obviously fail on trend days............if we open in range tomorrow I think we need to be real agressive to get the breakout form todays low or high....here is the triples link...

http://www.mypivots.com/forum/topic.asp?TOPIC_ID=2163&SearchTerms=running,the,triples

http://www.mypivots.com/forum/topic.asp?TOPIC_ID=2163&SearchTerms=running,the,triples

quote:

Originally posted by MonkeyMeat

Question Bruce ... when you reference triples as in the prior post "...triples sit at the days highs and lows so I am powerless..." I'm clueless as to what that's describing ... blame it on my own ignorosity ... but would be nice for someone to learn me on that.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.