Range Bar System

Hello

I would like to invite traders that are using or have used range bars

in a team effort to develop a method and/or system to trade the e-minis

and the euro cme contract.

I have been using Hull(45) on tick charts (NQ 200T , 500T etc) and Hull(25) on range bars (3 point range) to establish trend and identify market turns.

Phantasmagoria has proposed Lsma(Lsma(21),5) for trend identification

( http://www.mypivots.com/forum/topic.asp?TOPIC_ID=4508&whichpage=5 )

Brad37 has been using a hull moving average with a 26 period and the displacement set to -1

( http://www.mypivots.com/forum/topic.asp?TOPIC_ID=4508&whichpage=5 )

and

KingKong has invested some time to develop a strategy on range bars, that may need refinement to produce positive expectancy.

( http://www.mypivots.com/forum/topic.asp?TOPIC_ID=4508&whichpage=9 )

So, if interested, join this discussion - development effort.

cheers.

I would like to invite traders that are using or have used range bars

in a team effort to develop a method and/or system to trade the e-minis

and the euro cme contract.

I have been using Hull(45) on tick charts (NQ 200T , 500T etc) and Hull(25) on range bars (3 point range) to establish trend and identify market turns.

Phantasmagoria has proposed Lsma(Lsma(21),5) for trend identification

( http://www.mypivots.com/forum/topic.asp?TOPIC_ID=4508&whichpage=5 )

Brad37 has been using a hull moving average with a 26 period and the displacement set to -1

( http://www.mypivots.com/forum/topic.asp?TOPIC_ID=4508&whichpage=5 )

and

KingKong has invested some time to develop a strategy on range bars, that may need refinement to produce positive expectancy.

( http://www.mypivots.com/forum/topic.asp?TOPIC_ID=4508&whichpage=9 )

So, if interested, join this discussion - development effort.

cheers.

The MONGOOSE trading strategy

The key items regarding the strategy to be developed:

1) how to define your entry signal

for longs

..a) bar above Hull(25) ( or lsma(lsma(21),5)

..b) bar above Hull(25) ( or lsma(lsma(21),5) AND positive momentum (rsi or macd ...)

for shorts

..a) bar below Hull(25) ( or lsma(lsma(21),5)

..b)bar below Hull(25) ( or lsma(lsma(21),5) AND negative momentum (rsi or macd ...)

AND to overtake a recent pivot (recent high for longs, recent low for shorts)

2) how to filter the signals?

for longs

..a) higher time frame Hull(25) or lsma(lsma(21),5) rising

..b) higher time frame momentum positive

..c) higher time frame Hull(25) or lsma(lsma(21),5) rising AND higher time frame momentum positive

for shorts

..a) higher time frame Hull(25) or lsma(lsma(21),5) falling

..b) higher time frame momentum negative

..c) higher time frame Hull(25) or lsma(lsma(21),5) falling AND higher time frame momentum negative

3) what is the exit strategy?

..a) take half position off at fixed target, say at twice the range bar setting and trail the other half using bar low crossing ema(C,8) or ema(C,x) x to be identified

..b) take half position off at fixed target, say at twice the range bar setting and trail the other half using bar low crossing Hull(C,34) or Hull(C, y) y to be identified

4) what is the initial stop?

..a) one range bar setting (close only)

..b) 1.5 times the range bar setting (exit if crossed by bar low) or k times the range bar setting ( k to be identified)

..c) bar low crossing Hull(c,34) or Hull(c, n) n to be identified

5) range bar setting for NQ and euro, for small trades (but larger than scalps)

FOR TRADING time frame I suggest 2 points for NQ and 8 pips for euro

FOR HIGHER time frame I suggest 3 points for NQ and 12 pips for euro

Ok guys and gals, pitch in;

For shorthand when posting, lets call Hull(25) the “Mongoose line”.

The Mongoose ( http://en.wikipedia.org/wiki/Mongoose ) can beat all snakes (for breakfast, for lunch and for dinner) hehehe

The key items regarding the strategy to be developed:

1) how to define your entry signal

for longs

..a) bar above Hull(25) ( or lsma(lsma(21),5)

..b) bar above Hull(25) ( or lsma(lsma(21),5) AND positive momentum (rsi or macd ...)

for shorts

..a) bar below Hull(25) ( or lsma(lsma(21),5)

..b)bar below Hull(25) ( or lsma(lsma(21),5) AND negative momentum (rsi or macd ...)

AND to overtake a recent pivot (recent high for longs, recent low for shorts)

2) how to filter the signals?

for longs

..a) higher time frame Hull(25) or lsma(lsma(21),5) rising

..b) higher time frame momentum positive

..c) higher time frame Hull(25) or lsma(lsma(21),5) rising AND higher time frame momentum positive

for shorts

..a) higher time frame Hull(25) or lsma(lsma(21),5) falling

..b) higher time frame momentum negative

..c) higher time frame Hull(25) or lsma(lsma(21),5) falling AND higher time frame momentum negative

3) what is the exit strategy?

..a) take half position off at fixed target, say at twice the range bar setting and trail the other half using bar low crossing ema(C,8) or ema(C,x) x to be identified

..b) take half position off at fixed target, say at twice the range bar setting and trail the other half using bar low crossing Hull(C,34) or Hull(C, y) y to be identified

4) what is the initial stop?

..a) one range bar setting (close only)

..b) 1.5 times the range bar setting (exit if crossed by bar low) or k times the range bar setting ( k to be identified)

..c) bar low crossing Hull(c,34) or Hull(c, n) n to be identified

5) range bar setting for NQ and euro, for small trades (but larger than scalps)

FOR TRADING time frame I suggest 2 points for NQ and 8 pips for euro

FOR HIGHER time frame I suggest 3 points for NQ and 12 pips for euro

Ok guys and gals, pitch in;

For shorthand when posting, lets call Hull(25) the “Mongoose line”.

The Mongoose ( http://en.wikipedia.org/wiki/Mongoose ) can beat all snakes (for breakfast, for lunch and for dinner) hehehe

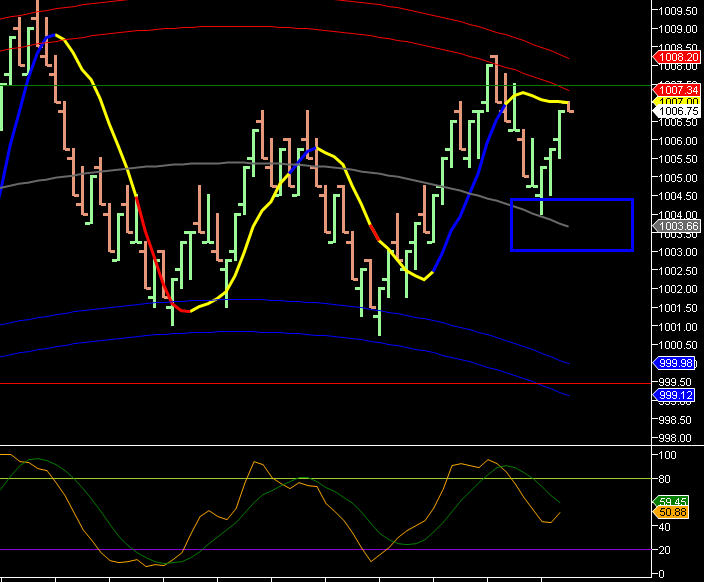

ive used range bars for a while now (4 range is my favorite) - i have good luck using a polynominal regression channel (you can google that)- i filter the trades with a stochastic of 7 14 3

when price reaches the upper bands it tends to come back down to the mean (reversion to the mean)

as i type this, price is reaching the upper bands - now i wait for the stochs to cross down for a short trade - price is now at 1008 and the mean is at 1003

maybe you could try using your mongoose with that and see how you do

when price reaches the upper bands it tends to come back down to the mean (reversion to the mean)

as i type this, price is reaching the upper bands - now i wait for the stochs to cross down for a short trade - price is now at 1008 and the mean is at 1003

maybe you could try using your mongoose with that and see how you do

heres your mongoose on the ES

should get a stoch cross soon and hopefully back to the mean of 1003.5

we shall see in the fullness of time

should get a stoch cross soon and hopefully back to the mean of 1003.5

we shall see in the fullness of time

Hi gio5959;

I appreciate your feedback; thank you.

I will look into the polynomial regression channel.

cheers.

I appreciate your feedback; thank you.

I will look into the polynomial regression channel.

cheers.

quote:

Originally posted by unicorn

Hi gio5959;

I appreciate your feedback; thank you.

I will look into the polynomial regression channel.

cheers.

you're welcome

btw, i didnt include another indicator on the charts i posted that i always use to show if im buying or selling with the trend - its the Inverse Fisher Transformation

almost every charting package has the IFT for free - put it on a range chart for friday and you will notice that the IFT was in confluence with your mongoose - in particular the trade on friday at aprox 10h59cst

quote:

Originally posted by gio5959

i didnt include another indicator on the charts i posted that i always use to show if im buying or selling with the trend - its the Inverse Fisher Transformation

Thank you gio

cheers

Hello Friends

FOMC day today

Suggestions for those forward testing the MONGOOSE method

Before "FOMC release" forward test the mongoose scalper (ES 4 ticks range bar and NQ 5 ticks range bar). Use small targets before "FOMC release".

or just hang out....

After "FOMC release" forward test the mongoose trader (ES 6 ticks range bar and NQ 8 ticks range bar).

1st target is 2 times the range bar setting.

Exit the runner on close past Hull(35) (against the trade direction).

Enjoy...

FOMC day today

Suggestions for those forward testing the MONGOOSE method

Before "FOMC release" forward test the mongoose scalper (ES 4 ticks range bar and NQ 5 ticks range bar). Use small targets before "FOMC release".

or just hang out....

After "FOMC release" forward test the mongoose trader (ES 6 ticks range bar and NQ 8 ticks range bar).

1st target is 2 times the range bar setting.

Exit the runner on close past Hull(35) (against the trade direction).

Enjoy...

quote:

Originally posted by unicorn

Hello Friends

FOMC day today

Before "FOMC release" trade the mongoose scalper (ES 4 ticks range bar and NQ 5 ticks range bar). Use small targets before "FOMC release".

or just hang out....

After "FOMC release" trade the mongoose trader (ES 6 ticks range bar and NQ 8 ticks range bar).

1st target is 2 times the range bar setting.

Exit the runner on close past Hull(35) (against the trade direction).

Enjoy...

Just to make certain that I am forward testing this method and

NOT GIVING TRADING ADVISE

The word "trade" here is clearly meant to be "forward test".

cheers..

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.