New to daytrading/shorting... where do I start!

I have practiced the art of daytrading and shorting for a little while now and I am ready to get started doing it for real. I have no clue where to go or which company to go with. I already use TD Ameritrade for some other forms of trading but they take 3 days to mature before you can do anything with the stock you buy and that just isn't going to work for what I want to do. Any suggestions????

Joyce A.

Joyce A.

If your looking to trade futures Trade Station is a good place to start. Gotrade.us (gotrader is there best platform) is also a good broker I use both. And there both free, and there trades are commissions smaller than ameritrade and that can add up to thousands a month depending on how much you trade. And tradestation is also good for stocks and options. I have been trading for 10 years almost and the best thing to trade IMHO is the emini S&P, and the emini Nasdaq. I would suggest starting with the NQ (nasdaq emini)I wish I knew about these instruments when I started.

Joyce,

Can you be a little more specific in what your trying to do? You say your day trading. What instruments are you using stocks, options, futures? Do you plan on making a few trades per day after hours or sitting in front of the screen bell to bell. For the most part this forum is filled with Futures traders if that's the path you choose you can find a wealth of knowledge and help here.

Can you be a little more specific in what your trying to do? You say your day trading. What instruments are you using stocks, options, futures? Do you plan on making a few trades per day after hours or sitting in front of the screen bell to bell. For the most part this forum is filled with Futures traders if that's the path you choose you can find a wealth of knowledge and help here.

eminis joyce. try s&p(ES) and russell(TF). trade station is not free, it requires a $5000 deposit to get there software and then you can use it. amp is a decent broker with ninja and zenfire.

i use ninjatrader with interactive brokers (cheap) and they seem to work fine

Joyce,

I am not suggesting you use TD Ameritrade when I say this, but the reason it takes three days to reuse the money has nothing to do with TD Ameritrade, it has to do with being set up as a cash account instead of a margin account. I have posted this elsewhere in this forum in the past. You don't have to use margin (leverage) with a margin account, it just allows you to use the money immediately after you close out a position. You can buy and sell as many times as you want in one day (assuming you have over the required $25K to overcome the pattern daytrader rule), reusing the money over and over. I hope this helps, since you will run into the same issue at any broker unless you open a margin account.

Also, although I personally loves the minis, and the tax and accounting advantages of trading futures, I tell my students that even one mini contract is far too big of a position for a beginner, unless they are very wealthy and have money to burn. I suggest 100 shares of something like SPY, and once that is proving to be profitable, increase to 200 shares, and so on, until one is at mini levels. 500 shares of SPY is about equivalent to 1 ES mini. If the 100 shares isn't profitable after a reasonable try at it, go back to sim trading, and assess the reason(s) for the lack of profitablility. Repeat until successful. This way the least amount of money is exposed to risk and burned up in the process. Most people are amazed at how much money they can burn through trading even 1 mini if it turns out their plan isn't 'net postive outcome' i.e. profitable. Just my two cents.

I am not suggesting you use TD Ameritrade when I say this, but the reason it takes three days to reuse the money has nothing to do with TD Ameritrade, it has to do with being set up as a cash account instead of a margin account. I have posted this elsewhere in this forum in the past. You don't have to use margin (leverage) with a margin account, it just allows you to use the money immediately after you close out a position. You can buy and sell as many times as you want in one day (assuming you have over the required $25K to overcome the pattern daytrader rule), reusing the money over and over. I hope this helps, since you will run into the same issue at any broker unless you open a margin account.

Also, although I personally loves the minis, and the tax and accounting advantages of trading futures, I tell my students that even one mini contract is far too big of a position for a beginner, unless they are very wealthy and have money to burn. I suggest 100 shares of something like SPY, and once that is proving to be profitable, increase to 200 shares, and so on, until one is at mini levels. 500 shares of SPY is about equivalent to 1 ES mini. If the 100 shares isn't profitable after a reasonable try at it, go back to sim trading, and assess the reason(s) for the lack of profitablility. Repeat until successful. This way the least amount of money is exposed to risk and burned up in the process. Most people are amazed at how much money they can burn through trading even 1 mini if it turns out their plan isn't 'net postive outcome' i.e. profitable. Just my two cents.

Choose what market you want to trade. A big mistake of many beginners is to want to trade everything... fight that urge, focus.

Choose a maximum of 3 instruments to follow. Don't be a generalist, be a specialist.

Watch the markets. Just by observing you'll be surprised at what you can learn.

Keep a trading journal. Even before you start trading keep notes, ideas and observations in one place.

Choose a maximum of 3 instruments to follow. Don't be a generalist, be a specialist.

Watch the markets. Just by observing you'll be surprised at what you can learn.

Keep a trading journal. Even before you start trading keep notes, ideas and observations in one place.

Hi Joyce,

All the best with your day-trading.

One of the things you will want to decide on is your trading style

and trading objectives. These should match your personality.

Some people are analytical and like to look at lots of numbers (myself). Some people like to trade more instinctively.

I just read a book from the library "Forex Trading for Maximum Profit" by Ms. Raghee Horner. Though her style doesn't suit me, the book is simple and straight-forward. There is a DVD in it with a few video lessons. She is using esignal software. It looked WAY easier than the free "garbage" charting program interactive brokers has. (I'm thinking of switching to trade station).

(Perhaps others with more experience than I could recommend a few good books?)

In the video she justs click on menu and it automatically drew trendlines. She could also forward and back play in time, which looked great for practicing with a stimulated account, one you can practise on (you should ask for one with your new broker whoever you choose).

As Jim says, you'll probably get blown out of the water with the ES mini (each point move in the SP500 is $50 profit or loss). It can jump 10 points in a minute or two. You could trade SSO (and SH) which track the SP500 and change to the ES later.

I'd suggest you get a book or two and read them and try out some trades in a practice account. Remember though to trade your practice account like real money. Don't take a trade you wouldn't in real life and use stops and money management techniques.

Also, you need an "edge". You need something to tip the odds in your favor. The floor gets the spread and you may have slippage and then you have commissions. So you want a strategy to help you win more than 50&-50%, like 60-%40. From that you will have a set of trading rules. You should write these out and make sure you follow them.. If you "wing-it" you'll never know if your strategy is sound or not.

A simple example:

1. You buy at the open and sell at the close in an uptrend. You define uptrend as the EMA 5 greater than the EMA 10 (yellow line above the green). You also define the uptrend as ending when the divergence (black hill in the MACD area is above zero), that is you want both conditions.

2. Vice-versa for down trend.

3. You close your trade if you are down by more than $0.28 (one-third of the daily range). For 100 shares this is -$28.

Once your strategy is working in practice and then in real life, you can slowly increase size e.g. trade 200 shares, 300 shares etc.

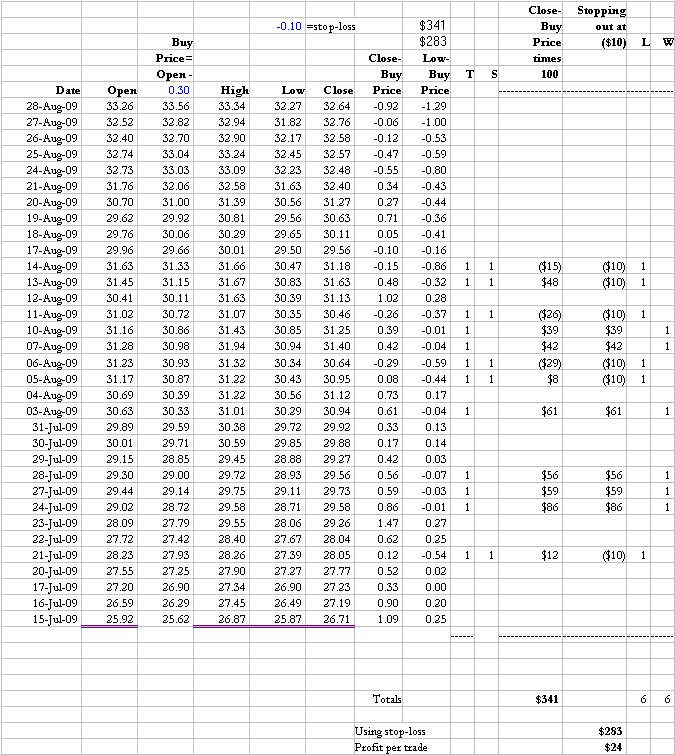

The example below is just a quick and dirty and overstates the profit because I don't have intraday data. {It's just an example.}

Hope it helps!

All the best with your day-trading.

One of the things you will want to decide on is your trading style

and trading objectives. These should match your personality.

Some people are analytical and like to look at lots of numbers (myself). Some people like to trade more instinctively.

I just read a book from the library "Forex Trading for Maximum Profit" by Ms. Raghee Horner. Though her style doesn't suit me, the book is simple and straight-forward. There is a DVD in it with a few video lessons. She is using esignal software. It looked WAY easier than the free "garbage" charting program interactive brokers has. (I'm thinking of switching to trade station).

(Perhaps others with more experience than I could recommend a few good books?)

In the video she justs click on menu and it automatically drew trendlines. She could also forward and back play in time, which looked great for practicing with a stimulated account, one you can practise on (you should ask for one with your new broker whoever you choose).

As Jim says, you'll probably get blown out of the water with the ES mini (each point move in the SP500 is $50 profit or loss). It can jump 10 points in a minute or two. You could trade SSO (and SH) which track the SP500 and change to the ES later.

I'd suggest you get a book or two and read them and try out some trades in a practice account. Remember though to trade your practice account like real money. Don't take a trade you wouldn't in real life and use stops and money management techniques.

Also, you need an "edge". You need something to tip the odds in your favor. The floor gets the spread and you may have slippage and then you have commissions. So you want a strategy to help you win more than 50&-50%, like 60-%40. From that you will have a set of trading rules. You should write these out and make sure you follow them.. If you "wing-it" you'll never know if your strategy is sound or not.

A simple example:

1. You buy at the open and sell at the close in an uptrend. You define uptrend as the EMA 5 greater than the EMA 10 (yellow line above the green). You also define the uptrend as ending when the divergence (black hill in the MACD area is above zero), that is you want both conditions.

2. Vice-versa for down trend.

3. You close your trade if you are down by more than $0.28 (one-third of the daily range). For 100 shares this is -$28.

Once your strategy is working in practice and then in real life, you can slowly increase size e.g. trade 200 shares, 300 shares etc.

The example below is just a quick and dirty and overstates the profit because I don't have intraday data. {It's just an example.}

Hope it helps!

I think I messed up my math in the post above.

The math wasn't the key to the post, I was just trying to

show a strategy and using a stop-loss.

Here's another try. I changed the idea to buy at the open less 30 cents and stopping out at minus ten cents below purchase price.

No guarantees of accuracy - I'm really tired and my eyes

are going wonky

The math wasn't the key to the post, I was just trying to

show a strategy and using a stop-loss.

Here's another try. I changed the idea to buy at the open less 30 cents and stopping out at minus ten cents below purchase price.

No guarantees of accuracy - I'm really tired and my eyes

are going wonky

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.