Scaling In And Trade Management in ES futures.

Hi, I'm new here. I've been trolling this forum for some time, and I am very impressed with the knowledge and information provided in this forum.

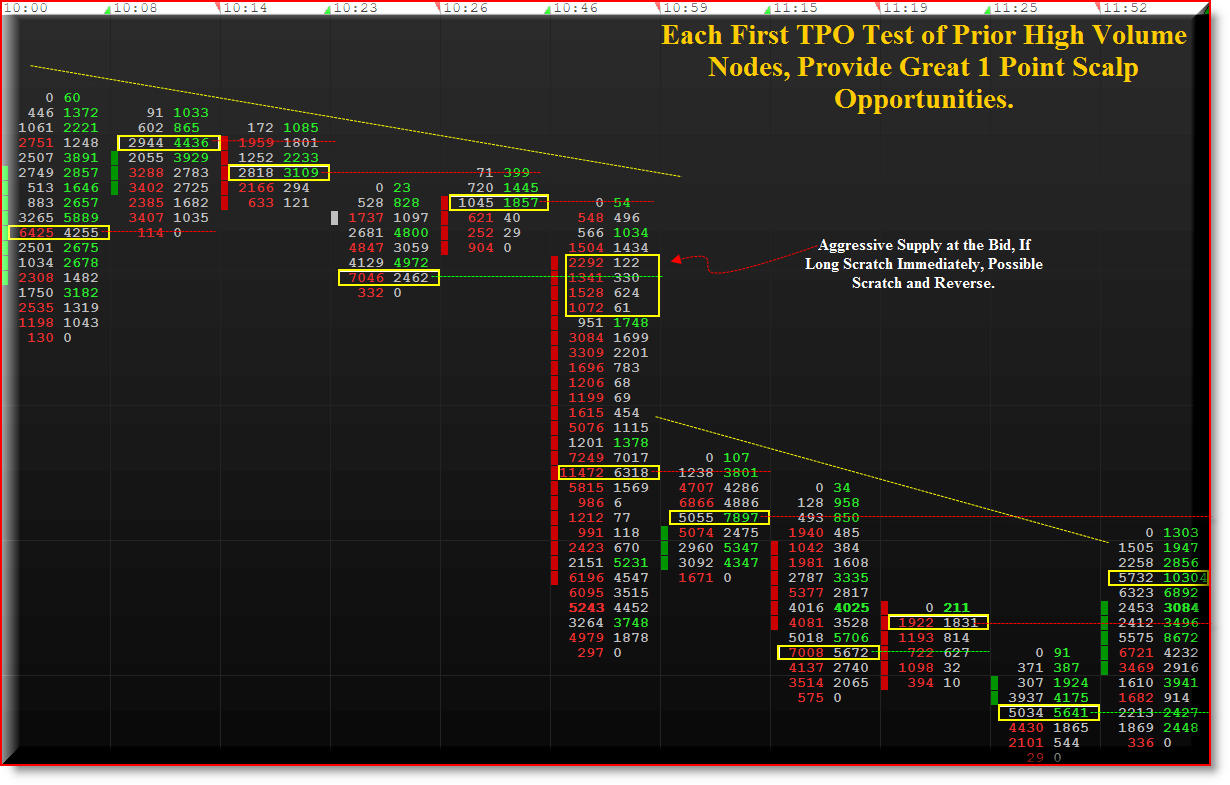

I am an active ES day trader. I use Market Delta footprint using a 6 tick reversal chart. I trade Order flow, scalp 1 point on 2 contracts at a time, with a daily goal of 500 dollars currently.

My strategy is basically placing limit orders or selling the inside ask,buying the inside bid, at a cluster of high volume nodes in the current market structure, while inside the developing value area. I have noticed a tendency for the market to react on the first TPO test of prior high volume nodes in current market development on a 6 tick reversal footprint chart. The reaction the majority of the time is 4 ticks, most likely a reaction from resting limit orders and prior commitments of traders defending their position or getting out a even.

The majority of market noise during the entire trading day, I believe, is relative to how participants respond at these particular clusters of volume. Breaks of these high volume clusters, because of the high level of commitment; which can be objectively identified using a volume at price chart, show immediately where one is wrong and create a forcing point where either shorts will need to cover, or longs will need to liquidate.

Tests of these high volume nodes, I particularly like to see them in clusters of 4-6 ticks, almost immediately respond with a 4-8 tick reversal. I enter at right on the inside tick of these high volume nodes and scale in once more at another point behind the entry point. On the first scale in, I expect the high volume area to react with two sided trade, allowing me to scale out of my first contract at even, and out of my second at +1. This has greatly increased my win rate relative to my prior use of a 5 tick stop. On my second scale I use a 4 point stop, 3 points behind my first entry, on the entire position and only have it there as a black swan protection so as to not be completely exposed to market uncertainty and quick changes in the perception of value. If I am ever in a hole back 2.25 points or so I will scratch and get out as close to even as possible. Using the Context of most recent market activity on the volume at price chart, provides me with the confidence to trade this way.

I'm sorry being long winded, but basically I would like to know how others here scale in or out of their trades, how they use it as a way of managing a trade and the execution tactics that go with it. I am working extremely hard on my trade management and execution lately because I realize, at least for me, it is about as important, if not more important than the actual strategy one uses. So hopefully we can have an extensive topic on scaling in and out of trades, trade management and execution. It would be refreshing because it is extremely hard to find a good site or people to discuss it with. Judging by the quality of the various threads I have trolled here in the last year, I believe the forum participants here are intelligent to hold a logical discussion on this topic and how to apply it to day trading the ES futures contract.

Pleasure meeting you all,

-Matt

I am an active ES day trader. I use Market Delta footprint using a 6 tick reversal chart. I trade Order flow, scalp 1 point on 2 contracts at a time, with a daily goal of 500 dollars currently.

My strategy is basically placing limit orders or selling the inside ask,buying the inside bid, at a cluster of high volume nodes in the current market structure, while inside the developing value area. I have noticed a tendency for the market to react on the first TPO test of prior high volume nodes in current market development on a 6 tick reversal footprint chart. The reaction the majority of the time is 4 ticks, most likely a reaction from resting limit orders and prior commitments of traders defending their position or getting out a even.

The majority of market noise during the entire trading day, I believe, is relative to how participants respond at these particular clusters of volume. Breaks of these high volume clusters, because of the high level of commitment; which can be objectively identified using a volume at price chart, show immediately where one is wrong and create a forcing point where either shorts will need to cover, or longs will need to liquidate.

Tests of these high volume nodes, I particularly like to see them in clusters of 4-6 ticks, almost immediately respond with a 4-8 tick reversal. I enter at right on the inside tick of these high volume nodes and scale in once more at another point behind the entry point. On the first scale in, I expect the high volume area to react with two sided trade, allowing me to scale out of my first contract at even, and out of my second at +1. This has greatly increased my win rate relative to my prior use of a 5 tick stop. On my second scale I use a 4 point stop, 3 points behind my first entry, on the entire position and only have it there as a black swan protection so as to not be completely exposed to market uncertainty and quick changes in the perception of value. If I am ever in a hole back 2.25 points or so I will scratch and get out as close to even as possible. Using the Context of most recent market activity on the volume at price chart, provides me with the confidence to trade this way.

I'm sorry being long winded, but basically I would like to know how others here scale in or out of their trades, how they use it as a way of managing a trade and the execution tactics that go with it. I am working extremely hard on my trade management and execution lately because I realize, at least for me, it is about as important, if not more important than the actual strategy one uses. So hopefully we can have an extensive topic on scaling in and out of trades, trade management and execution. It would be refreshing because it is extremely hard to find a good site or people to discuss it with. Judging by the quality of the various threads I have trolled here in the last year, I believe the forum participants here are intelligent to hold a logical discussion on this topic and how to apply it to day trading the ES futures contract.

Pleasure meeting you all,

-Matt

Nice chart matt,

I do the same thing with MD. I look for bulges on the volume profiles and have for some time. You cannot tell much after the fact, but as the bar is progressing (15min on my setting) I tell were at the moment price is being accepted i.e. at/below/above key levels...pivots/sqnine/yesterdays high and low.

And I also keep in mind how each 15min POC (volume) is moving higher/lower/or no where, this means a lot to me. And how they move off clusters of POC's or a box as I call it.

I do the same thing with MD. I look for bulges on the volume profiles and have for some time. You cannot tell much after the fact, but as the bar is progressing (15min on my setting) I tell were at the moment price is being accepted i.e. at/below/above key levels...pivots/sqnine/yesterdays high and low.

And I also keep in mind how each 15min POC (volume) is moving higher/lower/or no where, this means a lot to me. And how they move off clusters of POC's or a box as I call it.

Matt... What are your rules regarding scaling in (adding contrats) once you are in a good trend? How do you decide when to add or when to exit?

quote:

Originally posted by bakrob99

Matt... What are your rules regarding scaling in (adding contrats) once you are in a good trend? How do you decide when to add or when to exit?

I'm scaling as such: initial entry on 2 contracts looking for 1 point. First scale in 1 point above initial entry. Move initial target to break even on initial entry point. Second scale target is also at initial entry point. Thus on second scale I'm looking for break even on the first contract and +1 on the second contract. On the third and final scale, I'm looking to get out of all 6 contracts at the average price of all three scales at break even. I am not looking to make a profit on the third scale, just get out of everything at even.

Scaling out and in is for me not so much a factor of profitability but psychology. Having guaranteed profit helps alot for psychology.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.