A Filtered Approach for Trading Market Turns

This approach is geared towards tight entries at potential market turns, but also blending in an initial "confirmation" move that price has begun (at least at this point) to move in our direction. As you will see, it can provide some excellent trade opportunities (2 of these I took today), but of course, as with all setups, some will not work out. I'll let you assess the merits (if any, lol).

First, the key components of this approach:

1. 2 timeframes. Setup and Entry. Setup TF is a multiple of 3 times the Entry TF.

2. 2 indicators. RSI and short term stochastics.

3. While not required, I would throw on a moving average of medium length (I use a 50SMA)

The premise of this trading approach.

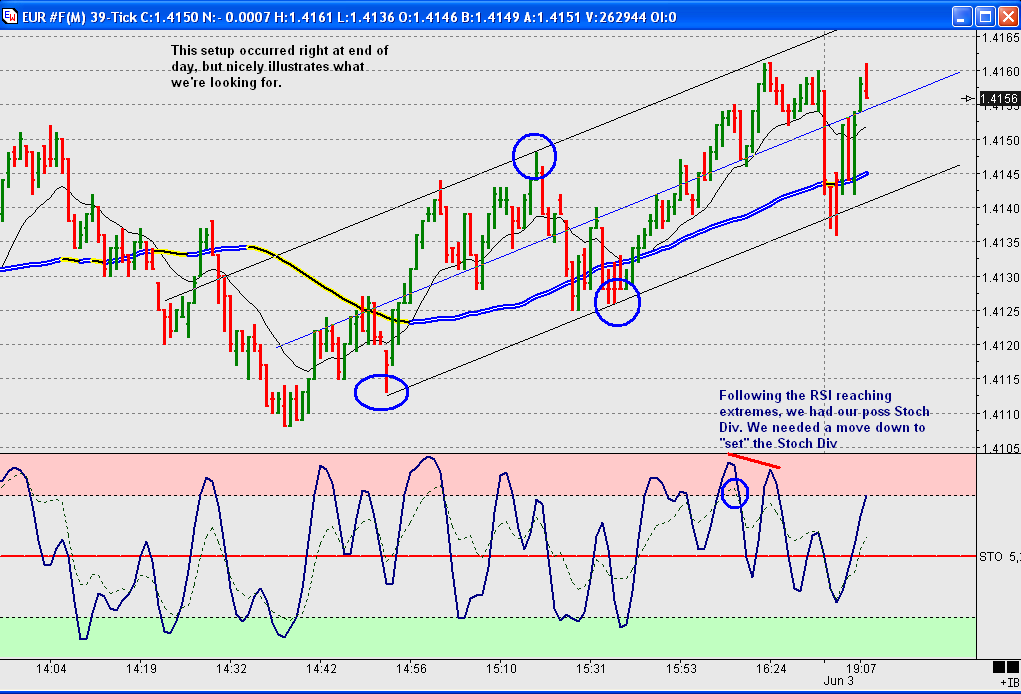

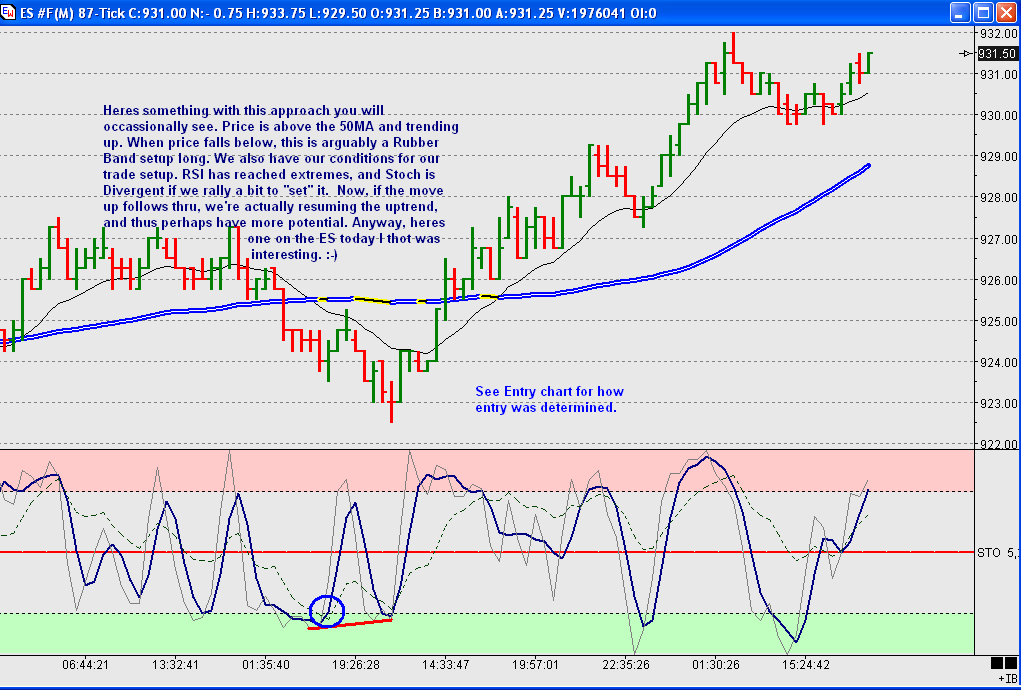

We will be looking for moves that reach extremes on RSI on the Setup chart. Some setups will be a divergence on RSI after having been at extremes. We will be filtering these setups with the Stochastics by requiring a divergence with this indicator on the Setup chart.

We will use the Stochastics on the Entry chart for entry.

We will be looking for channels and wedges to define targets for our market turns.

This approach will result in moves that prove to be bounces (pullbacks) sometimes and occassionally will be market trend reversals. By using the lower TF for entry, we will have tight stops (if desired), and should allow for very favorable reward/risk ratios on our trades.

I have attached 6 charts, 3 Setup charts and their related Entry charts. 2 of these trades I took today, and I have noted where and how the entries were chosen. I hope my explanations and comments are helpful. My %K entry hooks are aggressive, so perhaps you can see a better way more suited to you if you find these too aggressive.

As always, any and all comments, suggestions, etc are welcome.

First, the key components of this approach:

1. 2 timeframes. Setup and Entry. Setup TF is a multiple of 3 times the Entry TF.

2. 2 indicators. RSI and short term stochastics.

3. While not required, I would throw on a moving average of medium length (I use a 50SMA)

The premise of this trading approach.

We will be looking for moves that reach extremes on RSI on the Setup chart. Some setups will be a divergence on RSI after having been at extremes. We will be filtering these setups with the Stochastics by requiring a divergence with this indicator on the Setup chart.

We will use the Stochastics on the Entry chart for entry.

We will be looking for channels and wedges to define targets for our market turns.

This approach will result in moves that prove to be bounces (pullbacks) sometimes and occassionally will be market trend reversals. By using the lower TF for entry, we will have tight stops (if desired), and should allow for very favorable reward/risk ratios on our trades.

I have attached 6 charts, 3 Setup charts and their related Entry charts. 2 of these trades I took today, and I have noted where and how the entries were chosen. I hope my explanations and comments are helpful. My %K entry hooks are aggressive, so perhaps you can see a better way more suited to you if you find these too aggressive.

As always, any and all comments, suggestions, etc are welcome.

Heres a variation that may provide some excellent "trend" trades. Our same setup and entry methodology, just applied at a different market "juncture".

Hi Ninja, Looks very interesting....i have been hoping to find you somewhere having seen your posts of a trend turn method on dacharts some time back. This setup looks along the same lines but a little different, what prompted the changes?

When i can work out how to get screen shots off ensign i will post up some of my setups for you to compare! Also what T/F do those tick charts on eur and es equate too as our data might well be different and would be interesting to see how fast your charts are!

Good trading to you.

When i can work out how to get screen shots off ensign i will post up some of my setups for you to compare! Also what T/F do those tick charts on eur and es equate too as our data might well be different and would be interesting to see how fast your charts are!

Good trading to you.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.