The "Rubber Band" trade setup

I hope you will find this to be of benefit in some way in your trading.

This setup was provided to me by another trader. I take no credit for the setup, although I do apply employ it a bit differently. Here are the criteria. Very simple......

1. Using a longer mid/long term MA (he uses 50 simple as do I), we look for it to be sloping either up or down.

2. Lets assume UP here, so based upon the theory of reversion to the mean (price moving back to MA from beyond it), we look for price to be BELOW the rising MA.

3. The MA may flatten with the dropping price, this is ok, as long as MA does not turn DOWN before entry. The preference is to be still sloping up.

4. Price needs to move beyond the MA far enough to allow for a tradable move back (his example was having an entire bar/candle clear of the MA.

He states that this is a high % trade, but not necessarily a high reward/risk trade. He enters on the same TF as the setup. His target is of course the MA. A few will fail, so as always, stops are advised.

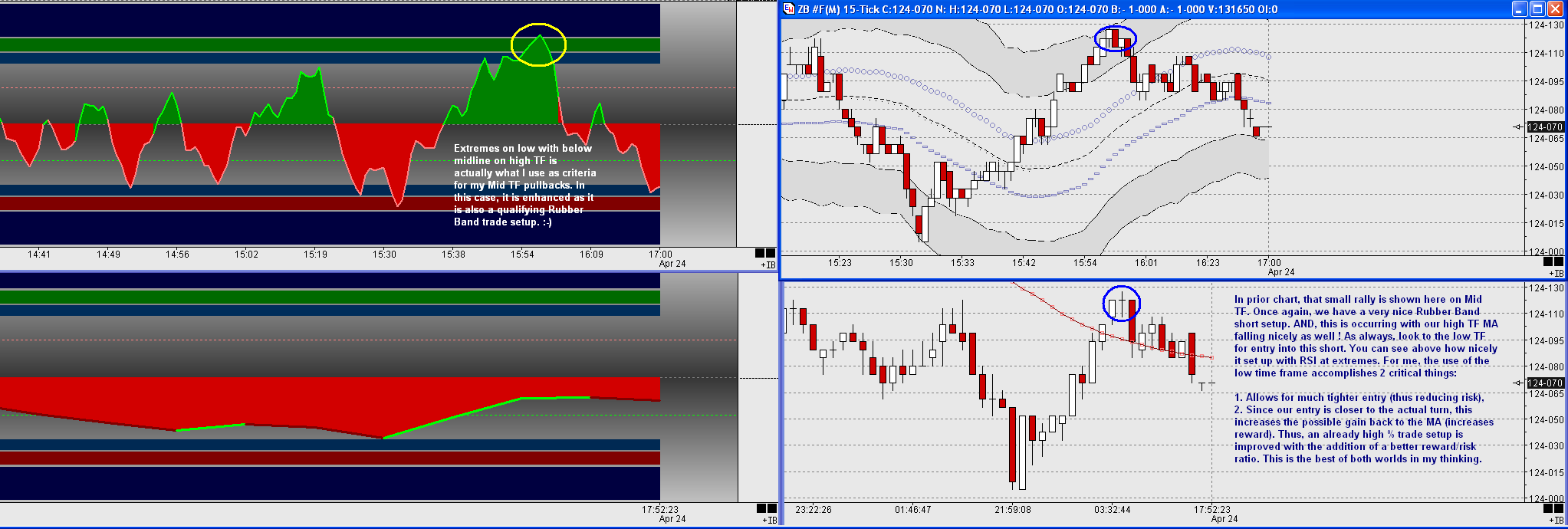

Heres my "tweak" to this basic premise. I look for these ONLY on my Mid/High TFs, and actual entry is ONLY done on low TF. By using the low for entry, we can tighten our entry (reducing risk), and increase the possible gain in returning to MA because of the entry being closer to the actual turn (tighter). Thus, we realize a stronger reward/risk ratio on this high % trade.

Ive attached 3 charts showing actual applications today referring to my prior post (Bonds Morning Long setup). I think you'll see how this setup can be helpful and profitable both when used within the context of another trade premise. Obviously, it can also be traded "stand alone" on its own merits as well.

I hope Ive simplified this and provided some useful insights.

This setup was provided to me by another trader. I take no credit for the setup, although I do apply employ it a bit differently. Here are the criteria. Very simple......

1. Using a longer mid/long term MA (he uses 50 simple as do I), we look for it to be sloping either up or down.

2. Lets assume UP here, so based upon the theory of reversion to the mean (price moving back to MA from beyond it), we look for price to be BELOW the rising MA.

3. The MA may flatten with the dropping price, this is ok, as long as MA does not turn DOWN before entry. The preference is to be still sloping up.

4. Price needs to move beyond the MA far enough to allow for a tradable move back (his example was having an entire bar/candle clear of the MA.

He states that this is a high % trade, but not necessarily a high reward/risk trade. He enters on the same TF as the setup. His target is of course the MA. A few will fail, so as always, stops are advised.

Heres my "tweak" to this basic premise. I look for these ONLY on my Mid/High TFs, and actual entry is ONLY done on low TF. By using the low for entry, we can tighten our entry (reducing risk), and increase the possible gain in returning to MA because of the entry being closer to the actual turn (tighter). Thus, we realize a stronger reward/risk ratio on this high % trade.

Ive attached 3 charts showing actual applications today referring to my prior post (Bonds Morning Long setup). I think you'll see how this setup can be helpful and profitable both when used within the context of another trade premise. Obviously, it can also be traded "stand alone" on its own merits as well.

I hope Ive simplified this and provided some useful insights.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.