+10%/-10% from the 50 day SMA.

I posted this in the square of nine thread and decided to post the findings here

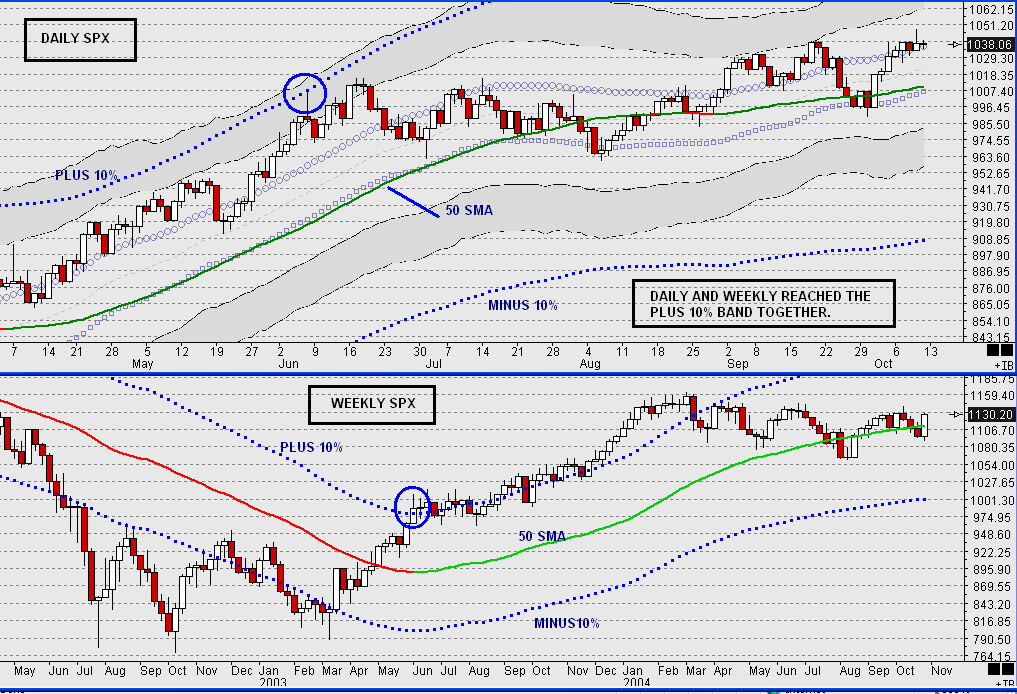

Something interesting to note the last time this happened we were starting the last bull market off the 2002 lows.

What a wild indicator this is. Every time the market moves counter trend to +10% from its 50Day SMA the next cycle takes over.

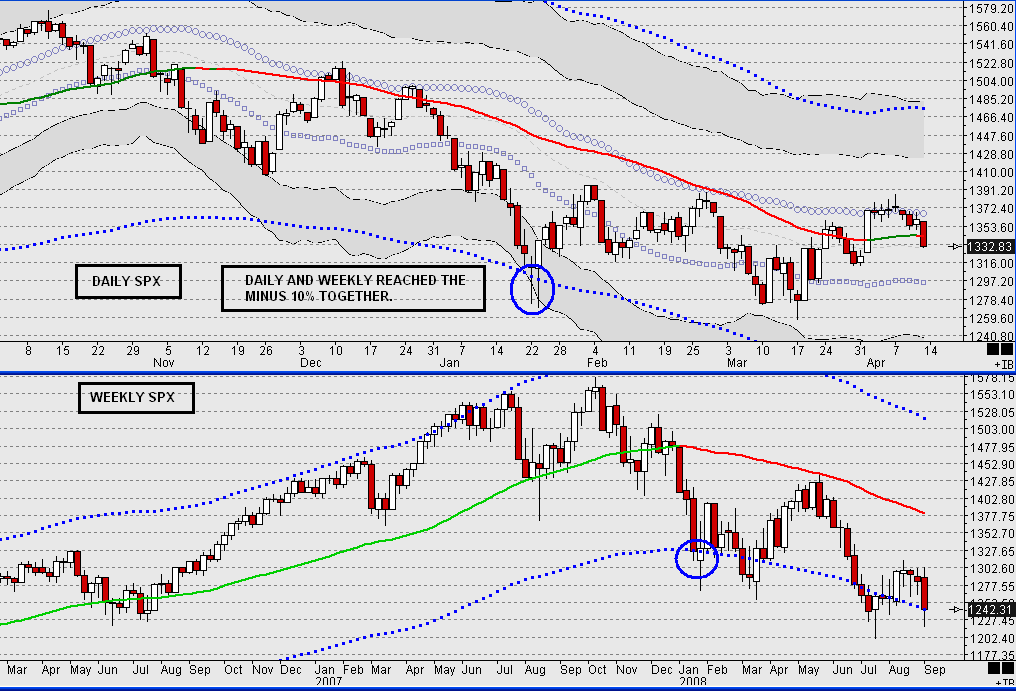

1)1/23/2008 Market was in a longterm Bull, pulled back for the first time 10% below the 50dSMA. After a brief pullback from the oversold levels the market is no longer in a Bull market.

2) 06/06/03 Market was in a longterm Bear reaches for the first time 10% above the 50dSMA and after a breif overbough pullback enters a 4 year bull market.

3)10/18/2000 Market was in what I called the great Bull market pulls back for the first time in the bull market to the 10% below the 50dSMA the Great bull ended and the bear started.

4)11/06/1998 Market was in a small bear market. Hit 10% over the 50dSMA and after a brief pullback rallied higher. for almost 2 years

5) 8/31/1998 Market was in a bull market hit the -10% below the 50dSMA and only made one more lower low before rocketing to the +10% of the 50dSMA

6)1 Day BEFORE the crash of 87' it hit -10% below the 50dSMA!

7)8/10/84 Markets were in a 10 month bear market and hit 10% over the 50dSMA rallied until 1987 high!!

8)08/26/1982 the market was in a major bear market and hit for the first time +10% over the 50dSMA and rallied almost 60% in 12 monoths

WOW thats all the data I have, I am buying as many dec 2010 leap CALLS I can afford after this pullback.

quote:

Originally posted by CharterJoe

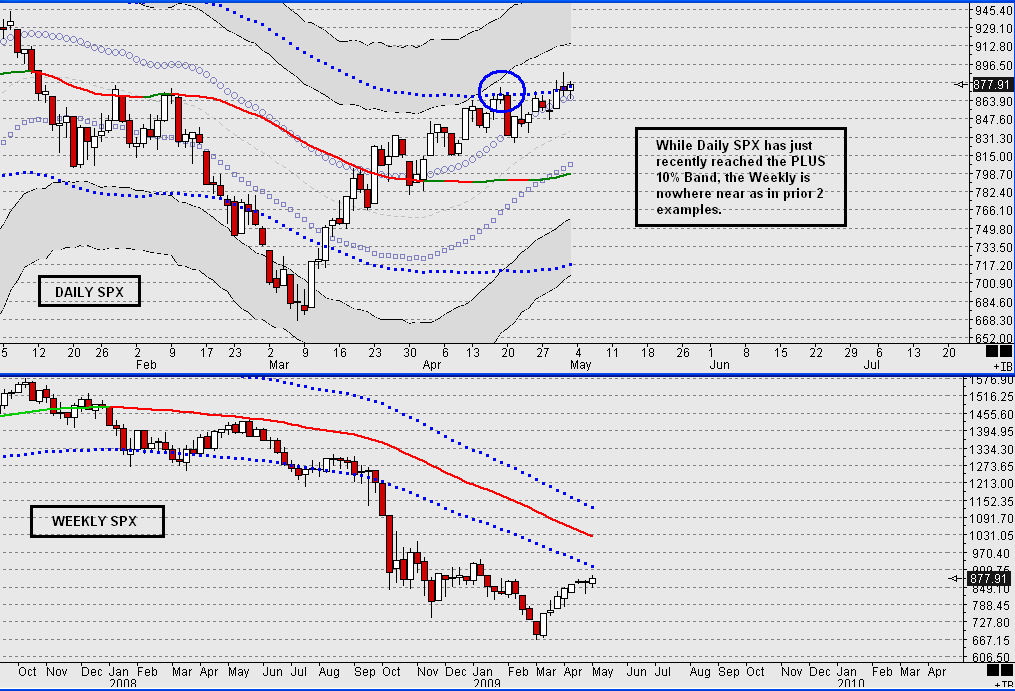

We are 84 points above the 50 day SMA this is the largest we have seen since the high in oct 2007, the number then was 86 points. And from a % basis its 10% from its 50 day MA overbought since levels not seen since 2003.

Something interesting to note the last time this happened we were starting the last bull market off the 2002 lows.

What a wild indicator this is. Every time the market moves counter trend to +10% from its 50Day SMA the next cycle takes over.

1)1/23/2008 Market was in a longterm Bull, pulled back for the first time 10% below the 50dSMA. After a brief pullback from the oversold levels the market is no longer in a Bull market.

2) 06/06/03 Market was in a longterm Bear reaches for the first time 10% above the 50dSMA and after a breif overbough pullback enters a 4 year bull market.

3)10/18/2000 Market was in what I called the great Bull market pulls back for the first time in the bull market to the 10% below the 50dSMA the Great bull ended and the bear started.

4)11/06/1998 Market was in a small bear market. Hit 10% over the 50dSMA and after a brief pullback rallied higher. for almost 2 years

5) 8/31/1998 Market was in a bull market hit the -10% below the 50dSMA and only made one more lower low before rocketing to the +10% of the 50dSMA

6)1 Day BEFORE the crash of 87' it hit -10% below the 50dSMA!

7)8/10/84 Markets were in a 10 month bear market and hit 10% over the 50dSMA rallied until 1987 high!!

8)08/26/1982 the market was in a major bear market and hit for the first time +10% over the 50dSMA and rallied almost 60% in 12 monoths

WOW thats all the data I have, I am buying as many dec 2010 leap CALLS I can afford after this pullback.

Joe

Is that you buying the RUT??

Is that you buying the RUT??

LOL...no

I bought some SPY dec 2010 the other day at $4.20. And bought some BAC @ 8.60 and some Csco @ 19.30 today.

This is my first time "investing" LOL lets see if I can hold it for 2 years. Thats my goal...

Im not sure what implications (if any) these 3 charts have, but these show both the Daily/Weekly SPX going back to 2002. This is all the data I have loaded. I tracked the +10%/-10% on both the Daily/Weekly. Just thought it might be of interest. FWIW

CJ:

I dont know if youre interested, but I have Dow data back to mid 1929. I chose weekly, and put the +10/-10 bands on it, and did a SnagIt on each time price moved from one outer band to the other. There are 21 pics if you have any use for them. No biggie if you dont. :-)

I dont know if youre interested, but I have Dow data back to mid 1929. I chose weekly, and put the +10/-10 bands on it, and did a SnagIt on each time price moved from one outer band to the other. There are 21 pics if you have any use for them. No biggie if you dont. :-)

1929-present from one band to the other...yes I would love that.

BAC @ 9.24 I am sweating bullets trying not to sell. This is hard for a daytrader...

quote:

Originally posted by CharterJoe

I bought some SPY dec 2010 the other day at $4.20. And bought some BAC @ 8.60 and some Csco @ 19.30 today.

Sold those BAC @ 9.94 +1.30, LOL I'll buy a pullback....CSCO stinks, not the mover I remember.

quote:

Originally posted by CharterJoe

I bought some SPY dec 2010 the other day at $4.20. And bought some BAC @ 8.60 and some Csco @ 19.30 today.

those Dec 2010 SPY 1000 calls just got in the money today....+220 points would have done better buying ES. fwiw holding these till the SPY hits the lower band or exp. which ever comes first.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.