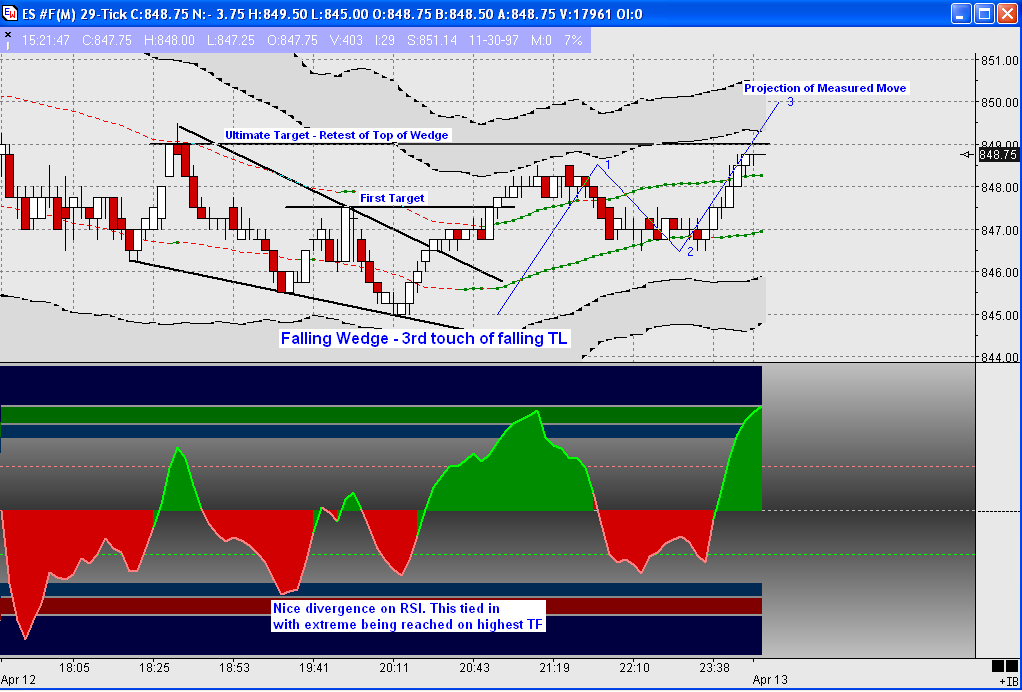

Sunday Evening Turn setup ES

This is a great example of a turn setup I look for. My highest TF had reached extreme (oversold). My low TF (entry chart) was showing a falling wedge (bullish pattern). The third touch of the falling TF of the wedge was my entry trigger for the potential turn up. The initial target of a falling wedge is the prior peak (pt 4), with the ultimate target being a retest of the wedge top. You can see the the intial push up took my low TF to extreme (overbought). This was an opport to lighten up/exit and look for possible pullback upon which to reenter. Not all wedges will reach the top retest (a few dont even make the prior peak), so whether to sit it out or not is each traders choice.

After the pullback, using a measured move tool, this gives us an add'l target area. My exit is the wedge top (notice I chose the price level which several candles rached rather than the extreme top of wedge. This is my conservatism shining thru. :-) As Ive written this, price has shelfed and turned down just shy of the 849 level. As RSI is again extreme, the position is exited. Perhaps you will find this analysis beneficial in some way.

After the pullback, using a measured move tool, this gives us an add'l target area. My exit is the wedge top (notice I chose the price level which several candles rached rather than the extreme top of wedge. This is my conservatism shining thru. :-) As Ive written this, price has shelfed and turned down just shy of the 849 level. As RSI is again extreme, the position is exited. Perhaps you will find this analysis beneficial in some way.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.