Week 12

quote:CL/CES - Week 12

This is the sixth weekly installment of my CL/CES journal I outlined in The Intro. Previous weeks can be found here.

The course is based on material provided by DLC Profiles, as well as Jim's texts on Market Profile, MoM and MiP. Anyone needing more information should fill out this form and schedule some time with DLC to get a deeper overview of the course.

On with the journal ...

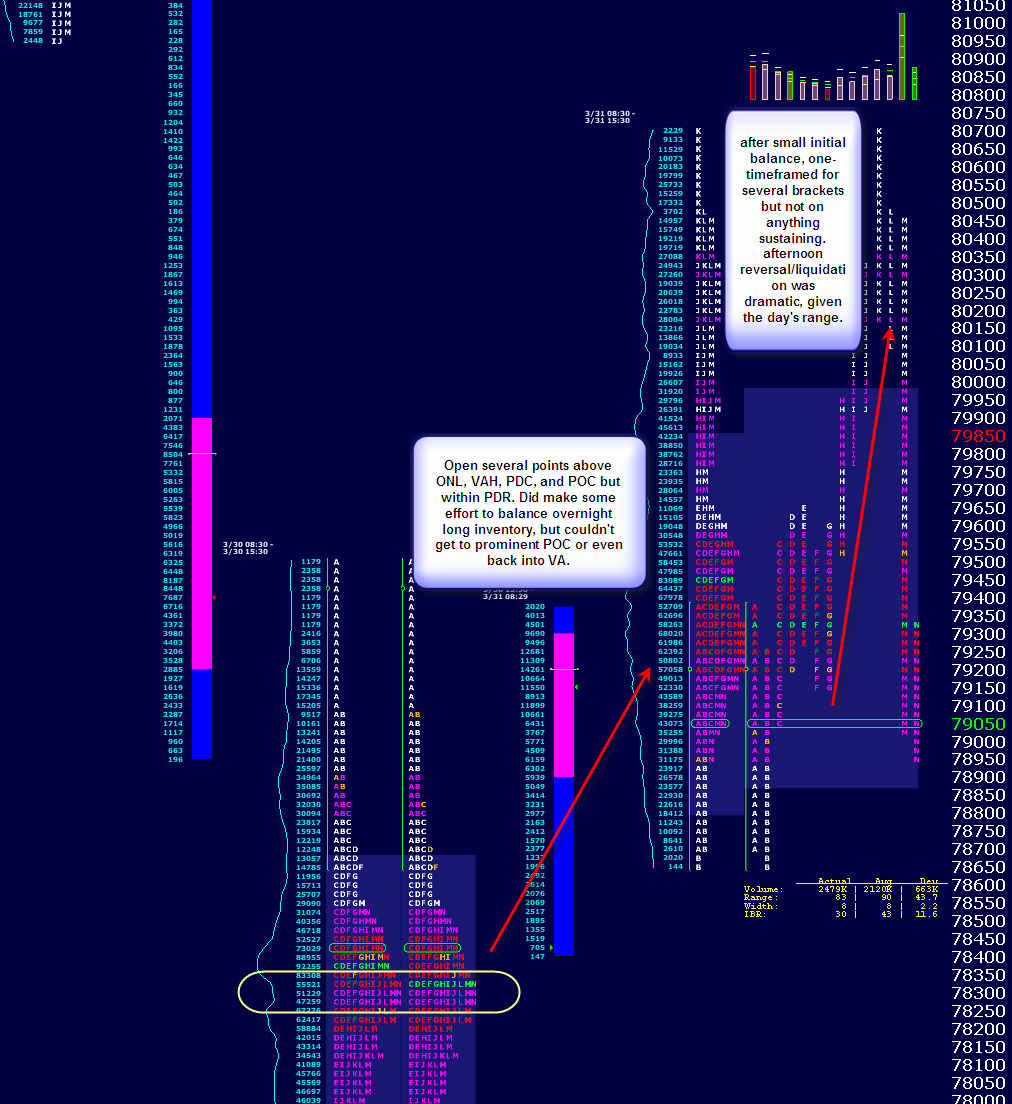

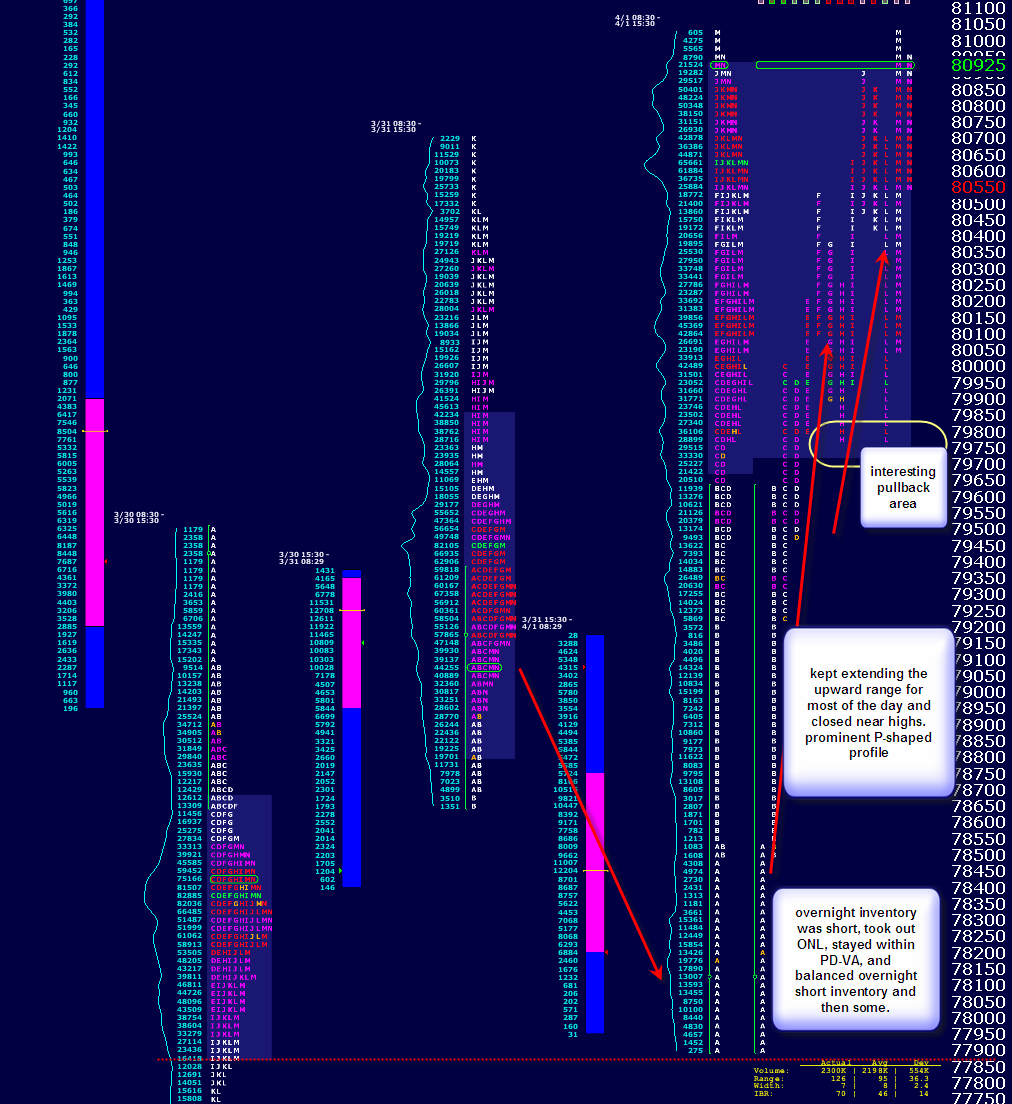

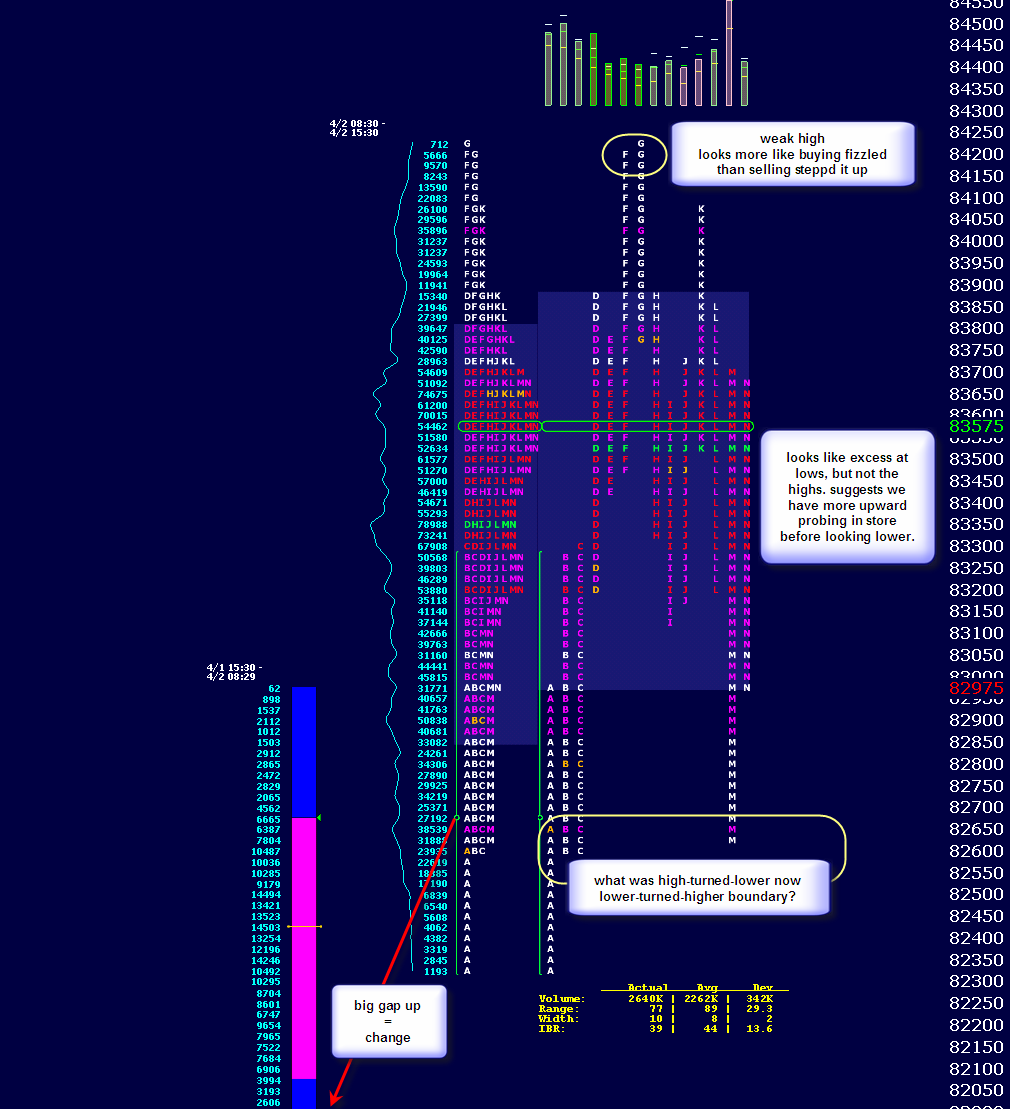

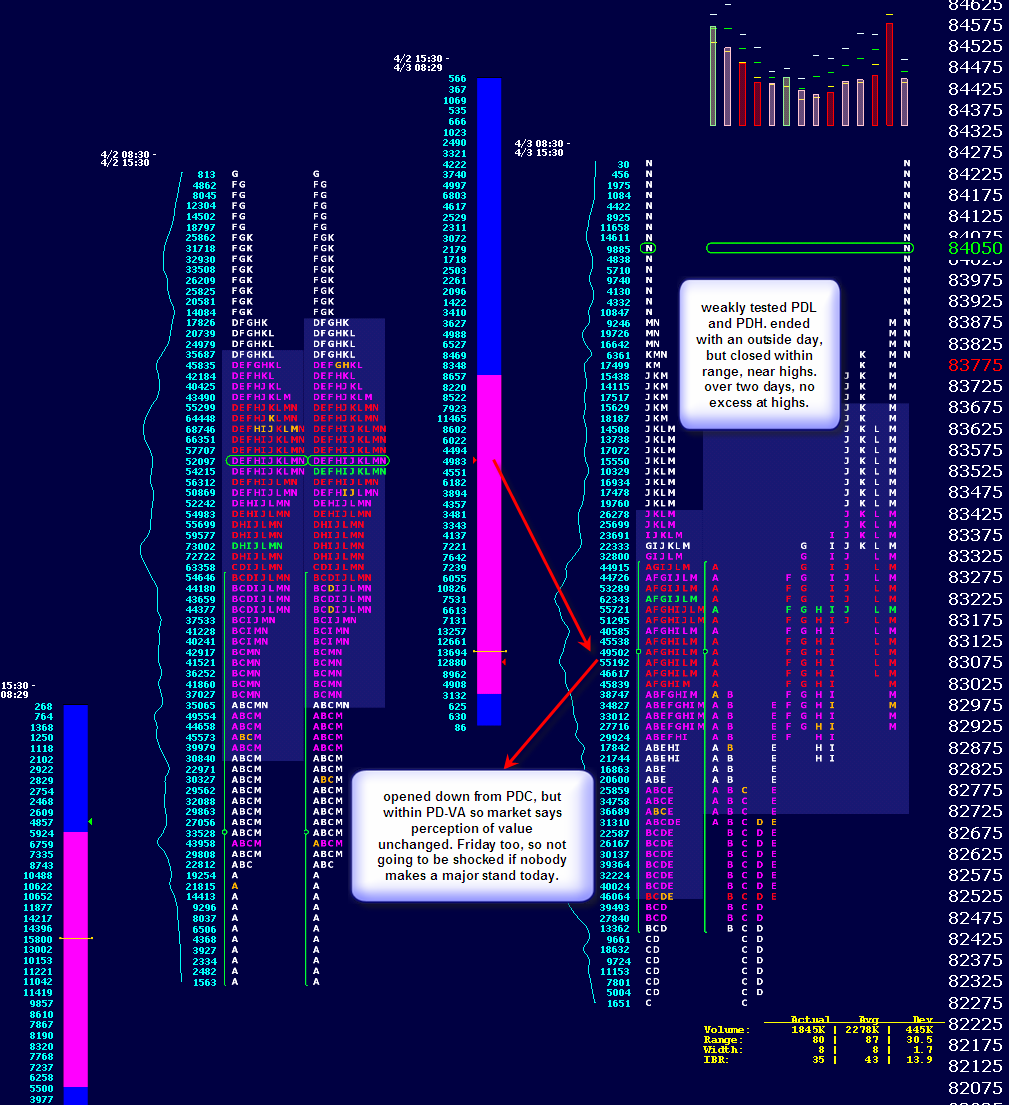

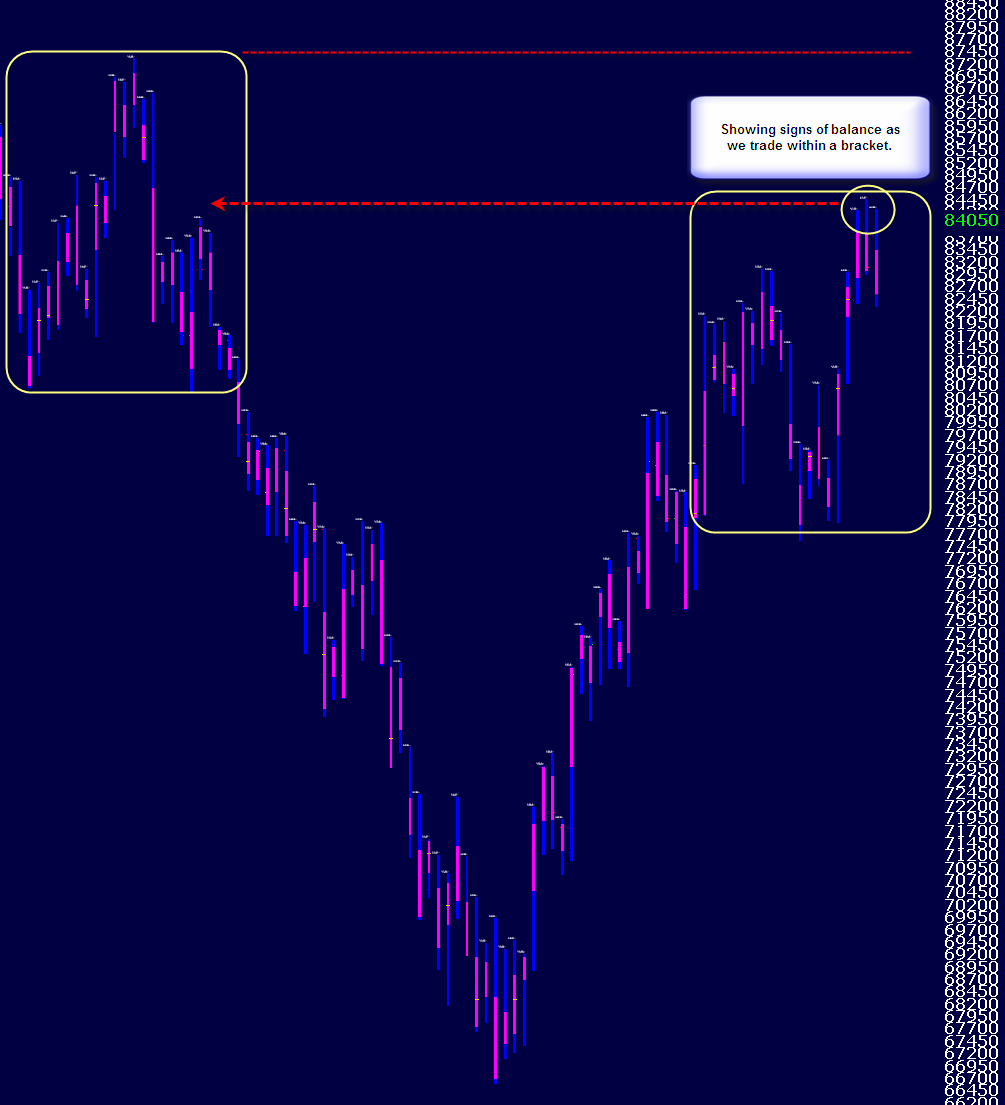

Trying something completely different this week: charts only. I've added notes to the charts and will let them stand as my entry this week.

I will add that this week was challenging for me to read, observe, trade, you name it. Many times i found myself looking at a much smaller fractal and riding the more micro-sized price action. that seemed to stem from not finding solid feeling directions, so i went into a pseudo scalp mode to keep my feet in the current. there were just a couple days where i simply couldn't identify what i felt were legitimate, asymmetrical trading opportunities so i played it quick and tight.

course-wise, i was really off my game this week. i always feel like i am more connected with the material and the markets when we have a webinar, and this wasn't a webinar week. i know that's on me, so i have to work on that going forward.

moving forward, if i decide to take a more visual approach, i will likely split up the week into more posts. i like the chart-based post, but think i might like it better if it is parsed throughout the week.

Omini...On your Friday chart why do you say that there is "no excess" at the "N" period high...it looked like alot of excess to me....perhaps you can clarify..I like the new format

quote:Hi Bruce

Originally posted by BruceM

Omini...On your Friday chart why do you say that there is "no excess" at the "N" period high...it looked like alot of excess to me....perhaps you can clarify..I like the new format

when i wrote that there was no excess at the highs, i was referring to the Thurs/Fri RTH sessions. almost identical highs over two sessions doesn't look excessive to me. however, with very delayed hindsight, the overnight high in the session between Thurs and Fri looks like it wasn't taken very seriously, so possible excess there.

also, that N-period rally on friday was suspect to me. Last 15min of the day, after cash close, and right before the weekend. the Thurs/Fri highs look too mechanical, too technical. they beg to be revisited.

btw, thx, glad you like the new format. i'm going to try out a variation of it for this week too.

as always, thx for your comments and contributions in general.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.