Market Delta

I wanted to get some feed back regarding Market Delta. Is anyone using it? Has it help your trading? Or is it more info overload.

Thanks

Printer

Thanks

Printer

I tried Market Delta a while back and could not find any strategy that made it useful or profitable. I also did a fairly in-depth back test to see if the excessive trading (or bid/ask size) on one side of the future influenced the short term (scalping) direction of the market and my results showed it to be neutral. As such I never went any further with Market Delta - this was a few years ago.

I also remember that the Market Delta web site would constantly be asking traders for feedback for strategies that they'd used based on Market Delta and I know that for a couple of years nobody ever came up with a strategy. That may have changed more recently because I haven't been there (their site) for a few years.

I also remember that the Market Delta web site would constantly be asking traders for feedback for strategies that they'd used based on Market Delta and I know that for a couple of years nobody ever came up with a strategy. That may have changed more recently because I haven't been there (their site) for a few years.

I'm on a trial now.....it looks good but this bid and ask stuff is just killing me......I just don't get it!! The program seems to have a lot of features though ..this is what people type in charts "after the fact"

"I'm seeing lots of ask volume up at 866 but no price appreciation" so if it can't go up it must come down.......I hope so

"I'm seeing lots of ask volume up at 866 but no price appreciation" so if it can't go up it must come down.......I hope so

Bruce,

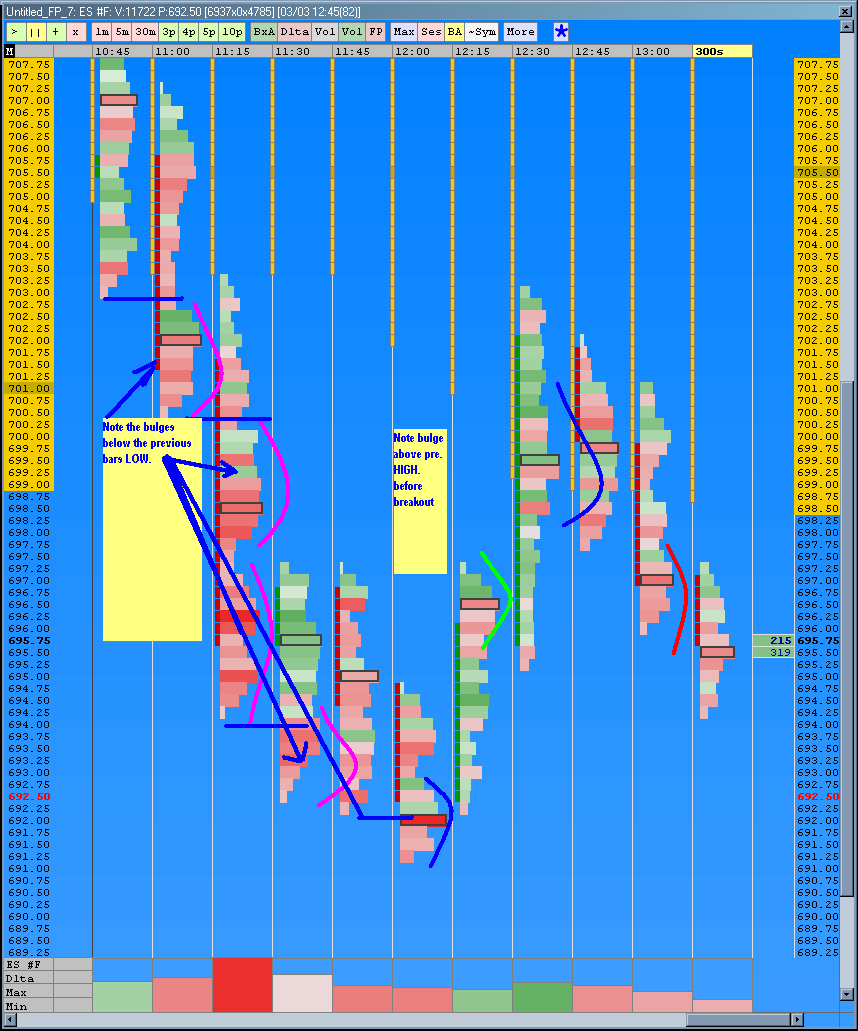

I use the volume footprint 15 min and the 5 min total volume, shade the volume on the total volume chart and it tells me at a glance where most volume is happening at. I look for bulges on the 15 min V.P. I want to see bulges above resistance If I am long and bulges below support if I am short. This helps me filter out whats bouncing off S/R and whats being accepted above and below. For example a bounce off of 871 when the market is heading up would be a hit and a bulge below 871 an acceptance to 871 would be a hit a stale then bulge forms over 871 and then continues higher.

I don't think it helps much to look at individual bars, unless you are looking for volume climax which the 5 min total volume works well for that. I have had Market delta for almost 3 years now and I like it.

I use the volume footprint 15 min and the 5 min total volume, shade the volume on the total volume chart and it tells me at a glance where most volume is happening at. I look for bulges on the 15 min V.P. I want to see bulges above resistance If I am long and bulges below support if I am short. This helps me filter out whats bouncing off S/R and whats being accepted above and below. For example a bounce off of 871 when the market is heading up would be a hit and a bulge below 871 an acceptance to 871 would be a hit a stale then bulge forms over 871 and then continues higher.

I don't think it helps much to look at individual bars, unless you are looking for volume climax which the 5 min total volume works well for that. I have had Market delta for almost 3 years now and I like it.

I may need some help with it Joe...you can put Vwap and bands right on your Footprint chart....I'm not sure which version you currently run but the new one does that......the bid / ask stuff is a challenge...

quote:

Originally posted by CharterJoe

Bruce,

I use the volume footprint 15 min and the 5 min total volume, shade the volume on the total volume chart and it tells me at a glance where most volume is happening at. I look for bulges on the 15 min V.P. I want to see bulges above resistance If I am long and bulges below support if I am short. This helps me filter out whats bouncing off S/R and whats being accepted above and below. For example a bounce off of 871 when the market is heading up would be a hit and a bulge below 871 an acceptance to 871 would be a hit a stale then bulge forms over 871 and then continues higher.

I don't think it helps much to look at individual bars, unless you are looking for volume climax which the 5 min total volume works well for that. I have had Market delta for almost 3 years now and I like it.

I still use the older version, but have both. The chart I use you cannot put indicators on there. But thats no problem just open there new chart if you want indicators. Its the exact same chart I just like the layout of the old version with the count down and all.

1) open market delta

2) click open footprint

3) click footprint-Delta Profile then OK

The chart should come up.

4) right click on chart under general you should see bar periodicity, you can set it to any time frame you choose, min, tick, volume, culm. delta ect ect

I have my delta volume set to 15 min. Just looking at this chart you don't see anything special but just watch it RTH around important areas and watch how the volume bulges around prices that are accepted at the moment.

1) open market delta

2) click open footprint

3) click footprint-Delta Profile then OK

The chart should come up.

4) right click on chart under general you should see bar periodicity, you can set it to any time frame you choose, min, tick, volume, culm. delta ect ect

I have my delta volume set to 15 min. Just looking at this chart you don't see anything special but just watch it RTH around important areas and watch how the volume bulges around prices that are accepted at the moment.

There is another way to do it...

If you have there old charts up just click on the red Dlta button at the top for delta profile.

The Dlta and Vol buttons at the top are all I use. I am sure the bid x ask thing works I just don't have that many eyes

If you have there old charts up just click on the red Dlta button at the top for delta profile.

The Dlta and Vol buttons at the top are all I use. I am sure the bid x ask thing works I just don't have that many eyes

LOL I just realized there lots of ways to run a chart.

Click file

footprint classic chart

I don't much care for there new charts, the way to move the chart is weired to me and it cost me some money one time so I never made the switch. If it ain't broke...

Click file

footprint classic chart

I don't much care for there new charts, the way to move the chart is weired to me and it cost me some money one time so I never made the switch. If it ain't broke...

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.