Best Trade of the Week 3922

Post em up boys and girls.

WELL DONE GUYS!!!

Vo, I was wondering how you handled the retrace from 737 back up to 740.50 (Roughly) I thought the stop may have come into play.

Do you move your stop at each fib value, or only the major ones? (161.8, 261.8...)

Great trade though, and well done for sticking to the rules.

Do you move your stop at each fib value, or only the major ones? (161.8, 261.8...)

Great trade though, and well done for sticking to the rules.

Vast if you notice, there are 2 sets of extensions on the chart. 1 for the bigger ABC and 1 for the smaller. I basically used the bigger extensions with the fib ma. Price was kind enough to find its way down to the 261.8% (100% of bigger or 1st target) of smaller where I peeled 1 off. What we know from experience is that when price has made a move to that level it likes to retrace and find its way back to the 161.8%. Look where my fib ma is at that point. Right at the 161.8% - and right where my stop was.

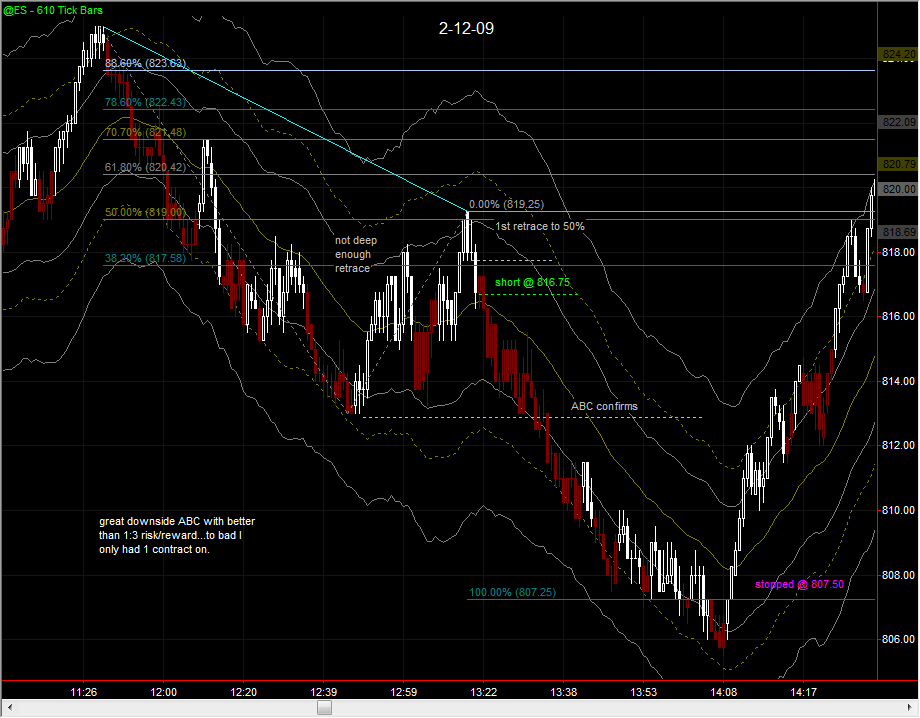

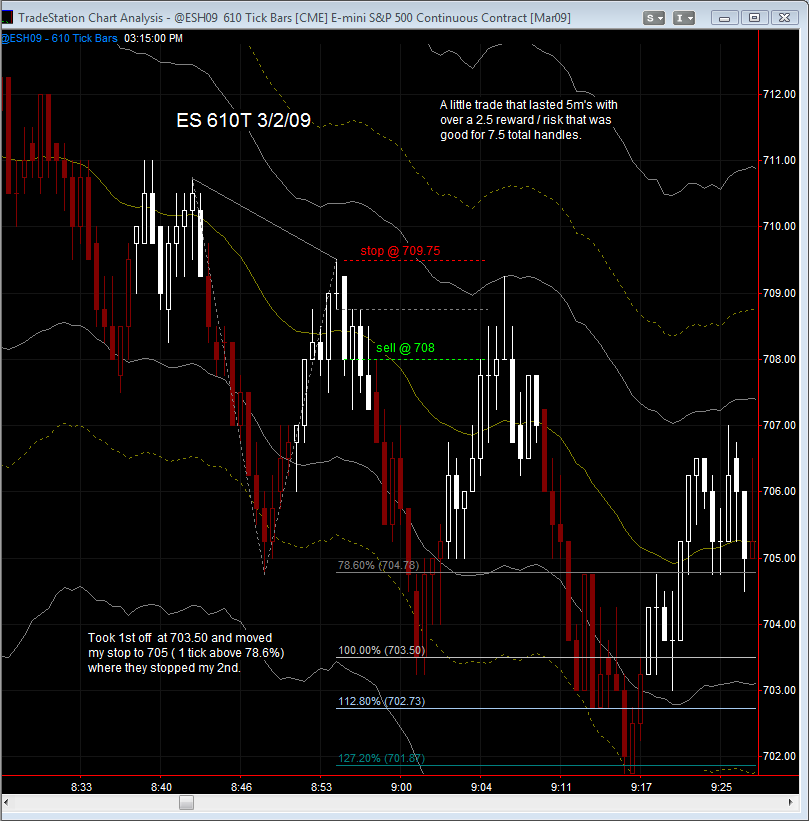

Two from this week.

Note the different position management strategies employed.

Friday's afternoon trade: enter "all-in", then scale out in 3 parts, Reward:Risk ratio noted.

Tuesday afternoon trade: scale in 3 parts, exit "all-out"

Note the different position management strategies employed.

Friday's afternoon trade: enter "all-in", then scale out in 3 parts, Reward:Risk ratio noted.

Tuesday afternoon trade: scale in 3 parts, exit "all-out"

Nice trades PT. I was just reviewing yesterday's PA and was wondering if you could tell me which 15 min candle you used to get the 666.5 deadly low, and what were the high and low for the projection. I noticed some discrepancy on my ninja charts (60 min) and want to make sure the 15 min chart is accurate. Thanks for the great input and assistance in the room btw. Einstein

My small contribution to the forum. No big winner, but I followed the rules.

The other is a trade I chickened out of by not sticking with the plan.

Trade the plan and trust it. It is the only way to realise real trading results to the back testing results you have.

The other is a trade I chickened out of by not sticking with the plan.

Trade the plan and trust it. It is the only way to realise real trading results to the back testing results you have.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.