Larry Pesavento's Insights on the Markets & Charts

roofer: I find your charts fascinating, being a newbie to fibonacci stuff and seeing what others are accomplishing with it.

How often do you actually catch one of those mega reward/risk trades like the ones you depict in your charts?

How often do you actually catch one of those mega reward/risk trades like the ones you depict in your charts?

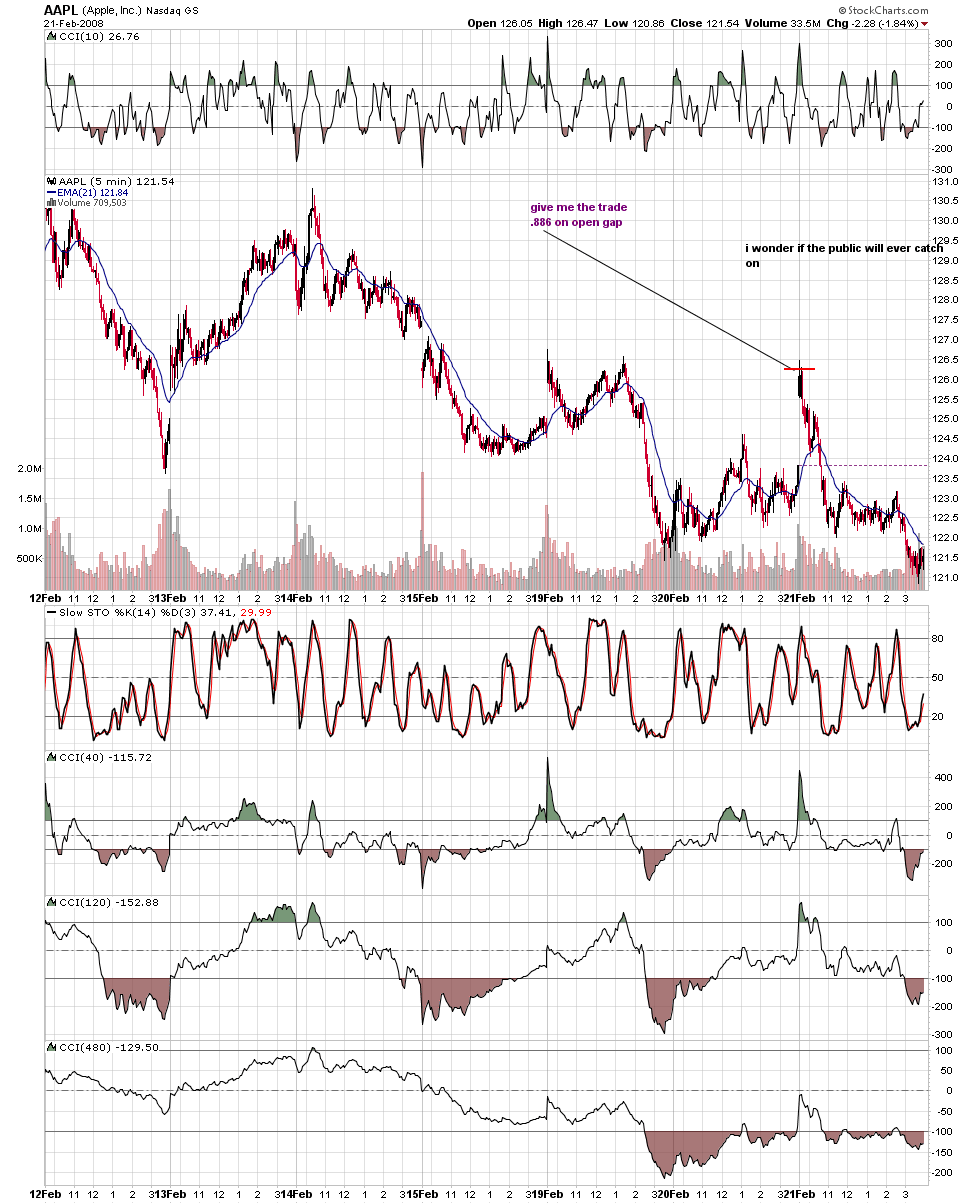

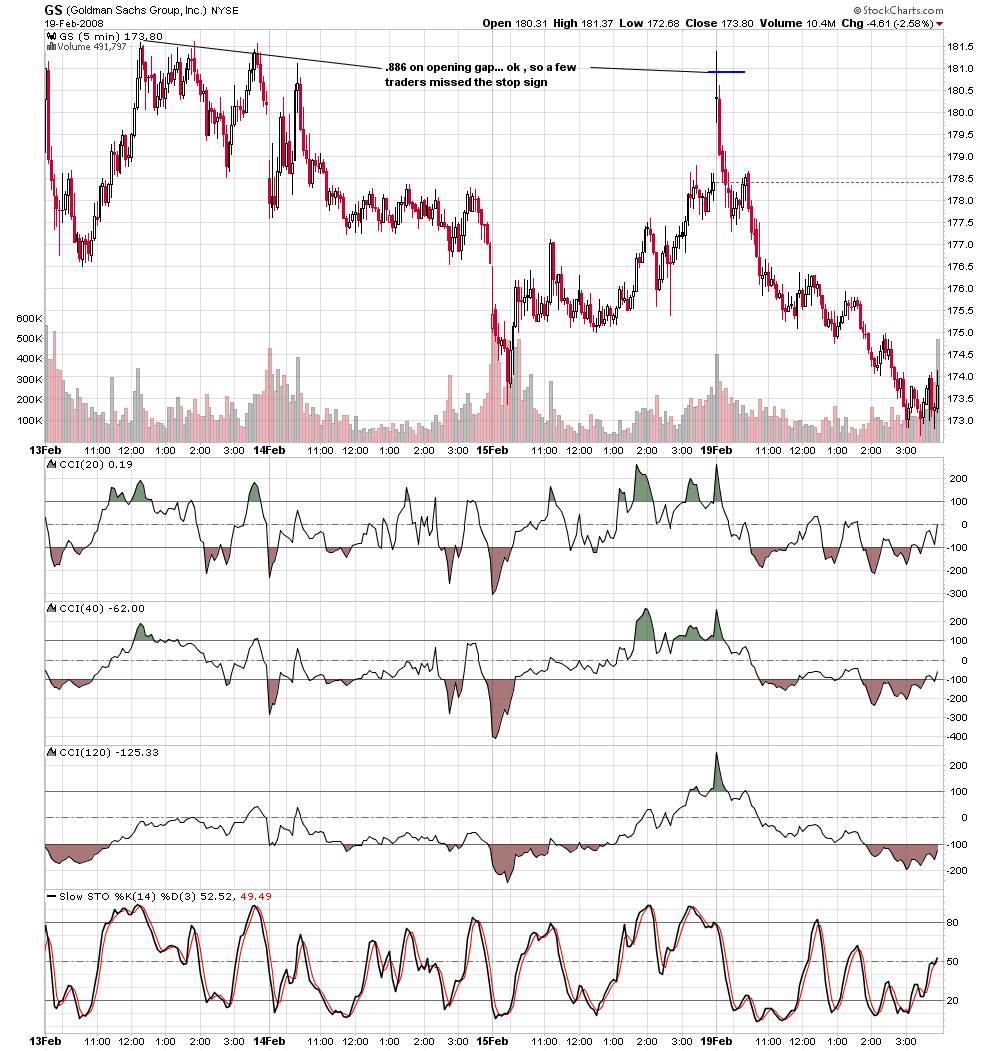

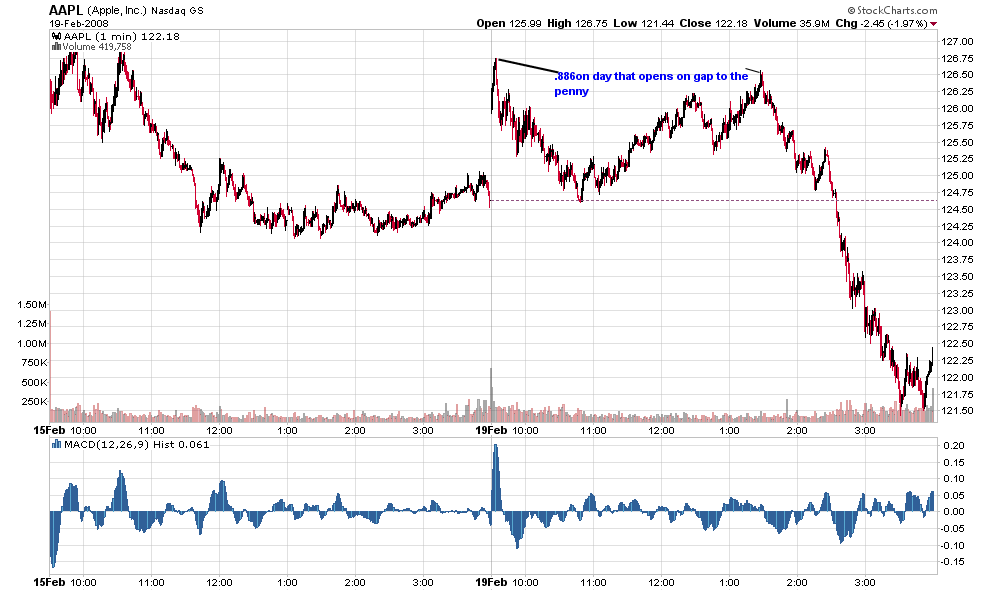

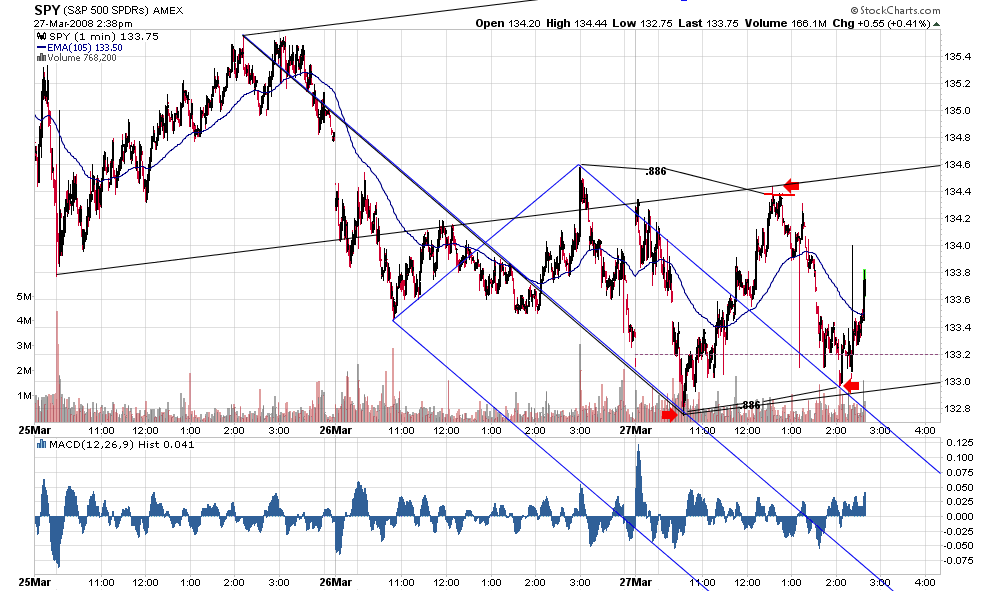

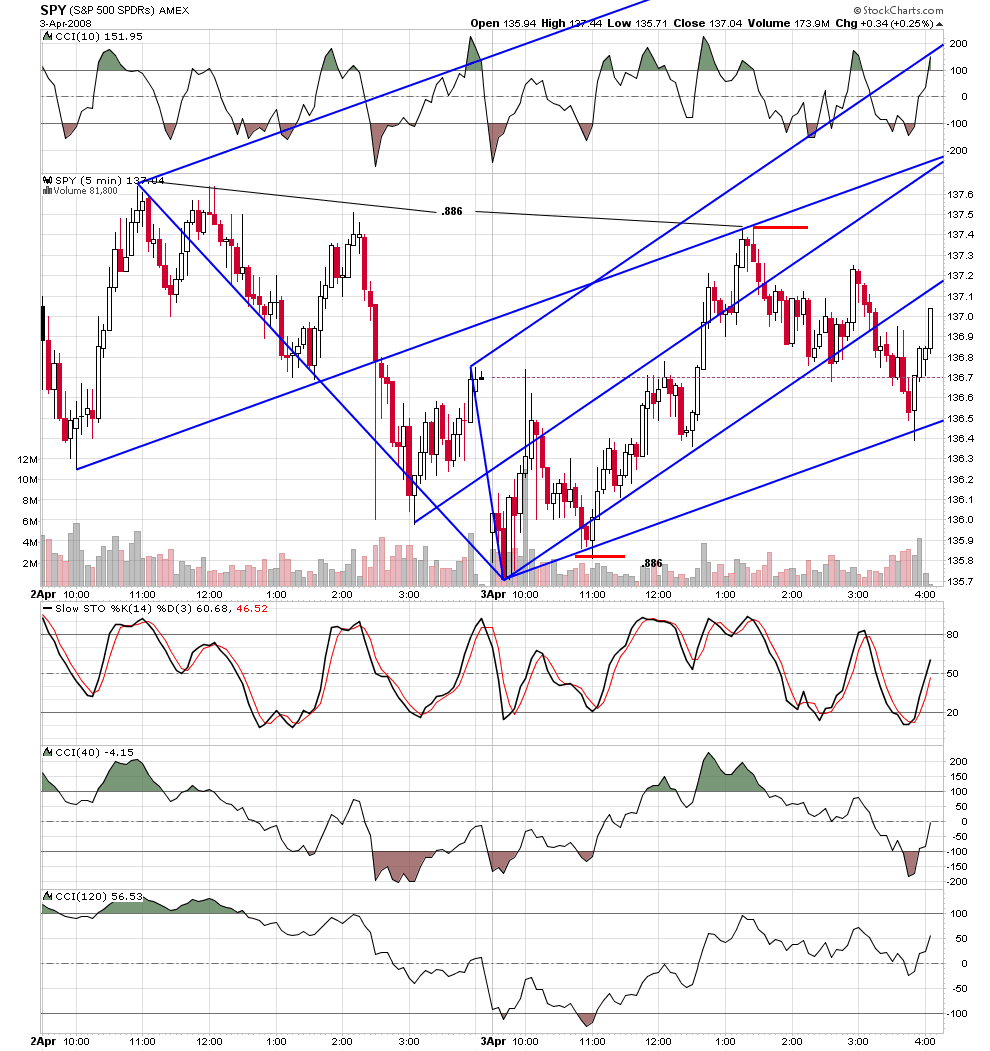

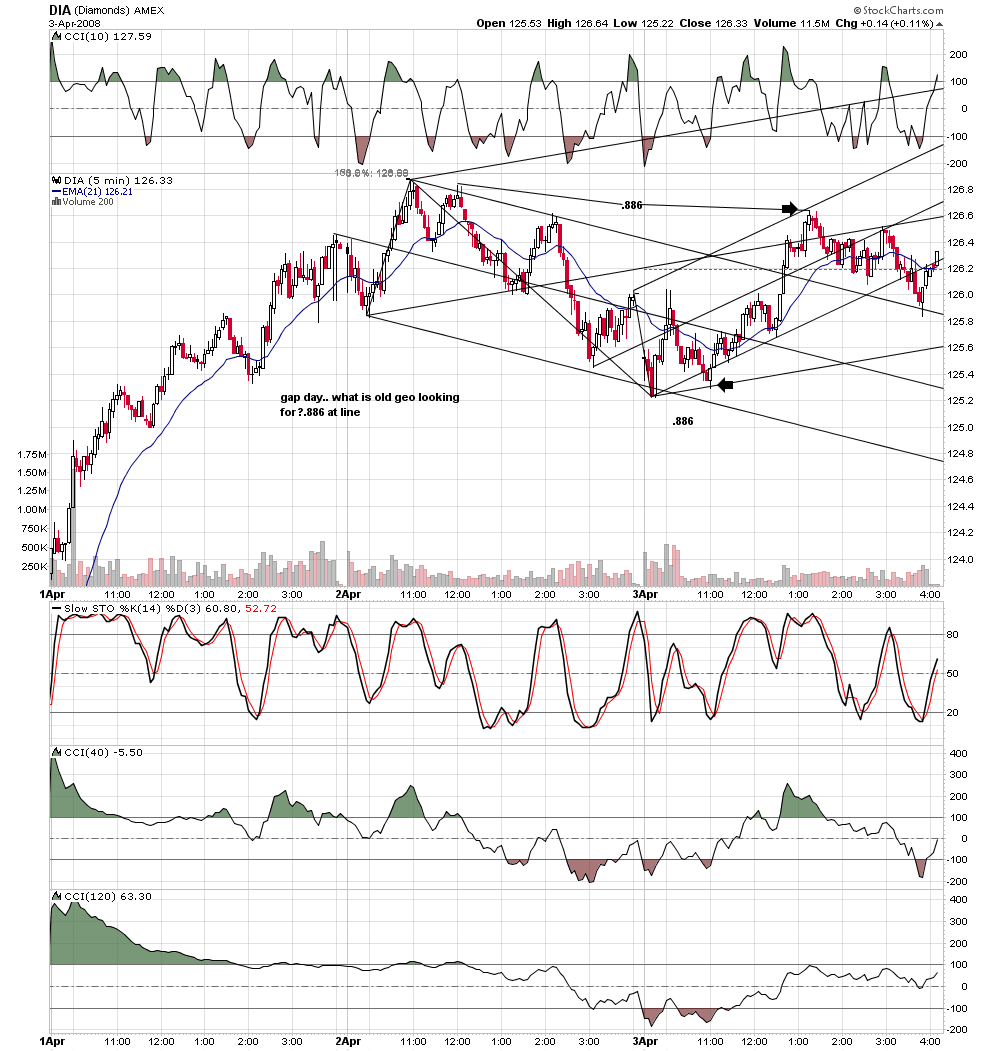

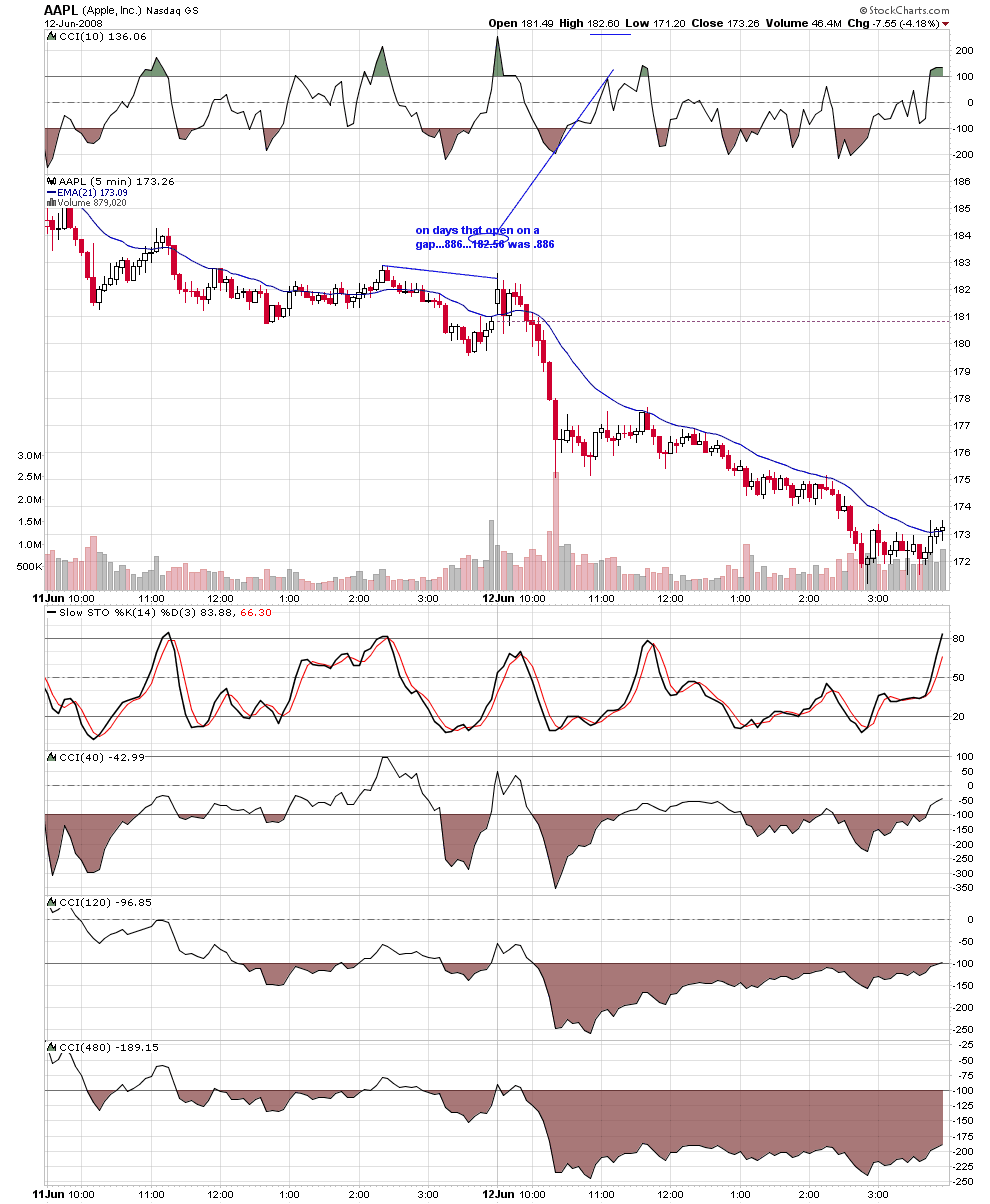

bruce raises good questions ... i tend to go in streaks in terms of what i write about.. in 2005 i wrote for months about the importance of measuring fib from the middle of gaps... til folks at the forums said ''we get the point!'' where? at leavittbrothers and the old medianline forum. so though bruce sees a picked example, there are whole other groups of trades who would toss me from their forums if i showed one more example. for two years i have been writing about the.886 on opening gap and wondering aloud when the public would catch on.again at leavitt, old and new medianline forums, and at the kane forum...my process is always this ..if i find something that might be of value i go to my charts and find endless examples... if i find value, i track it in real time for a month.. if i agree it has value i trade it..as far as posting in advance in real time.. we all know that is a battle that can not be won unless the traders you are speaking to have a basic working knowledge of your work.. thus, for example, i only post in advance based on straight forward medianline theory at marketgeometry... if you go there you will see charts posted in advance on jan15, two hours before the bottom telling traders to pay attention strictly based on the tools... EVERY trader there knows in advance that the ideal trade once the line is hit is to draw a smaller set and if a retest of retest occurs, to trade it with tight stop above the previous swing... that is what happened and that is what i showed.the traders dream has been in the public domain for six years.. i still get emails from the old email based forum from traders thanking me for teaching it.. i feel a little silly about it.. it is simply something that has always been in the markets and always will be... all i did was write about it.. i did not ''discover'' it.in that light NOTHING i write about has not always been in the market..thus who i am does not matter. in my other life as a roofer there is no greater enjoyment tnan to pass on what i know. trading is no different.here are some more examples from over time of the value of the .886 on opening gap.

i do not know how to respond to how often... every chance i get...mega reward risk? to me that means 100/1... each trade setup that i trade i know the odds of making it to a minimum target.. the trade itself gives the target. that is one of the basic premises of medianline trading... if you want a ton of free info on that premise as taught by a long time line trader FOR FREE.. go to www.medianline.com and study the archived posts.most traders tell me it takes days of concentrated study to wade through. the difference between my work and the work shown there is that my trades are triggered by a predefined trade setup( .886 on gap, traders dream,e.g.) at the line.only then do i use line as target and set stop.there is a ton of free stuff out there.. all of the fib i use is available for free to any trader willing to play with the sqrt function on their calculator...

Thanks roofer.

Roofer,

You know your stuff. I think you harped on this in 2007 about 0.886 and the reciprocal...1.27. Yes, I did wax on people taking courses, but maybe you found a true source. Congrats.

You know your stuff and I think you have something here for sure. Personally, I use Time and price and probably the way I look at price may conicide with your way of trading. Sqrt I use for longer term in commodities and indices but not based on Fib but time and price.

Nonetheless, do continue, because you are a bright light and I can see you are a good trader.

BTW, have you taken a Morge webinar?? If so, how did it help your trading? He is an Andrews fan and takes the pitchfork from his teachings or I stand to be corrected.

Best

You know your stuff. I think you harped on this in 2007 about 0.886 and the reciprocal...1.27. Yes, I did wax on people taking courses, but maybe you found a true source. Congrats.

You know your stuff and I think you have something here for sure. Personally, I use Time and price and probably the way I look at price may conicide with your way of trading. Sqrt I use for longer term in commodities and indices but not based on Fib but time and price.

Nonetheless, do continue, because you are a bright light and I can see you are a good trader.

BTW, have you taken a Morge webinar?? If so, how did it help your trading? He is an Andrews fan and takes the pitchfork from his teachings or I stand to be corrected.

Best

pips-no, i have not taken webinar...i had the good fortune to be a member of tim morge's first forum at a time when he would write 8 pages a day about the day's trading.when people ask me where to start, i always point them to the archived posts and the article x- marks the spot at his site. i do not trade like tim morge or jim kane...i simply use the tools they teach.the trader cooper made a great distinction.. descriptive vs predictive...any tool we use begins as descriptive and remains so until each trader does for himself the boring grinding work of making it his own until he is willing to risk his financial well being on it.. only then does it become predictive for that trader.i have come to see it is very hard to teach.. say it.. they forget it.. show them they know of it.have them do it they understand it..but this process does not work unless it is one on one..even then there is a trap. what we know prevents us from seeing what is knowable.. cooper made the distintion in saying how he thought his gann work was predictive and indicators are merely descriptive. yet the greatest gann trader i know, trades both forcast time(gann) and market time( indicators) and from that work you see the indicators on my charts..i do not exclude an awareness of any work.. i trade my charts.. but each day i have written down where the gann, pivot and market profile traders are looking to trade...

i should have completed my thought. once or twice a week you will get a setup where every technique looks to take the same trade.. the trade works..but what you will see over and over is that each group will tout their success based on their technique that they have mastered and take a swipe at other techniques that have not taken the time to understand.. i am not talking about anything here. i am refering to the blogs of some well known book writers.the deeper truth is that all groups were looking to take the same trade...daytrading spoke of his''cluster''my awareness of the intent of all groups is my cluster.

I think this really sums it up Roofer...it isn't a particulary fib ratio, median line , MP , pivot number etc...that will turn the market it is the CONFLUENCE when they line up......

If I had the time I could find tons of examples where the .86 retrace fails but also tons where it worked off of some well chosen high or low point in the past....I think the BEST trades will have multiple players involved using the method that they think works the best......

As a quick example, in the daytrading threads I would see Kool or VO post their levels and we would get a "turn" in the market....I would be in there with my MP or volume numbers at the excat same level......thinking " hey it's my zone that's turing it not yours" but the reality is that the collective methods are truning the market and not one specific thing

This is why I was asking that you post some .86 levels ahead of time......I would bet that we will find other numbers (pivots, mp etc) that will fall at these exact same levels.....when they work!

At best it becomes another tool for the fib players tool box.,..,,,,this can be said about any idea posted and it is our egos and our beleif system ( which we need to feel) that leads us to beleive that WE turned the market....the reality is that we ALL did it for different reasons.....the .86 seems like a good addition for those looking at fib numbers but to use it in isolation I think would be a mistake

Today we may get a gap down in the S&P, perhaps somebody wants to step up and snap the .86 and post the chart right after the open print....probably not going to happen....but I'm sure someone can find a nice .86 retrace off some level and todays opening print given enough TIME to find it.....

An idea is one thing but actually applying it is whole different ball game....this is the same reason we never get an Entry, target and stop loss from PIPS...........it's just too hard to actually trade but showing up for bragging rights later helps feed the ego if not the bank account.....

If I had the time I could find tons of examples where the .86 retrace fails but also tons where it worked off of some well chosen high or low point in the past....I think the BEST trades will have multiple players involved using the method that they think works the best......

As a quick example, in the daytrading threads I would see Kool or VO post their levels and we would get a "turn" in the market....I would be in there with my MP or volume numbers at the excat same level......thinking " hey it's my zone that's turing it not yours" but the reality is that the collective methods are truning the market and not one specific thing

This is why I was asking that you post some .86 levels ahead of time......I would bet that we will find other numbers (pivots, mp etc) that will fall at these exact same levels.....when they work!

At best it becomes another tool for the fib players tool box.,..,,,,this can be said about any idea posted and it is our egos and our beleif system ( which we need to feel) that leads us to beleive that WE turned the market....the reality is that we ALL did it for different reasons.....the .86 seems like a good addition for those looking at fib numbers but to use it in isolation I think would be a mistake

Today we may get a gap down in the S&P, perhaps somebody wants to step up and snap the .86 and post the chart right after the open print....probably not going to happen....but I'm sure someone can find a nice .86 retrace off some level and todays opening print given enough TIME to find it.....

An idea is one thing but actually applying it is whole different ball game....this is the same reason we never get an Entry, target and stop loss from PIPS...........it's just too hard to actually trade but showing up for bragging rights later helps feed the ego if not the bank account.....

quote:

Originally posted by roofer

i should have completed my thought. once or twice a week you will get a setup where every technique looks to take the same trade.. the trade works..but what you will see over and over is that each group will tout their success based on their technique that they have mastered and take a swipe at other techniques that have not taken the time to understand.. i am not talking about anything here. i am refering to the blogs of some well known book writers.the deeper truth is that all groups were looking to take the same trade...daytrading spoke of his''cluster''my awareness of the intent of all groups is my cluster.

Just another quick comment...I have an mp number near 35 this week.....the weekly pivot is up there too...so for me to think that it is just my MP level that made the market act like a magnet (assuming we can get a rally back to it this week) would be ridiculous...but if we bring in the players that KNOW how often weekly pivot numbers get traded to then we may have something......I'm sure some can find a fib ratio to that also.....so now we have a collective thought process going on which can possible help us form a bias........I didn't want you to think I was picking on the .86.......this concept would hold true to any single number/concept

quote:

Originally posted by BruceM

......thinking " hey it's my zone that's turing it not yours" but the reality is that the collective methods are truning the market and not one specific thing

LOL bruce...you mean it wasn't MY number

.,..,,,,this can be said about any idea posted and it is our egos and our beleif system ( which we need to feel) that leads us to beleive that WE turned the market....the reality is that we ALL did it for different reasons

Bruce this was an excellent post friend...I feel this to be true as well. Thats why I want to know the wave count, the MP levels, pivots, volume zones ect. When there are confluences then the probability of success increases dramatically (and I get to think to myself "those guys sure are lucky I had a number there"

The stock market attempted to make new highs again today. In fact, the

NASDAQ was able to make new highs. This presents a potential problem for the

Bears, or a great opportunity. Divergence between similar contracts can be

highly indicative of a major trend change. As you can see from the enclosed

chart, the NASDAQ easily exceeded last week's highs, while at the same time

the S&P 500 (i.e. Dow Jones also) were unable to do so! The bearish case is

still up for grabs. Any move in the S&P 500 above 875 would mean that we are

going higher. The figure for the Dow Jones is 8112. This week will be

critical to what happens going into May 18th which is our next Astro

harmonic date( combust ).

This weekend we will present a comprehensive pattern analysis on all the

major markets as we are approaching some completion of very significant

patterns.

NASDAQ was able to make new highs. This presents a potential problem for the

Bears, or a great opportunity. Divergence between similar contracts can be

highly indicative of a major trend change. As you can see from the enclosed

chart, the NASDAQ easily exceeded last week's highs, while at the same time

the S&P 500 (i.e. Dow Jones also) were unable to do so! The bearish case is

still up for grabs. Any move in the S&P 500 above 875 would mean that we are

going higher. The figure for the Dow Jones is 8112. This week will be

critical to what happens going into May 18th which is our next Astro

harmonic date( combust ).

This weekend we will present a comprehensive pattern analysis on all the

major markets as we are approaching some completion of very significant

patterns.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.