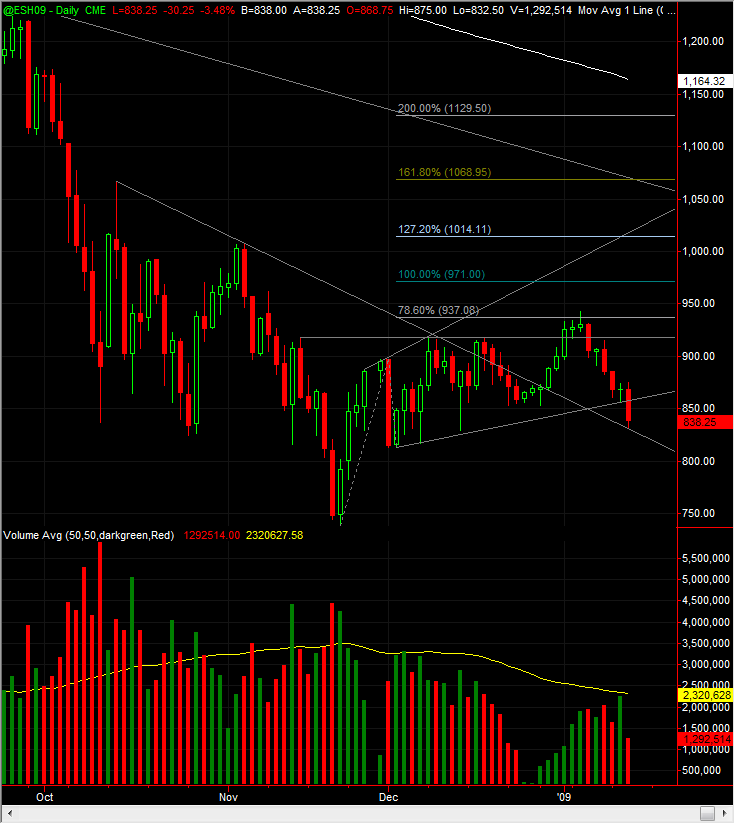

ES 1-14-09

we have a selling tail and single prints...how many more clues do we need to avoid buying low under these conditions.....so they will smack us around a bit today...

at least es and YM are spiking volume at the same time now....

My technique is simple and here it is:

On a 1 min chart apply a 10 period (High) Simple moving average and an 8 period (Low) SMA. Now when the MACD passes above the zero line(Zero line is where the Histogram is formed) from below and you get a green candle whose open and close are above the 10 SMA go long. Now when the MACD passes below the zero line from above and you get a red candle whose open and close is below the 8 SMA go short. Today is a wonderful day where there were good shorts as the MACD was below the zero line. MACD settings are 12/26/9

On a 1 min chart apply a 10 period (High) Simple moving average and an 8 period (Low) SMA. Now when the MACD passes above the zero line(Zero line is where the Histogram is formed) from below and you get a green candle whose open and close are above the 10 SMA go long. Now when the MACD passes below the zero line from above and you get a red candle whose open and close is below the 8 SMA go short. Today is a wonderful day where there were good shorts as the MACD was below the zero line. MACD settings are 12/26/9

have you ever incorporated the premium into divergences VO ? I did in th past but my current data doesn't support the $prem..I have the weekly projection....( the second one) down at 830...so we are close

yeah bruce I used to pay attention to premium but I dont anymore...i will bail on this awful long im in at be which is 41

unfortunately my longer term stuff in making me hold this.....so this is a good test for me mentally.....after all it's easy to lose money trading.....we have a composite that was run from the 10-10-08 low /date as we have consolidated since that time....with very little time spent below

there....

http://www.mypivots.com/forum/topic.asp?TOPIC_ID=3667&whichpage=2

look there for reference

there....

http://www.mypivots.com/forum/topic.asp?TOPIC_ID=3667&whichpage=2

look there for reference

quote:

Originally posted by ak1

My technique is simple and here it is:

On a 1 min chart apply a 10 period (High) Simple moving average and an 8 period (Low) SMA. Now when the MACD passes above the zero line(Zero line is where the Histogram is formed) from below and you get a green candle whose open and close are above the 10 SMA go long. Now when the MACD passes below the zero line from above and you get a red candle whose open and close is below the 8 SMA go short. Today is a wonderful day where there were good shorts as the MACD was below the zero line. MACD settings are 12/26/9

Thanks AK

How do you determine your profit target(s) and can you post some snapshots of your method for visualization?

quote:

Originally posted by Maria

Nice charts that hit the spots ptemini. How do you trade them?

TIA

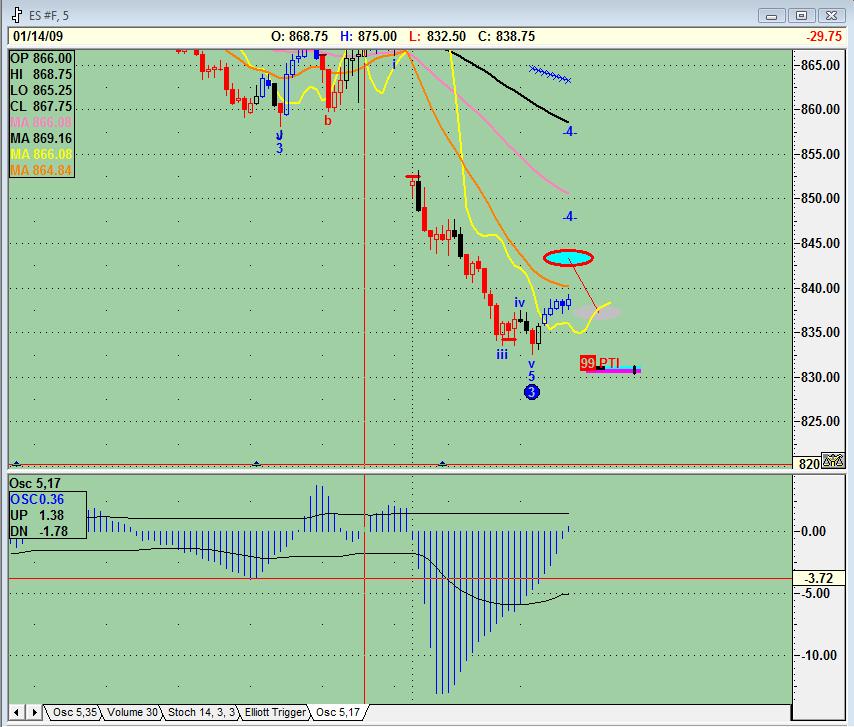

That is a short at the 261.8 Fibonacci extension level (845.75).

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.