Charts 1-14-09

I see so many complicated charts, with dozens of indicators, sometimes makes my head spin

Here is something real simple

Here is a simple daily chart of the E-mini SP 500, with just 2 charting indicators. 2 indicators keep things real simple.

A 14 day ADX combined with a 50 day simple moving average. As you can see the bounce of the lows of the SP 500, (or E-mini) made on November 21, 2008 did bounce or retrace to its mean as defined here by the 50 day moving average As we can also see the bounce was done a basis of declining strength.

The ADX is a good indicator for a pure measure of strength, and in my own personal experience tends to work better on longer time frames than on shorter ones A bounce on weakness suggests that the big money has yet to step back into the market and gives greater weight to the Markets Like to Retest Prior Lows theory

![]()

[email protected]

Here is something real simple

Here is a simple daily chart of the E-mini SP 500, with just 2 charting indicators. 2 indicators keep things real simple.

A 14 day ADX combined with a 50 day simple moving average. As you can see the bounce of the lows of the SP 500, (or E-mini) made on November 21, 2008 did bounce or retrace to its mean as defined here by the 50 day moving average As we can also see the bounce was done a basis of declining strength.

The ADX is a good indicator for a pure measure of strength, and in my own personal experience tends to work better on longer time frames than on shorter ones A bounce on weakness suggests that the big money has yet to step back into the market and gives greater weight to the Markets Like to Retest Prior Lows theory

[email protected]

THE BRADLEY CHART I POSTED SIMPLY REINFORCES THE 23RD AS POSSIBLY THE MOST IMPORTANT DATE OF THE TWO DATES I HAVE PREVIOUSLY GIVEN TO WATCH!

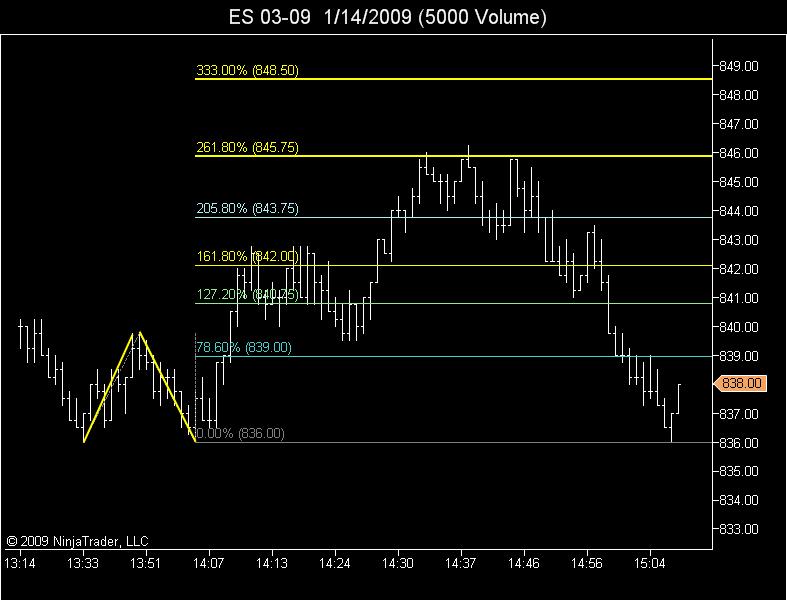

They don't always work out. This was a beautiful ABC setup. Price had moved all the way across the fibo bands and made a move above the MA to the 1.618 band. It then retraced back down through the MA to the 61.8% and the opposite 1.618 band. We had a nice bullish candle that shot back through the MA and gave an entry. This is a classic setup (my favorite) and in my experience the most reliable, however, as you can see it didn't follow through and stop was taken.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.