Globex 12-9-08

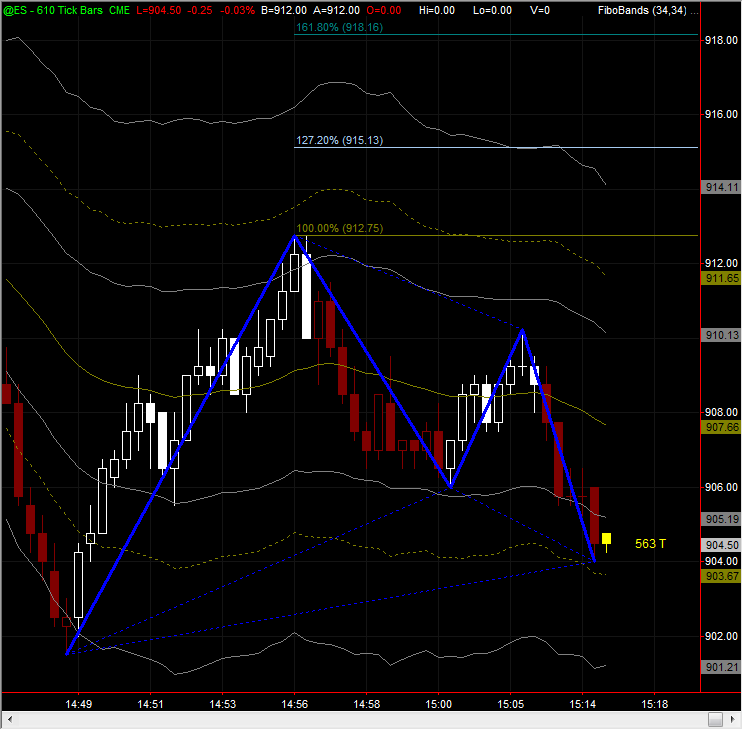

Look what we get to start off with boys! This is a Bullish Gartley...targets are in chart...stop is below "D" once it triggers with higher high or wide range bar

this pause is the 15 min avg, but that 15 min bar at 919.25(low of 910.25)is very clear of what they want@!

i would say by wed , Palmer.cycles seem to me to be positive to late tomorrow

looking for a runner on the downside- just want some heads up :)

the daily chart says till thurs at the outside for the rally to end

I sucked today- I will get them back tomorrow- rrrrrrrrrg

Art Cashin was on cnbc today saying that there should be a cycle top this week

he must have my computer tapped too!

yep- they are on you KOOL- The FEDS wil soon come knocking saying you are the one sending the market down :)

well, goota go... see everyone tomorroww! good trading all!

I trade 2 S&P position systems that I use to trade the SDS and SSO. One is based on the VIX and the other is based on an inverted and normalized TRIN. Both systems have 70-75% winning trades. Both systems went short on the close today. Their average trade duration is 2-5 days. Average trade for each is 2-5% however the last time they went short together was Nov 5 and they picked up 20% in 2 days trading the SDS.

if they can hold that 901.50 they will run it to 90 -88 area

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.