6 July 2005 (Wednesday)

Session Start: Wed Jul 06 09:17:50 2005

Session Ident: #t1

[09:30:52] <guy> Challenger Job-Cut Report

[09:30:52] <guy> 10:00 ET

[09:30:52] <guy> ISM Non-Mfg Survey

[09:30:52] <guy> 10:00 ET

[09:32:34] <guy> Single Print test strategy is long from 654.7 with stop at 653.7

[09:32:38] <guy> Single Print test strategy is long from 654.7 with stop at 653.7

[09:33:47] <signal>

[09:45:10] <guy> Innerworth: Sifting through the news

[09:53:42] <guy> reports in 7 min

[10:00:54] <guy> Single Print test strategy takes +2 points on 1 contract and stop now at b/e 654.7

[10:01:46] <guy> .

[10:01:58] <guy> High for year in ER2 is 659.1 from 3 Jan

[10:20:15] <guy> balance of single print test stopped out at b/e

[10:21:24] <guy> Next single print test strategy long is from 651.3

[10:32:33] <guy> .

[10:32:42] <guy> Rotation Factor for ER2 is 0

[10:32:48] <guy> We already have RE down on ER2

[10:32:59] <guy> and currently at POC

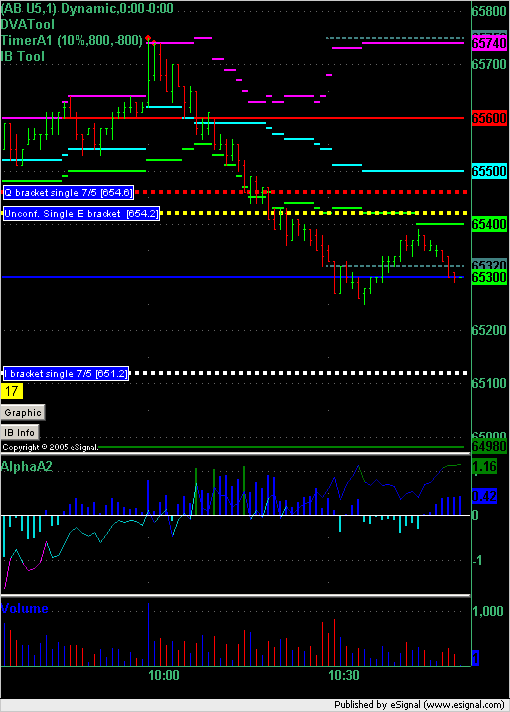

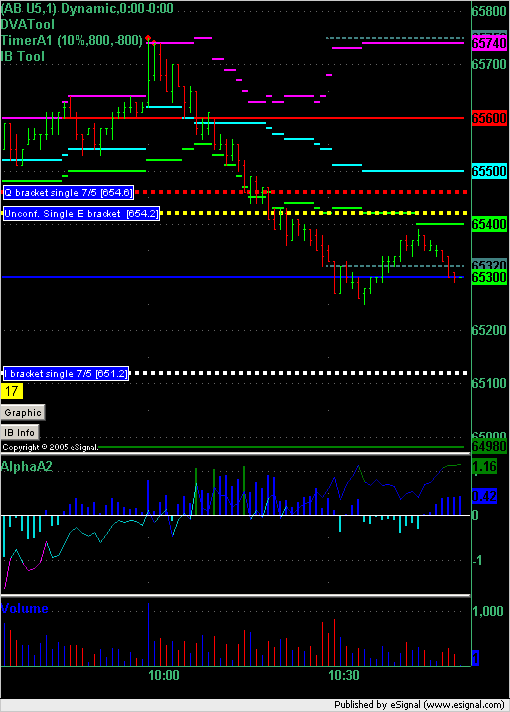

[10:52:32] <guy> Current ER2 chart

[10:52:40] <signal>

[10:52:50] <guy> at 11:00 EST the yellow dotted line will be a confirmed single

[10:53:03] <guy> so we have a previously failed single just above it

[10:53:11] <guy> could have the cluster effect here

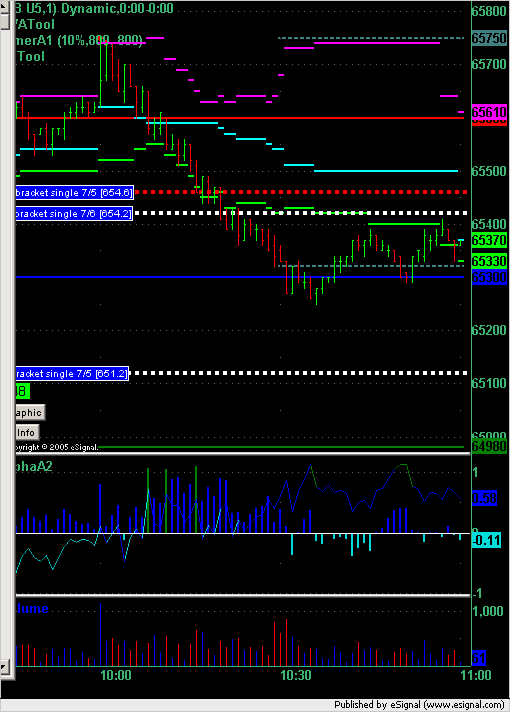

[11:00:43] <guy> 2 single prints

[11:00:45] <signal>

[11:01:32] <signal>

[11:01:40] <guy> Single print test strategy short at 654.1

[11:08:38] <guy> if/when we hit 651.2 then we'll be running both long and short single print strategies

[11:08:57] <guy> trading platforms like Ninja allow you to do this and net off the contracts for you

[12:26:30] <guy> a touch on 652.0 gives the current single print a +2 profit

[12:32:23] <guy> Single Print short takes a +2 profit on 1 contract and stop now at b/e at 654.1

[13:16:01] <guy> Shorts ER2 @ 653.8

[13:17:37] <guy> exit stop set ER2 @ 654.8

[13:20:12] <guy> Single Print second contract stopped at b/e

[13:33:10] <guy> stop hit ER2 @ 654.8 --> - 1

[Addendum: That was a particularly unlucky stop-out. It was the high tick of the move and the trade then went on to hit all the profit targets. My mistake on that particular trade was rushing the entry. An entry 1 tick higher would have allowed me to use a 1 point stop and the trade would have worked.]

[14:30:01] <guy> Oil Futures closed

[14:32:46] <guy> Single Print long at 651.3

[14:36:51] <guy> Single Print stopped for -1 on (current) low tick

[14:43:29] <guy> Buys ER2 @ 650.5

[14:43:55] <guy> exit stop set ER2 @ 649.5

[14:48:16] <guy> Exited 1/2 Long ER2 at 651.5 --> + 1

[14:48:22] <guy> exit stop moved to breakeven ER2 @ 650.5

[15:30:01] <guy> Bond Futures closed

[15:40:33] <guy> stop hit ER2 @ 650.5 --> 0

[16:15:15] <guy> gn all

[16:22:01] * Disconnected

Session Close: Wed Jul 06 16:22:04 2005

Session Ident: #t1

[09:30:52] <guy> Challenger Job-Cut Report

[09:30:52] <guy> 10:00 ET

[09:30:52] <guy> ISM Non-Mfg Survey

[09:30:52] <guy> 10:00 ET

[09:32:34] <guy> Single Print test strategy is long from 654.7 with stop at 653.7

[09:32:38] <guy> Single Print test strategy is long from 654.7 with stop at 653.7

[09:33:47] <signal>

[09:45:10] <guy> Innerworth: Sifting through the news

[09:53:42] <guy> reports in 7 min

[10:00:54] <guy> Single Print test strategy takes +2 points on 1 contract and stop now at b/e 654.7

[10:01:46] <guy> .

[10:01:58] <guy> High for year in ER2 is 659.1 from 3 Jan

[10:20:15] <guy> balance of single print test stopped out at b/e

[10:21:24] <guy> Next single print test strategy long is from 651.3

[10:32:33] <guy> .

[10:32:42] <guy> Rotation Factor for ER2 is 0

[10:32:48] <guy> We already have RE down on ER2

[10:32:59] <guy> and currently at POC

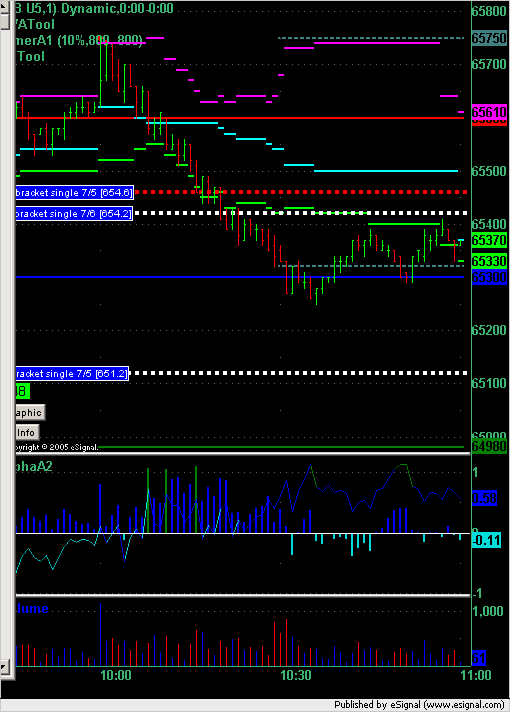

[10:52:32] <guy> Current ER2 chart

[10:52:40] <signal>

[10:52:50] <guy> at 11:00 EST the yellow dotted line will be a confirmed single

[10:53:03] <guy> so we have a previously failed single just above it

[10:53:11] <guy> could have the cluster effect here

[11:00:43] <guy> 2 single prints

[11:00:45] <signal>

[11:01:32] <signal>

[11:01:40] <guy> Single print test strategy short at 654.1

[11:08:38] <guy> if/when we hit 651.2 then we'll be running both long and short single print strategies

[11:08:57] <guy> trading platforms like Ninja allow you to do this and net off the contracts for you

[12:26:30] <guy> a touch on 652.0 gives the current single print a +2 profit

[12:32:23] <guy> Single Print short takes a +2 profit on 1 contract and stop now at b/e at 654.1

[13:16:01] <guy> Shorts ER2 @ 653.8

[13:17:37] <guy> exit stop set ER2 @ 654.8

[13:20:12] <guy> Single Print second contract stopped at b/e

[13:33:10] <guy> stop hit ER2 @ 654.8 --> - 1

[Addendum: That was a particularly unlucky stop-out. It was the high tick of the move and the trade then went on to hit all the profit targets. My mistake on that particular trade was rushing the entry. An entry 1 tick higher would have allowed me to use a 1 point stop and the trade would have worked.]

[14:30:01] <guy> Oil Futures closed

[14:32:46] <guy> Single Print long at 651.3

[14:36:51] <guy> Single Print stopped for -1 on (current) low tick

[14:43:29] <guy> Buys ER2 @ 650.5

[14:43:55] <guy> exit stop set ER2 @ 649.5

[14:48:16] <guy> Exited 1/2 Long ER2 at 651.5 --> + 1

[14:48:22] <guy> exit stop moved to breakeven ER2 @ 650.5

[15:30:01] <guy> Bond Futures closed

[15:40:33] <guy> stop hit ER2 @ 650.5 --> 0

[16:15:15] <guy> gn all

[16:22:01] * Disconnected

Session Close: Wed Jul 06 16:22:04 2005

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.