Fib EMAs

Anyone give them a try? Bulls did test the 377 (1298.53). The 240 minute showed bulls reaching within two ticks before the day's selloff. Coincidence maybe, but I'm finding the fib EMAs offer more market breadth than any of the other fundamentally used. Resistance and support are clearly shown, and it's uncanny how the 55, 144 and 377 interact. It's like having a moving fib tool. If prices aren't supported by the 55 a correction is due. During counter trend attacks if prices battle past the 55 at the 144 twice, a botom attempt is due to test the 377.

It's my belief we'll chop here trying to get above the 377, maybe do so by a point or two and then sell off hard head-faking all the way down to create a bottom, or a possible pan-market crash. The jury isn't in on that one yet.

But it's been my observation a reversal doesn't happen without first testing, and then losing to, the 377.

There's always that one time the market god throws you a curve ball when least expected however.

In any event, consider putting them on all your prefered timeframes. Coupled with the A/D line and A/D volume line they're a trader's delight.

It's my belief we'll chop here trying to get above the 377, maybe do so by a point or two and then sell off hard head-faking all the way down to create a bottom, or a possible pan-market crash. The jury isn't in on that one yet.

But it's been my observation a reversal doesn't happen without first testing, and then losing to, the 377.

There's always that one time the market god throws you a curve ball when least expected however.

In any event, consider putting them on all your prefered timeframes. Coupled with the A/D line and A/D volume line they're a trader's delight.

Hi SPQR - I have the 34, 89, and 144 EMA lines on my 5 minute day-session ES chart. Today at 09:10 CT these three lines were pretty close together (within a couple of ticks of each other) when the smart money, which generally moves three points at a time, powered through it in 6 points! There was no turning back after that. Thanks for your insights - I'll implement them. Please continue to share your knowledge to help new traders.

Hello, anouska. I put your combination on a 5 minute to get a feel for it and I must say you happened upon a useful mix too. Do you use it to scalp counter-trends mostly? That was what mostly caught my eye. As a matter of fact I'll implement it on a floating chart for days when swing plays just don't sit well with me, like right about now.

Something to keep in mind when swing trading with my fib combo: they're useful on all timeframes but the 233T is the weakest, and the 240 minute is the best barometer of the swings in the daily chart imo. All my decisions are centered around the 240, but I like the 610T and 10,000T to confirm, and they will if it's a solid play.

The swing channels on any minute chart is my bread and butter though. Mechanical systems either operate from trend channels or some form of overbought and oversold volatility algorithm, more times than not arriving at trend channels. The moves found in counter-trend corrections foretell where prices will go and fail. It still blows my mind. But it takes some experimenting identifying which lines to use and which to avoid. And a study of Elliot Waves can't hurt either, I'm still learning the latter though. I find the waves useful as a gauge in hindsight mostly but real-time ABC patterns are the only reliable patterns to trade imo. That was why I set out to find the perfect fib moving average combo. And I do believe you and I hit a gold mine.

Something to keep in mind when swing trading with my fib combo: they're useful on all timeframes but the 233T is the weakest, and the 240 minute is the best barometer of the swings in the daily chart imo. All my decisions are centered around the 240, but I like the 610T and 10,000T to confirm, and they will if it's a solid play.

The swing channels on any minute chart is my bread and butter though. Mechanical systems either operate from trend channels or some form of overbought and oversold volatility algorithm, more times than not arriving at trend channels. The moves found in counter-trend corrections foretell where prices will go and fail. It still blows my mind. But it takes some experimenting identifying which lines to use and which to avoid. And a study of Elliot Waves can't hurt either, I'm still learning the latter though. I find the waves useful as a gauge in hindsight mostly but real-time ABC patterns are the only reliable patterns to trade imo. That was why I set out to find the perfect fib moving average combo. And I do believe you and I hit a gold mine.

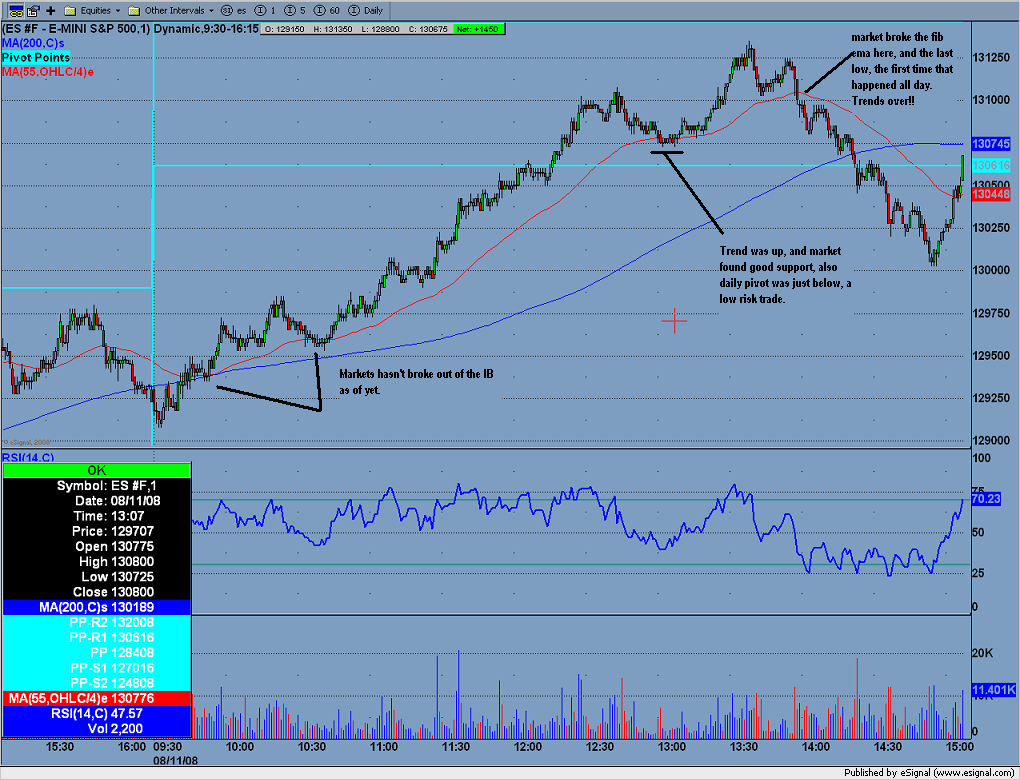

I use a 55 one min EMA, I disregaurd it on nontrend days and nutral days. But today as you can see it serves as a system to go with the market direction.

Joe,

Trend's over! lol Funny stuff. I sure hope so, of course I scalped this minor swing and covered where near everyone else did. I'm waiting to see what kind of bounce we get at 96 (377 EMA 610T) and if it's relatively strong I'ld like to see even stronger resistance at the 1306 area [RTH R1] before I think about GTC though. We already know the weekly pivot strongly rejected the bull, it's just a matter of waiting for a breakout from propulsion plays from 96 to 06, which may be a session possibly more methinks. Either way the chances are good we're heading to 56 the next weekly pivot, and a possible, failed correction after that, then a consolidation period to bust up the breakout level at mid 30s or so.

Whoever wins this inevitable breakout I'ld get GTC and fair it for months.

Trend's over! lol Funny stuff. I sure hope so, of course I scalped this minor swing and covered where near everyone else did. I'm waiting to see what kind of bounce we get at 96 (377 EMA 610T) and if it's relatively strong I'ld like to see even stronger resistance at the 1306 area [RTH R1] before I think about GTC though. We already know the weekly pivot strongly rejected the bull, it's just a matter of waiting for a breakout from propulsion plays from 96 to 06, which may be a session possibly more methinks. Either way the chances are good we're heading to 56 the next weekly pivot, and a possible, failed correction after that, then a consolidation period to bust up the breakout level at mid 30s or so.

Whoever wins this inevitable breakout I'ld get GTC and fair it for months.

There's your 377 ema bounce....its perrty too. Todays afternoon market low i.e. 1297.75 was only one tick below yesterdays VAH.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.