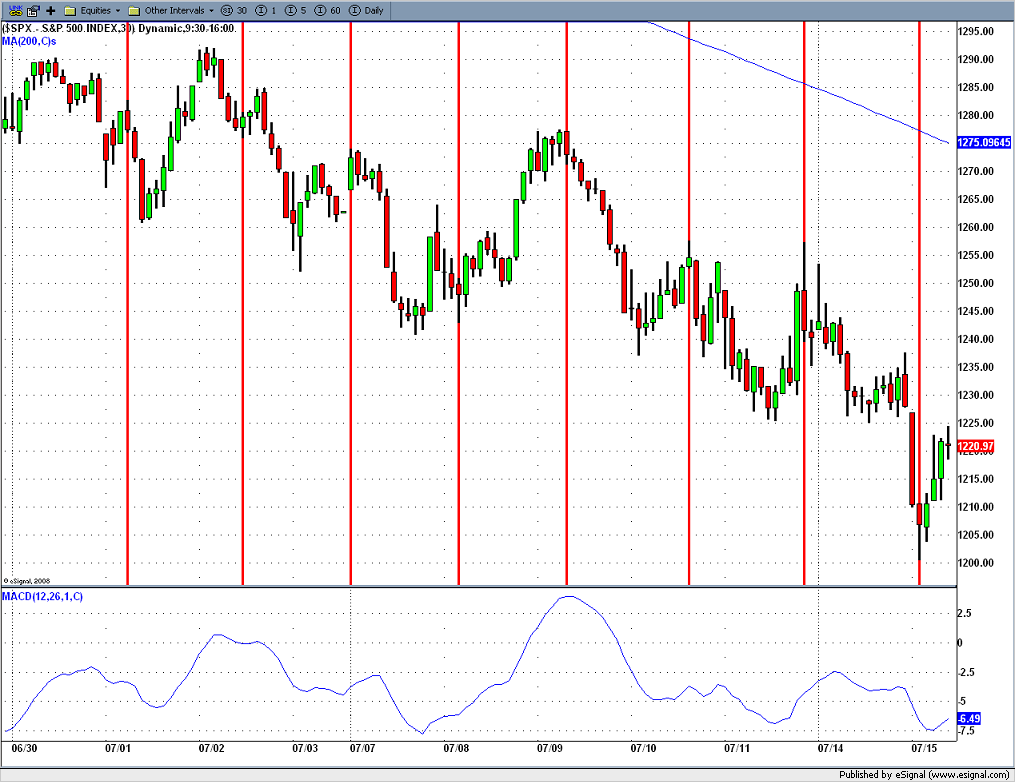

Short Term ES cycles.

Each one of these red lines is 16-30min bars this cycle has been lasting at least since late 06. Next reversal is due at 11:30 tommorow 7/16.

quote:

Originally posted by CharterJoe

Thanks for the intrest,

But I really cannot expalin it in a couple of minitues how it works or why and how to figure it. I had taken the J.M Hurst cource a couple of years of years ago (200 hour cource) and turned it into an very short term indicator. Here is a link to the basics if your interested I would buy one of hursts books and stronlgly advise you to do hand drawn charts if your interested. this is a very powerful to to be addded to any good price tools. Sorry I couldn't directly answer your question but there's no easy way to expalin it, the good news is once you've done all the work it last forever and never changes. The same cylce I use now worked in the 60's when Hurst was selling his cources. You can search these books on AMZN...channels and cycles: a tribute to J.M. Hurst......And Cyclic Analyiss bu J.m. Hurst....both are just a few bucks. But if you really want to get your feet wet I'd get the cource. But its a lot of work.

http://marketscalpel.com/approach/cycleTheory.htm

Thanks, Joe. I'm left to wonder if Hurst's course was failthfully reprinted though. Unwarranted editing from hacks positioning themselves to profit off of another's work often leads to fundamental disprepancies. The gaff of Covel's reviving Richard Dennis' work, for an example, rests in his lack of coverage of drawback curve downsizing and disregard waiting for a confirmed minor pullback.

What if any do you opine are errors in Hurst's reproduction?

Cycle out @9:30 this am, next one due @ 11am july 23rd.

Good call Joe!!!

Joe; When the cycle is @ the market open do you make your entry @ the open? I mean if there is not some other market moving event @ the time.

No..I try to get a feel for order flow and try to get the best entry via tape reading and other methods Sq roots, fib, adv/lines RSI all that good stuff.

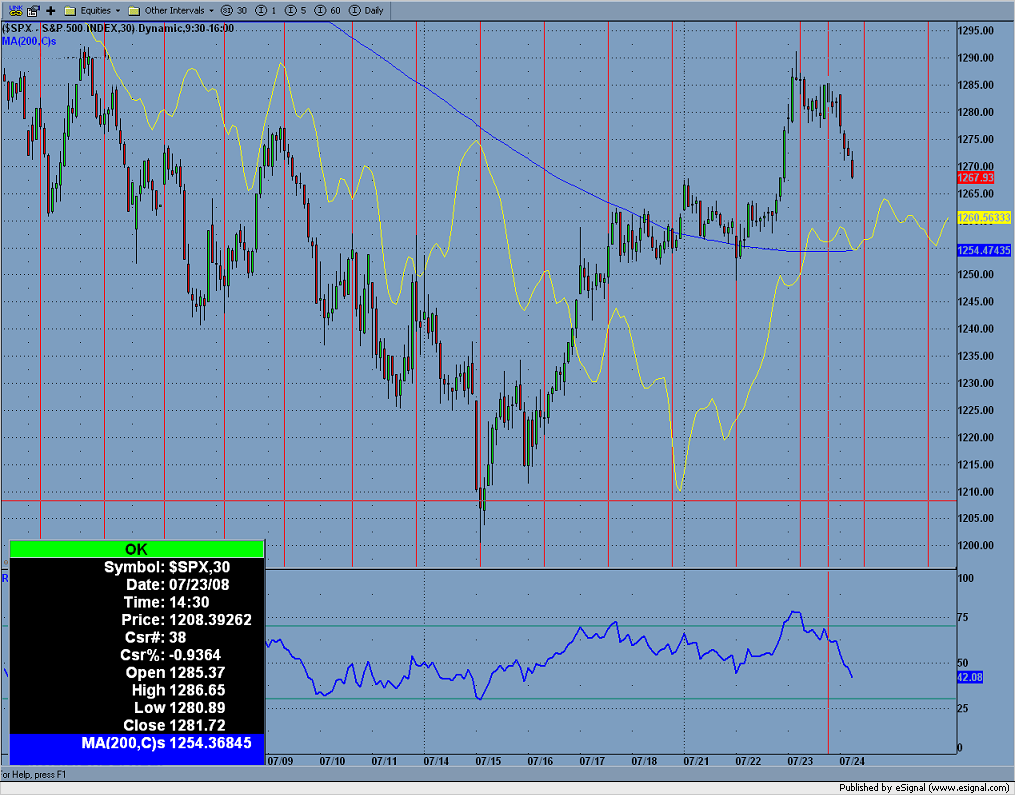

Cycle out yesterday @ 11:00 that was one bar off the high. Next one is due today @ 12:30. Here's an updated chart.

Here is an updated chart the vertical lines have not changed nor never will. It will always extend 16 30min bars into the future, on these bars I look for a counter trend trade in the current trend. Next one is due at the 3:00 bar...

well done Joe..I think most underestimate these lines

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.