Crash looming?

quote:

The authorities cannot respond with easy money because oil and food costs continue to push headline inflation to levels that are unsettling the markets.

There's a good chance, but don't you think that much of that has already been discounted?

The prediction can be supported by both technical and fundamental analysis.

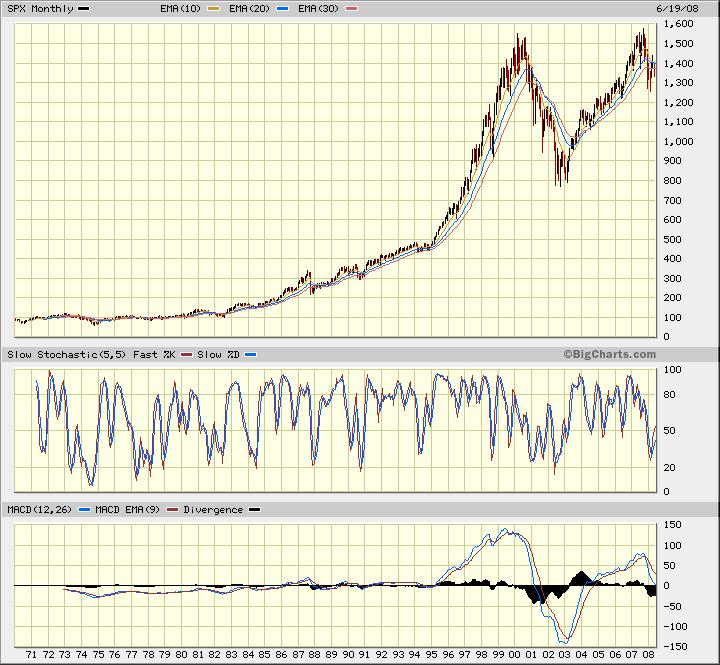

1) The 1050 SP coincide with 62% Fib retracement from 1st QTR 2003 low 800 to 4th QTR 2007 high of 1550.

2) MACD divergence: The SP made a higher high at 2007 peak compared to the 2000 peak. However, the MACD made a lower low.

3)A-B-C correction: Looking at 20yr SP. We are at the C leg of the correction. If C leg will be equal in magnitude with A and B, then we are looking at SP going down to 800 level.

4)Current credit crunch and rise & rise of oil (ie. rise of oil = inflation). And when inflation rises..... (I leave it to your imagination!!).

5)Resource boom heavy correction most likely in the near future.

So, SP at 1050 is not surprising when 800 level is a probability, considering it was at this level only 5 years ago.

1) The 1050 SP coincide with 62% Fib retracement from 1st QTR 2003 low 800 to 4th QTR 2007 high of 1550.

2) MACD divergence: The SP made a higher high at 2007 peak compared to the 2000 peak. However, the MACD made a lower low.

3)A-B-C correction: Looking at 20yr SP. We are at the C leg of the correction. If C leg will be equal in magnitude with A and B, then we are looking at SP going down to 800 level.

4)Current credit crunch and rise & rise of oil (ie. rise of oil = inflation). And when inflation rises..... (I leave it to your imagination!!).

5)Resource boom heavy correction most likely in the near future.

So, SP at 1050 is not surprising when 800 level is a probability, considering it was at this level only 5 years ago.

Here is a list of links along this theme:

http://www.thekirkreport.com/2008/06/caveat-emptor.html

http://www.thekirkreport.com/2008/06/caveat-emptor.html

Any chance you could post some charts..? that would be cool and a good record to keep on the board...Thanks

Bruce

Bruce

quote:

Originally posted by leobust

Correction to my previous post....

item 2)

Monthly SP MACD made a LOWER HIGH.

quote:

Originally posted by BruceM

Any chance you could post some charts..? that would be cool and a good record to keep on the board...Thanks

What's your thoughts, Bruce?

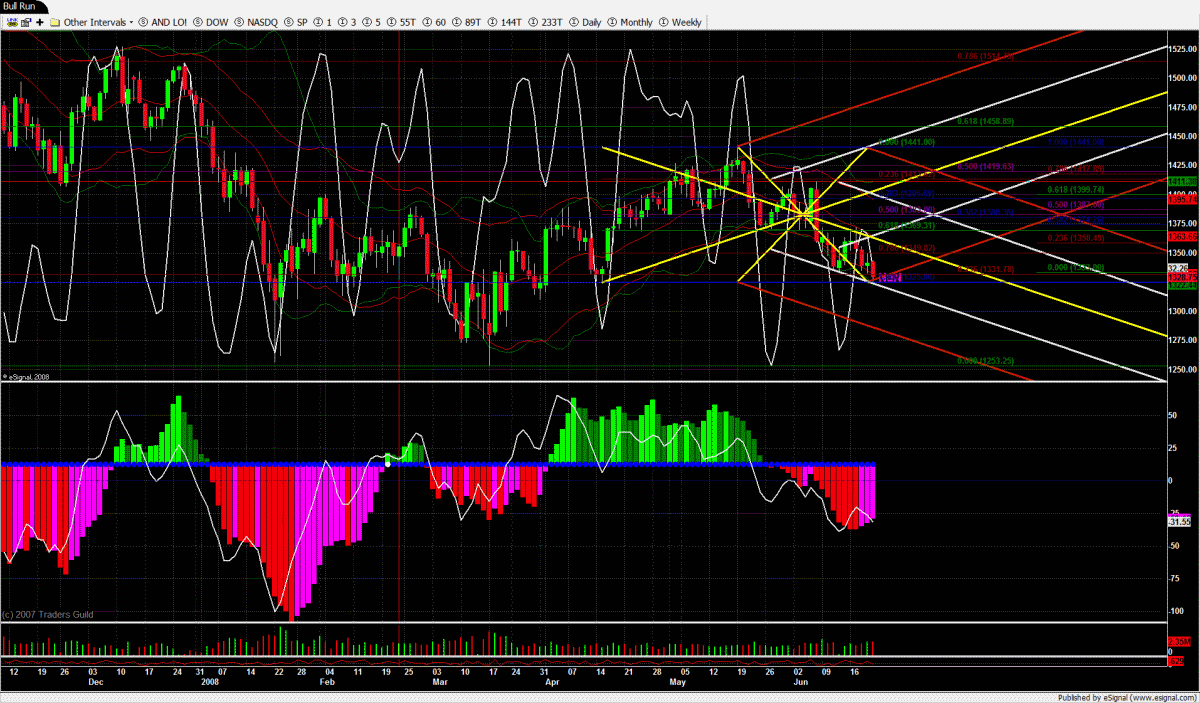

I'm not Bruce but that divergence was corrected at 1253, and wherever sellers decide to give up in this run there is a continuation divergence for long.

Not sure what this is suppose to mean ? I know you are not me...lots of great individuals here with lots of talent...

Thanks to you and Leo for the charts...always good to see a picture

Thanks to you and Leo for the charts...always good to see a picture

quote:

Originally posted by SPQR

I'm not Bruce but that divergence was corrected at 1253, and wherever sellers decide to give up in this run there is a continuation divergence for long.

quote:

Originally posted by BruceM

Not sure what this is suppose to mean ? I know you are not me...lots of great individuals here with lots of talent...

Thanks to you and Leo for the charts...always good to see a picturequote:

Originally posted by SPQR

I'm not Bruce but that divergence was corrected at 1253, and wherever sellers decide to give up in this run there is a continuation divergence for long.

I only meant that Leo didn't ask me of my thoughts, since I'm not you. And I hope you'll consider answering him . You've a way with numbers it can't be denied.

I tend to agree with Leo despite appearences to the contrary. We haven't had a sustained, bonified downtrend in the history of the indices, and we're due. Ironically the crashes of 1929 and 1987, and our grossly mismanaged politico-economic system, will be the cause. I just don't think the downtrend is as imminent as squawk spinsters in the pockets of Oligarchs, the very same cadre putting on this window dressing, would have us believe. A crash certainly could be self-fulfilled, though. I want to believe traders and investors will trace their roots to unemotional, mechanical trading discipline well before then though.

Personally, I think we'll see 1586 and above before rejecting 1250 and below though only time will tell.

I agree with Leo on wave theory, but just not as drastic of an outlook.

Again please do consider giving us your thoughts on the matter.

Thanks, Bruce; and I bid you a great weekend.

quote:

Originally posted by day trading

quote:

The authorities cannot respond with easy money because oil and food costs continue to push headline inflation to levels that are unsettling the markets.

There's a good chance, but don't you think that much of that has already been discounted?

Apparently not !!

Daytrading,

My dad has been in housing for 35 years so have my brother-in-laws and I am licensed contractor, I built 8 homes from the bottom in '02-'05 and I GUARANTEE I put more money on the line in housing then some daytraders I called the housing bottom in 02' while every one else in my town didn't dare build...You have to predict housing a lot different than the stock market if you wait for the bottom by the time your spec is done the market is flooded. Its just like trading, i.e. build/trade when all others are scared and sit on the sidelines when mom and pop are coming out of the woods...intrest rates are low, building material is cheap, gas is lower. The only thing missing is the banks willing to lend money and the FED is bent on changing that, so its a no duh thing to all of us contractors who pulled out at the highs to get ready for some spring building.

My dad has been in housing for 35 years so have my brother-in-laws and I am licensed contractor, I built 8 homes from the bottom in '02-'05 and I GUARANTEE I put more money on the line in housing then some daytraders I called the housing bottom in 02' while every one else in my town didn't dare build...You have to predict housing a lot different than the stock market if you wait for the bottom by the time your spec is done the market is flooded. Its just like trading, i.e. build/trade when all others are scared and sit on the sidelines when mom and pop are coming out of the woods...intrest rates are low, building material is cheap, gas is lower. The only thing missing is the banks willing to lend money and the FED is bent on changing that, so its a no duh thing to all of us contractors who pulled out at the highs to get ready for some spring building.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.