24 June 2004 (Friday)

Session Start: Fri Jun 24 07:59:07 2005

Session Ident: #t1

[08:41:58] <tuna> gm

[08:43:04] <tuna> ga to anyone in S.A

[08:51:44] <guy> gm tuna :)

[09:06:11] <tuna> spoos singles at 1203.1 from 6/13

[09:34:42] <guy> eSignal problems here at the moment...

[09:35:10] <guy> New Home Sales 10:00 ET

[09:36:55] <guy> Innerworth: Closing the Gap

[09:39:02] <tuna> spoos singles holding

[09:40:15] <tuna> 1203.1

[09:42:19] <tuna> 1202.7

[09:42:25] <tuna> .6

[09:44:21] <tuna> 6 tic fill on spoos

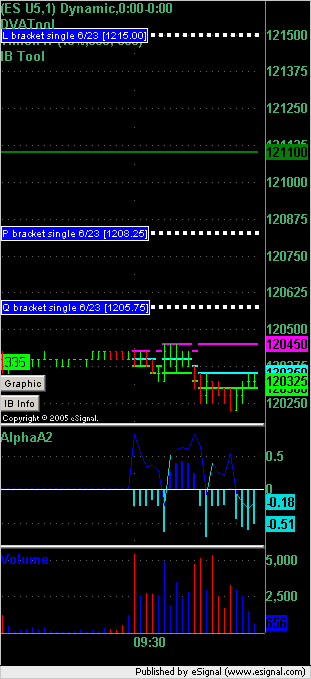

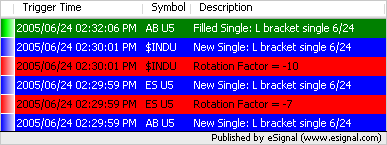

[09:50:39] <guy> ES chart to now:

[09:50:45] <signal>

[09:50:56] <guy> According to DVATool there were 3 sets of singles formed yesterday in the ES

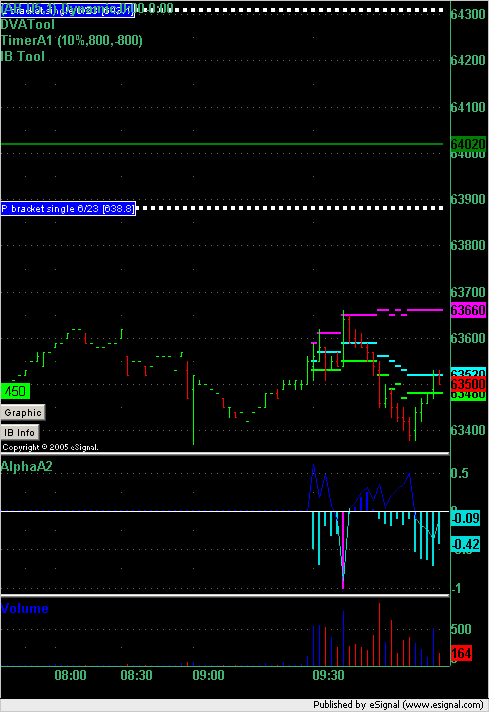

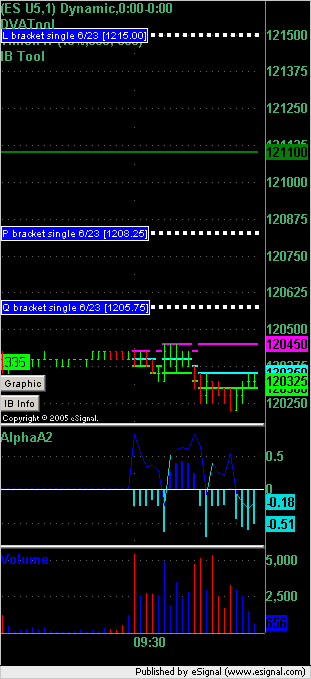

[09:52:06] <guy> ER2 chart to now:

[09:52:16] <guy> You can see the 2 singles formed yesterday above us

[09:52:16] <signal>

[09:52:29] <guy> and the green line between the 2 marks yest. VAL

[09:52:58] <guy> we can also see an alpha sell signal on the current HOD for the ER2

[09:53:46] <guy> Here is an expaned view of the ER2

[09:53:52] <signal>

[09:54:01] <guy> with the alpha signal/confirm

[09:55:49] <guy> New Home Sales 10:00 ET

[10:01:58] <guy> 1.298M

[10:02:07] <guy> new home sales = 1.298M

[10:14:56] <guy> I can't see any great trade setups atm

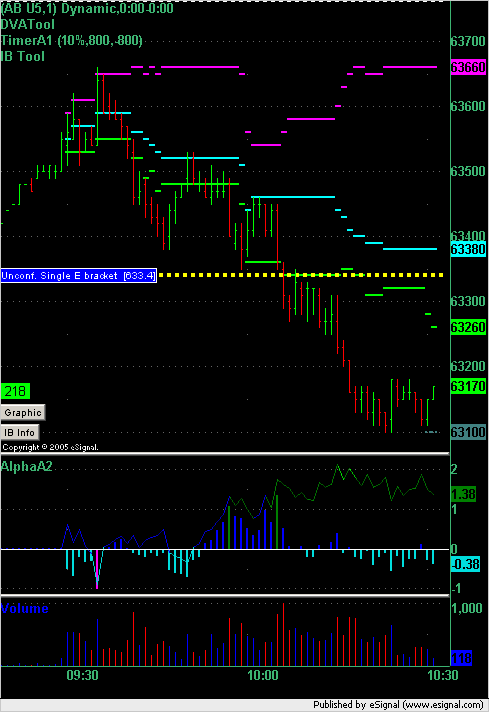

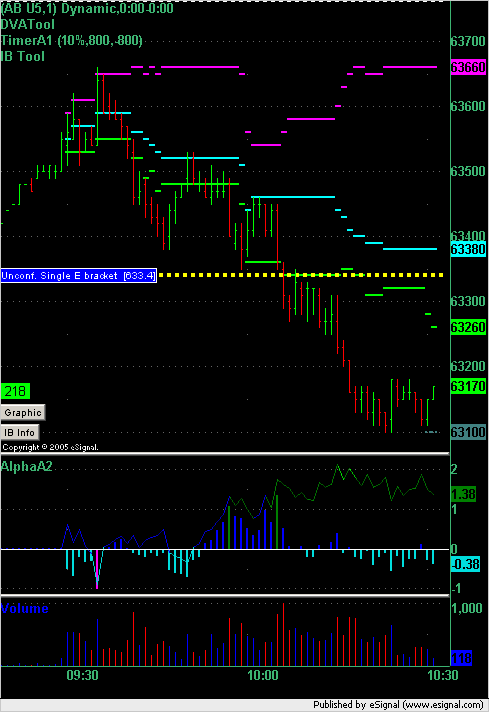

[10:27:43] <guy> Here is a 30min ER2 chart RTH

[10:27:49] <signal>

[10:28:05] <guy> you can see the blue line I've drawn across the chart showing the support on 15 June

[10:28:11] <guy> which is where we are now

[10:28:24] <guy> I am hoping that alpha turns positive here

[10:28:35] <guy> which will give me a good setup to buy at this level

[10:28:40] <guy> with this type of support

[10:28:45] <guy> and confirmation from alpha

[10:30:01] <guy> strong reverse and rally in oil atm - i believe that this is contributing some of the weakness to the equity indices

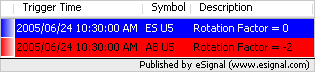

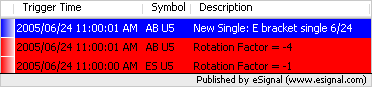

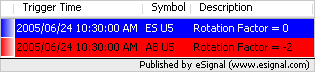

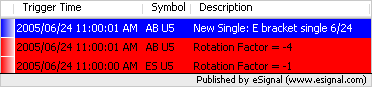

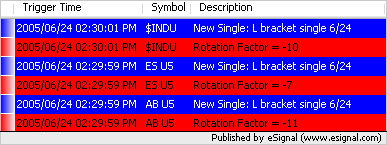

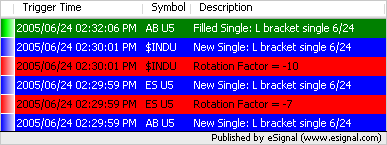

[10:30:52] <guy> Here are our rotation factors for the ER2

[10:30:59] <signal>

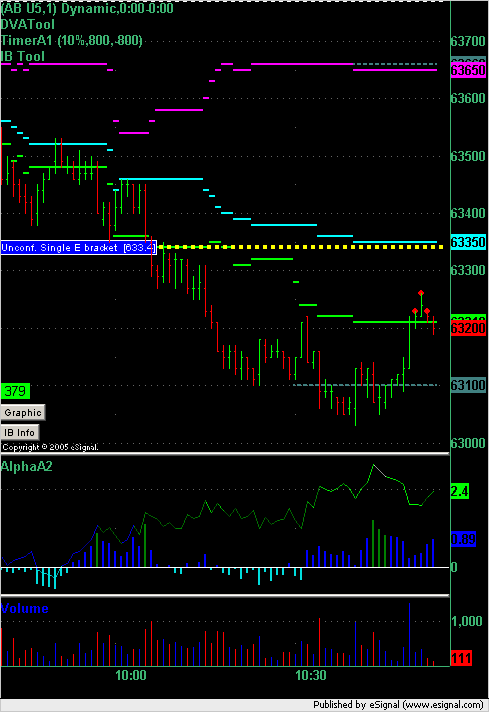

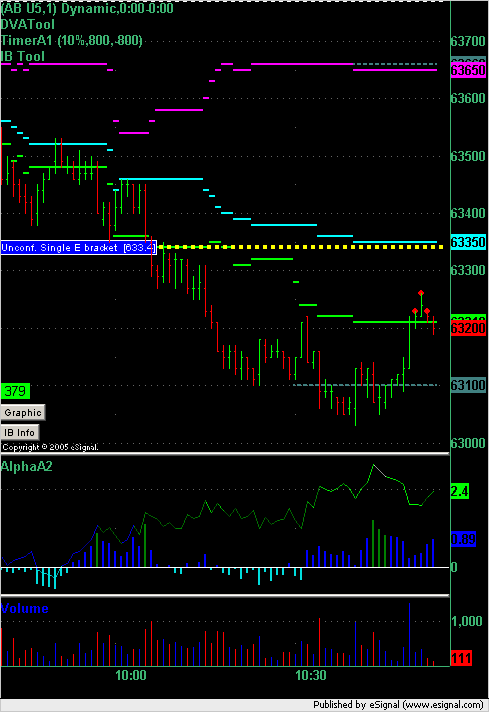

[10:31:25] <guy> Here is ER2 chart showing an unconfirmed single for today

[10:31:29] <signal>

[10:31:50] <guy> if we don't touch 633.4 by 11:00 ET then that single will confirm

[10:50:06] <guy> no sure if anybody was watching the market depth on dome

[10:50:23] <guy> but there was an enormous bidder on ER2 just below the bid

[10:50:33] <guy> biggest i've ever seen

[10:53:38] <guy> ER2 just moved into DVA

[10:53:45] <guy> let's see if we can hold that

[10:53:57] <signal>

[10:54:14] <tuna> what size?

[10:58:24] <guy> i think it was 450 contracts at 1 price

[10:58:42] <tuna> spoofer

[10:59:15] <guy> i don't think so because i think they had the "chase" feature enabled

[10:59:28] <guy> because it was moving up with the price

[11:00:27] <guy> spoofers usually flash big volume and then remove - i've never seen that size chase the market before

[11:00:34] <guy> in the ER2

[11:01:04] <tuna> no kidding

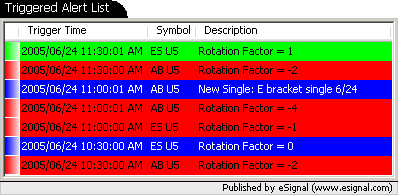

[11:01:15] <signal>

[11:01:20] <tuna> wasnt watching

[11:01:35] <guy> DVA has shifted on us so now we're at DPOC

[11:08:10] <guy> it looks like we're going to hit this single at 633.4

[11:08:30] <guy> so the test strategy shorts at 633.3 if 633.4 is touched

[11:11:30] <guy> Looking for a long at 631.0 DVAL

[11:13:23] <guy> here is the ER2 chart

[11:13:33] <guy> alpha and k-line are happily confirming a long

[11:13:35] <signal>

[11:18:40] <guy> limit to enter long ER2 @ 632

[11:19:18] <guy> will probably add at 631 and stop at 630

[11:21:52] <guy> i'm long

[11:22:01] <guy> Buys ER2 @ 632

[11:22:15] <guy> exit stop set ER2 @ 630

[11:24:28] <guy> i have a limit order to add at 631

[11:31:11] <signal>

[11:38:32] <guy> My current strategy is long DVAL with alpha confirm

[11:38:44] <guy> I front ran the first entry by 1 point

[11:38:49] <guy> and will add at the DVAL

[11:38:58] <guy> with stop 1 point below that

[11:52:04] <guy> Buys ER2 @ 631 -> Add

[11:52:46] <guy> Not a great trade setup

[11:52:50] <guy> RE to the downside

[12:13:09] <tuna> guy would you let it single tic before u stop?

[12:13:46] <guy> yes tuna - i've got it on a sim stop

[12:13:50] <guy> on ninja

[12:14:03] <guy> so it won't stop until there are less than X contracts being bid

[12:14:34] <guy> so if it touches 630 with 1 contract that won't trigger the stop

[12:14:41] <guy> do you use ninja?

[12:14:54] <tuna> n

[12:15:27] <guy> but you understand what i mean about the sim stop?

[12:15:41] <tuna> ya

[12:15:44] <guy> it should be explained on the www.ninjatrader.com web site

[12:15:52] <guy> great

[12:16:18] <guy> i'm doing pretty badly so far with this trade

[12:17:50] <tuna> me too

[12:18:14] <tuna> es goin nowhere

[12:18:21] <guy> are long ES?

[12:18:25] <tuna> s

[12:18:29] <tuna> at 4

[12:18:42] <tuna> rotation play

[12:18:47] <guy> k

[12:19:48] <tuna> all out now

[12:21:34] <tuna> dow singles filled

[12:21:55] <tuna> by 5

[12:25:44] <tuna> lookin to join u on a long

[12:25:54] <guy> what singles tuna?

[12:25:56] <guy> on YM?

[12:26:05] <guy> or INDU?

[12:26:08] <tuna> dow cash

[12:26:19] <tuna> 369

[12:26:53] <tuna> unconfirmed

[12:27:04] <guy> ah - okay

[12:27:37] <tuna> they was keepin me in the es short

[12:27:49] <guy> i couldn't work out why they weren't showing up on DVATool

[12:28:01] <guy> but DVATool removes the line if it fills in and it's unconfirmed

[12:29:18] <tuna> just lookin at an old fashion mp chart here

[12:29:43] <tuna> speakin of which

[12:30:17] <tuna> have u ever looked at ivestor/rt charts?

[12:30:27] <tuna> investor

[12:30:34] <guy> no but i've heard of them

[12:30:37] <guy> do you use them?

[12:30:43] <tuna> no

[12:30:53] <guy> what fancy MP tools do they have?

[12:30:59] <tuna> but im thinking about it

[12:31:19] <guy> do they use esignal as the feed?

[12:31:35] <tuna> they show something that looks like mp

[12:32:02] <guy> a horizontal bar chart?

[12:32:36] <tuna> http://www.linnsoft.com/investorrt/

[12:33:11] <tuna> http://www.linnsoft.com/datafeed/index.html

[12:34:39] <tuna> http://www.linnsoft.com/tour/marketprofilechart.htm

[12:35:01] <tuna> last one show something like a mp chart

[12:36:47] <tuna> they dont use the term MP though,,prolly cuz of the copyright

[12:37:14] <guy> well in the web address is says marketprofilechart :)

[12:37:30] <guy> keep us posted on what you find

[12:37:42] <guy> let us know how it goes if you try it

[12:38:27] <tuna> ive heard its great stuff for a programer

[12:38:44] <tuna> which im not

[12:38:59] <guy> from what I've found is that each of them have a few great features but lack elsewhere

[12:39:08] <guy> if they moved to C# and .NET

[12:39:20] <guy> then that would solve all the problems that these charting packages have

[12:39:37] <guy> because then the whole of .NET would be available as part of the charting package

[12:39:46] <guy> at the moment eSignal use java script

[12:39:51] <guy> what do RT use?

[12:40:00] <tuna> the pro version looks like it has open code

[12:40:17] <tuna> i dunno guy

[12:40:27] <They> I used Invester R/T for VP and MP in 2001, they have more improvements since then. The developer is very receptive to new ideas and will generally add them in the next release

[12:41:14] <tuna> ty they

[12:42:04] <guy> thanks They

[12:42:24] <guy> just looking on the web - looks like they have an inhouse RTL - Real Time Language

[12:42:57] <tuna> guy i wouldnt know a java script from a coffee script

[12:43:06] <guy> :)

[12:43:34] <guy> the java script keeps you awake longer

[12:43:40] <tuna> ic

[12:43:43] <guy> while you're trying to debug it

[12:44:38] <tuna> well it is getting late over there in the swamp

[12:44:55] <guy> yup - frogs are croaking on the banks

[12:45:07] <tuna> lol

[12:57:23] <tuna> some sox movement

[13:10:27] <guy> stop hit ER2 @ 629.9 --> - 3.1

[14:05:22] <guy> We have a single print at 624.3 from 6/9

[14:30:01] <guy> Oil Futures closed

[14:30:08] <guy> I've just noticed that DIBL is at 625.4 and that single I mentioned earlier is 624.3

[14:30:24] <guy> so a 1.1 point difference and a cluster there

[14:30:37] <guy> however less that 2 hours trading left today

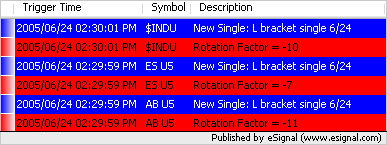

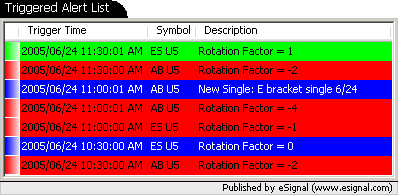

[14:32:00] <guy> Rotaton Factors and singles confirmed...

[14:32:08] <signal>

[14:32:24] <guy> .

[14:32:30] <guy> ER2 single has just filled:

[14:32:37] <signal>

[14:33:46] <guy> that looks wrong to me

[14:35:05] <tuna> spoos single ay 1200.5

[14:40:47] <guy> thanks tuna

[14:41:05] <guy> that single had filled in so no ER2 single in L bracket

[14:42:00] <tuna> filled by 4 tics

[14:53:20] <fspeculator> anyone tried the new 7,9.1 ? esignal?

[14:53:31] <fspeculator> has it fixed the MP bugs?

[14:54:07] <fspeculator> still can't believe they'd mess the MP code so badly

[14:54:28] <fspeculator> many markets became untradeable, like bonds and forex

[14:55:30] <tuna> i never did 7.9

[15:05:55] <fspeculator> [22:03] <fspeculator> http://www.sed.gr/cgi-bin/ikonboard/ikonboard.cgi?act=ST;f=2;t=1703

[15:05:55] <fspeculator> [22:03] <fspeculator> commodity charts expressed in euros

[15:06:12] <fspeculator> 22:04] <fspeculator> (descriptions are in greek, but pictures speak for themselves)

[15:07:05] <guy> I'm using the latest beta release fspec

[15:07:19] <guy> I've been told that the next release of esignal will fix major MP bugs

[15:09:31] <tuna> i cant even figure out how to get into the file share library

[15:09:46] <guy> looks like prices are going up according to those chart fspec :)

[15:09:57] <guy> it's a bit tricky tuna

[15:10:16] <guy> This is an interesting chart coming up

[15:10:26] <signal>

[15:10:29] <guy> What it shows is the ER2 5min chart over the last 2 days

[15:11:27] <guy> The white X's mark where the TimerA1 indicator said that $TICK was at an extreme.

[15:11:53] <guy> The rules for an extreme in this case can be seen in the settings of TimerA1 at the top of the chart which are 10%,800,-800

[15:12:10] <guy> This means that $tick needs to be outside of the 800s and in the 10th percentile

[15:12:46] <guy> What I find strange is that today, the day after a major down move, we have no negative $tick extremes

[15:13:18] <guy> a negative $tick extreme would produce a buy blob in green

[15:13:49] <guy> the market has only shown us sell points today with respect to $tick

[15:19:48] <tuna> tick creeping up

[15:20:47] <tuna> some covering prolly

[15:30:01] <guy> Bond Futures closed

[15:32:33] <guy> damn!

[15:32:48] <guy> i kept on trying to get short up there but was too slow

[15:33:06] <guy> my theory on times like this is that we see new LOD before close

[15:33:17] <guy> look at the 30min RTH chart

[15:33:53] <guy> how many people want to hold long into the weekend with the market looking like that

[15:34:15] <guy> however - all the shorts will be happy to carry shorts through the w/e because of the buffer they have

[15:34:44] <guy> so my theory is that we have longs exiting positions now...

[15:34:50] <guy> more so than shorts taking profits

[15:36:12] <guy> Here is the ER2 30min chart to now

[15:36:21] <signal>

[15:40:45] <signal>

[15:40:49] <tuna> my 1200 short off singles looks like crap now

[15:41:03] <tuna> lol

[15:42:51] <guy> this is what you're looking at right tuna:

[15:42:56] <signal>

[15:43:08] <guy> shows the single that you're shorting at 1200.25 right?

[15:43:47] <tuna> n bracket

[15:43:57] <tuna> long ago

[15:44:17] <tuna> spoos never got close

[15:44:57] <tuna> 1200.25 is correct

[15:45:19] <guy> ah - okay

[15:45:35] <tuna> spoos will save it

[15:47:29] <tuna> i hope

[15:49:15] <tuna> singles on spoos from1200 to 1200.5

[15:49:24] <tuna> l backet

[15:49:31] <tuna> bracket

[15:52:54] <tuna> couldnt get a 2xib fill for a long but the singles on the spoos looked good

[15:58:56] <tuna> i think the extra 23$ a month is worth being able to see bigs

[15:59:08] <tuna> fwiw

[16:00:40] <tuna> cuz theres a big fat singles gap u see on spoos but dont on es

[16:01:09] <guy> i had the bigs for a while but wasn't watching it because i've switched from ES to ER so I cancelled it

[16:01:29] <guy> I wish they'd ditch SP contract and make the ES trade in 0.1 points

[16:01:56] <tuna> prolly will

[16:02:00] <tuna> in time

[16:02:30] <tuna> i heard theres a bid in for nymex

[16:04:52] <tuna> im not sure if all electronic is a good thing tho

[16:05:22] <tuna> looking at these ym charts anyway

[16:07:24] <guy> [15:33:06] <guy> my theory on times like this is that we see new LOD before close

[16:07:31] <guy> So far that is true for NQ and ES

[16:07:40] <guy> still waiting on YM and ER2

[16:09:22] <tuna> flat

[16:09:39] <guy> you must have made a fortune on that tuna?

[16:09:45] <guy> how many points?

[16:10:08] <tuna> 6 on last part

[16:10:16] <guy> VERY NICE !!!

[16:11:29] <tuna> there was some 'hope' involved tho

[16:11:44] <tuna> spoos was the key

[16:12:00] <guy> :)

[16:12:55] <tuna> even a blind squirrel finds a nut every once in while

[16:13:28] <guy> LOL

[16:15:01] <tuna> so we have those spoos singles for monday

[16:15:07] <tuna> 1200.5

[16:15:11] <guy> yup

[16:15:12] <tuna> fwiw

[16:15:16] <guy> have a safe weekend everyone

[16:15:24] <tuna> cya

Session Close: Fri Jun 24 16:17:37 2005

Session Ident: #t1

[08:41:58] <tuna> gm

[08:43:04] <tuna> ga to anyone in S.A

[08:51:44] <guy> gm tuna :)

[09:06:11] <tuna> spoos singles at 1203.1 from 6/13

[09:34:42] <guy> eSignal problems here at the moment...

[09:35:10] <guy> New Home Sales 10:00 ET

[09:36:55] <guy> Innerworth: Closing the Gap

[09:39:02] <tuna> spoos singles holding

[09:40:15] <tuna> 1203.1

[09:42:19] <tuna> 1202.7

[09:42:25] <tuna> .6

[09:44:21] <tuna> 6 tic fill on spoos

[09:50:39] <guy> ES chart to now:

[09:50:45] <signal>

[09:50:56] <guy> According to DVATool there were 3 sets of singles formed yesterday in the ES

[09:52:06] <guy> ER2 chart to now:

[09:52:16] <guy> You can see the 2 singles formed yesterday above us

[09:52:16] <signal>

[09:52:29] <guy> and the green line between the 2 marks yest. VAL

[09:52:58] <guy> we can also see an alpha sell signal on the current HOD for the ER2

[09:53:46] <guy> Here is an expaned view of the ER2

[09:53:52] <signal>

[09:54:01] <guy> with the alpha signal/confirm

[09:55:49] <guy> New Home Sales 10:00 ET

[10:01:58] <guy> 1.298M

[10:02:07] <guy> new home sales = 1.298M

[10:14:56] <guy> I can't see any great trade setups atm

[10:27:43] <guy> Here is a 30min ER2 chart RTH

[10:27:49] <signal>

[10:28:05] <guy> you can see the blue line I've drawn across the chart showing the support on 15 June

[10:28:11] <guy> which is where we are now

[10:28:24] <guy> I am hoping that alpha turns positive here

[10:28:35] <guy> which will give me a good setup to buy at this level

[10:28:40] <guy> with this type of support

[10:28:45] <guy> and confirmation from alpha

[10:30:01] <guy> strong reverse and rally in oil atm - i believe that this is contributing some of the weakness to the equity indices

[10:30:52] <guy> Here are our rotation factors for the ER2

[10:30:59] <signal>

[10:31:25] <guy> Here is ER2 chart showing an unconfirmed single for today

[10:31:29] <signal>

[10:31:50] <guy> if we don't touch 633.4 by 11:00 ET then that single will confirm

[10:50:06] <guy> no sure if anybody was watching the market depth on dome

[10:50:23] <guy> but there was an enormous bidder on ER2 just below the bid

[10:50:33] <guy> biggest i've ever seen

[10:53:38] <guy> ER2 just moved into DVA

[10:53:45] <guy> let's see if we can hold that

[10:53:57] <signal>

[10:54:14] <tuna> what size?

[10:58:24] <guy> i think it was 450 contracts at 1 price

[10:58:42] <tuna> spoofer

[10:59:15] <guy> i don't think so because i think they had the "chase" feature enabled

[10:59:28] <guy> because it was moving up with the price

[11:00:27] <guy> spoofers usually flash big volume and then remove - i've never seen that size chase the market before

[11:00:34] <guy> in the ER2

[11:01:04] <tuna> no kidding

[11:01:15] <signal>

[11:01:20] <tuna> wasnt watching

[11:01:35] <guy> DVA has shifted on us so now we're at DPOC

[11:08:10] <guy> it looks like we're going to hit this single at 633.4

[11:08:30] <guy> so the test strategy shorts at 633.3 if 633.4 is touched

[11:11:30] <guy> Looking for a long at 631.0 DVAL

[11:13:23] <guy> here is the ER2 chart

[11:13:33] <guy> alpha and k-line are happily confirming a long

[11:13:35] <signal>

[11:18:40] <guy> limit to enter long ER2 @ 632

[11:19:18] <guy> will probably add at 631 and stop at 630

[11:21:52] <guy> i'm long

[11:22:01] <guy> Buys ER2 @ 632

[11:22:15] <guy> exit stop set ER2 @ 630

[11:24:28] <guy> i have a limit order to add at 631

[11:31:11] <signal>

[11:38:32] <guy> My current strategy is long DVAL with alpha confirm

[11:38:44] <guy> I front ran the first entry by 1 point

[11:38:49] <guy> and will add at the DVAL

[11:38:58] <guy> with stop 1 point below that

[11:52:04] <guy> Buys ER2 @ 631 -> Add

[11:52:46] <guy> Not a great trade setup

[11:52:50] <guy> RE to the downside

[12:13:09] <tuna> guy would you let it single tic before u stop?

[12:13:46] <guy> yes tuna - i've got it on a sim stop

[12:13:50] <guy> on ninja

[12:14:03] <guy> so it won't stop until there are less than X contracts being bid

[12:14:34] <guy> so if it touches 630 with 1 contract that won't trigger the stop

[12:14:41] <guy> do you use ninja?

[12:14:54] <tuna> n

[12:15:27] <guy> but you understand what i mean about the sim stop?

[12:15:41] <tuna> ya

[12:15:44] <guy> it should be explained on the www.ninjatrader.com web site

[12:15:52] <guy> great

[12:16:18] <guy> i'm doing pretty badly so far with this trade

[12:17:50] <tuna> me too

[12:18:14] <tuna> es goin nowhere

[12:18:21] <guy> are long ES?

[12:18:25] <tuna> s

[12:18:29] <tuna> at 4

[12:18:42] <tuna> rotation play

[12:18:47] <guy> k

[12:19:48] <tuna> all out now

[12:21:34] <tuna> dow singles filled

[12:21:55] <tuna> by 5

[12:25:44] <tuna> lookin to join u on a long

[12:25:54] <guy> what singles tuna?

[12:25:56] <guy> on YM?

[12:26:05] <guy> or INDU?

[12:26:08] <tuna> dow cash

[12:26:19] <tuna> 369

[12:26:53] <tuna> unconfirmed

[12:27:04] <guy> ah - okay

[12:27:37] <tuna> they was keepin me in the es short

[12:27:49] <guy> i couldn't work out why they weren't showing up on DVATool

[12:28:01] <guy> but DVATool removes the line if it fills in and it's unconfirmed

[12:29:18] <tuna> just lookin at an old fashion mp chart here

[12:29:43] <tuna> speakin of which

[12:30:17] <tuna> have u ever looked at ivestor/rt charts?

[12:30:27] <tuna> investor

[12:30:34] <guy> no but i've heard of them

[12:30:37] <guy> do you use them?

[12:30:43] <tuna> no

[12:30:53] <guy> what fancy MP tools do they have?

[12:30:59] <tuna> but im thinking about it

[12:31:19] <guy> do they use esignal as the feed?

[12:31:35] <tuna> they show something that looks like mp

[12:32:02] <guy> a horizontal bar chart?

[12:32:36] <tuna> http://www.linnsoft.com/investorrt/

[12:33:11] <tuna> http://www.linnsoft.com/datafeed/index.html

[12:34:39] <tuna> http://www.linnsoft.com/tour/marketprofilechart.htm

[12:35:01] <tuna> last one show something like a mp chart

[12:36:47] <tuna> they dont use the term MP though,,prolly cuz of the copyright

[12:37:14] <guy> well in the web address is says marketprofilechart :)

[12:37:30] <guy> keep us posted on what you find

[12:37:42] <guy> let us know how it goes if you try it

[12:38:27] <tuna> ive heard its great stuff for a programer

[12:38:44] <tuna> which im not

[12:38:59] <guy> from what I've found is that each of them have a few great features but lack elsewhere

[12:39:08] <guy> if they moved to C# and .NET

[12:39:20] <guy> then that would solve all the problems that these charting packages have

[12:39:37] <guy> because then the whole of .NET would be available as part of the charting package

[12:39:46] <guy> at the moment eSignal use java script

[12:39:51] <guy> what do RT use?

[12:40:00] <tuna> the pro version looks like it has open code

[12:40:17] <tuna> i dunno guy

[12:40:27] <They> I used Invester R/T for VP and MP in 2001, they have more improvements since then. The developer is very receptive to new ideas and will generally add them in the next release

[12:41:14] <tuna> ty they

[12:42:04] <guy> thanks They

[12:42:24] <guy> just looking on the web - looks like they have an inhouse RTL - Real Time Language

[12:42:57] <tuna> guy i wouldnt know a java script from a coffee script

[12:43:06] <guy> :)

[12:43:34] <guy> the java script keeps you awake longer

[12:43:40] <tuna> ic

[12:43:43] <guy> while you're trying to debug it

[12:44:38] <tuna> well it is getting late over there in the swamp

[12:44:55] <guy> yup - frogs are croaking on the banks

[12:45:07] <tuna> lol

[12:57:23] <tuna> some sox movement

[13:10:27] <guy> stop hit ER2 @ 629.9 --> - 3.1

[14:05:22] <guy> We have a single print at 624.3 from 6/9

[14:30:01] <guy> Oil Futures closed

[14:30:08] <guy> I've just noticed that DIBL is at 625.4 and that single I mentioned earlier is 624.3

[14:30:24] <guy> so a 1.1 point difference and a cluster there

[14:30:37] <guy> however less that 2 hours trading left today

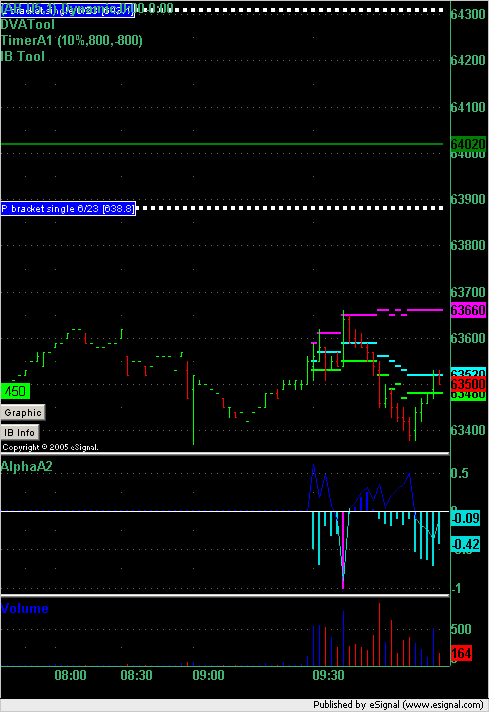

[14:32:00] <guy> Rotaton Factors and singles confirmed...

[14:32:08] <signal>

[14:32:24] <guy> .

[14:32:30] <guy> ER2 single has just filled:

[14:32:37] <signal>

[14:33:46] <guy> that looks wrong to me

[14:35:05] <tuna> spoos single ay 1200.5

[14:40:47] <guy> thanks tuna

[14:41:05] <guy> that single had filled in so no ER2 single in L bracket

[14:42:00] <tuna> filled by 4 tics

[14:53:20] <fspeculator> anyone tried the new 7,9.1 ? esignal?

[14:53:31] <fspeculator> has it fixed the MP bugs?

[14:54:07] <fspeculator> still can't believe they'd mess the MP code so badly

[14:54:28] <fspeculator> many markets became untradeable, like bonds and forex

[14:55:30] <tuna> i never did 7.9

[15:05:55] <fspeculator> [22:03] <fspeculator> http://www.sed.gr/cgi-bin/ikonboard/ikonboard.cgi?act=ST;f=2;t=1703

[15:05:55] <fspeculator> [22:03] <fspeculator> commodity charts expressed in euros

[15:06:12] <fspeculator> 22:04] <fspeculator> (descriptions are in greek, but pictures speak for themselves)

[15:07:05] <guy> I'm using the latest beta release fspec

[15:07:19] <guy> I've been told that the next release of esignal will fix major MP bugs

[15:09:31] <tuna> i cant even figure out how to get into the file share library

[15:09:46] <guy> looks like prices are going up according to those chart fspec :)

[15:09:57] <guy> it's a bit tricky tuna

[15:10:16] <guy> This is an interesting chart coming up

[15:10:26] <signal>

[15:10:29] <guy> What it shows is the ER2 5min chart over the last 2 days

[15:11:27] <guy> The white X's mark where the TimerA1 indicator said that $TICK was at an extreme.

[15:11:53] <guy> The rules for an extreme in this case can be seen in the settings of TimerA1 at the top of the chart which are 10%,800,-800

[15:12:10] <guy> This means that $tick needs to be outside of the 800s and in the 10th percentile

[15:12:46] <guy> What I find strange is that today, the day after a major down move, we have no negative $tick extremes

[15:13:18] <guy> a negative $tick extreme would produce a buy blob in green

[15:13:49] <guy> the market has only shown us sell points today with respect to $tick

[15:19:48] <tuna> tick creeping up

[15:20:47] <tuna> some covering prolly

[15:30:01] <guy> Bond Futures closed

[15:32:33] <guy> damn!

[15:32:48] <guy> i kept on trying to get short up there but was too slow

[15:33:06] <guy> my theory on times like this is that we see new LOD before close

[15:33:17] <guy> look at the 30min RTH chart

[15:33:53] <guy> how many people want to hold long into the weekend with the market looking like that

[15:34:15] <guy> however - all the shorts will be happy to carry shorts through the w/e because of the buffer they have

[15:34:44] <guy> so my theory is that we have longs exiting positions now...

[15:34:50] <guy> more so than shorts taking profits

[15:36:12] <guy> Here is the ER2 30min chart to now

[15:36:21] <signal>

[15:40:45] <signal>

[15:40:49] <tuna> my 1200 short off singles looks like crap now

[15:41:03] <tuna> lol

[15:42:51] <guy> this is what you're looking at right tuna:

[15:42:56] <signal>

[15:43:08] <guy> shows the single that you're shorting at 1200.25 right?

[15:43:47] <tuna> n bracket

[15:43:57] <tuna> long ago

[15:44:17] <tuna> spoos never got close

[15:44:57] <tuna> 1200.25 is correct

[15:45:19] <guy> ah - okay

[15:45:35] <tuna> spoos will save it

[15:47:29] <tuna> i hope

[15:49:15] <tuna> singles on spoos from1200 to 1200.5

[15:49:24] <tuna> l backet

[15:49:31] <tuna> bracket

[15:52:54] <tuna> couldnt get a 2xib fill for a long but the singles on the spoos looked good

[15:58:56] <tuna> i think the extra 23$ a month is worth being able to see bigs

[15:59:08] <tuna> fwiw

[16:00:40] <tuna> cuz theres a big fat singles gap u see on spoos but dont on es

[16:01:09] <guy> i had the bigs for a while but wasn't watching it because i've switched from ES to ER so I cancelled it

[16:01:29] <guy> I wish they'd ditch SP contract and make the ES trade in 0.1 points

[16:01:56] <tuna> prolly will

[16:02:00] <tuna> in time

[16:02:30] <tuna> i heard theres a bid in for nymex

[16:04:52] <tuna> im not sure if all electronic is a good thing tho

[16:05:22] <tuna> looking at these ym charts anyway

[16:07:24] <guy> [15:33:06] <guy> my theory on times like this is that we see new LOD before close

[16:07:31] <guy> So far that is true for NQ and ES

[16:07:40] <guy> still waiting on YM and ER2

[16:09:22] <tuna> flat

[16:09:39] <guy> you must have made a fortune on that tuna?

[16:09:45] <guy> how many points?

[16:10:08] <tuna> 6 on last part

[16:10:16] <guy> VERY NICE !!!

[16:11:29] <tuna> there was some 'hope' involved tho

[16:11:44] <tuna> spoos was the key

[16:12:00] <guy> :)

[16:12:55] <tuna> even a blind squirrel finds a nut every once in while

[16:13:28] <guy> LOL

[16:15:01] <tuna> so we have those spoos singles for monday

[16:15:07] <tuna> 1200.5

[16:15:11] <guy> yup

[16:15:12] <tuna> fwiw

[16:15:16] <guy> have a safe weekend everyone

[16:15:24] <tuna> cya

Session Close: Fri Jun 24 16:17:37 2005

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.