17 June 2005 (Friday)

Session Start: Fri Jun 17 09:07:04 2005

Session Ident: #T1

[09:09:37] <guy> gm all

[09:16:12] <guy> Consumer Sentiment (p)

[09:16:12] <guy> 9:45 ET

[09:19:27] <mikee> gm

[09:19:50] <guy> gm mikee et al

[09:20:18] <mikee> hi guy

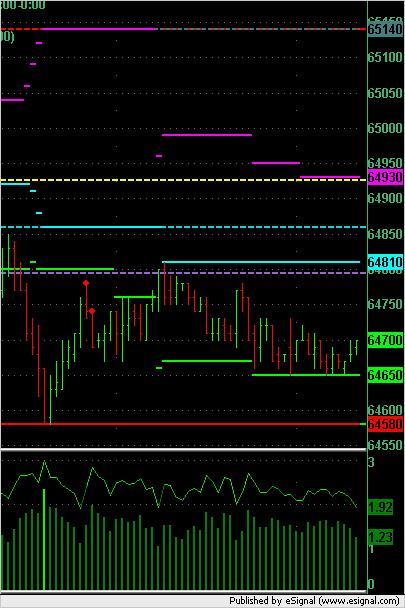

[09:20:38] <guy> ER2 pre-market

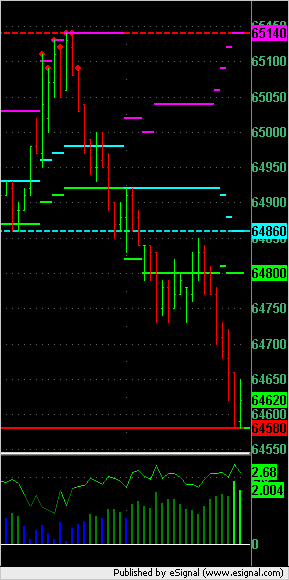

[09:20:46] <signal>

[09:21:14] <guy> VAH is 645.8 and yest high at 646.4 - red lines at top

[09:21:31] <guy> VAL and yest. (filled) single at 641.6

[09:21:36] <guy> yest. low at 638.2

[09:21:54] <guy> .

[09:22:05] <guy> so we're around 2 handles above yest. high at open

[09:22:17] <guy> and 2.5 above VAH

[09:22:34] <guy> so if we're playing the short to the VAH then our potential is around 2.5 points

[09:22:54] <guy> weight that against the probability of hitting that target versus the stop you need to use...

[09:23:06] <guy> i'm going to watch what alpha says out the gate

[09:23:18] <guy> and see if it supports a short to the VAH

[09:23:48] <guy> Consumer Sentiment (p) 9:45 ET

[09:23:58] <guy> that's 15 minutes after the open

[09:24:05] <guy> so we need to be nimble around the opening

[09:25:01] <guy> 5 minutes to open

[09:25:38] <guy> restarting esignal...

[09:29:01] <guy> 1 minute to open

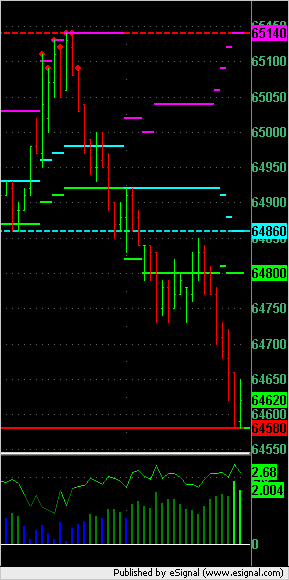

[09:31:36] <guy> ES chart showing the gap to the VAH

[09:31:49] <signal>

[09:34:11] <signal>

[09:34:16] <guy> k-line and alpha vote that this is a fair rally/value and not to sell it

[09:34:34] <guy> in fact both of them are in buy mode now

[09:40:48] <guy> ER2 long signals here

[09:41:12] <signal>

[09:42:37] <guy> .

[09:42:50] <guy> my buy point is around 48

[09:42:57] <guy> if i can get it

[09:43:03] <guy> because that allows for a stop at 47

[09:43:47] <guy> ES chart also shows buy signals

[09:43:56] <signal>

[09:44:07] <fspeculator> i took an JP OR trade

[09:46:19] <guy> Consumer Sentiment (p) 9:45 ET

[09:47:09] <guy> 94.8 vs 88.8

[09:54:30] <mikee> we seen top imo (currently short to hold)

[09:55:34] <guy> i'm getting more buy signals in ER2 mikee

[09:55:56] <guy> here's the chart

[09:56:08] <guy> i think we pop to a new HOD in ER2

[09:56:10] <mikee> well it's possible, i'm talking es

[09:56:17] <signal>

[09:57:10] <guy> okay - so you looking to short or are you already short ES ?

[09:57:19] <mikee> 23.75

[09:57:23] <mikee> target 17.75

[09:57:27] <mikee> stop 26

[09:58:09] <guy> good trading

[09:58:41] <mikee> +3 half

[09:58:49] <mikee> at tl

[09:58:53] <mikee> tks

[10:00:35] <mikee> stop b/e

[10:01:22] <mikee> another ss here

[10:03:07] <mikee> [08:37] <mikee> long es

[10:03:08] <mikee> [08:37] <mikee> 23.75, then 25.75

[10:03:38] <mikee> (from other room) these were objective targets

[10:03:57] <guy> Buys ER2 @ 648

[10:04:03] <mikee> 25.25 was tl

[10:05:02] <mikee> 648 is good buy as open. price but it may not stop here

[10:05:27] <mikee> still bearish

[10:05:36] <guy> exit stop set ER2 @ 647

[10:06:00] <mikee> right at 20me

[10:07:14] <guy> will scratch this if possible...

[10:08:13] <mikee> stop 22.5

[10:08:35] <guy> and retry from VAH if alpha okay with it

[10:08:48] <guy> Exited all Long ER2 at 648.1 --> + 0.1

[10:09:13] <guy> nice trading mikee :)

[10:09:18] <guy> i shouldn't be fading you :)

[10:09:32] <guy> i'm looking at another long from 645.8 if alpha is good for it

[10:09:37] <mikee> thanks guy

[10:10:02] <mikee> 21 is another ss imo

[10:10:05] <guy> that weakness below 648.0 (bottom of OR) convinced me that that isn't the place to be long from

[10:10:15] <guy> it may work but too high R/R for me

[10:10:51] <mikee> agree, not settle yet

[10:11:12] <mikee> 20 another ourt, left 1c

[10:11:34] <guy> very nice trading

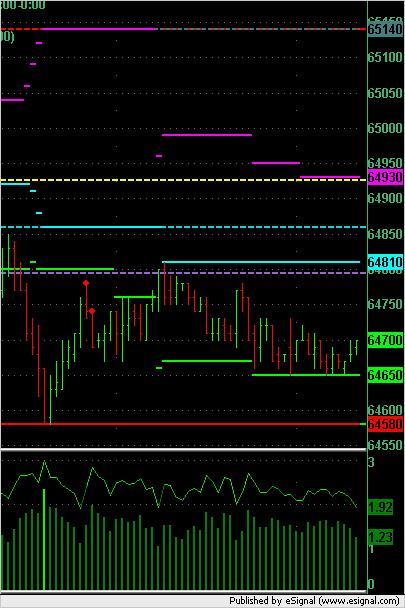

[10:11:40] <guy> here's ER2 chart again...

[10:11:42] <signal>

[10:11:49] <guy> showing VAH and alpha

[10:11:59] <guy> VAH is red line at bottom

[10:12:07] <guy> lime is DVAL

[10:12:27] <guy> cyan is DPOC which is probably 50% of range as well

[10:13:58] <mikee> 21.75 as .382 ss

[10:14:14] <mikee> but over it 22.5

[10:14:23] <mikee> as 50%

[10:18:02] <fspeculator> systems go short here

[10:18:21] <guy> limit to enter long ER2 @ 645.8

[10:18:42] <mikee> carefull

[10:19:09] <guy> Buys ER2 @ 645.8

[10:19:25] <mikee> good buy'

[10:19:44] <guy> exit stop moved to breakeven ER2 @ 645.8

[10:20:13] <guy> Buy signal: VAH + alpha

[10:20:19] <signal>

[10:20:20] <guy> chart coing up...

[10:21:12] <mikee> 627.2 target

[10:21:52] <fspeculator> doesn't it look like a reversal day?

[10:22:40] <mikee> we'll see monday

[10:23:04] <mikee> today is option expir. so everything is manipulated

[10:25:02] <guy> exit stop raised ER2 @ 646

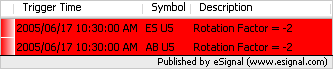

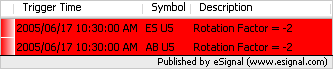

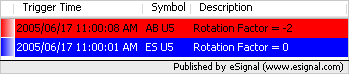

[10:30:42] <guy> Rotation Factors:

[10:30:53] <signal>

[10:32:18] <mikee> i wood take profit guy

[10:32:45] <mikee> if not option expiration day i wood agree to hold

[10:33:08] <guy> thanks mikee - you might be right

[10:33:35] <guy> atm alpha is holding strong so let me see what develops over next few minutes...

[10:33:54] <mikee> 647.9 is .382

[10:34:01] <guy> alpha looks like it might break to upside shortly...

[10:34:25] <mikee> at least partial

[10:34:59] <mikee> we came to 647.8 close enough

[10:37:45] <guy> alpha is signalling a follow through here so I will risk holding the long

[10:38:09] <guy> i.e. following through buying

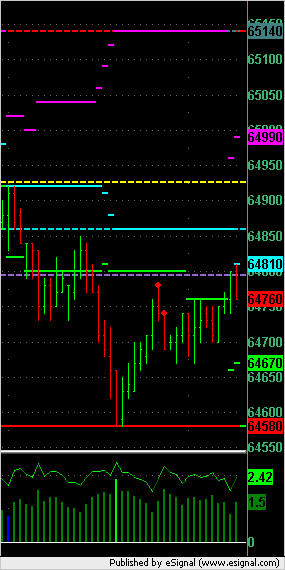

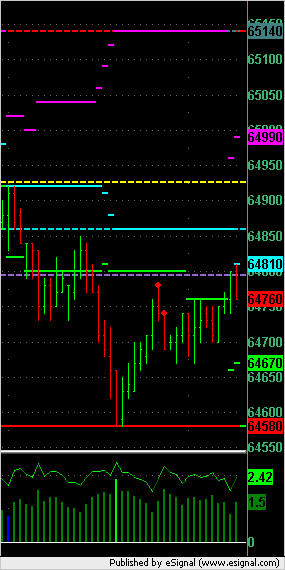

[10:39:14] <guy> Next ER2 chart has fib lines put in

[10:39:19] <signal>

[10:39:22] <guy> so you can see the 38.2% that mikee is talking about

[10:39:42] <guy> we've just hit the 38.2% right mikee?

[10:46:28] <mikee> right it was objective out at least partial

[10:48:18] <mikee> if 645.8 was low, looking for long now over 648.1

[10:48:48] <mikee> if so targets:648.6,649.2

[10:51:08] <mikee> if not downside targets...

[10:51:09] <mikee> [09:51] <mikee> close gap then 643.7

[10:53:17] <mikee> imo we going lower

[10:53:49] <mikee> but again [09:25] <mikee> with option expiration today it's highly manipulated,- better to stay aside

[10:56:23] <guy> Goal Setting Enhances Motivation

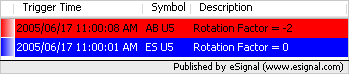

[11:00:31] <guy> Rotation Factors:

[11:00:38] <signal>

[11:10:32] <guy> DVAL is holding ER2 atm

[11:10:36] <signal>

[11:16:44] <guy> stop hit ER2 @ 646 --> + 0.2

[11:16:53] <guy> mikee: you were right

[11:23:56] <mikee> yeah 1st target reached - we closed gap

[11:24:35] <mikee> no wait for bounce to ss

[11:25:09] <mikee> and where bounce now...

[11:25:29] <mikee> 646 is .382, 646.4 is .5

[11:25:48] <mikee> err. no=now

[11:27:53] <mikee> almost there for 1st#

[11:28:04] <mikee> 1221 for es

[11:29:59] <mikee> 645.8 was er ss

[11:30:08] <mikee> as resistance

[11:35:11] <mikee> bbl

[11:35:59] <mikee> going to meeting, hope back at bonds close

[14:26:13] * Disconnected

Session Close: Fri Jun 17 14:26:15 2005

Session Ident: #T1

[09:09:37] <guy> gm all

[09:16:12] <guy> Consumer Sentiment (p)

[09:16:12] <guy> 9:45 ET

[09:19:27] <mikee> gm

[09:19:50] <guy> gm mikee et al

[09:20:18] <mikee> hi guy

[09:20:38] <guy> ER2 pre-market

[09:20:46] <signal>

[09:21:14] <guy> VAH is 645.8 and yest high at 646.4 - red lines at top

[09:21:31] <guy> VAL and yest. (filled) single at 641.6

[09:21:36] <guy> yest. low at 638.2

[09:21:54] <guy> .

[09:22:05] <guy> so we're around 2 handles above yest. high at open

[09:22:17] <guy> and 2.5 above VAH

[09:22:34] <guy> so if we're playing the short to the VAH then our potential is around 2.5 points

[09:22:54] <guy> weight that against the probability of hitting that target versus the stop you need to use...

[09:23:06] <guy> i'm going to watch what alpha says out the gate

[09:23:18] <guy> and see if it supports a short to the VAH

[09:23:48] <guy> Consumer Sentiment (p) 9:45 ET

[09:23:58] <guy> that's 15 minutes after the open

[09:24:05] <guy> so we need to be nimble around the opening

[09:25:01] <guy> 5 minutes to open

[09:25:38] <guy> restarting esignal...

[09:29:01] <guy> 1 minute to open

[09:31:36] <guy> ES chart showing the gap to the VAH

[09:31:49] <signal>

[09:34:11] <signal>

[09:34:16] <guy> k-line and alpha vote that this is a fair rally/value and not to sell it

[09:34:34] <guy> in fact both of them are in buy mode now

[09:40:48] <guy> ER2 long signals here

[09:41:12] <signal>

[09:42:37] <guy> .

[09:42:50] <guy> my buy point is around 48

[09:42:57] <guy> if i can get it

[09:43:03] <guy> because that allows for a stop at 47

[09:43:47] <guy> ES chart also shows buy signals

[09:43:56] <signal>

[09:44:07] <fspeculator> i took an JP OR trade

[09:46:19] <guy> Consumer Sentiment (p) 9:45 ET

[09:47:09] <guy> 94.8 vs 88.8

[09:54:30] <mikee> we seen top imo (currently short to hold)

[09:55:34] <guy> i'm getting more buy signals in ER2 mikee

[09:55:56] <guy> here's the chart

[09:56:08] <guy> i think we pop to a new HOD in ER2

[09:56:10] <mikee> well it's possible, i'm talking es

[09:56:17] <signal>

[09:57:10] <guy> okay - so you looking to short or are you already short ES ?

[09:57:19] <mikee> 23.75

[09:57:23] <mikee> target 17.75

[09:57:27] <mikee> stop 26

[09:58:09] <guy> good trading

[09:58:41] <mikee> +3 half

[09:58:49] <mikee> at tl

[09:58:53] <mikee> tks

[10:00:35] <mikee> stop b/e

[10:01:22] <mikee> another ss here

[10:03:07] <mikee> [08:37] <mikee> long es

[10:03:08] <mikee> [08:37] <mikee> 23.75, then 25.75

[10:03:38] <mikee> (from other room) these were objective targets

[10:03:57] <guy> Buys ER2 @ 648

[10:04:03] <mikee> 25.25 was tl

[10:05:02] <mikee> 648 is good buy as open. price but it may not stop here

[10:05:27] <mikee> still bearish

[10:05:36] <guy> exit stop set ER2 @ 647

[10:06:00] <mikee> right at 20me

[10:07:14] <guy> will scratch this if possible...

[10:08:13] <mikee> stop 22.5

[10:08:35] <guy> and retry from VAH if alpha okay with it

[10:08:48] <guy> Exited all Long ER2 at 648.1 --> + 0.1

[10:09:13] <guy> nice trading mikee :)

[10:09:18] <guy> i shouldn't be fading you :)

[10:09:32] <guy> i'm looking at another long from 645.8 if alpha is good for it

[10:09:37] <mikee> thanks guy

[10:10:02] <mikee> 21 is another ss imo

[10:10:05] <guy> that weakness below 648.0 (bottom of OR) convinced me that that isn't the place to be long from

[10:10:15] <guy> it may work but too high R/R for me

[10:10:51] <mikee> agree, not settle yet

[10:11:12] <mikee> 20 another ourt, left 1c

[10:11:34] <guy> very nice trading

[10:11:40] <guy> here's ER2 chart again...

[10:11:42] <signal>

[10:11:49] <guy> showing VAH and alpha

[10:11:59] <guy> VAH is red line at bottom

[10:12:07] <guy> lime is DVAL

[10:12:27] <guy> cyan is DPOC which is probably 50% of range as well

[10:13:58] <mikee> 21.75 as .382 ss

[10:14:14] <mikee> but over it 22.5

[10:14:23] <mikee> as 50%

[10:18:02] <fspeculator> systems go short here

[10:18:21] <guy> limit to enter long ER2 @ 645.8

[10:18:42] <mikee> carefull

[10:19:09] <guy> Buys ER2 @ 645.8

[10:19:25] <mikee> good buy'

[10:19:44] <guy> exit stop moved to breakeven ER2 @ 645.8

[10:20:13] <guy> Buy signal: VAH + alpha

[10:20:19] <signal>

[10:20:20] <guy> chart coing up...

[10:21:12] <mikee> 627.2 target

[10:21:52] <fspeculator> doesn't it look like a reversal day?

[10:22:40] <mikee> we'll see monday

[10:23:04] <mikee> today is option expir. so everything is manipulated

[10:25:02] <guy> exit stop raised ER2 @ 646

[10:30:42] <guy> Rotation Factors:

[10:30:53] <signal>

[10:32:18] <mikee> i wood take profit guy

[10:32:45] <mikee> if not option expiration day i wood agree to hold

[10:33:08] <guy> thanks mikee - you might be right

[10:33:35] <guy> atm alpha is holding strong so let me see what develops over next few minutes...

[10:33:54] <mikee> 647.9 is .382

[10:34:01] <guy> alpha looks like it might break to upside shortly...

[10:34:25] <mikee> at least partial

[10:34:59] <mikee> we came to 647.8 close enough

[10:37:45] <guy> alpha is signalling a follow through here so I will risk holding the long

[10:38:09] <guy> i.e. following through buying

[10:39:14] <guy> Next ER2 chart has fib lines put in

[10:39:19] <signal>

[10:39:22] <guy> so you can see the 38.2% that mikee is talking about

[10:39:42] <guy> we've just hit the 38.2% right mikee?

[10:46:28] <mikee> right it was objective out at least partial

[10:48:18] <mikee> if 645.8 was low, looking for long now over 648.1

[10:48:48] <mikee> if so targets:648.6,649.2

[10:51:08] <mikee> if not downside targets...

[10:51:09] <mikee> [09:51] <mikee> close gap then 643.7

[10:53:17] <mikee> imo we going lower

[10:53:49] <mikee> but again [09:25] <mikee> with option expiration today it's highly manipulated,- better to stay aside

[10:56:23] <guy> Goal Setting Enhances Motivation

[11:00:31] <guy> Rotation Factors:

[11:00:38] <signal>

[11:10:32] <guy> DVAL is holding ER2 atm

[11:10:36] <signal>

[11:16:44] <guy> stop hit ER2 @ 646 --> + 0.2

[11:16:53] <guy> mikee: you were right

[11:23:56] <mikee> yeah 1st target reached - we closed gap

[11:24:35] <mikee> no wait for bounce to ss

[11:25:09] <mikee> and where bounce now...

[11:25:29] <mikee> 646 is .382, 646.4 is .5

[11:25:48] <mikee> err. no=now

[11:27:53] <mikee> almost there for 1st#

[11:28:04] <mikee> 1221 for es

[11:29:59] <mikee> 645.8 was er ss

[11:30:08] <mikee> as resistance

[11:35:11] <mikee> bbl

[11:35:59] <mikee> going to meeting, hope back at bonds close

[14:26:13] * Disconnected

Session Close: Fri Jun 17 14:26:15 2005

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.