Opening Gap Trade

The Regular Trading Hours (RTH) opening gap trade is a well known trading setup. This trading setup is certainly something I always consider at the opening of the new RTH trading session.

Guy did an analysis of this setup in his article titled "Fading the Gap"

From his article we learn the following historical statistics from the sample period he used...

Given these basic concepts as a foundation, I thought it might be helpful to use this topic for further discussion, analysis and trading ideas.

Guy did an analysis of this setup in his article titled "Fading the Gap"

From his article we learn the following historical statistics from the sample period he used...

- "On average 76% or three quarters of all gaps close at some point during RTH."

- Gaps on Monday were the least likely to fill and Thursday gap openings the most likely.

- Opening gaps up to 7 ES points in size were filled during the session at least 70% of the time. This probability drops off surprisingly quickly above the 7 ES point range.

Given these basic concepts as a foundation, I thought it might be helpful to use this topic for further discussion, analysis and trading ideas.

it has been a choppy mess all day....it would be funny if the market managed to fill these gaps in the last hour today.

quote:

Originally posted by pt_emini

it has been a choppy mess all day....it would be funny if the market managed to fill these gaps in the last hour today.

ES just printed 1351.00 to the tick, filling today's gap...

that was so cool....once again they took everyones money who used the gap amount as a stop loss only to watch the market go in the direction they wanted.....The most recent vendor to jump on the train and promote the gap trade is John Carter.....The vendor I learned this from in the mid 90's called it a "jump" trade and said there was a generic 82% chance of filling in the same day when we open in the range...luckily we have DAY TRADING and his enhanced statistics to improve the stats.....

And thanks to you also PT for keeping us up to date here.....

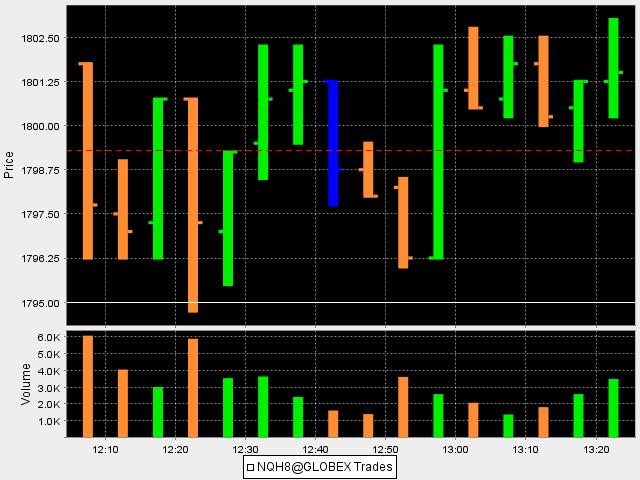

Here is something you may or may not find interesting PT..I'm not sure if you remember the "gap" I was referring to ( page 4 of this thread)in your NQ from wednesday in the overnight when the retail sales hit...at 8:30 a.m.EST....here is the screen shot ..look at the left side...someone got caught on the wrong side

Look what happened when they re - entered that zone yesterday////great reaction////I'm sure you have enough to look at but just thought I'd mention it....

here is the reaction when we traded back to that area on Thursday in the day session...we blew through it later in the day

And thanks to you also PT for keeping us up to date here.....

Here is something you may or may not find interesting PT..I'm not sure if you remember the "gap" I was referring to ( page 4 of this thread)in your NQ from wednesday in the overnight when the retail sales hit...at 8:30 a.m.EST....here is the screen shot ..look at the left side...someone got caught on the wrong side

Look what happened when they re - entered that zone yesterday////great reaction////I'm sure you have enough to look at but just thought I'd mention it....

here is the reaction when we traded back to that area on Thursday in the day session...we blew through it later in the day

Tuesday's ES close was 1355.50

Globex range is 1355.50 - 1332.75

80% probability boundary ( 7 ES point gap down ) = 1348.50

Gap Mid-point (close - globex low) = 1344.00

Today's RTH Open for the ES = 1337.75 down 17.75

Globex range is 1355.50 - 1332.75

80% probability boundary ( 7 ES point gap down ) = 1348.50

Gap Mid-point (close - globex low) = 1344.00

Today's RTH Open for the ES = 1337.75 down 17.75

...notice how the gap mid-point is once again acting as a price magnet this morning

as long as ES holds below the gap mid-point, I will remain neutral on the idea of a gap fill this morning.

as long as ES holds below the gap mid-point, I will remain neutral on the idea of a gap fill this morning.

ES traded up to 1343.75 = 1 tick from the mid-point and has reversed to the downside

ER2 has broken down and is trading below the RTH opening & globex lows

ER2 has broken down and is trading below the RTH opening & globex lows

ES just ticked the gap mid-point and is once again being rejected to the downside.

The gap fill traders are trying to get that pot at the end of the rainbow... but to get there they will have to overpower sellers laying in wait at the mid-point.

The gap fill traders are trying to get that pot at the end of the rainbow... but to get there they will have to overpower sellers laying in wait at the mid-point.

we are banging on the first High volume number at 1344 too..and S1 is there also..but as long as 1340 - 41 holds I think we are going to 1348 soon and then to the gap fill....interesting that the other high volume number comes in at 1337 so we are like a ping pong ball so far...

If we happen to get new lows then 1332 is the area to watch....I'm not trading for that...bias is to upside...

If we happen to get new lows then 1332 is the area to watch....I'm not trading for that...bias is to upside...

thanks pt....53.75 was my best exit...i don't like the way they ran that up...so i'm looking for shorts ahead of fed minutes to target back down at 1342 - 45 but this stair step is a concern...you can see a nice gap down at 1342....the obvious 64 - 65 is next upside but no longs for me up here

great gap play in the ES today. Huge rally sold near the R2 pivot to watch it gap fill and then some.WOOT!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.