Feedback on Kane Trading products

I noticed on another forum that someone had asked if anyone had any feedback on Kane Trading products. One of my students posted an honest reply, and even though the thread was 'dormant' for about three months since the original request for feedback, it came alive, and people came out of the woodwork, saying things like 'go away spammer', Fibonacci is worthless, etc., etc. I checked back shortly after that and the moderator deleted the entire thread.

I won't go into my detailed thoughts here on the state of most forums, other than to mention some obvious conclusions I've drawn about them after this experience:

1. If you have a positive view on anything, don't post it, because you must be a spammer. No chance whatsoever you legitimately find the material useful.

2. If you hate the material, post away, essentially no limits. Don't worry about libel or slander, the sky's the limit. Blast away. It makes good copy.

3. If it can't be verified 100%, and hence easily coded, don't bother to say anything good, because it can't be substantiated, and is hence useless. Obviously, then, there is no merit or value in anything discretionary.

4. There is no place on any forum for anything that is ever sold, only free material. If it is ever sold, any mention is spam and you are part of the conspiracy. Besides, no one who is any kind of a good trader would ever sell anything, they would give it away, so it's an automatic 'open season' sign if anything positive is posted for anything that is sold, and that behavior is encouraged.

Now, the purpose of this thread is to have an area were those who have direct experience with Kane Trading products i.e. full book set buyers and mentor students, can post comments they feel may help others make informed decisions about the products, and whether the products may be of use to them in the development of their own 'Trading Plan'. Everyone should understand that people will be posting their opinion, and it is a forum for Kane Trading, so take it all with a grain of salt.

Please don't make a post here if you don't have direct experience with the methodology. If you've read a few free commentary on the website and have some inborn hatred of Fibonacci, or median lines, or any technique, don't post and say Fibonacci is useless, or whatever. This thread is for those that want feedback from people who have direct experience, not people who have preconceived notions and no direct experience with this specific methodology. Let's try to make this a useful resource, one of many a person should use, to attempt to make an informed decision. Thanks.

I won't go into my detailed thoughts here on the state of most forums, other than to mention some obvious conclusions I've drawn about them after this experience:

1. If you have a positive view on anything, don't post it, because you must be a spammer. No chance whatsoever you legitimately find the material useful.

2. If you hate the material, post away, essentially no limits. Don't worry about libel or slander, the sky's the limit. Blast away. It makes good copy.

3. If it can't be verified 100%, and hence easily coded, don't bother to say anything good, because it can't be substantiated, and is hence useless. Obviously, then, there is no merit or value in anything discretionary.

4. There is no place on any forum for anything that is ever sold, only free material. If it is ever sold, any mention is spam and you are part of the conspiracy. Besides, no one who is any kind of a good trader would ever sell anything, they would give it away, so it's an automatic 'open season' sign if anything positive is posted for anything that is sold, and that behavior is encouraged.

Now, the purpose of this thread is to have an area were those who have direct experience with Kane Trading products i.e. full book set buyers and mentor students, can post comments they feel may help others make informed decisions about the products, and whether the products may be of use to them in the development of their own 'Trading Plan'. Everyone should understand that people will be posting their opinion, and it is a forum for Kane Trading, so take it all with a grain of salt.

Please don't make a post here if you don't have direct experience with the methodology. If you've read a few free commentary on the website and have some inborn hatred of Fibonacci, or median lines, or any technique, don't post and say Fibonacci is useless, or whatever. This thread is for those that want feedback from people who have direct experience, not people who have preconceived notions and no direct experience with this specific methodology. Let's try to make this a useful resource, one of many a person should use, to attempt to make an informed decision. Thanks.

I just posted the free monthly commentary. I was motivated by the discussion in here and in the private area, in an attempt to add more information to this area. See here:

http://www.kanetrading.com/a_comm/07_4Qarc/november/110407_d_comm_arc.html

I hope this gives you some useful information. It took me almost an entire day to put that one together.

I wonder if we shouldn't start a new thread so this one can stay on the topic, though, of feedback from people with direct experience with the products. Anyone can feel free to start a new thread for whatever kind of discussion they see fit.

http://www.kanetrading.com/a_comm/07_4Qarc/november/110407_d_comm_arc.html

I hope this gives you some useful information. It took me almost an entire day to put that one together.

I wonder if we shouldn't start a new thread so this one can stay on the topic, though, of feedback from people with direct experience with the products. Anyone can feel free to start a new thread for whatever kind of discussion they see fit.

quote:

Originally posted by BruceM

Thanks for the detailed response Jim. I merely wanted to see

some Pta's for the S&P only because that is what I trade and haven't had much luck with Fibs or medians lines. It seems like you have a very comprehensive training program and one would benefit from poking around your site to see if it is "right" for them.

I agree with your comments about entry setups. As one who does post setups I will freely admit that those are only a small piece of the trading puzzle and everyone will trade or manage positions differently ( the real key!!).

It's great to hear that you have removed most of the subjectivity to Fibs and median lines. That's a big step but not the whole package as you mentioned. I guess I just would have liked to see a few of your members post here in advance ( or somewhere for my market)just out of curiosity..probably nothing more....

Sorry this thread isn't turning out as you like. I'm sure it's not easy being an educator who sincerely believes in their course work. It only takes a few "bad" ones to make it harder on those who are legit.

Perhaps if you feel high motivated at some point in the future you could send me some S&P charts or post them here. I enjoy your writing and the content I have found time to read on your site.

Bruce

Hi everybody,

I have bought a full book set some time ago but I am still a novice in using Kane Trading techniques and therefore I thought it could be a help for people who are interested on Jim Kane’s work, if I post my opinions and experiences here.

After thinking about, how to do this I decided to describe my way from my first contact with Jim’s homepage and buying the book set after a while of consideration till my current standing as user of these techniques in a chronological process. Additional it may be mentionable, that I am a part time trader with a fulltime bred and butter job for living and therefore I need much more time to absorb and apply new trading stuff.

When I found Jim Kane’s homepage searching through the internet, I read a few commentaries and the free articles (some of them were very interesting for me) and my interest was caught. I studied the commentary archive from 2003 till 2005 and recognized, this method could fit to my personality. Btw, I stopped reading the archived commentaries for further decision finding, as I felt it got to complex for me without the knowledge of the basics of Jim Kane’s concepts. I ordered the two available ebooks to evaluate, what I could expect from the full book set and finally after that I bought the them.

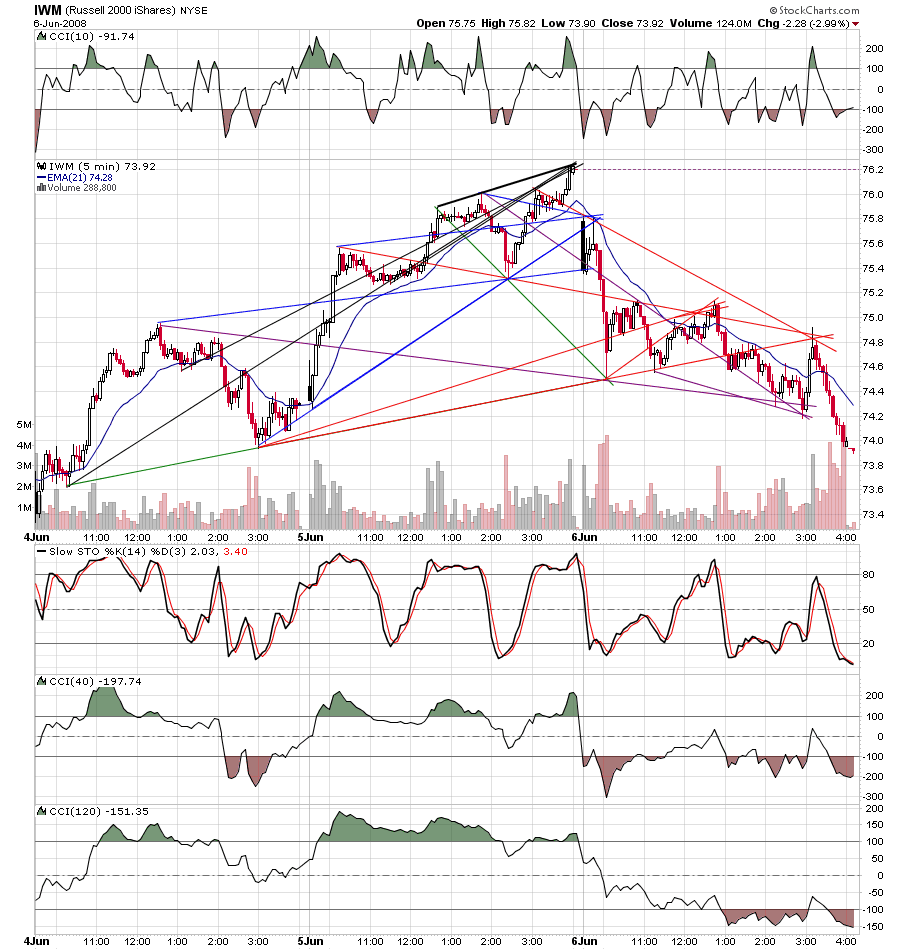

With the book set I have gotten concepts about the whole trading process from a professional trader and each piece fits into the others. The concepts lay out exploring trading spots with advanced Fibonacci techniques (layered Fibonacci support and resistance zones; harmony concept), Fibonacci based Patterns (especially ABCD’s) and Lines Synergy (especially MedianLines, but also Trendlines, etc) with high probability of success. Further entry techniques, especially trade management and context analysis. All these are important aspects which have to considered and implemented in a trading plan.

Jim Kane’s work opened my eyes for watching price action, impulsive and corrective chart structures, probabilities and the importance of an clear trading plan for every thinkable scenario, so you can follow a clear plan in the heat of the battle. Even if I should move away from analyzing and prospecting charts with Kane Trading techniques in my further trader life I can profit from the information I have gotten with the full book set in my opinion.

Nevertheless I have to say, that it is an discretionary approach to exploring, executing and managing trades. You don’t get simple rules, you can follow without interpreting what you see and you have to make your conclusions. You have to effort the necessary screen time to apply the concepts with success over the long run and pull out the best benefit for you.

Now I am trying to learn and apply the concepts and it’s not an easy way for me. But Jim always stated this on his website and in his books. Following the rules, patterns and chart examples in the books and exploring the patterns by yourself are different worlds, especially if you try it to apply them for intraday trading, as you have much less time to recognize and interpret what’s going on. I am focussing on the emini NQ intraday and as a part-time trader I can this only a limited time. Some days I can’t see any clear setup in advance and on other days they jump into my eyes. But these days are not very often till now. But I am getting better with every additional hour of screen time! And may be I have only to work on my patience to let the setup coming to me. Especially if a gap on the open destroys my prepared concept for the next trading day I often don’t know, what I should doing or looking for now.

With the book set in my mind (which I am reading repeatedly) I have started again to read the archived commentaries from 2006 till now with much an better understanding and viewing charts from the Kane Trading members forum to learn from. Some of the charts I have printed for studying purposes, cause I couldn’t grasp what they were showing me at my first look. Due the progressing in my knowledge and experience I can now recognize many things, I couldn’t see before.

With the full book set you also get access to the Kane Trading members forum, where you can search for further valuable information and discuss your explored setups in advance with other members. What you not get in the forum are trade setups (picks) to follow without doing the work by yourself. But if you present your thoughts about an developing setup in advance or have any questions, you can get qualified response from the other members.

Hope I could give you a little decision support (and haven’t discouraged you), if Kane Trading Techniques could be the way to go for you.

Wish you the best,

Hawk

I have bought a full book set some time ago but I am still a novice in using Kane Trading techniques and therefore I thought it could be a help for people who are interested on Jim Kane’s work, if I post my opinions and experiences here.

After thinking about, how to do this I decided to describe my way from my first contact with Jim’s homepage and buying the book set after a while of consideration till my current standing as user of these techniques in a chronological process. Additional it may be mentionable, that I am a part time trader with a fulltime bred and butter job for living and therefore I need much more time to absorb and apply new trading stuff.

When I found Jim Kane’s homepage searching through the internet, I read a few commentaries and the free articles (some of them were very interesting for me) and my interest was caught. I studied the commentary archive from 2003 till 2005 and recognized, this method could fit to my personality. Btw, I stopped reading the archived commentaries for further decision finding, as I felt it got to complex for me without the knowledge of the basics of Jim Kane’s concepts. I ordered the two available ebooks to evaluate, what I could expect from the full book set and finally after that I bought the them.

With the book set I have gotten concepts about the whole trading process from a professional trader and each piece fits into the others. The concepts lay out exploring trading spots with advanced Fibonacci techniques (layered Fibonacci support and resistance zones; harmony concept), Fibonacci based Patterns (especially ABCD’s) and Lines Synergy (especially MedianLines, but also Trendlines, etc) with high probability of success. Further entry techniques, especially trade management and context analysis. All these are important aspects which have to considered and implemented in a trading plan.

Jim Kane’s work opened my eyes for watching price action, impulsive and corrective chart structures, probabilities and the importance of an clear trading plan for every thinkable scenario, so you can follow a clear plan in the heat of the battle. Even if I should move away from analyzing and prospecting charts with Kane Trading techniques in my further trader life I can profit from the information I have gotten with the full book set in my opinion.

Nevertheless I have to say, that it is an discretionary approach to exploring, executing and managing trades. You don’t get simple rules, you can follow without interpreting what you see and you have to make your conclusions. You have to effort the necessary screen time to apply the concepts with success over the long run and pull out the best benefit for you.

Now I am trying to learn and apply the concepts and it’s not an easy way for me. But Jim always stated this on his website and in his books. Following the rules, patterns and chart examples in the books and exploring the patterns by yourself are different worlds, especially if you try it to apply them for intraday trading, as you have much less time to recognize and interpret what’s going on. I am focussing on the emini NQ intraday and as a part-time trader I can this only a limited time. Some days I can’t see any clear setup in advance and on other days they jump into my eyes. But these days are not very often till now. But I am getting better with every additional hour of screen time! And may be I have only to work on my patience to let the setup coming to me. Especially if a gap on the open destroys my prepared concept for the next trading day I often don’t know, what I should doing or looking for now.

With the book set in my mind (which I am reading repeatedly) I have started again to read the archived commentaries from 2006 till now with much an better understanding and viewing charts from the Kane Trading members forum to learn from. Some of the charts I have printed for studying purposes, cause I couldn’t grasp what they were showing me at my first look. Due the progressing in my knowledge and experience I can now recognize many things, I couldn’t see before.

With the full book set you also get access to the Kane Trading members forum, where you can search for further valuable information and discuss your explored setups in advance with other members. What you not get in the forum are trade setups (picks) to follow without doing the work by yourself. But if you present your thoughts about an developing setup in advance or have any questions, you can get qualified response from the other members.

Hope I could give you a little decision support (and haven’t discouraged you), if Kane Trading Techniques could be the way to go for you.

Wish you the best,

Hawk

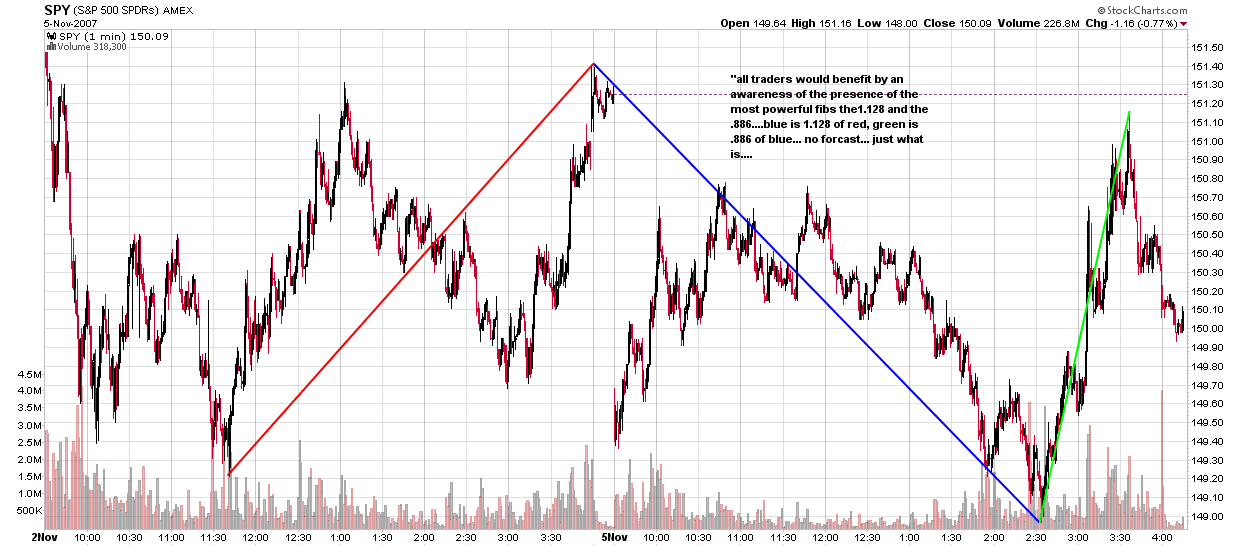

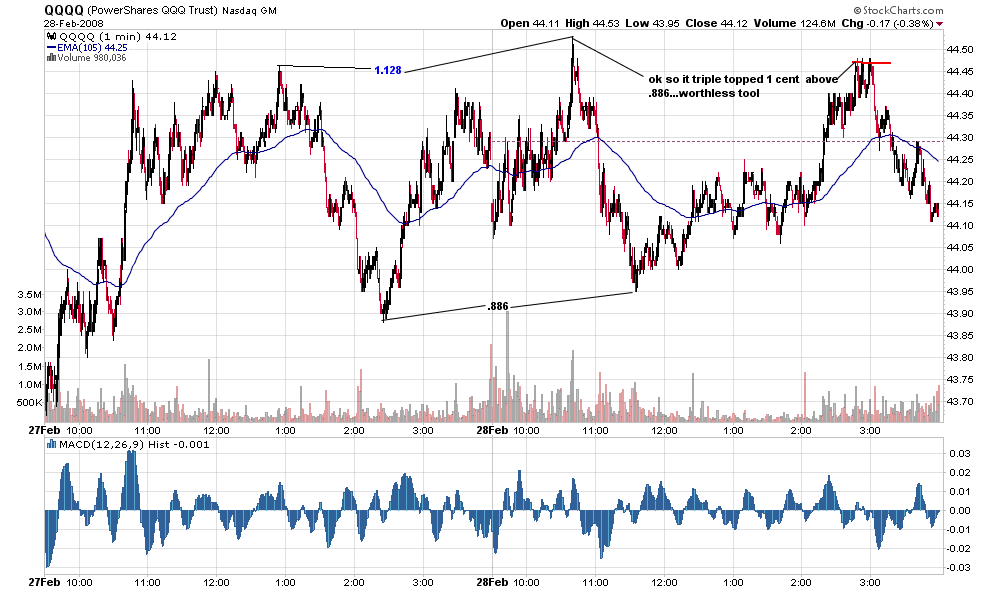

i will say it again.the 1.128 and the .886 are the most powerful fib. say or think what you will about jim kane's work....he is the person who did the work to show ALL traders the power of those two numbers... a great gift to all.

Thanks, Geo. I posted this at Market Geometry, too:

I just love that expression: "No forecast...just what is..." I might make that into a T-shirt to wear around, if you don't mind...

I just love that expression: "No forecast...just what is..." I might make that into a T-shirt to wear around, if you don't mind...

The Elliott/Fibonacci subject interested me since I started trading.

I tried to get into EW many times without much success until I came across Miner's work. Then I saw the "light"…

Hughes/DiNapoli took me diving into Fibonacci and I started reading also Pessavento and Fischer.

Carney flavored it all with his works on 5PP.

Parallel to all that, I was also reading Morge on Andrews Pitchfoks.

About five months ago I started seeing posts, in a forum, talking about the enlighten work of Jim Kane so I went to read all the material in his website.

Finally, in spite of their cost, I decided to buy his full set of books.

And there it was all!!!

All the great stuff I was learning was laid out in font of me in a perfectly coherent way.

Suddenly I could understand how all fit together.

I am finishing the second round of reading his books and I will read some of them for a third time.

The cost was well rewarded!!!

Keep writing, Jim!!! Please, keep writing.

Mario

I tried to get into EW many times without much success until I came across Miner's work. Then I saw the "light"…

Hughes/DiNapoli took me diving into Fibonacci and I started reading also Pessavento and Fischer.

Carney flavored it all with his works on 5PP.

Parallel to all that, I was also reading Morge on Andrews Pitchfoks.

About five months ago I started seeing posts, in a forum, talking about the enlighten work of Jim Kane so I went to read all the material in his website.

Finally, in spite of their cost, I decided to buy his full set of books.

And there it was all!!!

All the great stuff I was learning was laid out in font of me in a perfectly coherent way.

Suddenly I could understand how all fit together.

I am finishing the second round of reading his books and I will read some of them for a third time.

The cost was well rewarded!!!

Keep writing, Jim!!! Please, keep writing.

Mario

If I look a the "cost" (these books really aren't very expensive) of Jim's books based on what they bring to the table and in addition the tremendous value of the free member forum that comes with it I can only say: 'total bargain'.

yep.no forcasts, just what is... i continue to urge traders to know where the .886 and 1.128 are located.

every member of jim's forum knows the meaning of the lines and knows i only trade predefined trade setups off my list...thus at the 1.128 and both.886's there was a predefined setup separate from the numbers.. and that is how i trade price at a line and fib.. predefined trade setup in place... quick 90 second scan to see if wall and stack in place( both well known to the members).. trade on...i do not think this junk works because we're so smart.. i think it works because a lot of traders know this stuff but do not share it..jim teaches it for a modest fee and i give it away for free because nobody takes seriously anything shown for free.a trade setup i put in the public domain six years ago still hammers the market. i get emails from traders round the world thanking me for it.

. i trade it everey chance i get... but few traders take it seriously because it's free.

. i trade it everey chance i get... but few traders take it seriously because it's free.

where can I find that setup roofer ?

Hey, Bruce. I'm still around, I just haven't been posting in the public area much. I'll send you an e-mail with some details. I mostly post in my private area, where I'm posting many times on an average day. I'll use the same e-mail address I have for you. If that one isn't still good, let me know.

As for the above post, all I can say is that writing style is just how Nick writes, and I don't think he meant anything strange by it. I 'met' Nick a long time ago over in Scott Carney's Harmonic Trader chat room when he had that and I was active over there. He follows my work, too, and shows up from time to time, as his schedule allows. He sends me charts here and there, showing things he is looking at. I consider him fully 'legit'.

I may consider just deleting off this section, so no one will wonder anything about anything. I don't need any new 'business', and don't need to advertise looking for any. There is enough on my website for those that are interested to make a decision if they want to study my work. It's just something that 'runs in the background'. If someone finds the website by doing a targeted search (the only kind of buyer I'd want anyway), great. Otherwise, no problem, it's there waiting.

As I've said before, the mypivots audience are not the kind of traders who would be interested in my work anyway. I only have forums here because Guy offered them to me way back. And I only started this thread because someone over at Elite asked, legitimately, if anyone had any experience with my work, and I stumbled on that and it had gone unanswered. I asked a few of my students to make honest comments there. The firestorm that started within minutes was beyond comprehension. The entire thread was pulled shortly after that.

So, I figured if someone was doing a search for comments on my work, at least they could find this thread where I wouldn't allow that kind of shredding. Not because I have an interest in the postings, but because I would never allow that kind of behavior in any thread in a forum section I had. At least people can post their opinions as they see fit here. But, even that looks to perhaps be an issue. Like I said, I know what I have found, I know what I present in the books, I know what I show to one-on-one students, and I know I have presented more than enough for people to make a highly informed decision on all that. I don't need to do anything here to 'hawk for business'.

As for the above post, all I can say is that writing style is just how Nick writes, and I don't think he meant anything strange by it. I 'met' Nick a long time ago over in Scott Carney's Harmonic Trader chat room when he had that and I was active over there. He follows my work, too, and shows up from time to time, as his schedule allows. He sends me charts here and there, showing things he is looking at. I consider him fully 'legit'.

I may consider just deleting off this section, so no one will wonder anything about anything. I don't need any new 'business', and don't need to advertise looking for any. There is enough on my website for those that are interested to make a decision if they want to study my work. It's just something that 'runs in the background'. If someone finds the website by doing a targeted search (the only kind of buyer I'd want anyway), great. Otherwise, no problem, it's there waiting.

As I've said before, the mypivots audience are not the kind of traders who would be interested in my work anyway. I only have forums here because Guy offered them to me way back. And I only started this thread because someone over at Elite asked, legitimately, if anyone had any experience with my work, and I stumbled on that and it had gone unanswered. I asked a few of my students to make honest comments there. The firestorm that started within minutes was beyond comprehension. The entire thread was pulled shortly after that.

So, I figured if someone was doing a search for comments on my work, at least they could find this thread where I wouldn't allow that kind of shredding. Not because I have an interest in the postings, but because I would never allow that kind of behavior in any thread in a forum section I had. At least people can post their opinions as they see fit here. But, even that looks to perhaps be an issue. Like I said, I know what I have found, I know what I present in the books, I know what I show to one-on-one students, and I know I have presented more than enough for people to make a highly informed decision on all that. I don't need to do anything here to 'hawk for business'.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.