26 May 2005 (Thursday)

Session Start: Thu May 26 08:32:30 2005

Session Ident: #t1

[09:16:49] <guy> help wanted at 10 am

[09:26:28] <mashhad> Guy, will u wait 10 am before taking a position?

[09:26:54] <guy> no

[09:27:06] <guy> i'll get straight in on an alpha signal + OR

[09:27:08] <guy> looking now

[09:27:18] <guy> ES has an OR trade

[09:27:24] <mashhad> yes

[09:27:47] <guy> after the first minute you should reload AlphaA1

[09:28:01] <mashhad> ok

[09:28:43] <guy> watch the k-line in particular after the first minute

[09:29:02] <guy> if it is not lower than -1 then don't short the OR

[09:29:52] <mashhad> i see.. this will be interetesting.. first OR trade using alpha

[09:32:04] <mashhad> is your alpha + ? mine is

[09:32:13] <guy> yes

[09:32:18] <guy> alpha is +

[09:32:23] <guy> k-line is moving up

[09:33:01] <guy> so no short for me yet - on either ER2 or ES

[09:33:17] <mashhad> so according to JP's rule about 6.75 would be the rigt place right?

[09:34:03] <guy> well - i think 5.75 is the entry price limit order

[09:34:09] <guy> and the stop is 7.25

[09:34:51] <guy> so need to wait for a fill at 5.75 to get short the OR trade

[09:35:36] <mashhad> well, at the moment, alpha is not advising at 5.75

[09:35:57] <guy> exactly

[09:36:06] <guy> so i'm not shorting this because

[09:36:11] <guy> this is directly against alpha

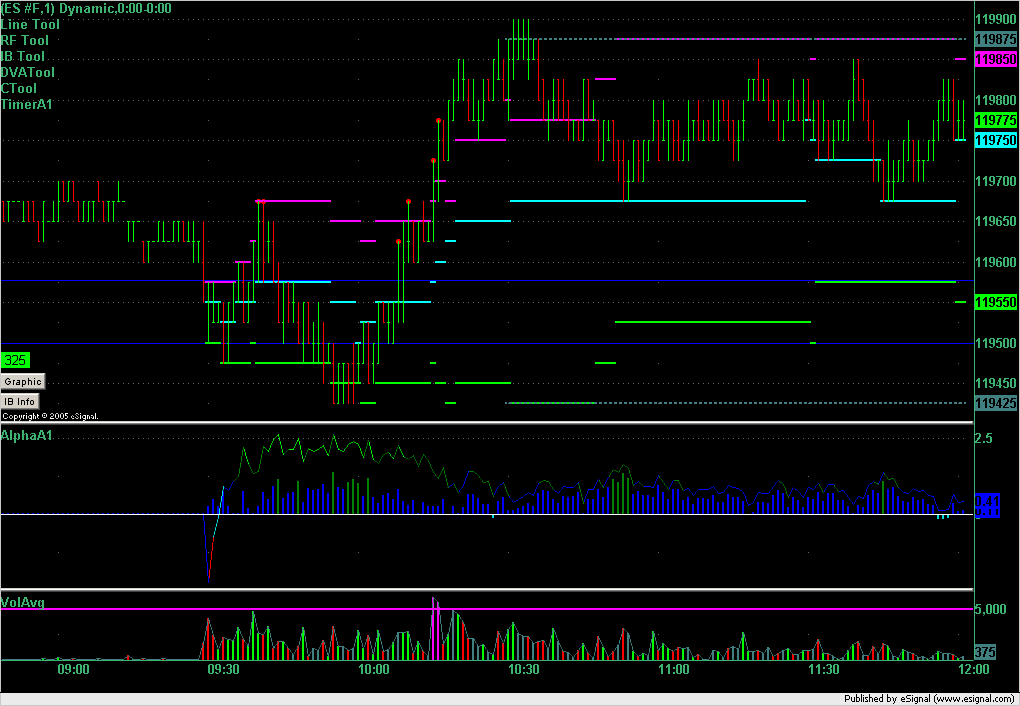

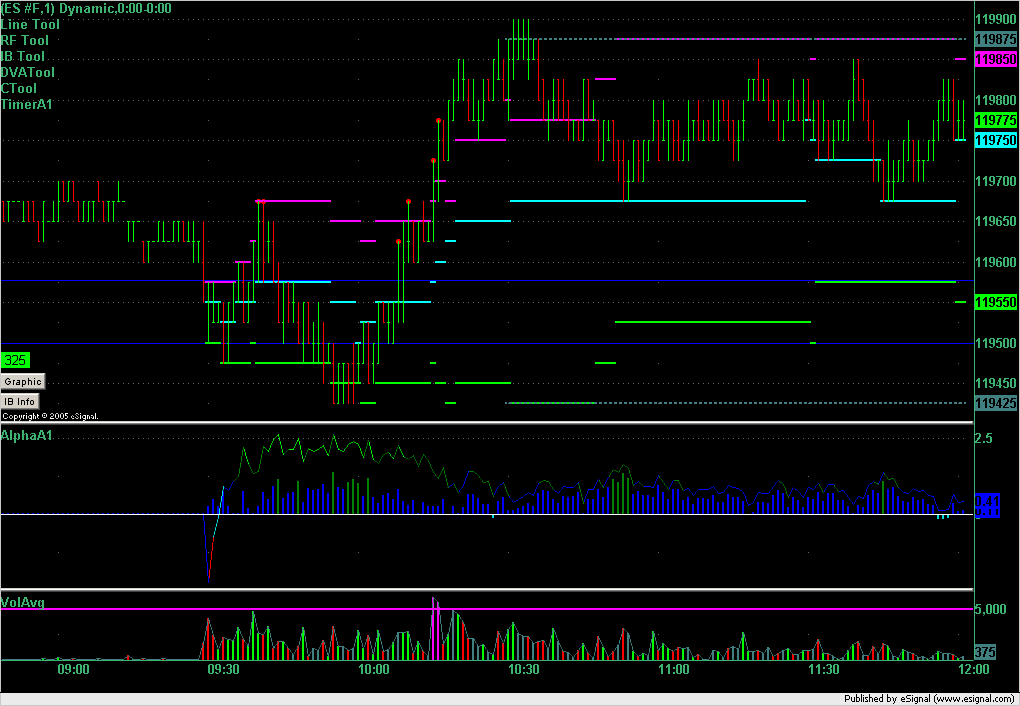

[09:36:46] <guy> Here is the ES chart

[09:36:54] <guy2>

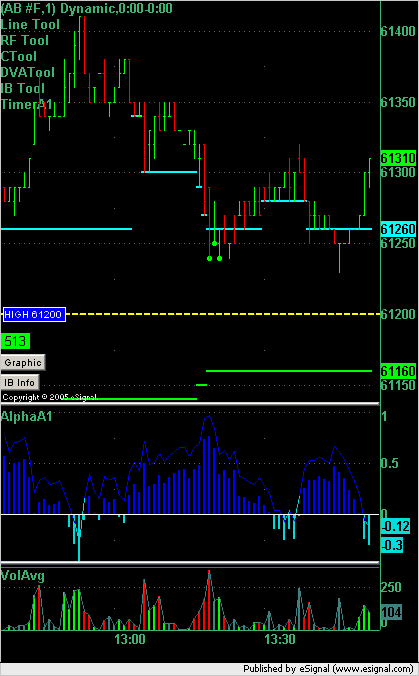

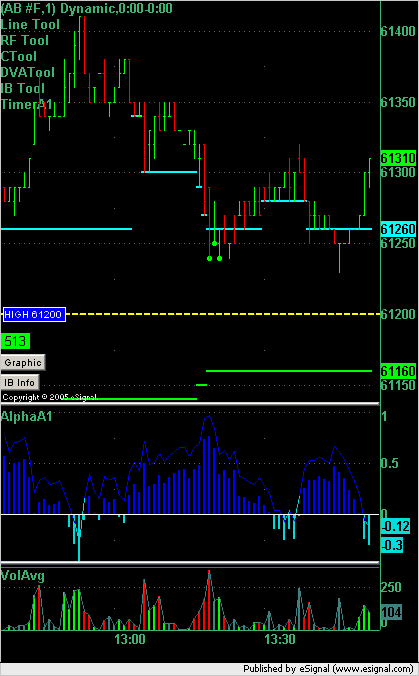

[09:37:10] <guy> Here is the ER2 chart:

[09:37:22] <guy2>

[09:38:51] <guy> so mash: even though this is a valid OR short here on both ER2 and ES I am NOT taking it

[09:39:01] <guy> because alpha has filtered me out of the trade

[09:39:15] <guy> if alpha changes before this OR trade is over and the trade is still valid

[09:39:19] <guy> then i will enter the short

[09:39:33] <mashhad> ok

[09:40:35] <guy> i'm actually watching the k-line a bit more than i am the value of alpha right now because we're at the open and k-line gives better indication after the first minute or two

[09:40:45] <guy> (and at extremes)

[09:41:20] <guy> Here is the ER2 chart:

[09:41:28] <guy2>

[09:41:39] <guy> the high k-line reading is saying we go up

[09:41:45] <guy> so no short OR here

[09:42:01] <guy> Same on ES:

[09:42:13] <guy2>

[09:45:00] <guy> ES Looks like a long to me here:

[09:45:01] <guy2>

[09:45:18] <guy> I'm thinking long off the bottom of the OR at 1195.00

[09:47:03] <mashhad> well, 6.75 was tue.'s high of the day

[09:47:18] <mashhad> so there may be some resistanse there for a long

[09:56:26] <guy> ES chart:

[09:56:47] <guy2>

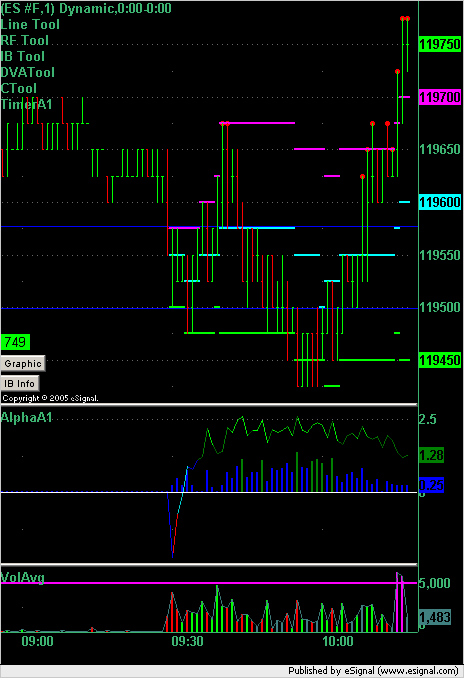

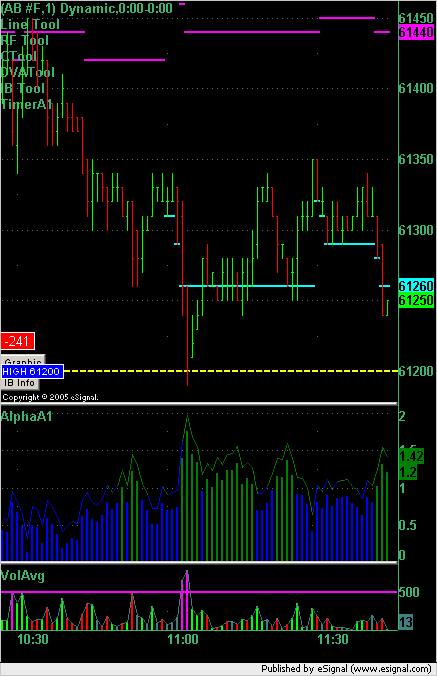

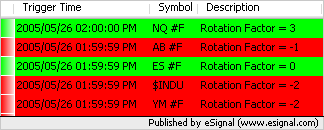

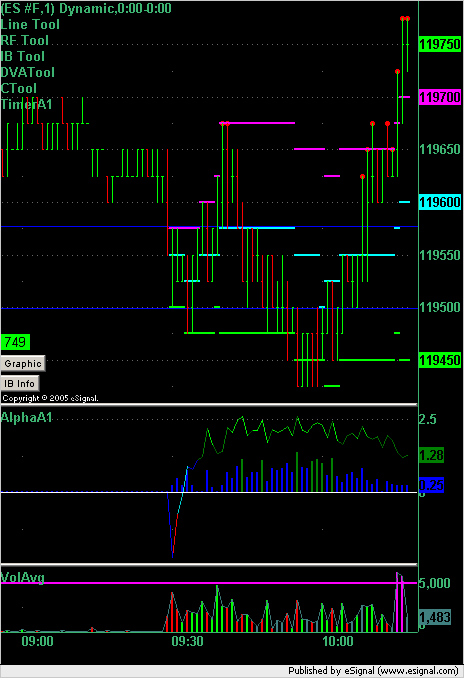

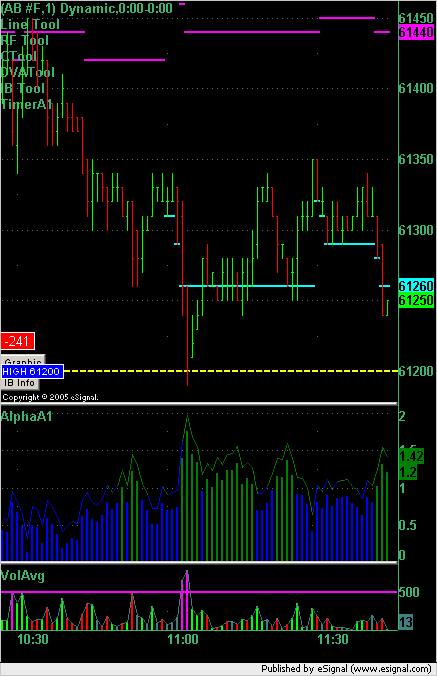

[10:05:20] <guy> Current reading on ER2

[10:05:25] <guy2>

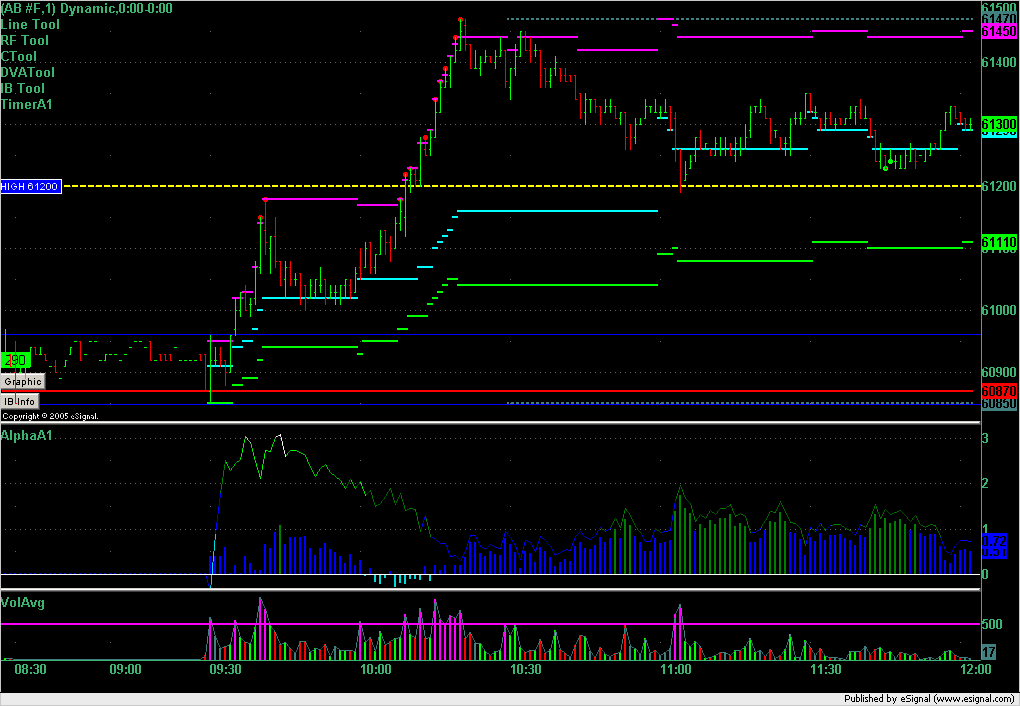

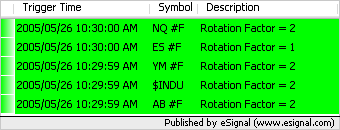

[10:13:19] <guy> And this is why I don't fade alpha on an OR trade:

[10:13:22] <guy2>

[10:13:50] <guy> you might notice a new indicator on that chart i've just posted

[10:14:06] <guy> That is what is drawing the red circles above the bars

[10:14:19] <guy> and the numbers in green above the buttons

[10:14:24] <guy> It's called TimerA1

[10:14:30] <mashhad> and what does that show?

[10:16:15] <mashhad> broke through 6.75 next res. should be 9.00 if it tries to go higher

[10:18:18] <guy> Here is the ES chart showing why I stayed out of the OR trade there:

[10:18:18] <guy2>

[10:18:42] <guy> hey mash: apart from making money with alpha you also need to think about the losing trades that it kept you out of

[10:18:50] <guy> as both a filter and a signaller

[10:21:08] <mashhad> yes... i do like that about alpha..

[10:23:21] <guy> i'm not sure how you would have played that OR trade but what I would do now if I were you would be to replay that trade and think about the OR rules that you use and see what you would have made/lost with and without the alpha there...

[10:23:59] <guy> you might have actually made money on the OR trade if you'd had small targets and tight stops

[10:24:13] <guy> but I think that the ultimate target on the OR trade is the VAH

[10:25:38] <mashhad> it was kind of close.. i like to take the trade +1.00 from top of open which would have been 6.75, and it would have paid me +2.00 if i had that fill, if no fill, i would have been out of this trade

[10:27:16] <guy> right - what trading platform are you using?

[10:27:42] <guy> i ask because if you're using ninja i think that it will give you a fairly accurate simulation of whether or not you got filled

[10:28:04] <guy> so if you enter your order at 6.75 and there were 1000 contracts there when you entered your order

[10:28:13] <guy> and subsequently 1000 trade at that price

[10:28:24] <guy> then it will give you a fill

[10:28:28] <guy> to keep it realistic

[10:28:46] <mashhad> i use my broker's platform

[10:28:56] <mashhad> it's not real fancy

[10:29:08] <mashhad> very simple

[10:29:53] <guy> k

[10:30:31] <guy> i only mention that because it makes testing more realistic

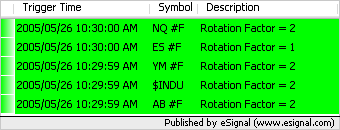

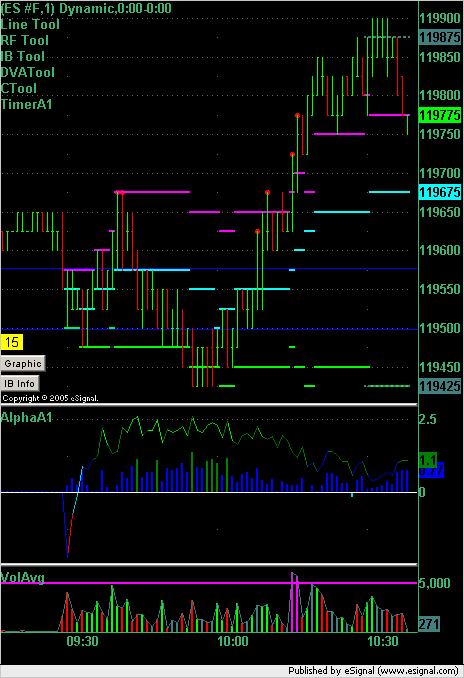

[10:30:32] <guy2>

[10:32:55] <mashhad> 99.00 is the weekly high

[10:34:28] <guy> and the pressure from alpha is easing

[10:38:20] <guy2>

[10:48:02] <fspeculator> EOM window dressing?

[10:48:29] <fspeculator> but there are still 3 days

[10:48:54] <fspeculator> i think the most deciding factor is relentless pumping (creation of money) by US Fed

[10:49:18] <mashhad> when is the next fed meeting?

[10:49:29] <fspeculator> 35days

[10:58:14] <guy2>

[10:58:39] <guy> 3 x +1 bars on alpha on ER2 there

[10:59:47] <tuna> divergence guy?

[11:00:33] <guy2>

[11:00:56] <guy> it looks like divergence but alpha is not designed to be used as a divergence tool because it is not an oscillator

[11:01:52] <mashhad> alpha gave a buy at 6.75 which happened to be that area of resistance we had earlier and DPOC

[11:02:40] <mashhad> i think it's gonna be a good signal...I should have taken it!

[11:02:51] <guy> yes it did and also alpha is +ve so we're looking for buy areas

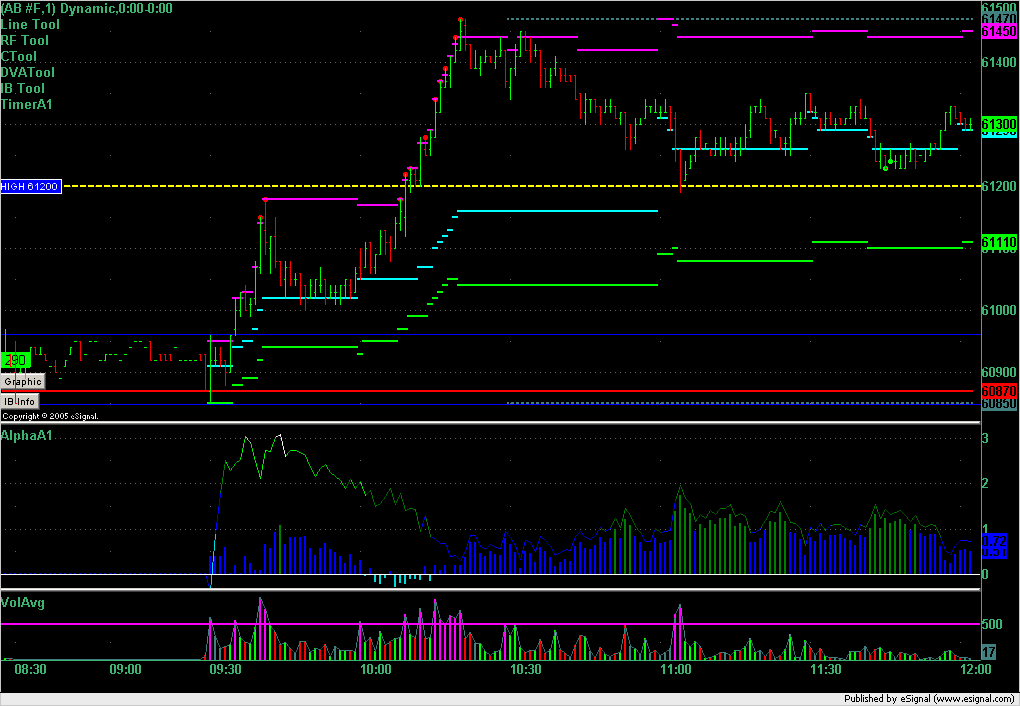

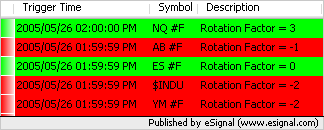

[11:05:16] <guy> Buys AB @ 612

[11:06:09] <tuna> me too

[11:07:23] <guy> can someone tell me what oil is doing - i've lost my oil chart

[11:07:34] <tuna> 51.35

[11:07:49] <tuna> 51.27

[11:08:21] <guy> thanks

[11:08:36] <fspeculator> +0.64%

[11:08:42] <fspeculator> on top of yesterday's +3.3%

[11:08:55] <guy> thanks fspec

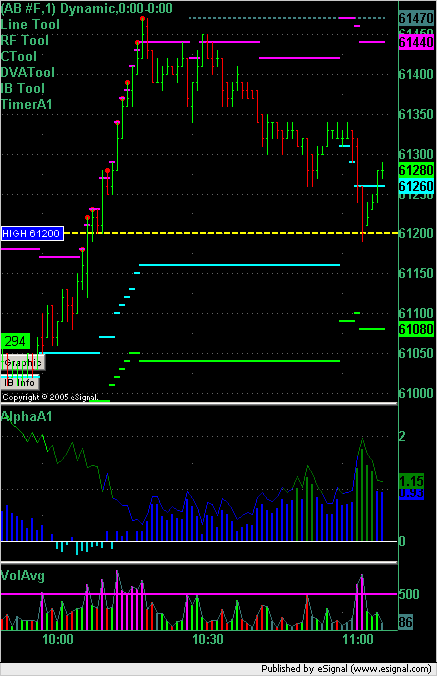

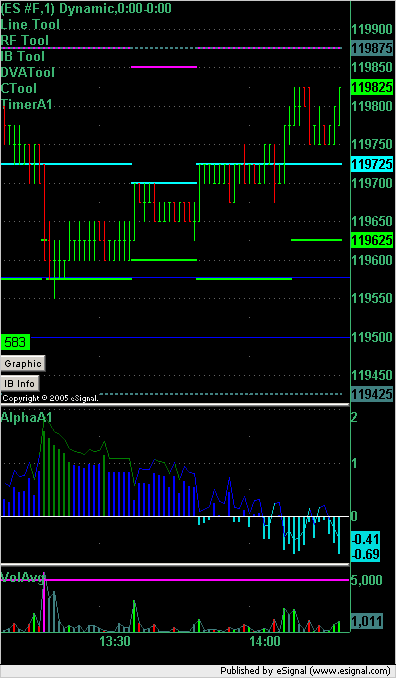

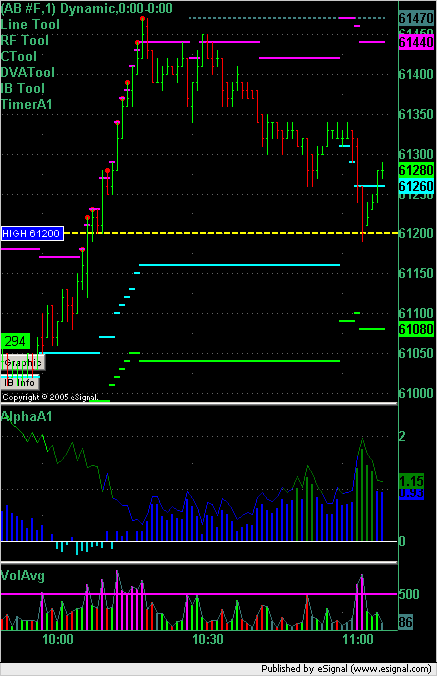

[11:09:00] <guy> here is my trade

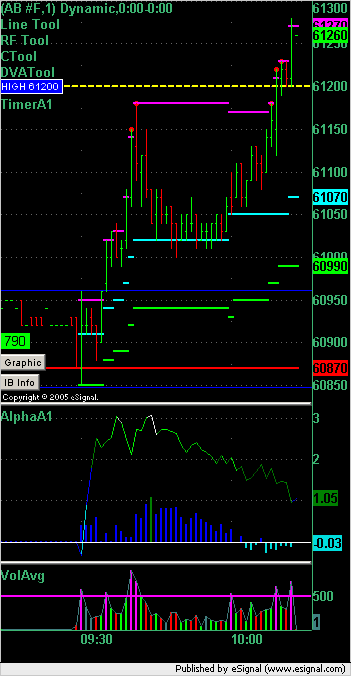

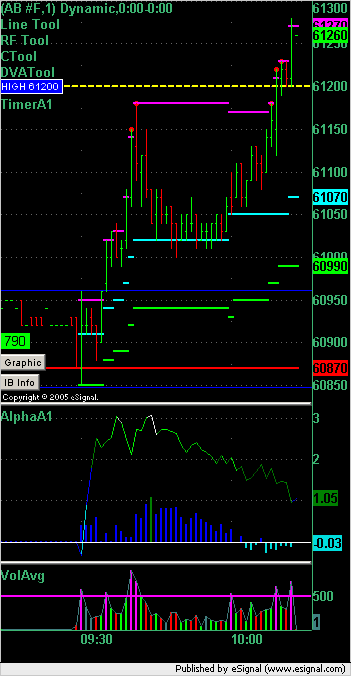

[11:09:01] <guy2>

[11:09:07] <guy> it was 90% alpha instigated

[11:09:25] <guy> and 10% was off the high (all sessions) from yest.

[11:10:08] <guy> exit stop set AB @ 611

[11:10:29] <guy> still very much in the embryo stage so we haven't made anything on it yet and could still lose 1 point

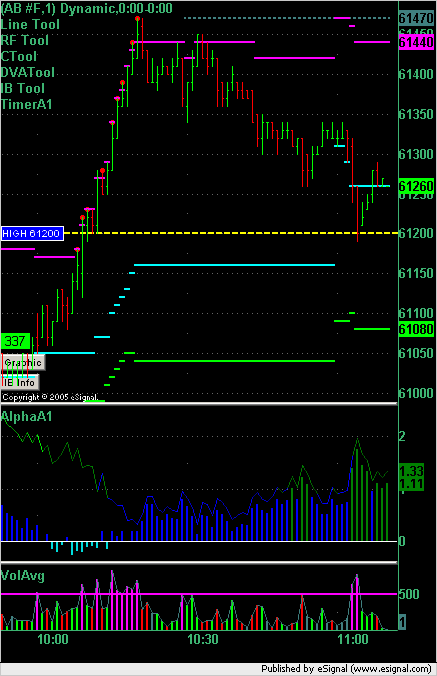

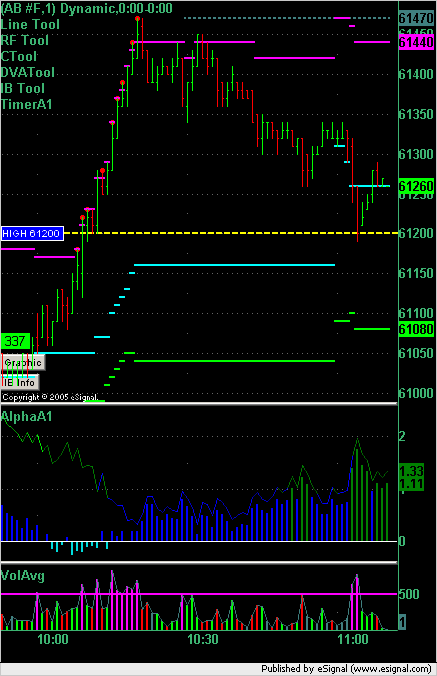

[11:10:52] <guy> good news is that alpha continues to support the trade:

[11:10:53] <tuna> it was single instigated here

[11:10:55] <guy2>

[11:11:07] <tuna> oh goody

[11:12:08] <tuna> plus vwap

[11:12:38] <tuna> vwap was real close to there too i should add

[11:13:56] <guy> vwap is volume weighted average price right?

[11:14:39] <fspeculator> y

[11:14:49] <fspeculator> volume poc so to say

[11:15:11] <tuna> well said fspec

[11:15:32] <guy> okay

[11:15:44] <guy> how do you identify it tuna? using the MP chart?

[11:15:51] <guy> that long is also a single print long btw

[11:15:56] <tuna> wish esig had it

[11:16:09] <tuna> right

[11:16:30] <tuna> that was my entry

[11:16:41] <tuna> that and vwap

[11:17:06] <fspeculator> vwap 96.75?

[11:17:20] <tuna> 612's

[11:17:25] <guy> so what do you use? chart/software to identify VWAP?

[11:17:39] <tuna> qt

[11:17:59] <guy> k

[11:18:00] <fspeculator> i'm a bit weary about these things

[11:18:08] <fspeculator> in 7pt ES ranges (let alone4pt)

[11:18:17] <tuna> fabulos charts amost free

[11:18:18] <fspeculator> every tick has a "meaning"

[11:18:34] <guy> the single print strategy has another winner today

[11:18:39] <fspeculator> tuna you use it with IB and backfill?

[11:18:47] <tuna> no

[11:18:57] <tuna> iqfeed

[11:19:15] <tuna> 1 off at 13

[11:20:06] <guy> [11:09:07] <guy> it was 90% alpha instigated

[11:20:06] <guy> [11:09:25] <guy> and 10% was off the high (all sessions) from yest.

[11:20:28] <guy> Had I noticed at the time that there was a single there I would have had even MORE conviction on that trade

[11:20:45] <tuna> lol

[11:20:53] <tuna> jeez guy

[11:21:02] <guy> I'm going to have to modify the DVATool to put in confirmed and unconfirmed singles for me

[11:21:16] <guy> so I don't miss stuff like that

[11:21:40] <tuna> those little things

[11:22:01] <fspeculator> guy you mean unconf singles for today's trade?

[11:22:28] <guy> correct fspec: so once a single is created but not confirmed a line is drawn in

[11:22:35] <guy> and if we trade through it then it's removed

[11:22:51] <guy> and the unconfirmed line will be a different style/color

[11:22:58] <guy> so we know that it's not a confirmed single

[11:23:28] <guy> and then once confirmed changed to the standard singles color

[11:28:12] <tuna> sounds like a plan

[11:30:15] <tuna> another one off here

[11:30:27] <guy> nice tuna

[11:30:32] <guy2>

[11:30:36] <tuna> tanks guy

[11:36:12] <tuna> chicago

[11:36:55] <guy> k

[11:41:31] <guy> okay my thinking here and now:

[11:41:40] <guy2>

[11:41:46] <guy> i am thinking that we can get RE to the upside

[11:42:00] <guy> so i'm looking to hold this long until at least RE and beyond

[11:42:14] <tuna> k

[11:42:25] <guy> if we hit RE extension I will look at 2 things:

[11:42:46] <guy> 1. If RE is a spike over the IB and no new business

[11:42:48] <guy> and

[11:42:56] <guy> 2. alpha not showing buying signs

[11:43:01] <guy> then i'll probably get out

[11:43:33] <guy> if, however, there is good follow through in both buying at and beyond RE indicating new business there and alpha shows follow through

[11:43:51] <guy> then I'll try and sit on it for the rest of the day hoping for it to turn into a trend day up

[11:44:05] <guy> but as i've been typing that the market is going against this trade

[11:44:25] <tuna> hmmm we have oops had a ledge

[11:44:28] <guy2>

[11:46:06] <tuna> another trip back to the vwap

[11:47:31] <tuna> prolly wont hold

[11:47:35] <tuna> imo

[11:47:54] <tuna> but i hope im wrong

[11:49:47] <guy> hard to tell but alpha seems green and happy so i will play out the odds

[11:50:31] <tuna> yeah im still in too with last 1

[11:52:16] <tuna> 89 ema at 11 on a 3min chart fwiw

[11:53:21] <guy> i've got my oil chart back and i can see the problem

[11:53:42] <guy> oil is going up and that's what is puting the dampener on the equities

[11:55:50] <tuna> was some sort of news about the bigs saying they're not gonna drill/develope new fields or something like that

[11:56:42] <guy> which should push the price down not up...

[11:57:05] <tuna> yeah,,one would think so

[11:58:59] <fspeculator> guy have you run some correlation analysis of oil-vs-stocks?

[11:59:18] <guy> yes

[11:59:31] <fspeculator> what was the result? and what timeframe please

[11:59:49] <fspeculator> and how? was it up-up, up-down etc?

[12:00:09] <fspeculator> or you take the magnitude of the move into account?

[12:00:23] <fspeculator> bec all i see is that oil is advancing up along equities

[12:00:30] <guy2>

[12:00:32] <fspeculator> and also bonds are advancing along equities

[12:01:04] <mashhad> Guy, would you say that ES is showing a little weakness on the long side since alpha went - for a few mins?

[12:01:26] <guy> Oil and E-mini S&P500

[12:01:30] <guy> that link fspec

[12:02:20] <guy> mash: here is the ES chart:

[12:02:26] <guy2>

[12:02:28] <guy> and yes, I agree with your comment

[12:02:54] <guy> especially when compared to ER2 chart:

[12:03:01] <mashhad> ok

[12:03:03] <guy> where alpha is showing far more strength on the ER2

[12:03:04] <guy2>

[12:09:15] <fspeculator> guy your alpha is mkt specific?

[12:09:21] <fspeculator> ie different for ES than ER?

[12:12:19] <guy> no - same formula

[12:13:51] <tuna> time to water the flowers bbiab

[12:14:16] <guy> k

[12:16:18] <fspeculator> guy i've read your piece on oil

[12:16:42] <fspeculator> i think if you do an analysis over a long period of 6-12mo or more

[12:17:03] <fspeculator> that last few years oil has had very little NEGATIVE impact on stocks

[12:17:22] <fspeculator> you may even find that it "boosted" stocks (positive correl)

[12:17:37] <fspeculator> as both oil and stocks had huge run-ups since 2003

[12:17:47] <fspeculator> my opinion is that the reason is inflation

[12:18:10] <guy> fspec - i think that i noticed most of the -ve correlation at oil extremes

[12:18:23] <fspeculator> increasing price in stocks, real-estate, oil, gold etc

[12:19:21] <fspeculator> as paper money becomes more abundant, EVERYTHING goes higher in price

[12:19:40] <fspeculator> everything of some scarcity

[12:29:30] <tuna> hmmm

[12:30:12] <tuna> shoulda changed the oil too

[12:30:39] <guy> :)

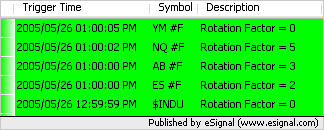

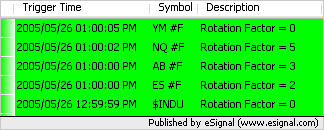

[12:30:53] <guy> here come the split counts

[12:31:00] <guy2>

[12:31:35] <guy> the one that i'm long is showing the worst split count

[12:31:50] <tuna> i noticed

[12:32:17] <tuna> sox are very strong

[12:32:34] <tuna> above my weekly r1

[12:53:28] <guy> exit stop moved to breakeven AB @ 612

[13:00:36] <guy2>

[13:02:09] <fspeculator> guy you really caught the bottom tick this time? :-)

[13:02:31] <guy> i did - so did the 'single print' strategy

[13:03:06] <guy> but could still breakeven if I get stopped

[13:04:03] <tuna> does it count if you didnt see the single?

[13:04:38] <guy> yes - the forward testing single counts because you can do the figures after the day is over

[13:04:42] <guy> it's a mechanical system

[13:04:53] <guy> and i'm testing it and not trading it

[13:05:04] <tuna> oh

[13:05:05] <guy> it is just coincidence that i'm long

[13:05:10] <guy> at the same point

[13:05:25] <tuna> yes

[13:05:26] <guy> i hadn't noticed that the forward testing system was also long

[13:06:16] <guy> i'm trying to work on the algorithm now to get the unconfirmed singles to print on the chart - boy it's complicated

[13:07:16] <tuna> see if you can come up with a vwap that plots like a ma

[13:07:45] <guy> i think i've tried that before but i don't think that esignal gives me the volume info that i need

[13:07:57] <tuna> ahh

[13:08:00] <tuna> ok

[13:08:08] <mashhad> Guy, how about VAh/l and POC?

[13:08:23] <guy> DVATool plots those mash

[13:08:26] <guy> it's an option

[13:08:44] <mashhad> oh,ok.. because i didn't see them on your charts

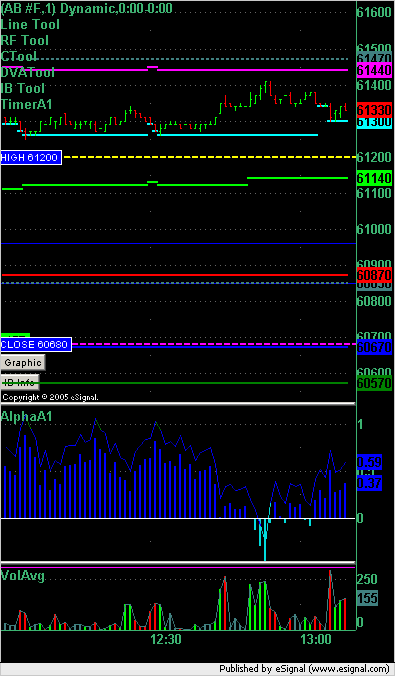

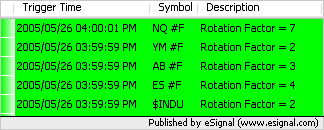

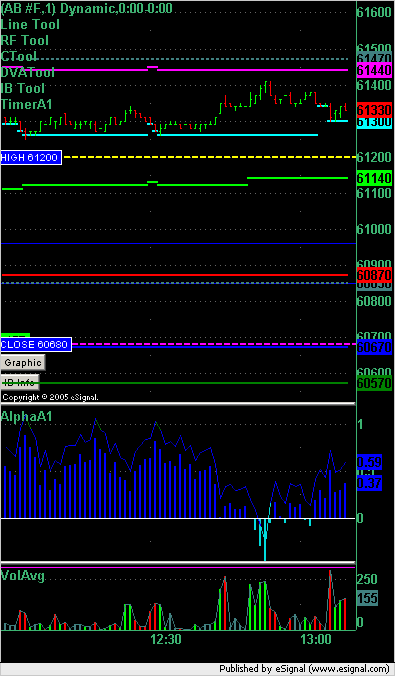

[13:09:48] <guy> Have a look at this chart mash:

[13:09:53] <guy2>

[13:10:14] <guy> from the bottom, the solid lines, green, blue, red

[13:10:21] <guy> are VAL, POC, VAH

[13:10:33] <guy> and those are put there by DVATool

[13:10:48] <guy> and then higher up the lime, cyan and pink lines are the

[13:10:57] <guy> DVAL, DPOC, and DVAH

[13:11:06] <guy> also put there by DVATool

[13:12:06] <guy> all the colors and styles can be changed

[13:12:13] <mashhad> so 608.30 which is the VAH, is that the gray line?

[13:14:08] <guy> no, the solid red line at 608.7 is the VAH

[13:14:21] <guy> different to esignal's which is 608.3

[13:15:02] <mashhad> you mean it calculates on it's own?

[13:15:05] <guy> i'm still working on the formula and not 100% convinced that esignal is correct here

[13:15:23] <guy> but i'm planning on adding an option to replicate esignal if that's what we want to do

[13:15:31] <guy> yes it calculates it mash

[13:15:42] <guy> from the previous day's data

[13:15:50] <mashhad> i see..

[13:16:05] <guy> the grey dotted line is the IBL

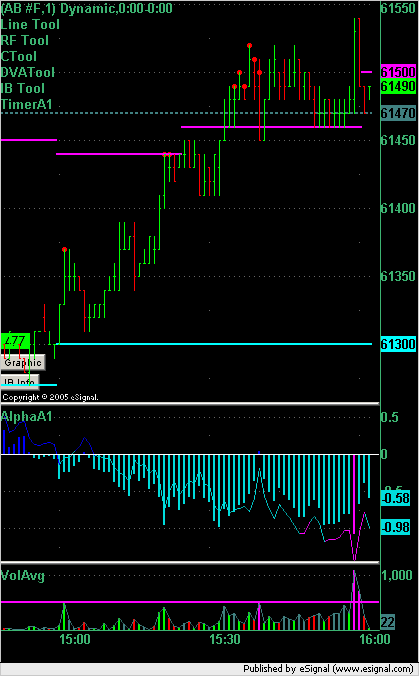

[13:17:23] <guy> another useful feature of the DVATool is the Graphic button

[13:17:38] <guy> On this ES chart:

[13:17:49] <guy2>

[13:17:49] <guy> see the Graphic button in the bottom left hand corner?

[13:18:11] <guy> Well if you click it you get this graphic:

[13:18:16] <guy2>

[13:18:35] <guy> which allows you to quickly view an MP graphic off any line chart without having to bring up a seperate MP chart

[13:19:23] <mashhad> but these VA's are different from E-signal

[13:20:17] <mashhad> right now es-gnals's val is 6.75 and your is 5.75

[13:21:19] <guy> i've got 6.25 on esig

[13:21:46] <guy> and 5.75 on mine

[13:21:51] <mashhad> now, but when u posted it was 6.75.. in anycase, 6.25 is 0.5 diff too

[13:22:30] <guy> true

[13:22:52] <guy> i'm looking into the difference

[13:22:59] <guy> i'll see if i can resolve it

[13:23:16] <mashhad> well, u never know though, yours might be more accurte

[13:24:21] <mashhad> got to observe it for a while .. it's difficult on Dvas but on VA's it could always be looked at for the opening trades to see which one gives a better signal, yours or e-signals

[13:24:24] <guy> well mine is according to the Dalton book

[13:24:36] <guy> and the esignal one according to the steidlmeyer book

[13:24:45] <guy> and it is an "area"

[13:24:54] <guy> which I use alpha with

[13:25:01] <guy> so it doesn't affect my profits

[13:25:12] <guy> but I can see how other people would prefer it to be to the tick

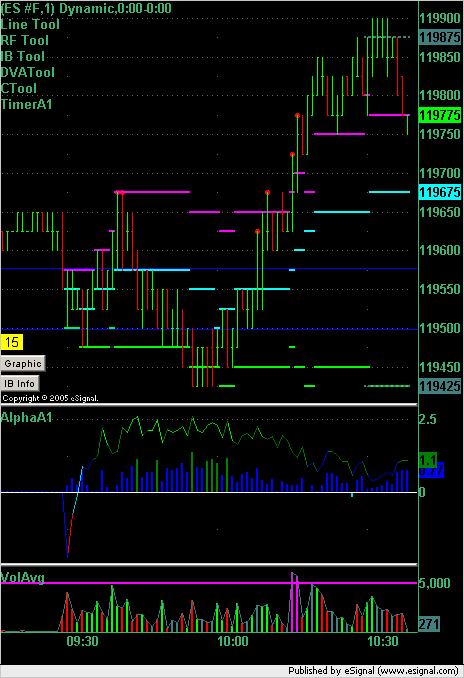

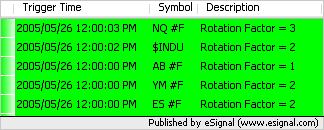

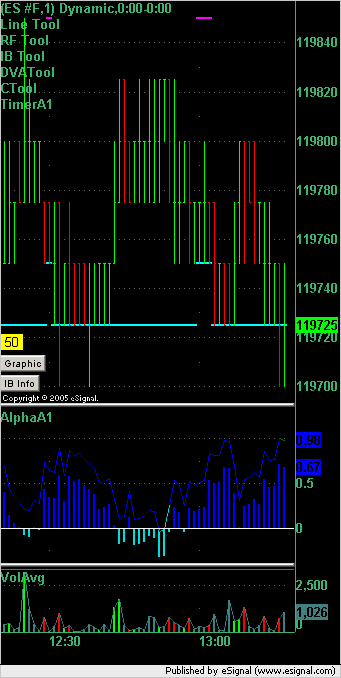

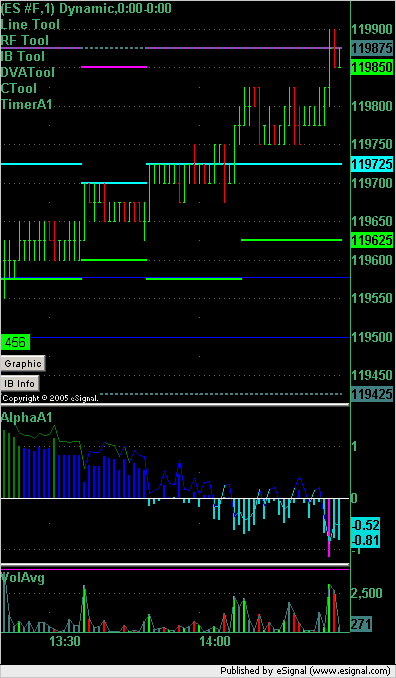

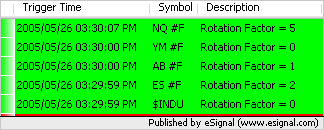

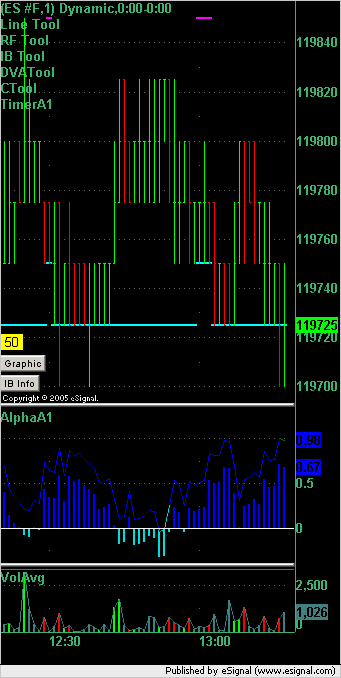

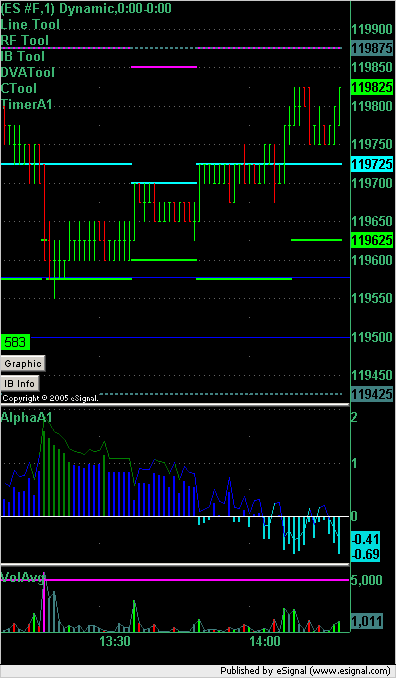

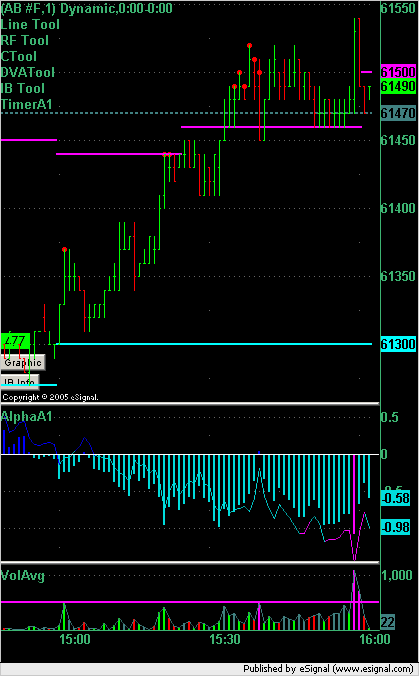

[13:28:36] <guy> Here is a chart showing the new TimingA1 tool

[13:28:48] <guy2>

[13:28:59] <guy> Sorry TimerA1

[13:29:29] <guy> you can see the parameters that I've set: 20, 800, -400

[13:29:54] <guy> and it put 2 green buy blobs around 11:40

[13:30:10] <guy> and has just now put 3 green buy blobs at this recent low

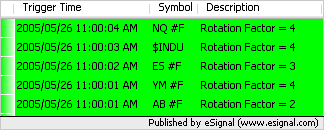

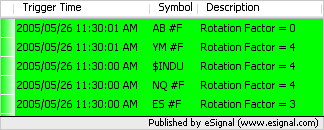

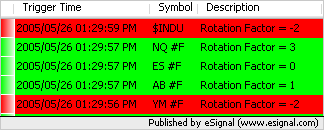

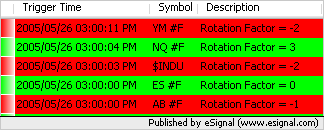

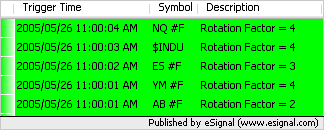

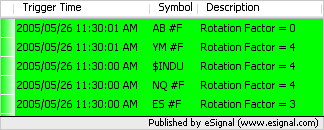

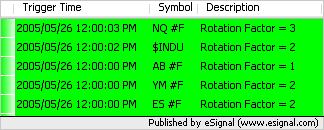

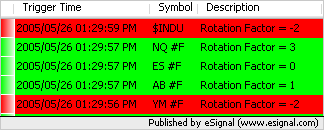

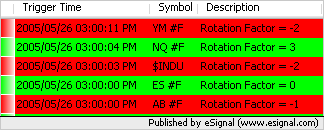

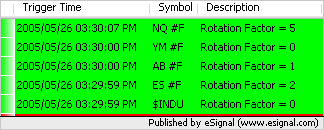

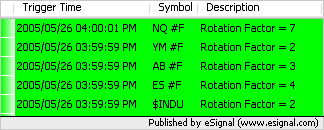

[13:30:24] <guy> current RF:

[13:30:32] <guy2>

[13:31:41] <guy> bbiab - hard stop in place

[13:38:45] <tuna> that was just anoyher trip to the vwap on er2

[13:38:53] <tuna> another

[13:51:39] <guy> Exited all Long AB at 613 --> + 1

[13:52:04] <guy2>

[13:52:09] <tuna> vn

[13:52:12] <guy> support from alpha is no longer with us

[13:52:21] <guy> so i've decided to abandon this trade here

[13:53:40] <guy> thx tuna

[13:55:24] <tuna> i still have the 1 long

[13:55:54] <tuna> almost added near dval

[13:56:06] <mashhad> i am looking at a place to short on ES

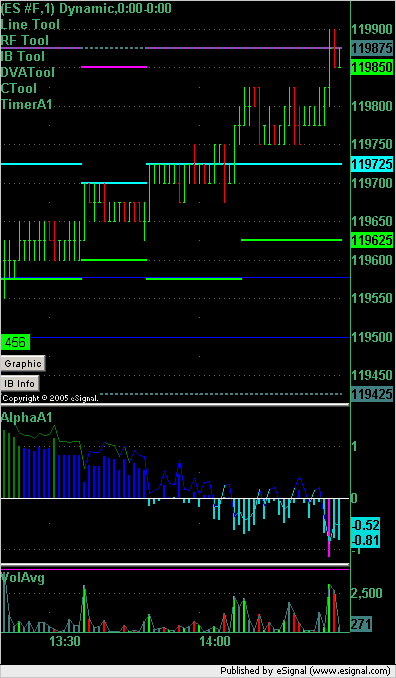

[13:59:30] <guy> here is the ES chart:

[13:59:36] <guy> why do you want to short mash?

[13:59:37] <guy2>

[13:59:43] <guy> we've just had an alpha buy

[14:00:06] <guy> are you looking to short the DVAH?

[14:00:17] <mashhad> yes

[14:00:23] <guy> RF's for ES are 0:

[14:00:29] <guy2>

[14:00:54] <guy> I have DVAH at 98.75 = what does esig MP have?

[14:01:04] <mashhad> same

[14:01:36] <mashhad> i am working 8.50 at the moment

[14:02:28] <guy> good strategy, 99.00 is HOD and that's 2 ticks below that and 1 tick below IBH

[14:02:46] <mashhad> and if i get filled, i am only risking 4 ticks

[14:02:58] <guy> the only thing that I would watch in your position is the value of alpha when you get filled

[14:03:11] <mashhad> exactly

[14:03:29] <tuna> keep in mind spoos has re up

[14:03:33] <tuna> fwiw

[14:03:45] <guy> how many ticks RE in SP?

[14:03:51] <tuna> 4

[14:04:13] <mashhad> was that in the f bracket?

[14:04:20] <tuna> just thought id pass it along

[14:04:28] <tuna> yes sir

[14:04:33] <mashhad> ok

[14:05:06] <fspeculator> just 4 ticks in RE?

[14:05:08] <fspeculator> in SP?

[14:05:20] <mashhad> now e-signal dvah dropped to 8.25..yours?

[14:05:45] <guy> no still at 8.75

[14:06:12] <tuna> 8.25 here

[14:06:15] <tuna> too

[14:07:06] <guy> you got MP on QT tuna?

[14:07:16] <tuna> spoos doesnt have that bottom ledge like es does

[14:08:23] <tuna> but it has a top one

[14:09:53] <tuna> no guy qt doesnt have mp

[14:11:37] <tuna> spoos chart isnt nearly as ugly as es imho

[14:12:40] <guy> how do you see the MP chart tuna?

[14:13:56] <tuna> it just doesnt have that bottom ledge on the 'p' like the es does,,also re up unlike es

[14:17:40] <mashhad> it doesn't look like alpha is gonna give a strong sell signal at 8.50

[14:18:12] <mashhad> moved order to 8.75

[14:18:45] <guy> here's your chart mash:

[14:18:50] <guy> you should see the same on yours

[14:18:56] <guy2>

[14:19:07] <guy> so i have both IBH and DVAH

[14:19:12] <guy> at same 98.75

[14:19:21] <guy> and alpha at around -.5

[14:25:34] <tuna> guy,new paltalk will try to auto start on your start up fwiw

[14:26:22] <tuna> tries to load a trojan too

[14:26:52] <tuna> pm's sit in the tray now

[14:27:34] <guy> thanks tuna

[14:28:01] <guy> what cleans out the trojan? adaware? pest patrol?

[14:28:12] <mashhad> s 98.75

[14:28:20] <guy> good trade mash

[14:28:27] <mashhad> hard stop 00.25

[14:28:34] <tuna> nod32

[14:28:43] <guy2>

[14:28:47] <tuna> i use nod32 beta

[14:28:50] <guy> there's your chart mash

[14:28:56] <guy> good luck

[14:29:10] <mashhad> thanks

[14:29:15] <guy> you've got alpha + DVAH + IBH + HOD all on your side

[14:29:25] <guy> i have to step away now but will be back...

[14:29:36] <tuna> spoos single ticked

[14:29:44] <tuna> fwiw

[14:31:18] <mashhad> what do u show for ur dval?

[14:31:43] <tuna> er2 is trying my patience again

[14:32:03] <tuna> me?

[14:32:29] <mashhad> no guy

[14:37:32] <guy> my DVAL is 1196.25 now

[14:37:47] <guy> here is a chart

[14:37:51] <guy> DVAL is the lime line

[14:37:53] <tuna> oil closed red btw

[14:37:57] <guy2>

[14:38:09] <guy> you can see that it dipped to 96.00 but it's back at 96.25 now

[14:38:38] <mashhad> so urs is 6.25 vs. esig 6.75

[14:38:49] <guy> yes

[14:39:01] <guy> very nice trade btw

[14:39:06] <guy> thanks for the oil update tuan

[14:39:07] <mashhad> btw, your dvah was more accurate since we hit 99

[14:39:08] <guy> tuna

[14:39:16] <guy> bbiab

[14:39:17] <mashhad> +2 on 1st contract! :)

[14:39:27] <guy> excellent !! :)

[14:39:49] <mashhad> setting my stop at 99.25 against any range extension

[14:42:49] <tuna> nice mash

[14:43:56] <mashhad> thanks

[15:00:36] <guy2>

[15:31:43] <guy2>

[15:35:25] <mashhad> out -0.50

[15:35:58] <guy> you made money though

[15:36:05] <guy> good hold there

[15:36:06] <tuna> lol guy

[15:36:08] <mashhad> yes,

[15:36:22] <mashhad> made 1.5+

[15:36:43] <mashhad> i actually got to run, see you tomorrow

[15:36:45] <tuna> nice mash

[15:37:16] <tuna> guy i still have the last 1

[15:37:33] <guy> excellent tuna!

[15:37:49] <tuna> what a test

[15:37:59] <guy> very good hold there

[15:38:13] <tuna> was NOT easy

[15:41:47] <tuna> but it was a free trade,, so not too bad

[15:42:26] <guy> true

[15:50:15] <tuna> seems like singles that match up with the vwap work pretty well

[16:00:50] <guy2>

[16:01:35] <guy> This is interesting:

[16:01:40] <guy2>

[16:01:46] <guy> alpha on ES is showing a buy signal

[16:01:54] <guy> and on ER2 a sell signal

[16:02:04] <guy> don't know if i've ever seen that together before

[16:02:12] <tuna> thx guy

[16:02:30] <guy2>

[16:02:33] <guy> y/w tuna

[16:02:49] <guy> still long tuna?

[16:03:18] <tuna> no

[16:03:47] <guy> good trading - you must have taken about 3 points on that last contract

[16:04:53] <tuna> yep last 1 was woth the wait

[16:04:59] <tuna> worth

[16:05:02] <guy> excellent :)

[16:05:13] <guy> i like it when people make points :)

[16:05:39] <tuna> was that or go change the oil

[16:05:55] <guy> finished watering the garden then?

[16:06:02] <tuna> yes

[16:06:21] <guy> changing the oil on your car?

[16:06:28] <tuna> right

[16:07:01] <guy> messy job - but has to be done

[16:07:13] <tuna> i have all weekend to do that tho

[16:07:56] <guy> not going away for w/e then?

[16:08:10] <tuna> nahh

[16:08:45] <tuna> cant afford the gas ;)

[16:08:53] <guy> :)

[16:09:07] <guy> It looks like the single print strategy is going to close its last contract at the last traded price

[16:09:24] <guy> I've just had to add another rule to the strategy that says that it doesn't carry overnight

[16:09:36] <guy> and that any open contracts close at the last traded price

[16:10:15] <tuna> im too chicken to hold overnite

[16:10:38] <guy> best not to unless you've got a good buffer and good reason

[16:11:28] <tuna> mebbe shorts are ok,,but still, anything can happen

[16:15:59] <guy> I'll update the singles shortly:

[16:16:19] <tuna> thx again guy

[16:17:35] <guy> y/w tuna

[16:24:52] <guy> Single print strategy made $870 today and cumulative for month is $2,150

[16:25:27] <guy> gn all

[16:26:25] * Disconnected

Session Close: Thu May 26 16:26:28 2005

Session Ident: #t1

[09:16:49] <guy> help wanted at 10 am

[09:26:28] <mashhad> Guy, will u wait 10 am before taking a position?

[09:26:54] <guy> no

[09:27:06] <guy> i'll get straight in on an alpha signal + OR

[09:27:08] <guy> looking now

[09:27:18] <guy> ES has an OR trade

[09:27:24] <mashhad> yes

[09:27:47] <guy> after the first minute you should reload AlphaA1

[09:28:01] <mashhad> ok

[09:28:43] <guy> watch the k-line in particular after the first minute

[09:29:02] <guy> if it is not lower than -1 then don't short the OR

[09:29:52] <mashhad> i see.. this will be interetesting.. first OR trade using alpha

[09:32:04] <mashhad> is your alpha + ? mine is

[09:32:13] <guy> yes

[09:32:18] <guy> alpha is +

[09:32:23] <guy> k-line is moving up

[09:33:01] <guy> so no short for me yet - on either ER2 or ES

[09:33:17] <mashhad> so according to JP's rule about 6.75 would be the rigt place right?

[09:34:03] <guy> well - i think 5.75 is the entry price limit order

[09:34:09] <guy> and the stop is 7.25

[09:34:51] <guy> so need to wait for a fill at 5.75 to get short the OR trade

[09:35:36] <mashhad> well, at the moment, alpha is not advising at 5.75

[09:35:57] <guy> exactly

[09:36:06] <guy> so i'm not shorting this because

[09:36:11] <guy> this is directly against alpha

[09:36:46] <guy> Here is the ES chart

[09:36:54] <guy2>

[09:37:10] <guy> Here is the ER2 chart:

[09:37:22] <guy2>

[09:38:51] <guy> so mash: even though this is a valid OR short here on both ER2 and ES I am NOT taking it

[09:39:01] <guy> because alpha has filtered me out of the trade

[09:39:15] <guy> if alpha changes before this OR trade is over and the trade is still valid

[09:39:19] <guy> then i will enter the short

[09:39:33] <mashhad> ok

[09:40:35] <guy> i'm actually watching the k-line a bit more than i am the value of alpha right now because we're at the open and k-line gives better indication after the first minute or two

[09:40:45] <guy> (and at extremes)

[09:41:20] <guy> Here is the ER2 chart:

[09:41:28] <guy2>

[09:41:39] <guy> the high k-line reading is saying we go up

[09:41:45] <guy> so no short OR here

[09:42:01] <guy> Same on ES:

[09:42:13] <guy2>

[09:45:00] <guy> ES Looks like a long to me here:

[09:45:01] <guy2>

[09:45:18] <guy> I'm thinking long off the bottom of the OR at 1195.00

[09:47:03] <mashhad> well, 6.75 was tue.'s high of the day

[09:47:18] <mashhad> so there may be some resistanse there for a long

[09:56:26] <guy> ES chart:

[09:56:47] <guy2>

[10:05:20] <guy> Current reading on ER2

[10:05:25] <guy2>

[10:13:19] <guy> And this is why I don't fade alpha on an OR trade:

[10:13:22] <guy2>

[10:13:50] <guy> you might notice a new indicator on that chart i've just posted

[10:14:06] <guy> That is what is drawing the red circles above the bars

[10:14:19] <guy> and the numbers in green above the buttons

[10:14:24] <guy> It's called TimerA1

[10:14:30] <mashhad> and what does that show?

[10:16:15] <mashhad> broke through 6.75 next res. should be 9.00 if it tries to go higher

[10:18:18] <guy> Here is the ES chart showing why I stayed out of the OR trade there:

[10:18:18] <guy2>

[10:18:42] <guy> hey mash: apart from making money with alpha you also need to think about the losing trades that it kept you out of

[10:18:50] <guy> as both a filter and a signaller

[10:21:08] <mashhad> yes... i do like that about alpha..

[10:23:21] <guy> i'm not sure how you would have played that OR trade but what I would do now if I were you would be to replay that trade and think about the OR rules that you use and see what you would have made/lost with and without the alpha there...

[10:23:59] <guy> you might have actually made money on the OR trade if you'd had small targets and tight stops

[10:24:13] <guy> but I think that the ultimate target on the OR trade is the VAH

[10:25:38] <mashhad> it was kind of close.. i like to take the trade +1.00 from top of open which would have been 6.75, and it would have paid me +2.00 if i had that fill, if no fill, i would have been out of this trade

[10:27:16] <guy> right - what trading platform are you using?

[10:27:42] <guy> i ask because if you're using ninja i think that it will give you a fairly accurate simulation of whether or not you got filled

[10:28:04] <guy> so if you enter your order at 6.75 and there were 1000 contracts there when you entered your order

[10:28:13] <guy> and subsequently 1000 trade at that price

[10:28:24] <guy> then it will give you a fill

[10:28:28] <guy> to keep it realistic

[10:28:46] <mashhad> i use my broker's platform

[10:28:56] <mashhad> it's not real fancy

[10:29:08] <mashhad> very simple

[10:29:53] <guy> k

[10:30:31] <guy> i only mention that because it makes testing more realistic

[10:30:32] <guy2>

[10:32:55] <mashhad> 99.00 is the weekly high

[10:34:28] <guy> and the pressure from alpha is easing

[10:38:20] <guy2>

[10:48:02] <fspeculator> EOM window dressing?

[10:48:29] <fspeculator> but there are still 3 days

[10:48:54] <fspeculator> i think the most deciding factor is relentless pumping (creation of money) by US Fed

[10:49:18] <mashhad> when is the next fed meeting?

[10:49:29] <fspeculator> 35days

[10:58:14] <guy2>

[10:58:39] <guy> 3 x +1 bars on alpha on ER2 there

[10:59:47] <tuna> divergence guy?

[11:00:33] <guy2>

[11:00:56] <guy> it looks like divergence but alpha is not designed to be used as a divergence tool because it is not an oscillator

[11:01:52] <mashhad> alpha gave a buy at 6.75 which happened to be that area of resistance we had earlier and DPOC

[11:02:40] <mashhad> i think it's gonna be a good signal...I should have taken it!

[11:02:51] <guy> yes it did and also alpha is +ve so we're looking for buy areas

[11:05:16] <guy> Buys AB @ 612

[11:06:09] <tuna> me too

[11:07:23] <guy> can someone tell me what oil is doing - i've lost my oil chart

[11:07:34] <tuna> 51.35

[11:07:49] <tuna> 51.27

[11:08:21] <guy> thanks

[11:08:36] <fspeculator> +0.64%

[11:08:42] <fspeculator> on top of yesterday's +3.3%

[11:08:55] <guy> thanks fspec

[11:09:00] <guy> here is my trade

[11:09:01] <guy2>

[11:09:07] <guy> it was 90% alpha instigated

[11:09:25] <guy> and 10% was off the high (all sessions) from yest.

[11:10:08] <guy> exit stop set AB @ 611

[11:10:29] <guy> still very much in the embryo stage so we haven't made anything on it yet and could still lose 1 point

[11:10:52] <guy> good news is that alpha continues to support the trade:

[11:10:53] <tuna> it was single instigated here

[11:10:55] <guy2>

[11:11:07] <tuna> oh goody

[11:12:08] <tuna> plus vwap

[11:12:38] <tuna> vwap was real close to there too i should add

[11:13:56] <guy> vwap is volume weighted average price right?

[11:14:39] <fspeculator> y

[11:14:49] <fspeculator> volume poc so to say

[11:15:11] <tuna> well said fspec

[11:15:32] <guy> okay

[11:15:44] <guy> how do you identify it tuna? using the MP chart?

[11:15:51] <guy> that long is also a single print long btw

[11:15:56] <tuna> wish esig had it

[11:16:09] <tuna> right

[11:16:30] <tuna> that was my entry

[11:16:41] <tuna> that and vwap

[11:17:06] <fspeculator> vwap 96.75?

[11:17:20] <tuna> 612's

[11:17:25] <guy> so what do you use? chart/software to identify VWAP?

[11:17:39] <tuna> qt

[11:17:59] <guy> k

[11:18:00] <fspeculator> i'm a bit weary about these things

[11:18:08] <fspeculator> in 7pt ES ranges (let alone4pt)

[11:18:17] <tuna> fabulos charts amost free

[11:18:18] <fspeculator> every tick has a "meaning"

[11:18:34] <guy> the single print strategy has another winner today

[11:18:39] <fspeculator> tuna you use it with IB and backfill?

[11:18:47] <tuna> no

[11:18:57] <tuna> iqfeed

[11:19:15] <tuna> 1 off at 13

[11:20:06] <guy> [11:09:07] <guy> it was 90% alpha instigated

[11:20:06] <guy> [11:09:25] <guy> and 10% was off the high (all sessions) from yest.

[11:20:28] <guy> Had I noticed at the time that there was a single there I would have had even MORE conviction on that trade

[11:20:45] <tuna> lol

[11:20:53] <tuna> jeez guy

[11:21:02] <guy> I'm going to have to modify the DVATool to put in confirmed and unconfirmed singles for me

[11:21:16] <guy> so I don't miss stuff like that

[11:21:40] <tuna> those little things

[11:22:01] <fspeculator> guy you mean unconf singles for today's trade?

[11:22:28] <guy> correct fspec: so once a single is created but not confirmed a line is drawn in

[11:22:35] <guy> and if we trade through it then it's removed

[11:22:51] <guy> and the unconfirmed line will be a different style/color

[11:22:58] <guy> so we know that it's not a confirmed single

[11:23:28] <guy> and then once confirmed changed to the standard singles color

[11:28:12] <tuna> sounds like a plan

[11:30:15] <tuna> another one off here

[11:30:27] <guy> nice tuna

[11:30:32] <guy2>

[11:30:36] <tuna> tanks guy

[11:36:12] <tuna> chicago

[11:36:55] <guy> k

[11:41:31] <guy> okay my thinking here and now:

[11:41:40] <guy2>

[11:41:46] <guy> i am thinking that we can get RE to the upside

[11:42:00] <guy> so i'm looking to hold this long until at least RE and beyond

[11:42:14] <tuna> k

[11:42:25] <guy> if we hit RE extension I will look at 2 things:

[11:42:46] <guy> 1. If RE is a spike over the IB and no new business

[11:42:48] <guy> and

[11:42:56] <guy> 2. alpha not showing buying signs

[11:43:01] <guy> then i'll probably get out

[11:43:33] <guy> if, however, there is good follow through in both buying at and beyond RE indicating new business there and alpha shows follow through

[11:43:51] <guy> then I'll try and sit on it for the rest of the day hoping for it to turn into a trend day up

[11:44:05] <guy> but as i've been typing that the market is going against this trade

[11:44:25] <tuna> hmmm we have oops had a ledge

[11:44:28] <guy2>

[11:46:06] <tuna> another trip back to the vwap

[11:47:31] <tuna> prolly wont hold

[11:47:35] <tuna> imo

[11:47:54] <tuna> but i hope im wrong

[11:49:47] <guy> hard to tell but alpha seems green and happy so i will play out the odds

[11:50:31] <tuna> yeah im still in too with last 1

[11:52:16] <tuna> 89 ema at 11 on a 3min chart fwiw

[11:53:21] <guy> i've got my oil chart back and i can see the problem

[11:53:42] <guy> oil is going up and that's what is puting the dampener on the equities

[11:55:50] <tuna> was some sort of news about the bigs saying they're not gonna drill/develope new fields or something like that

[11:56:42] <guy> which should push the price down not up...

[11:57:05] <tuna> yeah,,one would think so

[11:58:59] <fspeculator> guy have you run some correlation analysis of oil-vs-stocks?

[11:59:18] <guy> yes

[11:59:31] <fspeculator> what was the result? and what timeframe please

[11:59:49] <fspeculator> and how? was it up-up, up-down etc?

[12:00:09] <fspeculator> or you take the magnitude of the move into account?

[12:00:23] <fspeculator> bec all i see is that oil is advancing up along equities

[12:00:30] <guy2>

[12:00:32] <fspeculator> and also bonds are advancing along equities

[12:01:04] <mashhad> Guy, would you say that ES is showing a little weakness on the long side since alpha went - for a few mins?

[12:01:26] <guy> Oil and E-mini S&P500

[12:01:30] <guy> that link fspec

[12:02:20] <guy> mash: here is the ES chart:

[12:02:26] <guy2>

[12:02:28] <guy> and yes, I agree with your comment

[12:02:54] <guy> especially when compared to ER2 chart:

[12:03:01] <mashhad> ok

[12:03:03] <guy> where alpha is showing far more strength on the ER2

[12:03:04] <guy2>

[12:09:15] <fspeculator> guy your alpha is mkt specific?

[12:09:21] <fspeculator> ie different for ES than ER?

[12:12:19] <guy> no - same formula

[12:13:51] <tuna> time to water the flowers bbiab

[12:14:16] <guy> k

[12:16:18] <fspeculator> guy i've read your piece on oil

[12:16:42] <fspeculator> i think if you do an analysis over a long period of 6-12mo or more

[12:17:03] <fspeculator> that last few years oil has had very little NEGATIVE impact on stocks

[12:17:22] <fspeculator> you may even find that it "boosted" stocks (positive correl)

[12:17:37] <fspeculator> as both oil and stocks had huge run-ups since 2003

[12:17:47] <fspeculator> my opinion is that the reason is inflation

[12:18:10] <guy> fspec - i think that i noticed most of the -ve correlation at oil extremes

[12:18:23] <fspeculator> increasing price in stocks, real-estate, oil, gold etc

[12:19:21] <fspeculator> as paper money becomes more abundant, EVERYTHING goes higher in price

[12:19:40] <fspeculator> everything of some scarcity

[12:29:30] <tuna> hmmm

[12:30:12] <tuna> shoulda changed the oil too

[12:30:39] <guy> :)

[12:30:53] <guy> here come the split counts

[12:31:00] <guy2>

[12:31:35] <guy> the one that i'm long is showing the worst split count

[12:31:50] <tuna> i noticed

[12:32:17] <tuna> sox are very strong

[12:32:34] <tuna> above my weekly r1

[12:53:28] <guy> exit stop moved to breakeven AB @ 612

[13:00:36] <guy2>

[13:02:09] <fspeculator> guy you really caught the bottom tick this time? :-)

[13:02:31] <guy> i did - so did the 'single print' strategy

[13:03:06] <guy> but could still breakeven if I get stopped

[13:04:03] <tuna> does it count if you didnt see the single?

[13:04:38] <guy> yes - the forward testing single counts because you can do the figures after the day is over

[13:04:42] <guy> it's a mechanical system

[13:04:53] <guy> and i'm testing it and not trading it

[13:05:04] <tuna> oh

[13:05:05] <guy> it is just coincidence that i'm long

[13:05:10] <guy> at the same point

[13:05:25] <tuna> yes

[13:05:26] <guy> i hadn't noticed that the forward testing system was also long

[13:06:16] <guy> i'm trying to work on the algorithm now to get the unconfirmed singles to print on the chart - boy it's complicated

[13:07:16] <tuna> see if you can come up with a vwap that plots like a ma

[13:07:45] <guy> i think i've tried that before but i don't think that esignal gives me the volume info that i need

[13:07:57] <tuna> ahh

[13:08:00] <tuna> ok

[13:08:08] <mashhad> Guy, how about VAh/l and POC?

[13:08:23] <guy> DVATool plots those mash

[13:08:26] <guy> it's an option

[13:08:44] <mashhad> oh,ok.. because i didn't see them on your charts

[13:09:48] <guy> Have a look at this chart mash:

[13:09:53] <guy2>

[13:10:14] <guy> from the bottom, the solid lines, green, blue, red

[13:10:21] <guy> are VAL, POC, VAH

[13:10:33] <guy> and those are put there by DVATool

[13:10:48] <guy> and then higher up the lime, cyan and pink lines are the

[13:10:57] <guy> DVAL, DPOC, and DVAH

[13:11:06] <guy> also put there by DVATool

[13:12:06] <guy> all the colors and styles can be changed

[13:12:13] <mashhad> so 608.30 which is the VAH, is that the gray line?

[13:14:08] <guy> no, the solid red line at 608.7 is the VAH

[13:14:21] <guy> different to esignal's which is 608.3

[13:15:02] <mashhad> you mean it calculates on it's own?

[13:15:05] <guy> i'm still working on the formula and not 100% convinced that esignal is correct here

[13:15:23] <guy> but i'm planning on adding an option to replicate esignal if that's what we want to do

[13:15:31] <guy> yes it calculates it mash

[13:15:42] <guy> from the previous day's data

[13:15:50] <mashhad> i see..

[13:16:05] <guy> the grey dotted line is the IBL

[13:17:23] <guy> another useful feature of the DVATool is the Graphic button

[13:17:38] <guy> On this ES chart:

[13:17:49] <guy2>

[13:17:49] <guy> see the Graphic button in the bottom left hand corner?

[13:18:11] <guy> Well if you click it you get this graphic:

[13:18:16] <guy2>

[13:18:35] <guy> which allows you to quickly view an MP graphic off any line chart without having to bring up a seperate MP chart

[13:19:23] <mashhad> but these VA's are different from E-signal

[13:20:17] <mashhad> right now es-gnals's val is 6.75 and your is 5.75

[13:21:19] <guy> i've got 6.25 on esig

[13:21:46] <guy> and 5.75 on mine

[13:21:51] <mashhad> now, but when u posted it was 6.75.. in anycase, 6.25 is 0.5 diff too

[13:22:30] <guy> true

[13:22:52] <guy> i'm looking into the difference

[13:22:59] <guy> i'll see if i can resolve it

[13:23:16] <mashhad> well, u never know though, yours might be more accurte

[13:24:21] <mashhad> got to observe it for a while .. it's difficult on Dvas but on VA's it could always be looked at for the opening trades to see which one gives a better signal, yours or e-signals

[13:24:24] <guy> well mine is according to the Dalton book

[13:24:36] <guy> and the esignal one according to the steidlmeyer book

[13:24:45] <guy> and it is an "area"

[13:24:54] <guy> which I use alpha with

[13:25:01] <guy> so it doesn't affect my profits

[13:25:12] <guy> but I can see how other people would prefer it to be to the tick

[13:28:36] <guy> Here is a chart showing the new TimingA1 tool

[13:28:48] <guy2>

[13:28:59] <guy> Sorry TimerA1

[13:29:29] <guy> you can see the parameters that I've set: 20, 800, -400

[13:29:54] <guy> and it put 2 green buy blobs around 11:40

[13:30:10] <guy> and has just now put 3 green buy blobs at this recent low

[13:30:24] <guy> current RF:

[13:30:32] <guy2>

[13:31:41] <guy> bbiab - hard stop in place

[13:38:45] <tuna> that was just anoyher trip to the vwap on er2

[13:38:53] <tuna> another

[13:51:39] <guy> Exited all Long AB at 613 --> + 1

[13:52:04] <guy2>

[13:52:09] <tuna> vn

[13:52:12] <guy> support from alpha is no longer with us

[13:52:21] <guy> so i've decided to abandon this trade here

[13:53:40] <guy> thx tuna

[13:55:24] <tuna> i still have the 1 long

[13:55:54] <tuna> almost added near dval

[13:56:06] <mashhad> i am looking at a place to short on ES

[13:59:30] <guy> here is the ES chart:

[13:59:36] <guy> why do you want to short mash?

[13:59:37] <guy2>

[13:59:43] <guy> we've just had an alpha buy

[14:00:06] <guy> are you looking to short the DVAH?

[14:00:17] <mashhad> yes

[14:00:23] <guy> RF's for ES are 0:

[14:00:29] <guy2>

[14:00:54] <guy> I have DVAH at 98.75 = what does esig MP have?

[14:01:04] <mashhad> same

[14:01:36] <mashhad> i am working 8.50 at the moment

[14:02:28] <guy> good strategy, 99.00 is HOD and that's 2 ticks below that and 1 tick below IBH

[14:02:46] <mashhad> and if i get filled, i am only risking 4 ticks

[14:02:58] <guy> the only thing that I would watch in your position is the value of alpha when you get filled

[14:03:11] <mashhad> exactly

[14:03:29] <tuna> keep in mind spoos has re up

[14:03:33] <tuna> fwiw

[14:03:45] <guy> how many ticks RE in SP?

[14:03:51] <tuna> 4

[14:04:13] <mashhad> was that in the f bracket?

[14:04:20] <tuna> just thought id pass it along

[14:04:28] <tuna> yes sir

[14:04:33] <mashhad> ok

[14:05:06] <fspeculator> just 4 ticks in RE?

[14:05:08] <fspeculator> in SP?

[14:05:20] <mashhad> now e-signal dvah dropped to 8.25..yours?

[14:05:45] <guy> no still at 8.75

[14:06:12] <tuna> 8.25 here

[14:06:15] <tuna> too

[14:07:06] <guy> you got MP on QT tuna?

[14:07:16] <tuna> spoos doesnt have that bottom ledge like es does

[14:08:23] <tuna> but it has a top one

[14:09:53] <tuna> no guy qt doesnt have mp

[14:11:37] <tuna> spoos chart isnt nearly as ugly as es imho

[14:12:40] <guy> how do you see the MP chart tuna?

[14:13:56] <tuna> it just doesnt have that bottom ledge on the 'p' like the es does,,also re up unlike es

[14:17:40] <mashhad> it doesn't look like alpha is gonna give a strong sell signal at 8.50

[14:18:12] <mashhad> moved order to 8.75

[14:18:45] <guy> here's your chart mash:

[14:18:50] <guy> you should see the same on yours

[14:18:56] <guy2>

[14:19:07] <guy> so i have both IBH and DVAH

[14:19:12] <guy> at same 98.75

[14:19:21] <guy> and alpha at around -.5

[14:25:34] <tuna> guy,new paltalk will try to auto start on your start up fwiw

[14:26:22] <tuna> tries to load a trojan too

[14:26:52] <tuna> pm's sit in the tray now

[14:27:34] <guy> thanks tuna

[14:28:01] <guy> what cleans out the trojan? adaware? pest patrol?

[14:28:12] <mashhad> s 98.75

[14:28:20] <guy> good trade mash

[14:28:27] <mashhad> hard stop 00.25

[14:28:34] <tuna> nod32

[14:28:43] <guy2>

[14:28:47] <tuna> i use nod32 beta

[14:28:50] <guy> there's your chart mash

[14:28:56] <guy> good luck

[14:29:10] <mashhad> thanks

[14:29:15] <guy> you've got alpha + DVAH + IBH + HOD all on your side

[14:29:25] <guy> i have to step away now but will be back...

[14:29:36] <tuna> spoos single ticked

[14:29:44] <tuna> fwiw

[14:31:18] <mashhad> what do u show for ur dval?

[14:31:43] <tuna> er2 is trying my patience again

[14:32:03] <tuna> me?

[14:32:29] <mashhad> no guy

[14:37:32] <guy> my DVAL is 1196.25 now

[14:37:47] <guy> here is a chart

[14:37:51] <guy> DVAL is the lime line

[14:37:53] <tuna> oil closed red btw

[14:37:57] <guy2>

[14:38:09] <guy> you can see that it dipped to 96.00 but it's back at 96.25 now

[14:38:38] <mashhad> so urs is 6.25 vs. esig 6.75

[14:38:49] <guy> yes

[14:39:01] <guy> very nice trade btw

[14:39:06] <guy> thanks for the oil update tuan

[14:39:07] <mashhad> btw, your dvah was more accurate since we hit 99

[14:39:08] <guy> tuna

[14:39:16] <guy> bbiab

[14:39:17] <mashhad> +2 on 1st contract! :)

[14:39:27] <guy> excellent !! :)

[14:39:49] <mashhad> setting my stop at 99.25 against any range extension

[14:42:49] <tuna> nice mash

[14:43:56] <mashhad> thanks

[15:00:36] <guy2>

[15:31:43] <guy2>

[15:35:25] <mashhad> out -0.50

[15:35:58] <guy> you made money though

[15:36:05] <guy> good hold there

[15:36:06] <tuna> lol guy

[15:36:08] <mashhad> yes,

[15:36:22] <mashhad> made 1.5+

[15:36:43] <mashhad> i actually got to run, see you tomorrow

[15:36:45] <tuna> nice mash

[15:37:16] <tuna> guy i still have the last 1

[15:37:33] <guy> excellent tuna!

[15:37:49] <tuna> what a test

[15:37:59] <guy> very good hold there

[15:38:13] <tuna> was NOT easy

[15:41:47] <tuna> but it was a free trade,, so not too bad

[15:42:26] <guy> true

[15:50:15] <tuna> seems like singles that match up with the vwap work pretty well

[16:00:50] <guy2>

[16:01:35] <guy> This is interesting:

[16:01:40] <guy2>

[16:01:46] <guy> alpha on ES is showing a buy signal

[16:01:54] <guy> and on ER2 a sell signal

[16:02:04] <guy> don't know if i've ever seen that together before

[16:02:12] <tuna> thx guy

[16:02:30] <guy2>

[16:02:33] <guy> y/w tuna

[16:02:49] <guy> still long tuna?

[16:03:18] <tuna> no

[16:03:47] <guy> good trading - you must have taken about 3 points on that last contract

[16:04:53] <tuna> yep last 1 was woth the wait

[16:04:59] <tuna> worth

[16:05:02] <guy> excellent :)

[16:05:13] <guy> i like it when people make points :)

[16:05:39] <tuna> was that or go change the oil

[16:05:55] <guy> finished watering the garden then?

[16:06:02] <tuna> yes

[16:06:21] <guy> changing the oil on your car?

[16:06:28] <tuna> right

[16:07:01] <guy> messy job - but has to be done

[16:07:13] <tuna> i have all weekend to do that tho

[16:07:56] <guy> not going away for w/e then?

[16:08:10] <tuna> nahh

[16:08:45] <tuna> cant afford the gas ;)

[16:08:53] <guy> :)

[16:09:07] <guy> It looks like the single print strategy is going to close its last contract at the last traded price

[16:09:24] <guy> I've just had to add another rule to the strategy that says that it doesn't carry overnight

[16:09:36] <guy> and that any open contracts close at the last traded price

[16:10:15] <tuna> im too chicken to hold overnite

[16:10:38] <guy> best not to unless you've got a good buffer and good reason

[16:11:28] <tuna> mebbe shorts are ok,,but still, anything can happen

[16:15:59] <guy> I'll update the singles shortly:

[16:16:19] <tuna> thx again guy

[16:17:35] <guy> y/w tuna

[16:24:52] <guy> Single print strategy made $870 today and cumulative for month is $2,150

[16:25:27] <guy> gn all

[16:26:25] * Disconnected

Session Close: Thu May 26 16:26:28 2005

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.