Your favorite entry bars?

I thought I'd start a thread to share any ideas about specific entry bar techniques that people use. Although I prefer to average in this is one that I like the best. It is not new nor will I take credit for it as Lee Gettes, Haggerty, Kent Calhoun, Joe Ross and others have already done that...

For these entries to work you are looking for a support or resistance zone to be entered ( not discussed here)and then wait for the setup bars.

If you suspect a swing high is forming then you are looking for the following:

1) A down close bar

2) Followed within 5-6 bars an up close bar ( I like the 3 and 5 minute)

3) You enter on the break of the up bars low by one tick.

4) Your initial stop should be one tick above the up bars high.

Think about this: It will take an outside vertical bar to stop you out or a poor close after your entry.

I have a friend who used the 10 minute bars back in 1998 and he knew the probabilities of an outside bar forming on that time frame...just something to think about.

5) At a minimum your target should be at least what you are risking and then get your stop to break even on multiples but that's been written about before. Here is an example of a swing high..

Where just coming off the plus 4 - 5.5 number on a gap up opening..these examples aren't perfect...

Bar labeled one gives us the down close, bar labeled #2 gives us the up close ( also an inside bar), bar #3 is the entry bar..

Here is an example of a swing low setup..you are looking for the following:

1) an up close bar,

2) a down close bar within 5 -6 bars

3) Entry on a break of the Down close bars high by one tick

Bar 1 gives us our up close, bar 2 gives us our down close, we need to wait until the bar labeled # 3 for entry above bar #2's high.

For those who like indicators you will probably find some nice divergent trade and use this as a filter

Hope this is useful....It's kind of like the classic 1-2-3 pattern with some filtering and setup bars defined. Dome will watch retracement levels to coincide with these entries.

Bruce

For these entries to work you are looking for a support or resistance zone to be entered ( not discussed here)and then wait for the setup bars.

If you suspect a swing high is forming then you are looking for the following:

1) A down close bar

2) Followed within 5-6 bars an up close bar ( I like the 3 and 5 minute)

3) You enter on the break of the up bars low by one tick.

4) Your initial stop should be one tick above the up bars high.

Think about this: It will take an outside vertical bar to stop you out or a poor close after your entry.

I have a friend who used the 10 minute bars back in 1998 and he knew the probabilities of an outside bar forming on that time frame...just something to think about.

5) At a minimum your target should be at least what you are risking and then get your stop to break even on multiples but that's been written about before. Here is an example of a swing high..

Where just coming off the plus 4 - 5.5 number on a gap up opening..these examples aren't perfect...

Bar labeled one gives us the down close, bar labeled #2 gives us the up close ( also an inside bar), bar #3 is the entry bar..

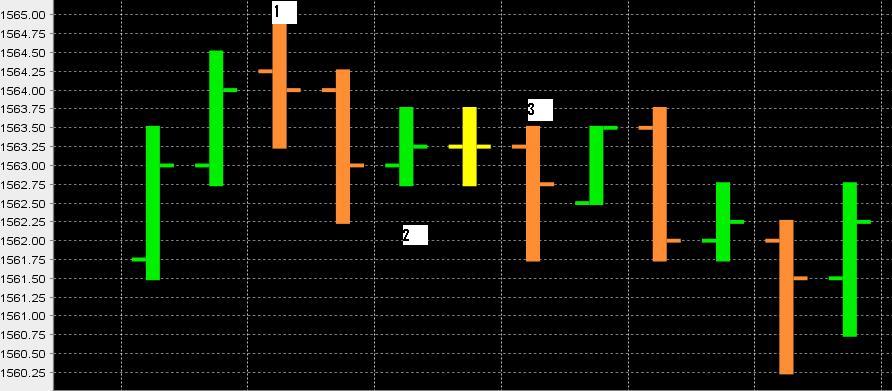

Here is an example of a swing low setup..you are looking for the following:

1) an up close bar,

2) a down close bar within 5 -6 bars

3) Entry on a break of the Down close bars high by one tick

Bar 1 gives us our up close, bar 2 gives us our down close, we need to wait until the bar labeled # 3 for entry above bar #2's high.

For those who like indicators you will probably find some nice divergent trade and use this as a filter

Hope this is useful....It's kind of like the classic 1-2-3 pattern with some filtering and setup bars defined. Dome will watch retracement levels to coincide with these entries.

Bruce

I went back and ran off the one minute to see what was happening at the early morning swing high.

here is the chart with the key 3 bars labeled..it seems like many like to scalp so this may be a good alternative

Here is the chart:

here is the chart with the key 3 bars labeled..it seems like many like to scalp so this may be a good alternative

Here is the chart:

You could have taken the break of the bar in between the number 2 and 3 bar ( yellow bar) on the one minute chart as it also made a higher high after the number 2 bar...Let me know if that makes sense. I beleive this is similar to the Traders Trick entry in Joe Ross material..this is just adding qualifying bars...

Bruce you must be trading for a long time...all very good observations.

I've been trading for last 1 year and 2 months and it has been a losing experience as I was trying to day trade using supp and resis pts...not been fully trained...I could never decipher went to enter the trade using supp and resis ( classic ) and what stop to use. Futhermore, since being a small trader....I could not afford to lose too many 1 pt stops on emini ER...this is what I trade. I did lose many 1 pt stops...and my ass was getting sore from looking at the computer screen and getting stage fright...do I enter....wait....paltalk rooms, courses........all....nonsense.

However, in dabbling with wolfewave from April ( never signed up...$3k I don't have ) and seeing how the market oscillates....I was trying to figure out and easier way to run 1 contract...without any stops.

I guess the point is when a mkt makes a swing hi or low....keep watching and the next day if it comes up to test the high or below to test the low...and does not break it....then in all likelihood within the next 2-4 trading days it will go down 15-25 pts.....as we saw this week on ES and Er down a lot. It seems this no indicator and low stress...Simple...simple system ( a la Warren Buffet...keep it simple) seems to work.

Point being it it easy to make 10-15 pts in the week....wait for high short or low long

All this gurus and daytrading stuff...is a money making racket.....every daytrading trade has 50% probability...but at the highs and lows....the probability to succeed....changes from 50% to 90-97% success...well you make be down $100-300 initially 1 lot from entry so 3% risk...only God can be right 100%.

Regrads,

Bootsy

T

I've been trading for last 1 year and 2 months and it has been a losing experience as I was trying to day trade using supp and resis pts...not been fully trained...I could never decipher went to enter the trade using supp and resis ( classic ) and what stop to use. Futhermore, since being a small trader....I could not afford to lose too many 1 pt stops on emini ER...this is what I trade. I did lose many 1 pt stops...and my ass was getting sore from looking at the computer screen and getting stage fright...do I enter....wait....paltalk rooms, courses........all....nonsense.

However, in dabbling with wolfewave from April ( never signed up...$3k I don't have ) and seeing how the market oscillates....I was trying to figure out and easier way to run 1 contract...without any stops.

I guess the point is when a mkt makes a swing hi or low....keep watching and the next day if it comes up to test the high or below to test the low...and does not break it....then in all likelihood within the next 2-4 trading days it will go down 15-25 pts.....as we saw this week on ES and Er down a lot. It seems this no indicator and low stress...Simple...simple system ( a la Warren Buffet...keep it simple) seems to work.

Point being it it easy to make 10-15 pts in the week....wait for high short or low long

All this gurus and daytrading stuff...is a money making racket.....every daytrading trade has 50% probability...but at the highs and lows....the probability to succeed....changes from 50% to 90-97% success...well you make be down $100-300 initially 1 lot from entry so 3% risk...only God can be right 100%.

Regrads,

Bootsy

T

correction insert

go down or up 15-25 pts...as the case may be

Bootsy

go down or up 15-25 pts...as the case may be

Bootsy

Here is one from today...we are looking for a swing low so we need

1) Up close bars followed by

2) Down close bars

3) the entry which happened to be the break above the inside bar

1) Up close bars followed by

2) Down close bars

3) the entry which happened to be the break above the inside bar

here is another from today...a bit harder to see and this chart sucks even more then my usual charts....

1) we get the green up close bar at point 1

2 ) we get the down close bar ( orange inside bar)

3) we get the long entry bar - the break of the number 2 bar

There is also a failed trade which I will post tomorrow which happened in the 14:25 - 14:40 time frame which touches on reverseability...is that even a word....? If any one is getting this then see if you can find it..the entry bar failed and almost made an outside bar which led to new lows

1) we get the green up close bar at point 1

2 ) we get the down close bar ( orange inside bar)

3) we get the long entry bar - the break of the number 2 bar

There is also a failed trade which I will post tomorrow which happened in the 14:25 - 14:40 time frame which touches on reverseability...is that even a word....? If any one is getting this then see if you can find it..the entry bar failed and almost made an outside bar which led to new lows

quote:

Originally posted by BruceM

Here is one from today...we are looking for a swing low so we need

1) Up close bars followed by

2) Down close bars

3) the entry which happened to be the break above the inside bar

BruceM,

I am trying to learn your method and I have two question ,

Between 11:40 and 11:50 on your chart a bar before point 2 is I understand is swing high formation. Would this not invalidate your pattern formation or you disregard that ?

What, if at swing high or low you have two bars forming swing high or low. Would you consider that for your pattern formation or disregard that swing ?

Thank You.

BruceM,

I forgot to confirm in my previous post to you, if your charts are 5 minute bars and times are EST ?

Thank you

I forgot to confirm in my previous post to you, if your charts are 5 minute bars and times are EST ?

Thank you

The one you mentioned is a 3 minute eastern time chart. Some may refer to that as a swing high but I was looking for them to put in a swing low. You may recall that this thread initially was not about support or resistence but the entry signal. So in this case we where looking at a POTENTIAL support area and that is why I wasn't looking for the swing high. I hope that makes sense and thanks for the questions.

Bruce

Bruce

quote:

Originally posted by pakeez

BruceM,

I forgot to confirm in my previous post to you, if your charts are 5 minute bars and times are EST ?

Thank you

BrucwM

Thanks for your response. Though I am confused at the moment with your clarification, It may take some time for me to understand your logic of the setup.

Thanks for your response. Though I am confused at the moment with your clarification, It may take some time for me to understand your logic of the setup.

Going by this concept 1090.50 will be a good short

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.