The "Stretch", ORB and ORBP

Hi

On the YM Pivot Points number every day at the bottom of the 2nd page on the left hand coloum ( under Crabel Price Pattens" I see the words the "Stretch" want does the Stretch mean?

It says ( I quote) "The Stretch is calculated by taking the 10 period SMA of the absolute difference between the Open and either the High or Low, whichever difference is smaller".

So if the number 47 is in it in plain Englaish want does that mean?? and how should I use it to daily trade the YM ? please e-mail me on

[email protected]

Thanks

& regards Mike

On the YM Pivot Points number every day at the bottom of the 2nd page on the left hand coloum ( under Crabel Price Pattens" I see the words the "Stretch" want does the Stretch mean?

It says ( I quote) "The Stretch is calculated by taking the 10 period SMA of the absolute difference between the Open and either the High or Low, whichever difference is smaller".

So if the number 47 is in it in plain Englaish want does that mean?? and how should I use it to daily trade the YM ? please e-mail me on

[email protected]

Thanks

& regards Mike

Mike: The stretch is a value that's used in an Opening Range Breakout (ORB) or Opening Range Breakout Preference (ORBP) trade.

Say you were considered an ORB trade in the YM this morning. The Open price for the YM was 13538 and the Stretch is 47. You add and subtract 47 from 13538 and get 13585 (where you would set a stop to buy) and 13491 (where you woud set a stop to sell).

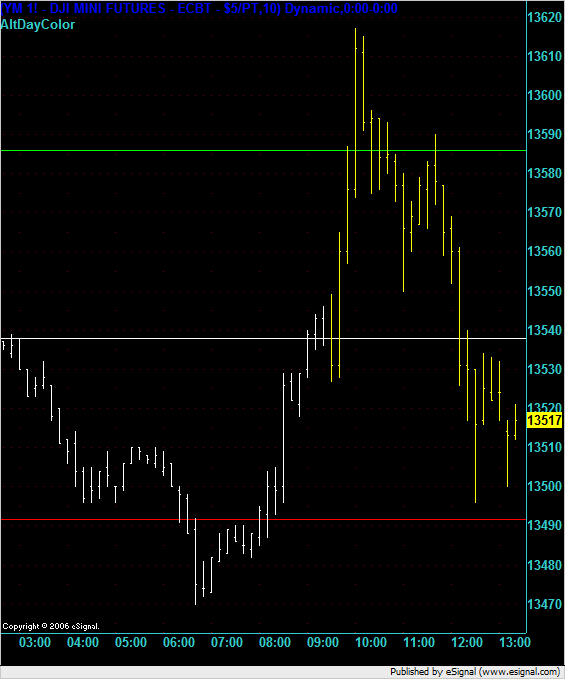

Now (1:15PM EST) you would have been filled on the long at 13585 but are very close to being stopped out at the stop of 13491. In the chart below, the white horizontal line shows the opening price in the YM and the green the stop to enter long and the red the stop to enter short. The untriggered trade becomes the protective stop after the other one is triggered.

Say you were considered an ORB trade in the YM this morning. The Open price for the YM was 13538 and the Stretch is 47. You add and subtract 47 from 13538 and get 13585 (where you would set a stop to buy) and 13491 (where you woud set a stop to sell).

Now (1:15PM EST) you would have been filled on the long at 13585 but are very close to being stopped out at the stop of 13491. In the chart below, the white horizontal line shows the opening price in the YM and the green the stop to enter long and the red the stop to enter short. The untriggered trade becomes the protective stop after the other one is triggered.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.