Single Prints Forward Test - May 2005

I have been trying to back test single prints as high probability reversal areas but have been unable to do it so far. As a second prize I'm toying with the idea of forward testing this in simulated real-time using the ER2 contract and testing during the month of May 2005.

So far I've come up with the following rules. Jump in and add or question a rule if you wish:

So far I've come up with the following rules. Jump in and add or question a rule if you wish:

- The single print must be less than a month old to be used.

- The single print must be a confirmed single print.

- The entry price is one tick inside the single print and an entry will only be recorded if the price touches the single.

- A stop of one handle will be used.

- 4 contracts will be traded.

- Partial profits will be taken at 1, 2, 3, and 4 points.

- Commissions will be $5 per contract.

- Stop will be moved to break even after first partial profit has been taken.

- Stop will not be trailed after moved to break even.

- No re-entries if stopped out but re-entries always taken if all 4 contracts are taken off profitably and re-entry is then only allowed on that day. (This is logical because single tick will not be there on subsequent days.)

- All single trades will be taken irrespective of other news items or announcements that are being made at that point.

- If multiple singles created in same day or time period then all of them will be traded using the same stops and targets and rules.

- No overnight carry. Any open contracts are closed out at the last traded price (not the settlement price) that is traded during RTH which in this case is usually at 16:14:59 or 16:15:00 EST. Although you would not be able to implement this in real trading it appears to be the fairest way to measure this strategy. In reality you will close the trade before this time and get a slightly more or less favorable price.

i don't think much this (your?) strategy so far. it's generated 2 trades and both of them are losers

quote:

Originally posted by phylup

i don't think much this (your?) strategy so far. it's generated 2 trades and both of them are losers

Hi phylup - the buy/sell signal isn't mine but the money management rules that I put together at the start of the thread are what I thought would work with these buy/sell signals. That's what we're testing here in this thread - to see if these buy/sell signals work with my set of money managment / risk management rules.

So far I have to agree with you that it's not looking good but as you said we've only executed 2 trades. We need at least 20 trades to start picking up an idea of the possible potential in this strategy and probably 50 to 100 trades to get a good "probability of success" reading.

11 May 2005: Intraday update.

Long from 588.6 at 12:07 EST.

1 contract off at 589.6 and stop moved to breakeven. (Draw down 5 ticks to 588.1)

1 contract off at each of 590.6, 591.6 and 592.6

Trade lasted a total of 8 minutes. Total profit for trade is $980.

Cumulative profit now in the green at $140

Spreadsheet updated.

Long from 588.6 at 12:07 EST.

1 contract off at 589.6 and stop moved to breakeven. (Draw down 5 ticks to 588.1)

1 contract off at each of 590.6, 591.6 and 592.6

Trade lasted a total of 8 minutes. Total profit for trade is $980.

Cumulative profit now in the green at $140

Spreadsheet updated.

Although premature, we can make an interesting observation about trading strategies at this point:

We have had 1 winner out of 3 trades which is a 33% win/loss rate and yet our strategy is showing a cumulative profit. This shows us (IMO) that the win/loss ratio is not nearly as important in a trading strategy as the size of the wins and losses that you take.

If we can repeat this time and again then this will work out to be a winning strategy. In reality I think that we will see a lot more partial winners which will increase the win/loss ratio and reduce the cumulative profits of this strategy.

We have had 1 winner out of 3 trades which is a 33% win/loss rate and yet our strategy is showing a cumulative profit. This shows us (IMO) that the win/loss ratio is not nearly as important in a trading strategy as the size of the wins and losses that you take.

If we can repeat this time and again then this will work out to be a winning strategy. In reality I think that we will see a lot more partial winners which will increase the win/loss ratio and reduce the cumulative profits of this strategy.

quote:

Originally posted by guy

...We have had 1 winner out of 3 trades which is a 33% win/loss rate and yet our strategy is showing a cumulative profit. This shows us (IMO) that the win/loss ratio is not nearly as important in a trading strategy as the size of the wins and losses that you take...

this is interesting because you see trading systems advertized on the internet with "this systems picks winners 75% of the time" etc. but you don't get told how big those 75% winners are and how big the losing trades are.

so if the 3 out of 4 winners were 1 point each and the 1 loser was for 5 points then we would be losing 2 points for each 4 trades that we take - if i've got my logic right...

Sounds like perfect logic to me phylup.

This also raises an interesting question about trading psychology. If only 1 out of every 3 trades is a winner then more of your trades are going to be losers than winners.

So how do you feel about putting on a trade knowing that it is more likely to be a losing trade than a winning trade? How does that affect you before you put in the limit order for that trade - knowing full well that 2 of each of the 3 trades that you take will be stopped out...?

This also raises an interesting question about trading psychology. If only 1 out of every 3 trades is a winner then more of your trades are going to be losers than winners.

So how do you feel about putting on a trade knowing that it is more likely to be a losing trade than a winning trade? How does that affect you before you put in the limit order for that trade - knowing full well that 2 of each of the 3 trades that you take will be stopped out...?

that was a pretty good trade today - with hindsight. 5 ticks above the low of day and you could have run that up to almost 10 points. i'm not so sure about the money management that you have in place. i think that you're going to find that you get stopped out of some very good trades because of over-agressively tight risk control. also, taking off partials so early means that you give away more profits.

i like the way that you're keeping notes in the spreadsheet though which i think is a good idea. that way you can revisit each trade and see if a theme develops and gives some more ideas for tweaking the risk managment.

thanks for sharing this with us - i think that it might be of some value.

phylup

i like the way that you're keeping notes in the spreadsheet though which i think is a good idea. that way you can revisit each trade and see if a theme develops and gives some more ideas for tweaking the risk managment.

thanks for sharing this with us - i think that it might be of some value.

phylup

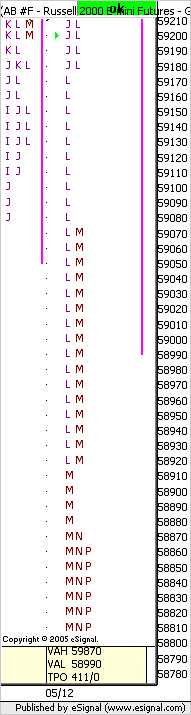

which ones are the singles? not all the prices with single letters?

did you see this?

quote:

On 11-May-05, at 7:20 AM

> I started forward testing the MP 'Single Prints' strategy at the

> beginning of this month. Hasn't traded much. Second trade (and second

> loser) yesterday, so the running loss is now at $840.

What is the " Single Print " strategy?

Never heard of it put in a package like that.

There is no blind buy/sell of single prints.

Furthermore arbitrary stops are useless. Entries and stops are to be

placed based on "structure ".

If interested I will tell you how to properly use single prints.

No offense but over the past 2 years I have not met more than one

other trader who applies MP correctly.

They all seem to pull out a thing or two and try to put together a

rule based system. Doesn't work that way.

Hence the "if MP really worked everyone using it would make money"

type of statement.

D.

The White Board is a discontinued indicator because its functionality was automated through the use of the DVATool which is much faster and more reliable in managing Single Prints - which is primarily what the White Board was used for.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.